Key Highlights

- Rice protein ingredients have a wide range of applications and are used in a variety of food and beverage products, including protein bars, protein meals, beverages, sports nutrition & supplements, infant nutrition, animal feed, and others.

- The protein supplements sector has been growing across North America over the past few years owing to many factors, including increasing participation in sports & fitness activities, busy lifestyles leading to deficiencies, etc. These factors could drive the market in the upcoming years. Additionally, the prevalence of lactose intolerance and celiac disease among the population could drive the demand for gluten-free and lactose-free products like rice protein ingredients.

- Rice proteins witnessed maximum demand in the food and beverage segment, majorly led by meat/poultry/seafood and meat alternative products. Rice protein satiates multiple consumer demands, such as vegan, gluten-free, and high-protein food products. Rice proteins were used as meat extenders at different concentration levels (3%, 6%, 9%, and 12%) for the development of chicken nuggets. The segment for baking supplies and baking mixes may have extremely high demand as a result of the protein trend, which is only expected to intensify. To meet the growing demand for vegan bakery products, food producers are using rice protein to create protein-rich bakery items.

- Moreover, the growing demand for fortified food and beverages can also play a key role in driving the market studied. The demand is majorly led by the changing snacking patterns of consumers and a shift toward protein-fortified snacks in the country. According to the International Food Information Council, in 2021, approximately 46% of people across the United States searched for protein or meal replacement bars. These factors, coupled with the rising demand for plant-based food products demand are expected to make rice ingredients one of the emerging markets across the region. Some of the players offering non-GMO, organic claims for their rice protein ingredients include Axiom and The Scoular Company, among others. Manufacturers have been incorporating such ingredients into their product offerings, further driving the market studied.

North America Rice Protein Ingredients Market Trends

Prevalence of Lactose Intolerance Driving the Market

- The increasing incidences of lactose tolerance as well as various allergies associated with the consumption of soy-based products and gluten across North America is expected to drive the demand for lactose-free and gluten-free protein sources, including rice protein ingredients. According to the National Institute of Diabetes and Digestive and Kidney Diseases, ethnic and racial groups that are more likely to have lactose malabsorption include African Americans, Asian Americans, Hispanics/Latinos, etc. Hence, these consumer segments tend to prefer protein products sourced from plants like rice proteins which could drive the market studied during the forecast period.

- Rice protein is becoming increasingly popular due to its low-glycemic content and its nutritional value as an alternative for those with lactose intolerances. According to ProCon Britannica Org, in 2022, approximately 36% of the United States population had lactose intolerance, leading to an increased need for alternative proteins such as rice protein. Rice-based formulas are especially popular among children with cow's milk allergy because they are a better alternative to soy milk, as polished rice protein has a human digestibility rate of 86-90%.

- As rice protein ingredients are lactose-free, gluten-free, and are available with non-GMO and organic claims. Hence, manufacturers have been incorporating clean-label products into their products to cater to the growing demand for the same. Meanwhile, the consumption of sports nutrition has increased among fitness enthusiasts and active lifestyle consumers as it aids in gaining energy and muscle and supports weight management.

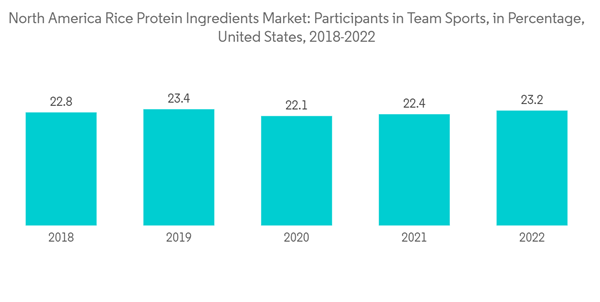

- A large number of customers residing across North America tend to perceive lactose-free and gluten-free sports nutrition products as healthy. According to the Sports and Fitness Industry Association, in 2022, 23.2% of individuals residing across the United States participated in team sports. Hence, the acceptance of sports and fitness activities is also expected to boost the protein-rich food demand, which could, in turn, create opportunities for the growth of rice protein ingredients in North America.

Food & Beverages as the Largest Segment by End-User

Rice protein is widely used across the food and beverage industry across the region. It is used in protein bars, meals, fortified beverages, and other such products. As the region has been witnessing a rise in demand for fortified food and beverages, this trend is expected to drive the demand for rice protein ingredients.Furthermore, the high-protein trend is gaining a foothold across North America as protein claims on food and drink launches continue its growth path. North American consumers are actively seeking more protein in their meals, beverages, and snacks. Additionally, socioeconomic trends like growing urbanization, rising incomes, and aging populations are ultimately what is driving the increased protein consumption that is resulting from this population rise. Plant-based diets are advised by organizations like the World Cancer Research Fund (WCRF) and the World Health Organization.

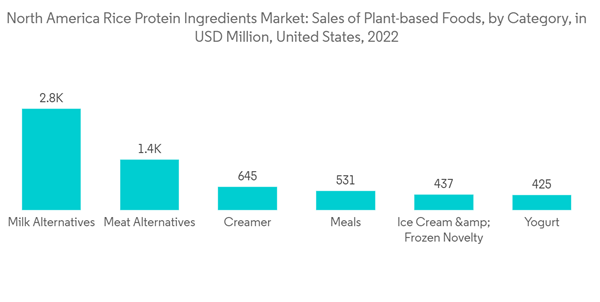

Due to the ongoing vegan trend, customers across North America tend to look for plant-based meat and dairy alternative products which could create lucrative opportunities for the rice protein ingredients market across the region. For instance, according to The Good Food Institute, in the year 2022, the sales value of vegan milk was valued at approximately USD 2,800 million whereas the sales of plant-based yogurt were valued at USD 425 million. The ongoing consumer demand for high protein/protein-rich food and beverages is driving the application of rice protein ingredients actively across various end-user food and beverage industries in North America.

North America Rice Protein Ingredients Industry Overview

The North America rice protein ingredients market is consolidated with the key players controlling the major market shares across the region. The major players in this market are Roquette Frères, Axiom Foods Inc., The Scoular Company, Kerry Group PLC, and Südzucker AG. The majorly adopted strategies used by the key players offering rice protein ingredients across North America include product innovations, partnerships, and mergers & acquisitions. The leading players are focused on expanding their rice protein business in both the local and international markets. Some players have been expanding their geographical presence by acquiring or merging with the international markets' manufacturers. Key ingredient companies have been actively innovating production technologies and delivering ideal proteins for industrial usage.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.