Key Highlights

- Protein demand in Japan is experiencing growth, and it is expected that this trend will continue or even accelerate in the following years, majorly due to changing dietary preferences and growing consumer awareness regarding protein intake. Japanese dietary habits have been evolving, with an increasing inclination towards a more Westernized diet. This includes a higher consumption of protein-rich foods like meat, dairy, eggs, and other plant protein sources.

- Additionally, urbanization tends to lead to changes in lifestyle and dietary patterns, often resulting in a higher demand for convenience foods, including protein-rich snacks and ready-to-eat meals. Such trends have been driving the growth in the demand for different types of protein, including meat protein, plant and microbial protein. They are driving manufacturers in the country to incorporate high protein into their products while processing.

- Also, Japan has been witnessing a surge in several vegetarian populations. This population can be divided into 3 types based on their consumption pattern: 'hidden veggies' (those who hide their vegetarianism),' 'yuruveggie' (flexitarian), and eating veggies once a week. These population groups consume plant-based proteins like soy protein and pea protein in their daily diet to compensate for animal proteins.

- Moreover, consumer's inclination towards the maintenance of personal care, including skincare and haircare, has further boosted the demand for animal-based protein ingredients like collagen, carmine, and gelatin from various personal care products manufacturers and supplement manufacturers. Manufacturers developing products with such ingredients and raising their production owing to the increasing demand are even expected to increase the usage, thus the demand for animal proteins in the country.

- For instance, in March 2023, Otsuka Pharmaceutical Co., Ltd. (Otsuka) launched a new version of EQUELLE gelée, an extension of the EQUELLE brand of supplements supporting women's health and beauty. The company claimed that its supplements include collagen and calcium that support skin and hair health.

- Furthermore, major players in the country are focused on investing in various companies that develop innovative technologies that aid in revolutionizing plant and animal-based protein production. Such developments are expected to further boost the demand for various protein ingredients in the country, which eventually drives the market's growth.

Japan Protein Market Trends

Increasing Demand for Meat Analogues

- Plant protein remained the growing source due to the Japanese consumers' rising protein intake and a boom in alternative protein options. Consumers are increasingly becoming aware of environmental concerns associated with the procurement and production of animal protein and their need to switch to sustainable protein sources, such as plant and microbial. Such factors, coupled with the availability of different plant-based protein sources in the country, are driving the growth of the market.

- For instance, various plant protein sources available in the country include soy protein and pea protein, among others. Additionally, consumers' familiarity with soy is one reason why plant-based protein sources have been accepted in Japan. For instance, tofu and soymilk have long been eaten as part of the varied Japanese diet. Other soy-based alternatives, such as meat, fit neatly into this existing pattern.

- Moreover, such factors have resulted in several ventures investing in alternative protein space to tap the potential, which led to the increasing growth of the market eventually. Textured soy protein is an ideal meat substitute and is gaining higher traction among vegan and flexitarian consumers. This phenomenon augmented the growth of the protein alternatives market, which helps food manufacturers provide meat-like texture and flavor profiles to their portfolio of faux meat or vegan meat products such as nuggets, burger patties, sausages, and crumbles.

- Companies are innovating with new plant protein-based meat offerings, including plant-based hamburgers, tofu, and gyoza dumplings, among others, to target consumers who are accustomed to Japan's meat-rich diet.

- For instance, in January 2023, Roquette, a global leader in plant-based ingredients and a pioneer of plant proteins, announced its investment in DAIZ Inc. This Japanese food tech startup has developed breakthrough technology utilizing the germination of plant seeds combined with an extrusion process to enhance the texture, flavor, and nutritional profile of plant-based foods.

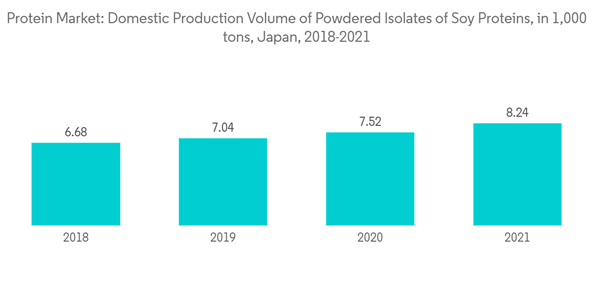

- Furthermore, with the increasing demand for plant-based ingredients, the production of various plant proteins is also increasing in Japan, which is expected to support the market's growth by providing enough supply. For instance, according to the Journal of Educational Development: Foundations and Applications in Japan, in 2021, the domestic production volume of powdered isolates of soy proteins in Japan amounted to around 8.24 thousand tons, which increased from 7.52 thousand tons when compared to the previous year. Such developments happening in the country are further expected to boost the market's growth during the forecast period.

Food and Beverages Accounts for the Largest Share

- Japan is known for its diverse and traditional cuisine, and its diet typically includes a mix of both plant-based and animal-based foods. However, the awareness regarding the increased intake of protein content through various foods and beverages consumed by consumers has been rising in the country in recent years due to various factors such as changing dietary preferences and increasing health awareness. These factors are driving the market of the food and beverages segment in the country.

- In the year 2021, there was an increase in plant-based meat and dairy products in the Japanese market, with new launches regularly. Domestic companies launched new alternative protein products. Nearly all major meat processors have released a plant-based meat alternative, as well as products from major plant oil crushers and soy-based processors, dairy processors, frozen food manufacturers, health food & drink manufacturers, as well as many major retail chains and major café and hamburger chains.

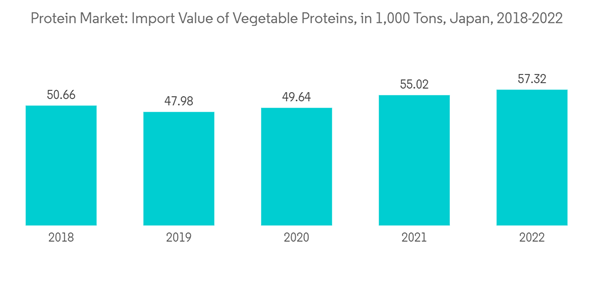

- Therefore, factors such as these are expected to increase the application of protein alternative ingredients in the country. Moreover, vegetable proteins utilized in Japan refer mainly to soy and wheat proteins, which can be added as an ingredient to processed foods or used as a meat substitute in the form of textured vegetable proteins.

- In line with this, players are also focused on offering protein ingredients that align with the manufacturers and the consumers' demands. For instance, ADM offers soy protein isolates in Japan that it claims can deliver nutrition and/or functionality in a variety of applications.

- According to the company, its soy protein isolates can be used in a long list of applications from beverages to extruded snacks and cereals, plus bars, dairy alternatives, meat and meat alternatives, sauces, gravies, and soups, and even feed & pet food. Such developments are expected to further boost the demand for protein ingredients from the food and beverages industries in the country, which eventually drives the market's growth.

Japan Protein Industry Overview

The Japan protein market is fragmented, with different players participating in the market to cater to the demand. The major players in this market are Archer Daniels Midland Company, Lacto Japan Co., Ltd., Morinaga Milk Industry Co., Ltd., Nitta Gelatin, Inc., and Darling Ingredients Inc. Several other small and international players are involved in the manufacturing and distribution of protein ingredients in the country to gain an advantage and cater to the growing demand. Major players are focused on offering organic protein ingredients with gluten-free and clean-label claims to attract more manufacturers. Furthermore, companies engage in capacity expansions, strategic partnerships, product portfolio expansions, and mergers & acquisitions to gain a competitive edge. Key players have been actively innovating production technologies and delivering ideal plant protein for industrial use.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.