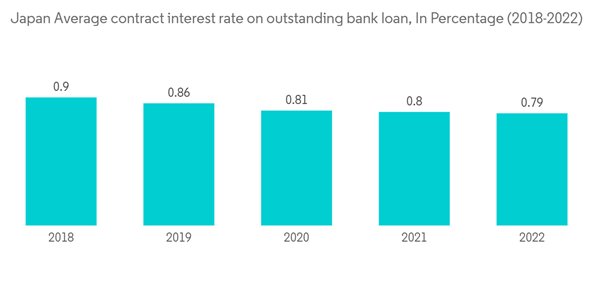

In Japan, the mortgage loan is available in the form of a fixed interest rate, Variable interest rate, Initial Fixed interest rate and a variable interest rate period thereafter. The interest rate on mortgage loans for commercial and residential real estate in Japan has observed a steady trend over the years. Mortgage Investors play a significant role in buying these mortgage loans providing insurance to a regular investor in the bond market in case of default.

With the advent of COVID-19 in Japan, its GDP observed a decline from a level of 5040.11 billion USD to 4,912.15 bn USD over the period showing a continuous decline in the per capita income of people and resulting in a constant increase in the value of mortgage debt outstanding in Japan with an increase in the issuance of new housing loans combined with a stable mortgage interest rate.

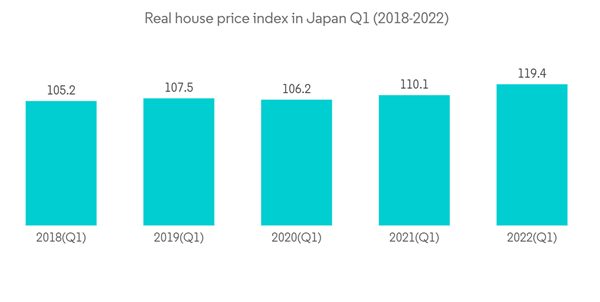

The growth rate of land prices in Japan has observed an increasing trend, with a continuous increase in the monthly residential property price index and real house price index. This, combined with a constant level of interest rate, will make mortgage loans a better option for the population of Japan to get a large loan value from the existing property at a stable interest rate.

Japan Mortgage/Loan Brokers Market Trends

Consistent level of interest rate and Increasing Real Estate price affecting Japan's Mortgage/Loan Broker Market.

Bank of Japan's Basic loan rate is at 0.3% over the years. An increase in real investment and a rise in asset price resulted in an accumulation of private debt and active investment with an increase in asset price. Almost half of the increase in total credit for the past decade is observed with increased housing and real estate loans.Real estate property acquisition by domestic investors had observed an increase with a decline in foreign investor acquisition during covid other than a trend of continuous increase in foreign investor acquisition of real estate property. In Japan, real estate loans by major banks have kept rising for real estate investment funds such as Kanto, Chubu, Kinki, etc.

Borrower type in Loan industry affecting Japan Mortgage /Loan Broker Market

Over the years real estate business has been observing a steady loan borrowing; with the advent of COVID-19, loans in the real estate business sector have grown at an increasing rate, followed by manufacturing and wholesale industries. Housing loans account for a large share of an individual with a y/y% change of around 3.5 % during the previous year.The real house price index in Japan has observed continuous growth, creating an increase in mortgage value for a home loan and a small property sufficient amount of loan can be taken with the surge in mortgage price of the house. When borrowing is considered, real estate is at the top of the mortgage industry.

Japan Mortgage/Loan Brokers Industry Overview

The outstanding amount of housing loans granted by private lending institutions had observed continuous growth as compared to Public financial institutions with an outstanding value of 1.43 trillion USD during last year for public financial institutions and 0.16 trillion USD for public financial institutions, leading to an effective role been played by a private financial institution for mortgage loans. Japan Housing Finance Agency is acting as a leading public housing loan lender. A few of the major banks in Japan offering mortgage loans are UOB (United Overseas Bank), Bank of China, Orix, OCBC (Overseas-Chinese Banking Corporation, Limited) etc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.