Key Highlights

- The upcoming IT load capacity of the Russian data center construction market is expected to reach 1516 MW by 2029.

- The country's construction of raised floor area is expected to increase by 4.3 million sq. ft by 2029.

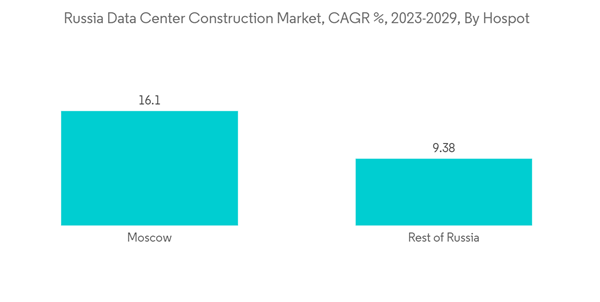

- The country's total number of racks to be installed is expected to reach 216,571 units by 2029. Moscow is expected to house the maximum number of racks by 2029.

- There are 10 submarine cable systems connecting Russia to the rest of the world. One such submarine cable that was built in 2022 is Petropavlovsk-Kamchatsky - Anadyr, which stretches over 2173 Kilometers with landing points Anadyr, Russia, Petropavlovsk-Kamchatsky, Russia, Ugolnye Kopi, Russia.

Russia Data Center Construction Market Trends

IT and Telecom to Have Significant Market Share

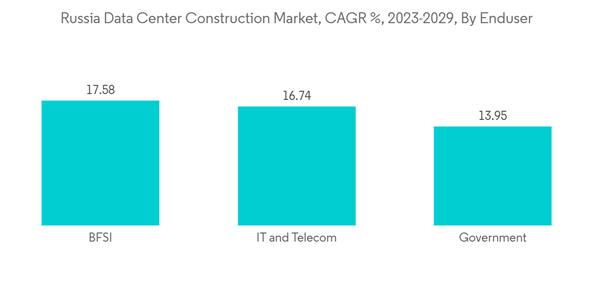

- The cloud sector reached an IT load capacity of 55.43 MW in 2022 and is projected to surpass 217.73 MW by 2029, recording a CAGR of 19.87%. On the other hand, the banking, financial services, and insurance (BFSI) sector is predicted to register a CAGR of 17.58% and reach a capacity of 142.11 MW by 2029.

- Among the end users, cloud and media & entertainment are expected to contribute the highest market shares. In contrast, BFSI and manufacturing sectors are expected to witness the fastest growth over the study period.

- The market in Russia is also driven by rising cloud use across most companies due to developing technologies like artificial intelligence, Big Data, and blockchain among various end users. Russia adopted cloud services later than other nations, which worked in its favor because it is currently experiencing a significant cloud boom. However, the COVID-19 pandemic did not lower those forecasts, and the Russian cloud service industry expanded by 24% to reach a total market value of roughly USD 1.3 billion in 2020. It reached USD 3.4 billion in 2022 with a 23% y-o-y growth.

- Despite the pandemic, the primary factor was the demand for cloud PBXs, virtual call centers, and other office software to support enterprises' shift to a remote/hybrid format. The conflict in Ukraine has hampered the Russian hardware industry, and international firms like Intel Corp. and Advanced Micro Devices Inc. no longer provide parts to Russian hardware manufacturers. These instances may impact the supply chain of data centers in the near future.

Moscow to Have Significant Investments for Data Centers

- Moscow is one of the country's major hotspots. Russia's major engineering hub, Moscow, develops many products for the aviation, space, nuclear, and defense industries. Most of the world's largest companies have Moscow offices, including the headquarters of Russian industrial holdings. The Moscow government promotes industrial growth by providing tax benefits and other incentives. The city is home to the special economic zone Technopolis Moscow and around 40 industrial and technological parks.

- The city's data center business is booming due to the digital economy. The startup ecosystem in Moscow is ranked 29 globally and has lost 20 spots since 2021 due to a negative trend. Moscow is ranked first in Eastern Europe and Russia.

- Other areas that are expanding are St. Petersburg, Novosibirsk, Nizhny Novgorod, Vladivostok, Kazan, Udomlya, and others. St. Petersburg is the second-largest city in population. It is a significant Russian financial, industrial, and commerce hub focusing on the oil and gas sector, shipbuilding, aerospace, radio and electronics, software, computers, machine building, heavy machinery, and transportation, including the manufacture of tanks and other military hardware. Thus, cities other than Moscow may see an opportunity for data center construction in the coming years.

Russia Data Center Construction Industry Overview

The Russia data center construction market is fairly concentrated with significant players, such as Arup Group, Datadome, Schneider Electric, KyotoCooling, and Aermec.In February 2023, Key Point, Russia's data center, announced the launch of its new data center, with a total capacity of 440 racks in its first phase. The facility aims to expand further by 90% in 2024. Such initiatives are expected to provide opportunities for the vendors in the market

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.