Key Highlights

- The upcoming IT load capacity of the United Kindom data center construction market is expected to reach 3,609.7 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase by 6.3 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 316,056 units by 2029. London is projected to house the maximum number of racks by 2029.

- There are close to 60 submarine cable systems connecting the United Kingdom to the globe, and many are under construction. One such submarine cable, estimated to be built by the end of 2023, is 2Africa, which stretches over 45,000 Kilometers spread across Asia, the Middle East, and Africa with the United Kingdom.

United Kingdom Data Center Construction Market Trends

IT and Telecom to have significant market share

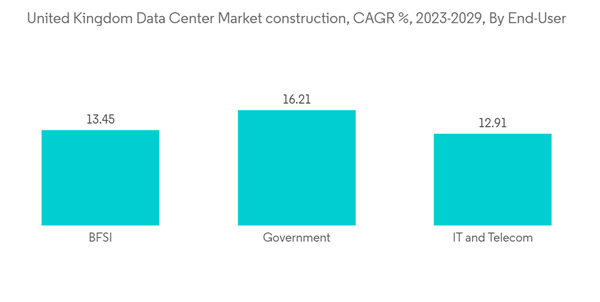

- The UK cloud market operated at an IT load capacity of 199.05 MW in 2022 and is expected to grow from 246.46 MW in 2023 to 577.91 MW in 2029, registering a CAGR of 15.26% during the forecast period. The government industry is expected to grow from 59.62 MW in 2023 to 145.85 MW in 2029, registering a CAGR of 16.21%.

- Cloud and telecom had the highest market shares in the market, with 20.3% and 17.9% market shares, respectively, in 2023. The segments are expected to witness stable growth, accounting for market shares of 20.1% and 20%, respectively, in 2029.

- Cloud adoption among UK enterprises is over 50%. The effective use of data can create GBP 66 billion of new business and innovation opportunities in the United Kingdom, yet studies suggest that companies only analyze 12% of the data generated. In March 2022, Amazon Web Service announced an investment of GBP 1.8 billion (USD 2.47 billion) in the UK over the next two years in the building and operating data centers, further contributing to growth during the forecast period.

- The UK government announced its new digital strategy, promising to deliver over GBP 1 billion of savings by 2025 with significant improvements in online public services. A GBP 90 million budget was allocated in 2022 to support the UK's existing platforms, services, and content. This scenario is catering to a major adoption of data centers.

- Overall, the digital economy in the United Kingdom accounted for more than 7% of the country's GDP in 2022. This upward trend is set to continue, creating demand for enterprise cloud and software-as-a-service (SaaS) utilities, as well as e-commerce, streaming video services, and mobile apps that are becoming omnipresent in today's society.

London is a major hotspot in the country for data center construction

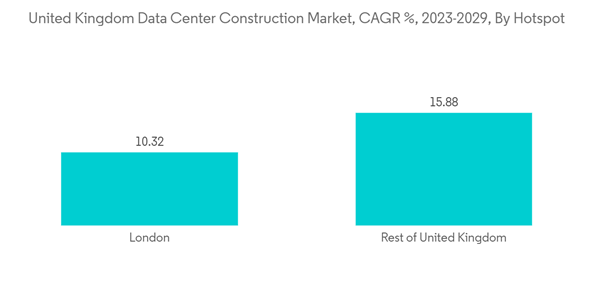

- London is the largest data center hotspot in the country, accounting for over 75.3% of the data center installed capacity in 2023, and is expected to reach 2499.72 MW by 2029. The future market share reflects a decreasing trend till 2029, as the market has already reached its maturity stage. In 2029, the market share is expected to reach 69.25%.

- This decreasing trend is majorly due to investor focus on other cooler regions to save the investment in power and cooling systems, such as Scotland, Manchester, and Wakefield, outside London, based on the digitalization investment and the pricing scenario in the energy sector. Most Londoners are currently on a variable price contract with their energy suppliers. The variable price was set at around GBP 1,971 (USD 2.7) per year in August 2022, but it is expected to increase to GBP 3,549 (USD 4.6) per year from October 2022.

- London is an IT hub, and technology investment attracts investors to look for DC construction. London remains the city driving the UK's digital technology success, securing more than 59% of all digital tech FDI recorded in the United Kingdom in 2022.

- The Rest of the United Kingdom comprises Manchester, Crawley, Surrey, Leeds, Edinburgh, Newcastle, Liverpool, and other smaller regions. These regions will have a market share of 24.7% in 2023, and it is expected to reach 31% by 2029. The main reason for DC construction in these regions is the adoption of digitalization. In 2022, Bristol was named among the top 20 European tech hubs for venture capital funding after its technology firms raised GBP 220 million in the first half of the year. These factors are set to increase the scope and demand for data processing facilities in the Rest of the United Kingdom.

United Kingdom Data Center Construction Industry Overview

The United Kingdom data center construction market is fairly consolidated, with significant companies such as Castrol Limited, Alfa Laval Ltd, Airedale International Air Conditioning, Datacentre UK, and Sweco AB.In February 2023, Datum Group, a UK data center firm, announced its plans to build two data center facilities in south and northwest England by 2024. The facilities are planned to host a capacity of 600 racks and 1000 new server racks over 25,000 sq ft (2,300 sqm) of space. Such developments are expected to drive opportunities for the vendors in the market.

In April 2023, Glencar, a UK construction firm, received a EUR 140 million contract to build a 6-story data center in London by 2025. The new data center campus is expected to host advanced cooling systems. Such developments are expected to provide opportunities for the vendors studied in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.