Key Highlights

- The upcoming IT load capacity of the Ireland data center construction market is expected to reach 1475.4 MW by 2029.

- The country's construction of raised floor area is expected to increase by 8.2 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 412121 units by 2029.

- There are close to 12 submarine cable systems connecting Ireland, and many are under construction. One such submarine cable, estimated to be built by the end of 2025, is Celtic Norse, which stretches over 2008 Kilometers with landing points in Killala, Ireland.

Ireland Data Center Construction Market Trends

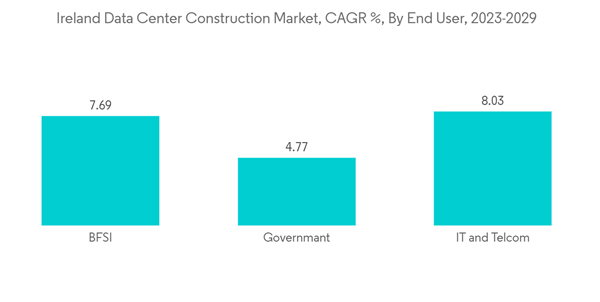

IT and Telecom to have significant market share

- The Ireland data center construction market is being driven by increasing cloud usage across major enterprises as a result of advancements in technology. An industry survey suggests that a 10% increase in cloud adoption by the Irish public sector could yield economic benefits of EUR 473 million (USD 558 million) annually.

- In terms of investment, Amazon Web Services (AWS) announced plans to invest in a new campus in Charlemont Square to accommodate its cloud computing workforce, which was scheduled to open in September 2022.

- Overall, the cloud is expected to exhibit substantial growth as a trend. Furthermore, Ireland underwent a remarkable transformation in digital government services between 2021 and 2022. E-government users increased from 67% of internet users to 92%. The public service comprises a diverse range of government entities. The portal currently links to over 8,800 datasets from approximately 100 publishers.

- Overall, the government is launching a new EUR 85 million fund to help businesses progress in their digital journey and develop new products, services, and processes. This scenario is expected to significantly drive the adoption of data centers within the public sector.

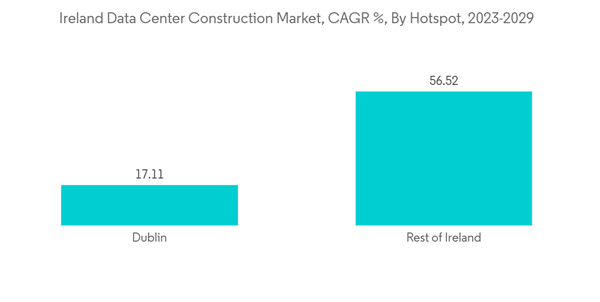

Dublin to host many data center construction in the country

- Currently, Dublin is the only city that has a colocation zonal area and occupies full market share. The western suburbs of Dublin have become an advantageous place to use fresh air to cool servers. It is home to a cluster of major colocation data centers. Much of Ireland's data center growth has been fueled by the efforts of IDA Ireland, an agency concerned with attracting inward foreign direct investment into the country.

- The government is aligning twin transitions, which are both digital and green. While data centers currently account for just under 2% of all greenhouse gas emissions, they are responsible for about 14% of electricity usage in Ireland. The Irish government has set itself a target of having at least 70% of the country's energy derived from renewable sources by 2030.

- Dublin has been Europe's fourth-largest recipient of ICT and internet infrastructure investments since 2010, with 21 projects, trailing London with 63 projects, Frankfurt with 58 projects, and Amsterdam with 52 projects. The majority of projects in this category are data center projects. In terms of projects, CyrusOne announced the breaking ground for its first data center campus in Dublin, Ireland. It is located in Grange Castle Business Park South, and the first phase of the advanced facility was ready for occupation in Q4 2020. On completion, the site will have a total power of 74 MW and is already responding to customer requests for space. Overall, the development of data center facilities is still an ongoing trend and is expected to continue to have a majority of IT load during the forecast period.

Ireland Data Center Construction Industry Overview

The Ireland data center construction market is fairly consolidated, with significant companies such as AECOM, Arup Group Limited, Legrand, Alfa Laval Ltd, and Callaghan Engineering.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.