South Africa's largest challenge, as a result of COVID-19, was that its population's health requirements outpaced available facilities and beds. Second, the vast majority of individuals are unaware of their health status, which delays treatment, and the system's funding reflects inequity. Doctor Saadiq Kariem, Chief of Operations for the Western Cape Department of Health, indicated in a news article published in October 2020 that Tygerberg Hospital had an estimated backlog of 3,500 surgeries. Similarly, during 20 weeks (between March and August), Groote Schuur Hospital had an estimated backlog of 4,142 procedures. In addition, Doctor Gavin Reagon, the Western Cape Department of Health's chief director of emergency and clinical support services, stated that 4,708 patients were on the waiting list for a hip or knee replacement. Hence, it is observed that COVID-19 had a significant impact on the market studied.

In addition, the same article detailed that as part of the COVID-19 response, the Gauteng department canceled elective procedures at the start of the countrywide lockdown on March 27, 2020. At Baragwanath Hospital, 7,541 elective procedures were postponed, which included 2,880 surgeries from the department of ophthalmology, 1,443 orthopedic treatments, and 1,200 pediatric surgery procedures. Such pandemic measures limited the adoption of elective surgeries in South Africa, thereby, impacting the uptake of digital X-ray imaging across various disease diagnoses. The decline in the number of surgical procedures also indicates the decline in diagnostic imaging that took place during the pandemic in South Africa which indicates the impact of COVID-19 on the market studied.

The major factors driving the growth of the market are the increasing prevalence of cancer, increasing technological advancements, and growing applications of digital x-ray imaging in the fields of orthopedic, dental, and cardiovascular disease diagnosis in South Africa. Moreover, the data published in 2021 by the Department of Nuclear Medicine at the University of Pretoria states that the university is collaborating with several international organizations and institutes to promote diagnostic imaging tools. Moreover, digital X-ray devices have several applications in diagnosing many chronic disorders, which then fuel the overall market growth.

Therefore, looking at the all above-mentioned factors, it is believed that the digital X-ray market is expected to witness healthy growth in South Africa over the forecast period.

South Africa Digital X-Ray Devices Market Trends

Cancer Holds Significant Share in the Application Segment

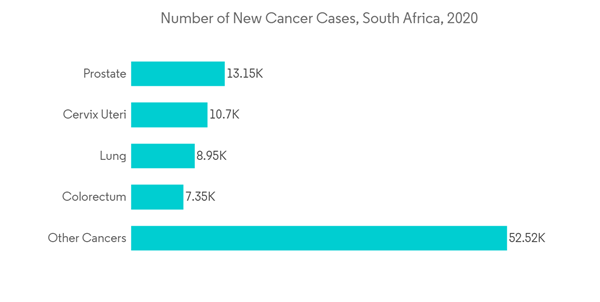

The major factors attributing to the growth of this segment in South Africa include the high number of the geriatric population who are at risk of cancer and greater applications of digital x-rays in diagnosing many types of cancer diseases. Many research studies are being conducted in the country that can boost the market growth.South Africa has one of the highest incidence rates of cancer in the sub-Saharan region. For instance, according to the International Agency for Research on Cancer published Globocan 2020 report, the total number of cancer cases in South Africa in the year 2020 was 108,168. The report also stated that the number of deaths amounted to 56,802. Additionally, according to the same source, the number of cancer cases is expected to increase up to 175k by the year 2040. The high burden of cancer disorders is expected to boost the market growth for digital x-ray devices for diagnosis. Since digital x-ray imaging can be used for the diagnosis of different types of cancer, there is likely to be a demand for this application in the forecast period.

Many research studies are being conducted in South Africa that uses digital x-rays for cancer diagnosis. For instance, in 2021, an article titled, 'Recommendations for lung cancer screening in Southern Africa' was published by Coenraad F. N. Koegelenberget al. and others in the Journal of Thoracic Disease. The researchers recommended a conservative threshold of 6 mm for a positive baseline screen during x-ray screening for lung cancer. They also stated that if a non-calcified solid or partly solid nodule is 6 mm, but 10 mm with no malignant features, the low-dose computed tomography(LDCT) should be repeated in 6 months. Thus, recommendations such as these that ask patients to seek X-ray-based screening for lung cancer are expected to boost the market growth.

Hence, the above developments are further expected to improve the market growth in this segment.

South Africa Digital X-Ray Devices Industry Overview

The South Africa digital X-ray devices market is consolidated and moderately competitive as per the competitive analysis owing to the few companies that are currently dominating the market. These companies include GE Healthcare, Koninklijke Philips NV, Fujifilm Holdings Corporation, Siemens Healthineers, and Canon Medical System Corporation (Toshiba Corporation) among others. The competition in the market is majorly based on technological advances and the pricing of digital X-ray equipment.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.