Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the United Kingdom data center market is expected to reach more than 3,000 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase above 17 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach above 889,000 units by 2029. London is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 58 submarine cable systems connecting the United Kingdom, and many are under construction.

UK Data Center Rack Market Trends

Full Rack accounted for majority market share in 2022

- Due to the increasing shortage of space in various companies, a full rack in the data center has taken a large part of the market share in France. The demand for full-rack data center infrastructure is increasing to cope with the increasing rack size due to the rapid growth of mobile broadband networks due to the increase in big data analytics combined with cloud computing.

- With large amounts of data generated every day, businesses rely on data centers to efficiently manage data and storage. Therefore, the increasing use of full-rack data centers is the most important factor affecting data center rack consumption. Increasing demand for technology services and investments by large companies are also changing the market growth.

- Initially, the focus was solely on data center rack infrastructure, with only size and cost considered during deployment. However, the introduction of high-density applications by various end-users, such as online banking, IT and telecommunications, media, and entertainment, creates opportunities for increased usage of full racks of data centers.

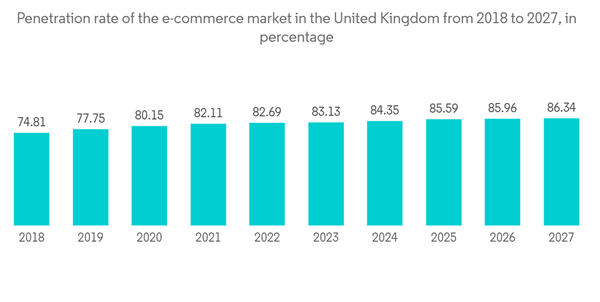

- E-commerce companies use data stored in their data centers in highly effective ways, such as improving their machine-learning capabilities to assist customers. The UK e-commerce market operated at an IT load capacity of 51.60 MW in 2022. The capacity is expected to grow from 63.11 MW in 2023 to 144.98 MW in 2029, registering a CAGR of 14.87%. The United Kingdom is the fourth-largest market for e-commerce. Thus, a large amount of data is generated daily from ecommerce, increasing the requirement for full racks in the country.

Cloud sector is the fastest growing sector in the country

- Emerging technologies and convergence of technologies such as artificial intelligence, Internet of Things, and machine learning will enable further growth in cloud computing and drive the development of the UK cloud computing market over the next five years.

- With cloud storage, the customer or company uses the provider's servers and hardware to store their data or run their systems. Some colocation providers not only offer data center hosting for customer systems but also offer managed services that isolate virtualized workloads in a multi-tenant server environment.

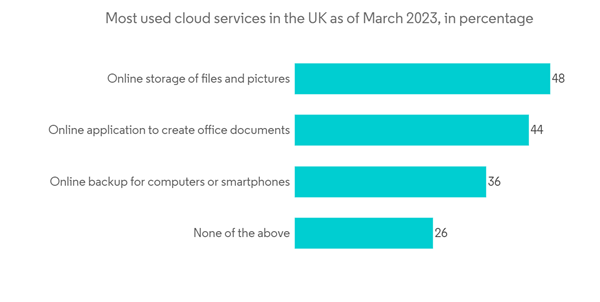

- Cloud adoption by UK businesses is over 50%, and adoption of cloud computing has been escalating over the years. In 2016, 30% of all UK businesses purchased cloud computing services via the Internet, but this share has risen to 44% in 2018 and 62% in 2020. In June 2022, the UK government announced that the value of cloud services for 2021-2022 was expected to exceed GBP 280 million (USD 340968600). Through the G-Cloud Procurement Framework, in just the fiscal year.

- In March 2022, Amazon Web Services (AWS) doubled its investment in the UK by investing £1.8bn in UK cloud computing infrastructure over the next two years. AWS is a cloud provider, but it faces increasing competition from tech giants Microsoft and Google in a battle for enterprise customers. Growing competition in the sector would increase the demand for more DC facilities with large data storage devices, creating demand for data center racks.

UK Data Center Rack Industry Overview

The United Kingdom Data Center Rack Market is moderaretly competitve, and has gained a competitive edge in recent years. In terms of market share, a few major players, such as Black Box Corporation, Eaton Corporation, Hewlett Packard Enterprise (HPE), Rittal GmbH & Co. KG, and Schneider Electric currently dominate the market. These major players with a prominent market share focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.In February 2023, British data center company Datum Group is planning two new facilities in England's South and North West. The company announced this week plans to open two new data center buildings in Farnborough and Manchester in 2024. The new DC facilities would increase the demand for data center racks in the coming years.

In October 2022, CyrusOne announced that it proposed a new data center in Iver Heath, Buckinghamshire, UK. The site had 10 data halls supporting approximately 90 MW of capacity and the project included a new on-site substation. Demand for data center racks with growth in DC facilities would rise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.