Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the South African data center market is expected to reach over 800 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 4.4 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach 220201 units by 2029. Johannesburg is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 9 submarine cable systems connecting South Korea, and many are under construction. One such submarine cable that is estimated to start service in 2023 is 2Africa, which stretches over 45,000 Kilometers with landing points from Cape Town, Mtunzini, and Port Elizabeth in South Africa.

South Africa Data Center Rack Market Trends

IT & Telecommunication Holds the Major Share

- The need for telecommunications services in South Africa has increased significantly during the last five years. Recently, the country's emphasis has been on fiber and LTE networks and backup capacity to increase and improve internet service connectivity. Telkom, one of the prominent telecom operator, anticipates shutting down its copper network in 2024 due to the ongoing transition to fiber.

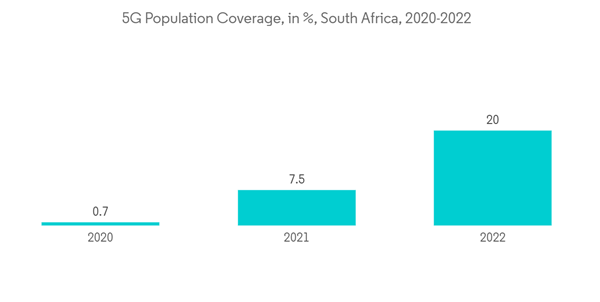

- The country has recently made significant efforts to improve 5G legislation and regulations. One recent instance is the launch of a three-stage 5G spectrum auction by the Independent Communications Authority of South Africa (ICASA). South Africa's efforts to expedite spectrum auctions and new spectrum allocations would maximize the economic benefits of cellular technology in the country.

- The rapidly increasing 4G penetration and the upcoming 5G wave are motivating telecom vendors to invest in the South African data center market. In October 2022, the South African telecom provider Telkom established the 5G high-speed internet network with the help of Huawei Technologies from China. Huawei continues to assist South Africa in developing its 5G networks. The prominent 5G network on the African continent has more than 2,800 base stations deployed.

- In September 2022, the US Department of Commerce's Market Development Cooperator Program (MDCP), run by the International Trade Administration, awarded the Wireless Infrastructure Association (WIA) a grant for its proposed Roadmap to 5G Success initiative. This project aims to accelerate the deployment of 5G in South Africa and boost business for US-based enterprises. South Africa has 109 million active mobile connections. Between 2021 and 2022, the share of individuals owning a mobile phone increased by 5%. Digital payments in South Africa are anticipated to grow from USD 14 billion to USD 25 billion during 2022-2027.

- Such developments, the growing population, and the ongoing demand for smartphones are, in turn, expected to boost the demand for data centers from the telecom segment leading to major demand for the racks during the forecast period.

Full Rack is Expected to Grow Significantly

- In South Africa, the demand for full rack is expected to increase due to preference for hyper-scale and wholesale data centers in the country. The need for the storing of the data has created a need for increasing installation of full racks in data centers.

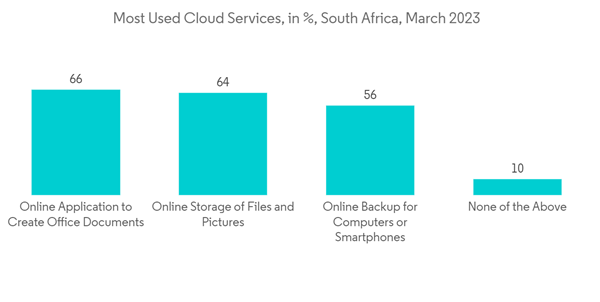

- The adoption of cloud services has accelerated across industries, including some highly regulated sectors like government, healthcare, and finance, owing to cloud providers' constant investment in cloud data center capacity in South Africa. For instance, in June 2022, Africa Data Centers planned to establish a cloud interconnect data center in Cape Town. The new facility provides eight data halls, with 15,000 sq. m of space and 20 MW of additional power.

- The amount of time spent by South Africans on social media has been rising yearly since 2017. There were 28 million active social media users in South Africa as of January 2022, a three-fold rise from 9.8 million users in 2014. As of the third quarter of 2021, WhatsApp was the nation's most widely used social media application.

- The scope of e-commerce is increasing with the growing internet adoption and the expanding retail spaces and distribution centers around the hotspots. For instance, in October 2021, the Takealot Group, a South African online retailer, started constructing a new distribution center (DC) near Cape Town, which was planned to become operational in August 2022. The building spans 24,000 sq. ft and comprises 2,000 sq. ft of offices and 22,000 sq. ft of warehouse space. Also, in December 2021, TFG Ltd acquired Quench, a last-mile delivery service and on-demand online shopping platform, to expand its e-commerce business.

- Overall, with increasing digitalization in above end user sector is adhering a demand for more data center construction, leading to major demand for the full rack.

South Africa Data Center Rack Industry Overview

South Africa Data Center Rack market is consolidated among and has gained a competitive edge in recent years. Few major players, such as CPS Technologies, Schneider Electric Chile S A, Falcon Electronics (Pty) Ltd are currently leading the market. These major players with a prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives and innovations to increase their market share and profitability.- October 2022 - Eaton announced the launch of its Open Compute Project (OCP) Open Rack v3 (ORV3) compatible solutions. It is purpose-built and preconfigured with a focus on the efficient, and scalable delivery of critical power for their data centers seeking to deploy ORV3 racks. The rack will be distributed worldwide including South Africa.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.