An electromagnetic bomb (E-bomb) is an advanced weapon designed to turn off electronics and mechanical systems with an electromagnetic pulse (EMP). It can couple with electrical/electronic systems to produce damaging current and voltage surges. E-Bomb generates a powerful EMP that permanently disables telecommunications systems,, electronic circuitry, satellites, computers, electrical transformers, and anything that relies on or transmits electrical current. It does not destroy targets or kill people.

The increasing use of high-power microwaves (HPM) and the rising use of E-bomb in the military sector as they target the enemy's mobile targets, naval vessels, mobile radars, air defense systems, and other electronics systems is driving the growth of the market during the forecast period. Nowadays, there is increased demand for GPS-guided munitions as these are highly useful in strategic air attacks. The GPS-guided munition is equipped with advanced sensors, control systems, and adjustable flight fins that provide more accurate guidance capacity. Technological advancements in military technology, the adoption of next-generation weapons, and rising spending on enhancing defense capabilities will drive market growth in the coming years. On the other hand, there is a limitation of the E bomb related to its means of delivery to the target. The effectiveness of an E bomb completely depends on the delivery platform's ability to reach and deploy the weapon. Such factors hinder the growth of the market.

E Bomb Market Trends

Air Force Segment is Expected to Show Highest Growth During the Forecast Period

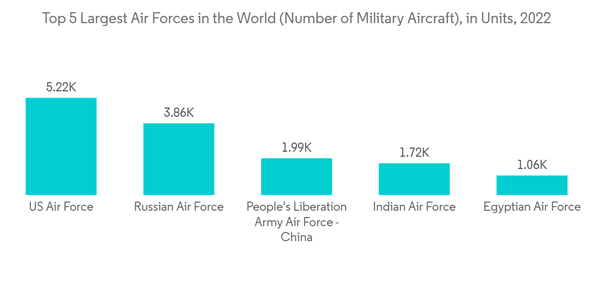

The Air Force segment will showcase remarkable growth during the forecast period. The growth is due to the increasing expenditure on the defense sector, growing procurement of advanced fighter jets, and adoption of next-generation e-bomb to target the electronic devices of enemies. Global military spending reached an all-time high of USD 2.24 trillion in 2022. Increasing cross-border conflicts, the Russia-Ukraine war, and political disputes in neighboring countries lead to increasing security threats. Thus, global defense forces are highly investing in improving their defense capabilities.The major advantage of electromagnetic bombs is that they can be delivered by any tactical aircraft with a nav-attack system capable of delivering GPS-guided munitions. E-bombs can fire millions of watts of energy in microwaves that can knock out electronic equipment and the weapons that rely on them. For instance, in June 2023, an improved Russian electronic warfare system destroyed about 10,000 Ukrainian drones in a month and was able to intercept and decrypt Ukrainian tactical communications in real-time. Thus, the growing adoption of advanced E-bombs and rising spending on procurement of next-generation fighter jets is boosting the growth of the market during the forecast period.

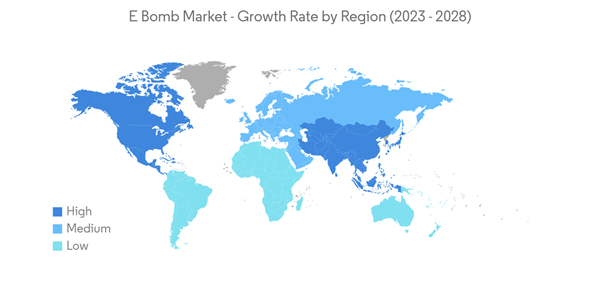

North America Dominates the Market During the Forecast Period

North America holds the highest shares in the market and continues its domination during the forecast period. The growth is due to increased defense spending from the US government, rising procurement of advanced military weapons, and the presence of the largest military aircraft fleet. The Stockholm International Peace Research Institute published a report in 2022 that stated that the US is the largest defense spender in the world, with a defense budget of USD 877 billion. The US Department of Defense (DoD) 2024 budget request is focused on national defense strategy with more emphasis on procurement of advanced munition. The 2024 budget for munitions is USD 30.6 billion, an increase of USD 5.8 billion above the 2023 request. For instance, the US DoD spends USD 1 billion annually on the design and development of directed energy-concentrated electromagnetic energy weapons. Currently, the US DoD is developing directed energy weapons with the goal of defeating a range of threats, including drones and missiles. Furthermore, the departments developed a range of high-power microwave capabilities for various applications, such as engaging missile or drone swarm attacks against a military base. Thus, growing expenditure on procurement of advanced weapons due to rising security threats and increased focus on improving defense capabilities is driving the market growth across the region.E Bomb Industry Overview

The E-bomb market is highly fragmented, with a presence of few players holding significant shares in the market. Some of the key players in the market are The Boeing Company, Raytheon Technologies Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, and BAE Systems plc. Key original equipment manufacturers (OEMs) highly focus on technological advancements and the design and development of advanced electromagnetic bombs with improved accuracy and reliability. For instance, in September 2019, Northrop Grumman Corporation received its first production order from the US Navy to manufacture the FMU-139D/B. It is a new all-electronic bomb fuze suitable for a number of general-purpose bombs used by the US Department of Defense and its allied nations.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.