Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Rising demand for medical device applications: Expanded beam cables are increasingly being used in medical device applications due to their small size, flexibility, and biocompatibility. These cables are ideal for use in minimally invasive surgical procedures and other medical applications where space is limited.

Key Market Drivers

Government Initiatives to Promote Fiber Optic Infrastructure

Governments around the world are investing in fiber optic infrastructure to improve internet connectivity and support the development of new technologies. These investments are creating a demand for expanded beam cables, as these cables are often used in fiber optic networks. Telecommunications: The telecommunications industry is the largest end-use market for expanded beam cables. This is due to the fact that expanded beam cables are ideal for use in high-speed data transmission applications. The aerospace and defense industries are also major end-use markets for expanded beam cables. This is due to the fact that expanded beam cables are durable and resistant to contamination, making them ideal for use in harsh environments. The healthcare industry is a growing end-use market for expanded beam cables. This is due to the fact that expanded beam cables are small, flexible, and biocompatible, making them ideal for use in medical device applications. The industrial industry is also an end-use market for expanded beam cables. This is due to the fact that expanded beam cables are able to withstand harsh environments and are ideal for use in industrial applications.Rising Demand for High-Bandwidth Applications: The increasing need for high-speed data transmission, driven by applications like 5G networks, data centers, and high-definition video streaming, was a significant driver for the expanded beam cable market. These applications require reliable and high-bandwidth connectivity, which expanded beam optical connectors can provide.

Harsh Environment Applications: In industries such as aerospace, defense, oil and gas, and outdoor telecommunications, where cables are subjected to harsh environmental conditions, expanded beam connectors were in demand. They offer superior resistance to dirt, moisture, and extreme temperatures, making them suitable for use in challenging environments.

Reliable Military and Defense Communication: The military and defense sector required secure and reliable communication systems, which drove the adoption of expanded beam connectors for rugged and dependable connections in tactical communication networks.

Data Center Expansion: The growth of data centers to support cloud computing and storage needs led to increased demand for high-performance optical connectors. Expanded beam connectors offered advantages in terms of durability and signal integrity in data center applications. Expanding telecommunication networks and the deployment of fiber-optic cables in remote and hard-to-reach areas created a demand for connectors that could maintain optical performance over longer distances, making expanded beam connectors appealing.

Increased Use in Oil and Gas Industry

In the oil and gas sector, expanded beam connectors were used for downhole applications and oil rig connections due to their ability to withstand extreme conditions and maintain signal integrity. The aerospace and avionics industries required connectors that could operate reliably in aerospace and aviation environments. Expanded beam connectors were suitable for applications such as in-flight entertainment systems, radar, and communication systems.Technological Advancements: Ongoing advancements in expanded beam connector technology, such as improved optical performance, reduced signal loss, and increased connector density, contributed to market growth. The growing adoption of fiber optic cables as an alternative to copper cables for higher bandwidth and data transmission speed in various industries played a role in driving demand for optical connectors.

Environmental Regulations: Environmental regulations and requirements for robust, sealed connectors in certain industries, like automotive and marine applications, drove the adoption of expanded beam connectors.

Key Market Challenges

High Initial Costs: Expanded beam connectors are often more expensive to manufacture and deploy compared to traditional physical contact connectors. The higher initial costs can deter potential customers, especially in price-sensitive industries.Interoperability Issues: Interoperability with existing optical connectors can be a challenge. Some organizations may have already invested in infrastructure based on traditional connectors, making it difficult to transition to expanded beam solutions. The expanded beam cable market lacked standardized designs and specifications, which could make it challenging for customers to select and integrate products from different manufacturers. Standardization efforts were ongoing but not universally adopted. While expanded beam connectors offer advantages in harsh environments, not all industries require this level of durability. Some applications may continue to use traditional connectors due to lower costs and sufficient performance for their needs.

Technical Complexity

Expanded beam connectors can be more technically complex to install and maintain compared to physical contact connectors. This complexity may require specialized knowledge and training.Size and Weight Considerations: In applications where size and weight constraints are critical, expanded beam connectors may not be the best option. Their larger form factor can be a limitation in certain scenarios.

Signal Loss and Insertion Loss: While expanded beam connectors are known for their resilience in harsh conditions, they may exhibit higher insertion loss and signal loss compared to physical contact connectors. This can impact signal quality and transmission distances in high-speed data applications.

Competitive Market: The expanded beam cable market is competitive, with multiple manufacturers offering different products and technologies. This competition can make it challenging for companies to differentiate themselves and maintain profitability.

Customer Education: Raising awareness and educating potential customers about the benefits of expanded beam connectors, especially in industries unfamiliar with the technology, can be a significant challenge.

Market Adoption Rate: The adoption of expanded beam connectors in certain industries can be slow due to resistance to change and concerns about compatibility and performance. Convincing industries to switch from existing solutions can be difficult.

Key Market Trends

Increased Adoption in Harsh Environments

The use of expanded beam connectors was growing in industries with demanding environmental conditions, such as military, aerospace, oil and gas, and outdoor telecommunications, where traditional connectors may not provide the needed durability and reliability.As data centers expanded to support cloud computing and high-speed data transfer requirements, there was an increasing demand for expanded beam connectors that could maintain signal integrity and reliability over longer distances.Fiber-to-the-Home (FTTH) and 5G Rollout: The rollout of 5G networks and the expansion of FTTH infrastructure drove the adoption of expanded beam connectors to meet the high bandwidth and low latency requirements of these technologies.

Miniaturization: There was a trend toward miniaturizing expanded beam connectors to make them more suitable for compact devices and equipment. This trend was particularly relevant in industries like medical devices and high-density electronics.

Standardization Efforts: The expanded beam cable market saw efforts to establish and standardize connector designs and specifications. Standardization aimed to improve compatibility and simplify the integration of different products from various manufacturers.

High-Density Solutions: In response to the demand for more connectors in limited space, manufacturers were developing high-density expanded beam connector solutions, which allowed for greater connectivity within smaller form factors. The industrial sector increasingly adopted expanded beam connectors for applications like factory automation and industrial robotics, where reliable optical connections were essential.

Technological Advancement

Ongoing technological innovations, such as improvements in optical performance and signal integrity, were driving the market. These advancements enhanced the appeal of expanded beam connectors.Sustainability and Environmental Considerations: The push for more environmentally sustainable solutions influenced the market. Expanded beam connectors, which are known for their resistance to moisture and contaminants, can have a longer service life, contributing to sustainability efforts.

Customization and Versatility: Customers were seeking connectors that could be customized to meet specific application requirements. Manufacturers were responding by offering versatile solutions that could address a wide range of applications.

Global Market Expansion: The adoption of expanded beam connectors was expanding globally, with growing demand in regions outside North America and Europe, particularly in Asia.

Aerospace and Defense Investments: The aerospace and defense sector continued to invest in expanded beam technology for rugged communication systems and avionics applications, where durability and reliability are paramount.

Emerging Fiber Optic Technologies: Innovations in fiber optic technology, such as multicore and few-mode fibers, were driving the development of expanded beam connectors optimized for these technologies.

Segmental Insights

Connector Type Insights

The global CNC fiber laser market is expected to reach a value of USD 4.72 billion by 2030, growing at a CAGR of 7.3% from 2023 to 2030. This growth is being driven by several factors, including the increasing demand for CNC fiber laser machines from the manufacturing sector for precision and intricate designs, the advancement of CNC fiber laser technology, and the growing adoption of CNC fiber laser machines in various end-use industries, such as automotive, aerospace, and medical device manufacturing.Regional Insights

Because of its high need for more bandwidth, North America dominates the global expanded beam cable industry. The European expanded beam cable industry is likely to increase rapidly in the future years. Simultaneously, the Asia-Pacific region, which includes with expanding markets in China, Japan, and India, is an emerging market for expanded beam cable. During the review period, a significant CAGR is predicted.The Asia-Pacific market has the highest consumption of fiber optic components. The new information technology and telecommunications industries, as well as planned innovations and initiatives in the United States, China, India, Brazil, and central and eastern countries, are likely to fuel telecom and broadband application growth in the next years. The development of new, high-quality items is pushing investments in technology implementation in the fiber optics sector.

Report Scope

In this report, the Global Expanded Beam Cable Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Expanded Beam Cable Market, By Lens Size :

- 8 mm

- 1.25 mm

- 2.0 mm

- 2.5 mm

- 3.0 mm

- Others

Global Expanded Beam Cable Market, By Technology:

- Single Mode

- Multi-Mode

- Hybrid

Global Expanded Beam Cable Market, By Single vs Multi-Channel Connector:

- Rack & Panel

- Panel Mount Connectors

- In-Line Circular

- Quick-Disconnect

- Others

Global Expanded Beam Cable Market, By Connector Type:

- Single Channel Expanded Beam Connector

- Multi-Channel Beam Connector

Global Expanded Beam Cable Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Expanded Beam Cable Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Expanded Beam Cable Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- TE CONNECTIVITY LTD

- Harting Technology Group

- Smiths Interconnects (Smith Group Plc)

- Neutrik

- Tech Optics

- X-Beam Tech

- Warren & Brown Networks

- Radiall

- Bel Fuse Inc.

- Foss Fiberoptics

- 3M Company

Table Information

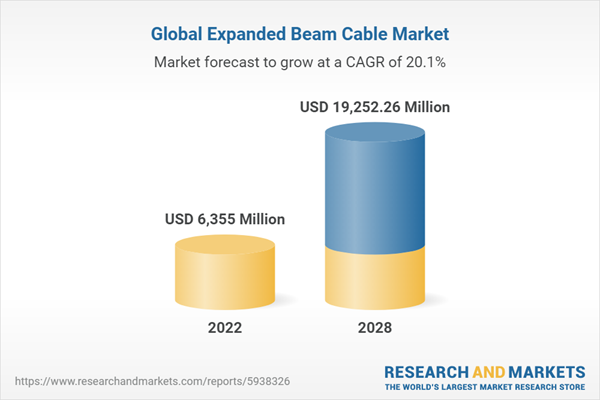

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2024 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 6355 Million |

| Forecasted Market Value ( USD | $ 19252.26 Million |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |