Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Challenges facing the automotive metal market include material cost volatility, supply chain disruptions, and competitive pressures from alternative materials and manufacturing technologies. Fluctuations in raw material prices, geopolitical risks, and trade tensions pose challenges for automakers and metal suppliers reliant on stable supply chains and predictable costs. Additionally, advancements in lightweight composites, polymers, and additive manufacturing technologies present competitive alternatives to traditional metal components, driving innovation and diversification in the automotive materials landscape.

Opportunities for market growth lie in the development of advanced metal alloys, coatings, and manufacturing processes that offer enhanced performance, durability, and sustainability for automotive applications. Collaborative efforts between automakers, metal suppliers, research institutions, and regulatory agencies facilitate technology transfer, innovation, and standardization initiatives that drive continuous improvement and competitiveness in the automotive metal market. Overall, the automotive metal market plays a critical role in shaping the future of vehicle design, performance, and sustainability.

Market Drivers

Automotive Production and Sales Growth

One of the most significant drivers of the global automotive metal market is the growth in automotive production and sales. The automotive industry is a major consumer of metals, including steel, aluminum, and various alloys. As global economies continue to expand, there is a rising demand for automobiles. Factors such as increasing population, urbanization, and rising disposable incomes in emerging markets are driving the demand for vehicles. The growth in automotive production is directly linked to the demand for automotive metals. Steel, for instance, is used extensively in the manufacturing of vehicle bodies, chassis, and other structural components. Aluminum, on the other hand, is utilized for lightweighting and improving fuel efficiency. With stricter environmental regulations, automakers are increasingly adopting lightweight materials like aluminum to reduce vehicle weight and emissions. As developing countries like India, China, and Brazil become major players in the automotive industry, the demand for automotive metals is expected to rise further. This trend is not limited to passenger cars but extends to commercial vehicles and electric vehicles (EVs) as well. EVs, in particular, require a significant number of lightweight materials like aluminum to enhance range and energy efficiency.Stringent Emission Standards and Fuel Efficiency Regulations

The global push to reduce greenhouse gas emissions and combat climate change has led to the implementation of stringent emission standards and fuel efficiency regulations in many regions. These regulations play a significant role in shaping the automotive metal market. To meet these requirements, automakers are adopting various strategies, including lightweighting and downsizing of vehicles. Lightweighting involves the use of lighter materials like aluminum and advanced high-strength steels in vehicle construction. These materials help reduce vehicle weight, leading to improved fuel efficiency and reduced emissions. Aluminum, in particular, is favored for its high strength-to-weight ratio and corrosion resistance, making it a popular choice in the development of lightweight vehicles. Moreover, the shift towards electric vehicles (EVs) as a means to reduce greenhouse gas emissions is also driving the demand for automotive metals. Electric vehicles require lightweight materials to compensate for the weight of batteries, making aluminum and other advanced materials essential in EV manufacturing. These regulations are not limited to one specific region but have a global impact. For instance, the European Union has introduced strict emissions targets, and several countries have set deadlines for phasing out internal combustion engine (ICE) vehicles. This has prompted automakers to accelerate the development of electric and hybrid vehicles, further increasing the demand for automotive metals.Technological Advancements in Automotive Materials

Technological advancements in materials science have a profound impact on the global automotive metal market. These advancements include the development of high-strength steels, advanced alloys, and new metal processing techniques. These innovations enable automakers to design and produce vehicles that are not only lighter but also safer and more durable. High-strength steels, for example, provide an excellent balance between strength and weight, allowing automakers to create lighter and safer vehicle structures. These steels are used in critical components like side impact beams, crash zones, and roof structures. Additionally, advancements in metal forming and joining technologies, such as hot stamping and laser welding, have improved the manufacturing processes and the quality of automotive parts. Aluminum alloys have also seen significant advancements, with new alloys offering improved strength and corrosion resistance. This has made aluminum an attractive choice for automakers looking to reduce vehicle weight while maintaining safety and durability. Furthermore, the development of advanced coatings and surface treatments enhances the corrosion resistance of automotive metals, extending the lifespan of vehicles and reducing maintenance costs. These technological advancements not only increase the demand for automotive metals but also drive innovation in the industry as automakers continually seek to optimize vehicle performance and safety.Growing Electric Vehicle (EV) Market

The growing electric vehicle market is a substantial driver of the global automotive metal industry. Electric vehicles require specific materials and designs to accommodate battery packs and provide the required structural integrity. Aluminum is a key material in electric vehicle construction, as it helps offset the weight of the battery, contributing to longer ranges and better overall performance. The demand for automotive metals in EVs is not limited to aluminum. Copper, for instance, is essential for the electrical wiring and components of electric vehicles. As EV production continues to rise, the demand for copper in the automotive sector is expected to increase significantly. Additionally, new materials, such as rare earth metals for electric motors and power electronics, are becoming critical in the manufacturing of EVs.Key Market Challenges

Fluctuating Raw Material Prices and Availability

One of the primary challenges that the global automotive metal market faces is the fluctuation in raw material prices and their availability. Metals like steel, aluminum, and copper are essential for vehicle manufacturing, and their prices are susceptible to various factors such as global economic conditions, geopolitical tensions, and supply and demand imbalances. For instance, steel is a fundamental material in automotive manufacturing, but its price can be highly volatile due to factors like changes in iron ore prices, trade tariffs, and demand fluctuations. Aluminum, on the other hand, is increasingly being used to reduce the weight of vehicles and improve fuel efficiency, but its price can be influenced by the energy costs required for smelting and processing. Additionally, the availability of these raw materials can be affected by factors like mine closures, export restrictions, or environmental regulations, which can disrupt the supply chain and impact the automotive metal market. These fluctuations in raw material prices and availability make it challenging for automotive manufacturers to plan their production and control costs effectively.Regulatory and Environmental Challenges

The global automotive metal market is under constant pressure to comply with stringent environmental regulations. Governments around the world are imposing stricter emission standards, which are driving the automotive industry to reduce the weight of vehicles, leading to increased use of lightweight metals like aluminum and magnesium. While this shift is beneficial for environmental reasons, it presents significant challenges for metal producers. Meeting these standards often requires significant investments in research and development to develop new alloys and manufacturing processes that are lighter, stronger, and more environmentally friendly. This can increase production costs and affect the overall competitiveness of metal suppliers. Additionally, environmental regulations may also impose restrictions on mining and processing activities, adding further challenges to the supply chain. Recycling and sustainable sourcing of metals have also become crucial in the automotive industry, as manufacturers aim to reduce their carbon footprint. However, implementing effective recycling and sustainability practices can be expensive and complex, posing another set of challenges for metal suppliers.Competition from Alternative Materials

The global automotive metal market faces competition from alternative materials, particularly composites and plastics. As automotive manufacturers seek to reduce the weight of vehicles to improve fuel efficiency and reduce emissions, they are exploring alternatives to traditional metals. Lightweight materials like carbon fiber, fiberglass, and various plastics are gaining popularity in the automotive industry. While metals still dominate the industry, the growth of alternative materials poses a significant challenge. These alternatives offer benefits such as reduced weight, increased design flexibility, and corrosion resistance. This competition is especially notable in electric vehicles (EVs) where reducing weight is critical for extending battery life and range. Automotive metal suppliers must continuously innovate to stay competitive in the face of this growing threat. They need to develop new alloys and metal processing techniques that provide unique advantages over alternative materials, such as improved strength-to-weight ratios and cost-effectiveness.Global Economic Uncertainty and Trade Barriers

The global automotive metal market is highly sensitive to global economic conditions and trade policies. Economic downturns can lead to decreased consumer spending, which, in turn, affects automobile demand. The industry is also exposed to geopolitical tensions and trade barriers that can disrupt the supply chain and affect market dynamics. For instance, trade disputes between major automotive manufacturing countries can result in tariffs on metals and components, raising costs for automotive manufacturers and affecting the demand for automotive metals. Furthermore, the COVID-19 pandemic demonstrated the industry's vulnerability to supply chain disruptions, leading to shortages of certain critical metals and parts. To navigate these challenges, automotive metal suppliers need to diversify their customer base and consider developing localized supply chains. Reducing dependence on a single market or region can help mitigate risks associated with economic uncertainties and trade disputes.Technological Advancements and Industry Trends

The rapid pace of technological advancements in the automotive industry presents both opportunities and challenges for the global automotive metal market. Vehicle electrification, autonomous driving, and connectivity are driving changes in design and materials used in automobiles. In the context of electrification, the shift toward electric vehicles (EVs) has led to changes in the demand for specific metals. For example, the growing demand for lithium-ion batteries in EVs has boosted the demand for metals like lithium, cobalt, and nickel. This trend can result in increased competition among metal suppliers for these materials, as well as concerns regarding their sustainability and responsible sourcing.Key Market Trends

Lightweight Materials for Improved Fuel Efficiency

One of the most significant trends in the global automotive metal market is the growing demand for lightweight materials to enhance fuel efficiency. This trend is driven by stringent regulations on emissions and the consumer's desire for vehicles with better gas mileage. Automakers are increasingly turning to advanced materials like aluminum, high-strength steel, and carbon fiber composites to reduce the weight of their vehicles while maintaining structural integrity. Aluminum has become a popular choice for automakers due to its lightweight properties and ability to improve fuel efficiency. It is used in various vehicle components, including body panels, engine blocks, and suspension components. Aluminum's versatility and recyclability make it an attractive option for automakers looking to meet fuel efficiency standards. High-strength steel is another essential material in the quest for lightweighting. It offers improved strength-to-weight ratios, enabling automakers to reduce the thickness of components without sacrificing safety. Advanced high-strength steels are used in safety-critical parts, such as the vehicle's safety cage, to meet crash safety requirements. Carbon fiber composites are gaining traction, particularly in high-performance and luxury vehicles. These materials are incredibly lightweight and provide excellent strength, making them suitable for applications where weight reduction is paramount. However, carbon fiber composites are more expensive than traditional materials, limiting their adoption in mainstream vehicles.Electrification and Battery Materials

The shift towards electric vehicles (EVs) is a dominant trend in the automotive industry, and it has significant implications for the automotive metal market. EVs require various metals and materials that are distinct from those used in internal combustion engine (ICE) vehicles. Key metals in this transition include lithium, cobalt, nickel, and rare earth elements. Lithium is a primary component in EV batteries, and its demand has surged with the growth of electric mobility. Lithium-ion batteries are the dominant technology for EVs, and the supply chain for this critical metal is under scrutiny to ensure sustainability and ethical sourcing. Cobalt and nickel are also vital elements in lithium-ion batteries. While cobalt is essential for stabilizing the batteries, there is a push to reduce its usage due to ethical and supply chain concerns. Nickel, on the other hand, plays a significant role in the energy density of batteries and is in high demand. Rare earth elements are used in electric motors, especially in permanent magnet motors found in many EVs. Neodymium, praseodymium, and dysprosium are crucial elements in the production of high-strength magnets used in these motors. These materials' demand and supply dynamics will significantly impact the automotive metal market as EV adoption continues to grow.Sustainable and Recycled Materials

Environmental sustainability is a top priority in the automotive industry. Automakers are increasingly turning to sustainable and recycled materials in their production processes to reduce their carbon footprint and meet regulatory requirements. This trend extends to the choice of metals and alloys used in vehicle manufacturing. Recycled aluminum is gaining prominence in the automotive industry. Recycled aluminum not only reduces the carbon footprint of production but also conserves natural resources. Automakers are working closely with aluminum suppliers to incorporate more recycled content in their vehicles. Copper is another metal where sustainability is a concern. Copper is essential for electrical wiring and components in vehicles. Manufacturers are exploring ways to reduce copper usage and employ more sustainable alternatives, like aluminum or conductive plastics, in electrical systems.Advanced Coatings and Finishes

The appearance and durability of a vehicle's exterior are crucial for consumer satisfaction and long-term value retention. To meet these demands, advanced coatings and finishes have become a growing trend in the automotive metal market. Galvanization and electrocoating are two popular processes to protect steel components from corrosion. These processes ensure that steel components maintain their integrity and appearance over time, even in harsh weather conditions. Advanced paint technologies have also evolved to enhance both aesthetics and durability. Ceramic and nano-ceramic coatings provide vehicles with a sleek, glossy finish while offering superior protection against environmental factors like UV rays, acid rain, and oxidation.Digitalization and Data-Driven Manufacturing

The automotive industry is undergoing a significant transformation due to digitalization and data-driven manufacturing. This trend is not limited to the assembly of vehicles but extends to the entire supply chain, including the production of automotive metals. Digital twin technology is being used to create virtual replicas of manufacturing processes and materials. This enables manufacturers to optimize processes, reduce waste, and improve quality control. In the context of automotive metals, digital twin technology can predict material properties and behavior, facilitating the development of stronger and lighter materials Data analytics and IoT are also being employed to monitor and improve the quality of metals used in vehicle manufacturing. Real-time data analysis helps identify deviations in material properties and allows for corrective actions before defects occur in the final product. Artificial intelligence (AI) is used in materials science to discover new alloys and materials with improved properties. AI-driven simulations can predict how new metals will perform under various conditions, allowing for rapid material development.Segmental Insights

Product Type Analysis

The global market was dominated by steel. The automotive industry's use of steel is expected to be positively impacted by the superior qualities and affordability of new steel grades, such as advanced and ultra-high strength steel. When compared to other metals, steel is thought to have a high recycling efficiency. In the upcoming years, the automotive industry's use of steel is anticipated to increase due to End-of-Life Vehicles (ELV) regulations in Europe, Japan, South Korea, and India.Regional Insights

The market is dominated by Asia Pacific. Factors such as government policies, environmental regulations, consumer preferences, and competition are driving the growth of the automotive industry in the region. In response to the constantly shifting demands of consumers, manufacturers are developing new designs and manufacturing techniques. One of the global markets for automotive metals is North America. In the upcoming years, it is anticipated that government initiatives to lower carbon dioxide emissions and improve vehicle fuel economy will create new market opportunities. Over the next eight years, the demand for metals is expected to increase due to the positive effects of a high urban population and an increasing GDP growth rate on the automotive sector.Report Scope

In this report, the Global Automotive Metal Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Metal Market, By Vehicle Type:

- Passenger cars

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

Automotive Metal Market, By Product Type:

- Aluminum

- Steel

- Magnesium

- Others

Automotive Metal Market, By Application Type:

- Body Structure

- Power Train

- Suspension

- Others

Automotive Metal Market, By Region:

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- South Korea

- Australia

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Turkey

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Metal Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Automotive Metal market report.This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

2. Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

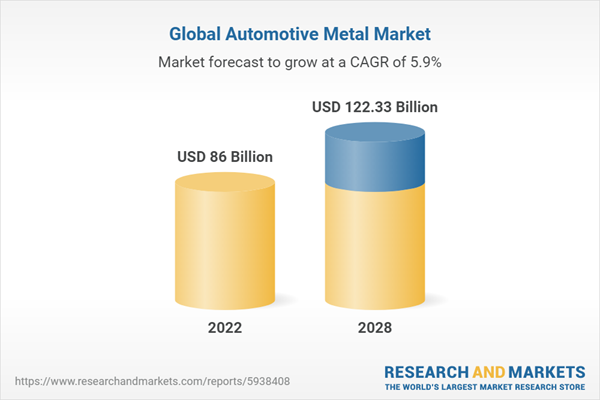

3. Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

4. Impact of COVID-19 on Global Automotive Metal Market

5. Global Automotive Metal Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Vehicle Type Market Share Analysis (Passenger Cars, Light Commercial Vehicles, Medium & Heavy Commercial Vehicles)

5.2.2. By Product Type Market Share Analysis (Aluminum, Steel, Magnesium, Others)

5.2.3. By Application Type Market Share Analysis (Body Structure, Power Train, Suspension, Others)

5.2.4. By Regional Market Share Analysis

5.2.4.1. Asia-Pacific Market Share Analysis

5.2.4.2. Europe & CIS Market Share Analysis

5.2.4.3. North America Market Share Analysis

5.2.4.4. South America Market Share Analysis

5.2.4.5. Middle East & Africa Market Share Analysis

5.2.5. By Company Market Share Analysis (Top 5 Companies, Others - By Value, 2022)

5.3. Global Automotive Metal Market Mapping & Opportunity Assessment

5.3.1. By Vehicle Type Market Mapping & Opportunity Assessment

5.3.2. By Product Type Market Mapping & Opportunity Assessment

5.3.3. By Application Type Market Mapping & Opportunity Assessment

5.3.4. By Regional Market Mapping & Opportunity Assessment

6. Asia-Pacific Automotive Metal Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Vehicle Type Market Share Analysis

6.2.2. By Product Type Market Share Analysis

6.2.3. By Application Type Market Share Analysis

6.2.4. By Country Market Share Analysis

6.2.4.1. China Market Share Analysis

6.2.4.2. India Market Share Analysis

6.2.4.3. Japan Market Share Analysis

6.2.4.4. Indonesia Market Share Analysis

6.2.4.5. Thailand Market Share Analysis

6.2.4.6. South Korea Market Share Analysis

6.2.4.7. Australia Market Share Analysis

6.2.4.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Automotive Metal Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Vehicle Type Market Share Analysis

6.3.1.2.2. By Product Type Market Share Analysis

6.3.1.2.3. By Application Type Market Share Analysis

6.3.2. India Automotive Metal Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Vehicle Type Market Share Analysis

6.3.2.2.2. By Product Type Market Share Analysis

6.3.2.2.3. By Application Type Market Share Analysis

6.3.3. Japan Automotive Metal Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Vehicle Type Market Share Analysis

6.3.3.2.2. By Product Type Market Share Analysis

6.3.3.2.3. By Application Type Market Share Analysis

6.3.4. Indonesia Automotive Metal Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Vehicle Type Market Share Analysis

6.3.4.2.2. By Product Type Market Share Analysis

6.3.4.2.3. By Application Type Market Share Analysis

6.3.5. Thailand Automotive Metal Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Vehicle Type Market Share Analysis

6.3.5.2.2. By Product Type Market Share Analysis

6.3.5.2.3. By Application Type Market Share Analysis

6.3.6. South Korea Automotive Metal Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Vehicle Type Market Share Analysis

6.3.6.2.2. By Product Type Market Share Analysis

6.3.6.2.3. By Application Type Market Share Analysis

6.3.7. Australia Automotive Metal Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Vehicle Type Market Share Analysis

6.3.7.2.2. By Product Type Market Share Analysis

6.3.7.2.3. By Application Type Market Share Analysis

7. Europe & CIS Automotive Metal Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Vehicle Type Market Share Analysis

7.2.2. By Product Type Market Share Analysis

7.2.3. By Application Type Market Share Analysis

7.2.4. By Country Market Share Analysis

7.2.4.1. Germany Market Share Analysis

7.2.4.2. Spain Market Share Analysis

7.2.4.3. France Market Share Analysis

7.2.4.4. Russia Market Share Analysis

7.2.4.5. Italy Market Share Analysis

7.2.4.6. United Kingdom Market Share Analysis

7.2.4.7. Belgium Market Share Analysis

7.2.4.8. Rest of Europe & CIS Market Share Analysis

7.3. Europe & CIS: Country Analysis

7.3.1. Germany Automotive Metal Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Vehicle Type Market Share Analysis

7.3.1.2.2. By Product Type Market Share Analysis

7.3.1.2.3. By Application Type Market Share Analysis

7.3.2. Spain Automotive Metal Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Vehicle Type Market Share Analysis

7.3.2.2.2. By Product Type Market Share Analysis

7.3.2.2.3. By Application Type Market Share Analysis

7.3.3. France Automotive Metal Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Vehicle Type Market Share Analysis

7.3.3.2.2. By Product Type Market Share Analysis

7.3.3.2.3. By Application Type Market Share Analysis

7.3.4. Russia Automotive Metal Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Vehicle Type Market Share Analysis

7.3.4.2.2. By Product Type Market Share Analysis

7.3.4.2.3. By Application Type Market Share Analysis

7.3.5. Italy Automotive Metal Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Vehicle Type Market Share Analysis

7.3.5.2.2. By Product Type Market Share Analysis

7.3.5.2.3. By Application Type Market Share Analysis

7.3.6. United Kingdom Automotive Metal Market Outlook

7.3.6.1. Market Size & Forecast

7.3.6.1.1. By Value

7.3.6.2. Market Share & Forecast

7.3.6.2.1. By Vehicle Type Market Share Analysis

7.3.6.2.2. By Product Type Market Share Analysis

7.3.6.2.3. By Application Type Market Share Analysis

7.3.7. Belgium Automotive Metal Market Outlook

7.3.7.1. Market Size & Forecast

7.3.7.1.1. By Value

7.3.7.2. Market Share & Forecast

7.3.7.2.1. By Vehicle Type Market Share Analysis

7.3.7.2.2. By Product Type Market Share Analysis

7.3.7.2.3. By Application Type Market Share Analysis

8. North America Automotive Metal Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Vehicle Type Market Share Analysis

8.2.2. By Product Type Market Share Analysis

8.2.3. By Application Type Market Share Analysis

8.2.4. By Country Market Share Analysis

8.2.4.1. United States Market Share Analysis

8.2.4.2. Mexico Market Share Analysis

8.2.4.3. Canada Market Share Analysis

8.3. North America: Country Analysis

8.3.1. United States Automotive Metal Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Vehicle Type Market Share Analysis

8.3.1.2.2. By Product Type Market Share Analysis

8.3.1.2.3. By Application Type Market Share Analysis

8.3.2. Mexico Automotive Metal Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Vehicle Type Market Share Analysis

8.3.2.2.2. By Product Type Market Share Analysis

8.3.2.2.3. By Application Type Market Share Analysis

8.3.3. Canada Automotive Metal Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Vehicle Type Market Share Analysis

8.3.3.2.2. By Product Type Market Share Analysis

8.3.3.2.3. By Application Type Market Share Analysis

9. South America Automotive Metal Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Vehicle Type Market Share Analysis

9.2.2. By Product Type Market Share Analysis

9.2.3. By Application Type Market Share Analysis

9.2.4. By Country Market Share Analysis

9.2.4.1. Brazil Market Share Analysis

9.2.4.2. Argentina Market Share Analysis

9.2.4.3. Colombia Market Share Analysis

9.2.4.4. Rest of South America Market Share Analysis

9.3. South America: Country Analysis

9.3.1. Brazil Automotive Metal Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Vehicle Type Market Share Analysis

9.3.1.2.2. By Product Type Market Share Analysis

9.3.1.2.3. By Application Type Market Share Analysis

9.3.2. Colombia Automotive Metal Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Vehicle Type Market Share Analysis

9.3.2.2.2. By Product Type Market Share Analysis

9.3.2.2.3. By Application Type Market Share Analysis

9.3.3. Argentina Automotive Metal Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Vehicle Type Market Share Analysis

9.3.3.2.2. By Product Type Market Share Analysis

9.3.3.2.3. By Application Type Market Share Analysis

10. Middle East & Africa Automotive Metal Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Vehicle Type Market Share Analysis

10.2.2. By Product Type Market Share Analysis

10.2.3. By Application Type Market Share Analysis

10.2.4. By Country Market Share Analysis

10.2.4.1. South Africa Market Share Analysis

10.2.4.2. Turkey Market Share Analysis

10.2.4.3. Saudi Arabia Market Share Analysis

10.2.4.4. UAE Market Share Analysis

10.2.4.5. Rest of Middle East & Africa Market Share Analysis

10.3. Middle East & Africa: Country Analysis

10.3.1. South Africa Automotive Metal Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Vehicle Type Market Share Analysis

10.3.1.2.2. By Product Type Market Share Analysis

10.3.1.2.3. By Application Type Market Share Analysis

10.3.2. Turkey Automotive Metal Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Vehicle Type Market Share Analysis

10.3.2.2.2. By Product Type Market Share Analysis

10.3.2.2.3. By Application Type Market Share Analysis

10.3.3. Saudi Arabia Automotive Metal Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Vehicle Type Market Share Analysis

10.3.3.2.2. By Product Type Market Share Analysis

10.3.3.2.3. By Application Type Market Share Analysis

10.3.4. UAE Automotive Metal Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Vehicle Type Market Share Analysis

10.3.4.2.2. By Product Type Market Share Analysis

10.3.4.2.3. By Application Type Market Share Analysis

11. SWOT Analysis

11.1. Strength

11.2. Weakness

11.3. Opportunities

11.4. Threats

12. Market Dynamics

12.1. Market Drivers

12.2. Market Challenges

13. Market Trends and Developments

14. Competitive Landscape

14.1. Company Profiles (Up to 10 Major Companies)

14.1.1. Allegheny Technologies Incorporated

14.1.1.1. Company Details

14.1.1.2. Key Product Offered

14.1.1.3. Financials (As Per Availability)

14.1.1.4. Recent Developments

14.1.1.5. Key Management Personnel

14.1.2. ArcelorMittal S.A.

14.1.2.1. Company Details

14.1.2.2. Key Product Offered

14.1.2.3. Financials (As Per Availability)

14.1.2.4. Recent Developments

14.1.2.5. Key Management Personnel

14.1.3. JSW Steel Ltd.

14.1.3.1. Company Details

14.1.3.2. Key Product Offered

14.1.3.3. Financials (As Per Availability)

14.1.3.4. Recent Developments

14.1.3.5. Key Management Personnel

14.1.4. Nippon Steel Corporation.

14.1.4.1. Company Details

14.1.4.2. Key Product Offered

14.1.4.3. Financials (As Per Availability)

14.1.4.4. Recent Developments

14.1.4.5. Key Management Personnel

14.1.5. Novelis Inc. (Hindalco Industries Limited).

14.1.5.1. Company Details

14.1.5.2. Key Product Offered

14.1.5.3. Financials (As Per Availability)

14.1.5.4. Recent Developments

14.1.5.5. Key Management Personnel

14.1.6. Nucor Corporation

14.1.6.1. Company Details

14.1.6.2. Key Product Offered

14.1.6.3. Financials (As Per Availability)

14.1.6.4. Recent Developments

14.1.6.5. Key Management Personnel

14.1.7. Tata Steel Ltd

14.1.7.1. Company Details

14.1.7.2. Key Product Offered

14.1.7.3. Financials (As Per Availability)

14.1.7.4. Recent Developments

14.1.7.5. Key Management Personnel

14.1.8. Thyssenkrupp AG.

14.1.8.1. Company Details

14.1.8.2. Key Product Offered

14.1.8.3. Financials (As Per Availability)

14.1.8.4. Recent Developments

14.1.8.5. Key Management Personnel

14.1.9. United States Steel Corporation.

14.1.9.1. Company Details

14.1.9.2. Key Product Offered

14.1.9.3. Financials (As Per Availability)

14.1.9.4. Recent Developments

14.1.9.5. Key Management Personnel

14.1.10. Voestalpine AG.

14.1.10.1. Company Details

14.1.10.2. Key Product Offered

14.1.10.3. Financials (As Per Availability)

14.1.10.4. Recent Developments

14.1.10.5. Key Management Personnel

15. Strategic Recommendations

15.1. Key Focus Areas

15.1.1. Target Regions

15.1.2. Target Vehicle Type

15.1.3. Target By Product Type

16. About Us & Disclaimer

Companies Mentioned

- Allegheny Technologies Incorporated

- ArcelorMittal S.A.

- JSW Steel Ltd

- Nippon Steel Corporation

- Novelis Inc. (Hindalco Industries Limited)

- Nucor Corporation

- Tata Steel Ltd

- Thyssenkrupp AG

- United States Steel Corporation

- Voestalpine AG.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2024 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 86 Billion |

| Forecasted Market Value ( USD | $ 122.33 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |