Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In terms of regional analysis, Asia Pacific holds a significant share in the global automotive plastic fasteners market. The region is a major hub for automotive manufacturing, with countries like China, Japan, and India witnessing substantial growth in vehicle production. The increasing demand for lightweight vehicles, coupled with the presence of a large consumer base, drives the market in this region.

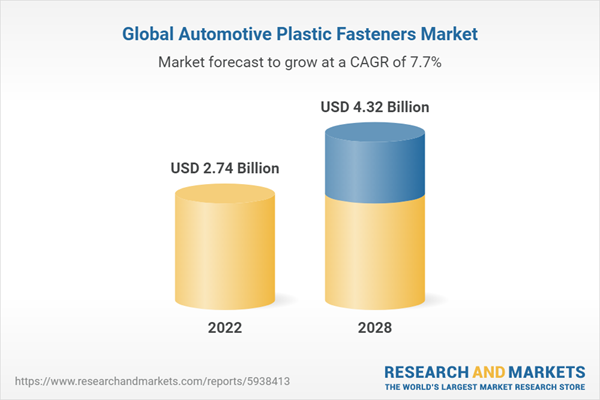

In conclusion, the global automotive plastic fasteners market is experiencing robust growth driven by factors such as the need for lightweight and cost-effective fastening solutions, the focus on fuel efficiency and emission reduction, and the growing adoption of electric vehicles. As the automotive industry continues to evolve, the demand for plastic fasteners is expected to rise, presenting opportunities for market players to innovate and expand their product offerings.

Key Market Drivers

Lightweight Vehicle Construction

The global automotive plastic fasteners market is driven by the increasing demand for lightweight vehicle construction. Plastic fasteners offer a significant weight advantage over traditional metal fasteners, contributing to improved fuel efficiency and reduced emissions. As automakers strive to meet stringent fuel efficiency standards and reduce the overall weight of vehicles, the demand for plastic fasteners continues to rise.Cost-Effectiveness

Cost-effectiveness is another major driver of the global automotive plastic fasteners market. Plastic fasteners are generally more affordable than their metal counterparts, making them an attractive choice for automotive manufacturers. The lower cost of plastic fasteners allows automakers to achieve cost savings in production without compromising on quality or performance.Design Flexibility: Plastic fasteners offer design flexibility, which is a key driver in the automotive industry. These fasteners can be molded into various shapes and sizes, allowing for easier integration into complex automotive components. The design flexibility of plastic fasteners enables automakers to optimize the assembly process, reduce production time, and enhance overall vehicle aesthetics.

Corrosion Resistance

Plastic fasteners are inherently resistant to corrosion, unlike metal fasteners that can rust over time. This corrosion resistance is a significant driver in the automotive industry, as it ensures the longevity and durability of fastening solutions. Plastic fasteners are particularly suitable for exterior applications where they are exposed to harsh weather conditions and corrosive substances.Increasing Vehicle Production

The global automotive plastic fasteners market is positively influenced by the increasing production of vehicles worldwide. The automotive industry has witnessed steady growth, particularly in emerging economies, due to factors such as rising population, improving economic conditions, and increasing urbanization. As vehicle production continues to rise, the demand for plastic fasteners for various applications such as interior trims, exterior body panels, and electrical components also increases.Growing Electric Vehicle Market

The growing market for electric vehicles (EVs) is driving down the demand for plastic fasteners. EVs require lightweight components to maximize their range and efficiency. Plastic fasteners offer a lightweight alternative to metal fasteners, making them ideal for EV applications. As the adoption of EVs continues to rise, the demand for plastic fasteners in the automotive industry is expected to grow significantly.Stringent Fuel Efficiency and Emission Standards

The global push for fuel efficiency and emission reduction is a significant driver for the automotive plastic fasteners market. Governments and regulatory bodies worldwide are implementing stringent fuel efficiency and emission standards to combat climate change and reduce dependence on fossil fuels. Plastic fasteners contribute to lightweight vehicle construction, which helps automakers meet these standards and reduce the carbon footprint of vehicles.Technological Advancements

Technological advancements in the field of plastic fasteners are driving market growth. Manufacturers are continuously developing innovative plastic fastening solutions that offer improved strength, durability, and performance. Advancements in materials, such as high-performance engineering plastics, are enabling the production of plastic fasteners that can withstand high temperatures, vibrations, and mechanical stresses. These technological advancements are expanding the application scope of plastic fasteners in the automotive industry and driving market growth.Key Market Challenges

Limited Load-Bearing Capacity

One of the key challenges in the global automotive plastic fasteners market is the limited load-bearing capacity of plastic materials compared to metals. While plastic fasteners offer advantages such as lightweight and corrosion resistance, they may not be suitable for applications that require high strength and load-bearing capabilities. This poses a challenge for manufacturers to develop plastic fasteners that can withstand heavy loads and provide sufficient structural integrity.Temperature Sensitivity

Plastic materials used in automotive fasteners can be sensitive to temperature variations. Extreme temperatures, such as high heat or extreme cold, can affect the performance and durability of plastic fasteners. This poses a challenge in applications where fasteners are exposed to harsh weather conditions or under-the-hood environments that experience high temperatures. Manufacturers need to develop plastic fasteners that can withstand a wide range of temperatures without compromising their functionality.Compatibility with Different Materials

Automotive fasteners often need to be compatible with various materials, including different types of plastics, metals, and composites. Ensuring proper compatibility and secure fastening across different materials can be challenging. The varying coefficients of thermal expansion and different material properties can affect the performance and reliability of plastic fasteners. Manufacturers need to develop fasteners that can provide secure and reliable connections across different materials used in automotive applications.Durability and Longevity

Automotive fasteners are subjected to various stresses, vibrations, and mechanical forces during the lifetime of a vehicle. Ensuring the durability and longevity of plastic fasteners is crucial to maintaining the integrity of automotive components and assemblies. Plastic materials may be susceptible to wear, fatigue, and degradation over time, which can compromise the performance and reliability of fasteners. Manufacturers need to develop plastic fasteners that can withstand long-term use and maintain their functionality under demanding conditions.Environmental Impact

While plastic fasteners offer advantages in terms of weight reduction and cost-effectiveness, they also raise concerns about their environmental impact. Plastic materials are derived from fossil fuels and can contribute to plastic waste and pollution. The automotive industry is increasingly focusing on sustainability and reducing its environmental footprint. Manufacturers need to address the challenge of developing environmentally friendly plastic fasteners, such as using recycled or bio-based materials, to align with the industry's sustainability goals.Quality and Standardization

Ensuring consistent quality and standardization of plastic fasteners can be a challenge in the global automotive market. With multiple suppliers and manufacturers involved in the production of fasteners, maintaining consistent quality across different batches and suppliers can be challenging. Standardization of fastener specifications and performance requirements is crucial to ensure compatibility and interchangeability. Manufacturers need to adhere to industry standards and implement robust quality control measures to address this challenge.Cost Competitiveness

While plastic fasteners are generally more cost-effective than metal fasteners, achieving cost competitiveness in the global market can be challenging. The automotive industry is highly competitive, and manufacturers are under constant pressure to reduce costs without compromising quality and performance. Raw material costs, production processes, and economies of scale play a significant role in determining the cost competitiveness of plastic fasteners. Manufacturers need to optimize their production processes, explore cost-effective sourcing options, and streamline their supply chains to remain competitive in the market.Counterfeit Products

The global automotive market is susceptible to counterfeit products, including fasteners. Counterfeit plastic fasteners can pose significant risks in terms of safety, reliability, and performance. These counterfeit products may not meet the required quality standards and can compromise the integrity of automotive components and assemblies. Manufacturers need to implement stringent quality control measures, establish secure supply chains, and educate customers about the risks of counterfeit products to address this challenge.Key Market Trends

Increasing Demand for Lightweight Vehicles

The global automotive industry is witnessing a growing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. This trend is driving the adoption of plastic fasteners, as they offer significant weight reduction compared to traditional metal fasteners. Plastic fasteners contribute to overall vehicle weight reduction, enabling automakers to meet stringent fuel efficiency standards and enhance the performance of vehicles.Growing Adoption of Electric Vehicles (EVs)

The increasing adoption of electric vehicles is another major trend in the global automotive industry. EVs require lightweight components to maximize their range and efficiency. Plastic fasteners are well-suited for EV applications due to their lightweight nature and design flexibility. As the demand for electric vehicles continues to rise, the demand for plastic fasteners is expected to grow significantly.

Advancements in Material Technology

The development of advanced plastic materials is driving innovation in the automotive plastic fasteners market. Manufacturers are investing in research and development to enhance the strength, durability, and performance of plastic fasteners. High-performance engineering plastics, such as polyamide (PA), polypropylene (PP), and polyethylene terephthalate (PET), are being used to produce plastic fasteners that can withstand high temperatures, vibrations, and mechanical stresses.Focus on Sustainability

The automotive industry is increasingly focused on sustainability and reducing its environmental impact. Plastic fasteners offer advantages in terms of recyclability and reduced energy consumption during production compared to metal fasteners. Manufacturers are exploring the use of recycled plastics and bio-based materials to develop sustainable plastic fasteners. This trend aligns with the industry's efforts to achieve circular economy principles and reduce plastic waste.Integration of Smart Fastening Solutions

The integration of smart technologies in automotive components is a growing trend, and it extends to plastic fasteners as well. Manufacturers are incorporating features such as RFID tags or embedded sensors in plastic fasteners to enable real-time monitoring, tracking, and quality control. These smart fastening solutions enhance the efficiency of assembly processes, improve product traceability, and enable predictive maintenance.Increasing Focus on Noise, Vibration, and Harshness (NVH) Reduction

Noise, vibration, and harshness (NVH) reduction is a key focus area for automotive manufacturers. Plastic fasteners offer advantages in terms of damping properties, which can help reduce noise and vibration in vehicles. Manufacturers are developing plastic fasteners with enhanced NVH characteristics to improve the overall comfort and driving experience.Shift towards Modular Assembly

The automotive industry is moving towards modular assembly processes to improve efficiency and reduce production costs. Plastic fasteners play a crucial role in modular assembly, as they enable easy disassembly and reassembly of components. Manufacturers are developing plastic fasteners with quick-release mechanisms and snap-fit designs to facilitate modular assembly and streamline production processes.Increasing Adoption of Advanced Manufacturing Techniques

The adoption of advanced manufacturing techniques, such as injection molding and 3D printing, is gaining traction in the automotive plastic fasteners market. These techniques offer advantages in terms of cost-effectiveness, design flexibility, and faster production cycles. Manufacturers are leveraging these technologies to produce complex and customized plastic fasteners with improved precision and efficiency.Segmental Insights

By Application

Interior: Plastic fasteners play a crucial role in the interior applications of vehicles, such as dashboard panels, door trims, seats, and consoles. These fasteners provide secure and reliable attachment of interior components, ensuring proper fit and finish. They also contribute to the overall aesthetics of the interior by providing seamless integration and enhancing the visual appeal of the cabin.Exterior: In exterior applications, plastic fasteners are used for attaching body panels, bumpers, grilles, and other exterior components. These fasteners need to withstand harsh weather conditions, UV radiation, and mechanical stresses. They provide secure attachment while maintaining the structural integrity of the vehicle's exterior. Plastic fasteners in exterior applications also contribute to weight reduction, which improves fuel efficiency and reduces emissions.

Electronics: With the increasing complexity of automotive electronics, plastic fasteners are used for securing various electronic components such as control modules, sensors, wiring harnesses, and connectors. These fasteners ensure proper positioning and alignment of electronic components, preventing damage and ensuring reliable electrical connections. They also play a crucial role in managing the routing of wires and cables, ensuring efficient wire harnessing and reducing the risk of electrical malfunctions.

Powertrain: The powertrain segment includes components such as engines, transmissions, and drivetrain systems. Plastic fasteners are used in powertrain applications for securing engine covers, transmission housings, and other powertrain components. These fasteners need to withstand high temperatures, vibrations, and mechanical stresses. They provide secure attachment and contribute to the overall performance and durability of the powertrain system.

Chassis: In chassis applications, plastic fasteners are used for attaching various components such as suspension systems, steering systems, and brake systems. These fasteners need to provide secure attachment while withstanding mechanical forces, vibrations, and impacts. They contribute to the overall stability, safety, and performance of the vehicle's chassis. Plastic fasteners are extensively used in wire harnessing applications for securing and organizing electrical wires and cables. They ensure proper routing and bundling of wires, preventing tangling and interference. Plastic fasteners in wire harnessing applications also facilitate easy installation, maintenance, and repair of electrical systems.

In conclusion, the global automotive plastic fasteners market is driven by the demand for lightweight, cost-effective, and reliable fastening solutions in various applications such as interior, exterior, electronics, powertrain, chassis, and wire harnessing. Manufacturers are focusing on developing innovative plastic fasteners that meet the specific requirements of each application segment, ensuring secure attachment, durability, and performance.

By Demand Category

OEM (Original Equipment Manufacturer): The OEM segment refers to the demand for plastic fasteners from vehicle manufacturers for use in new vehicles during the production process. OEMs have specific requirements and specifications for plastic fasteners to ensure optimal performance, durability, and compatibility with their vehicles. The OEM segment is driven by factors such as vehicle production volumes, new model launches, and technological advancements in the automotive industry. Plastic fastener manufacturers work closely with OEMs to develop customized fastening solutions that meet their specific needs and contribute to the overall quality and reliability of vehicles.Aftermarket: The aftermarket segment encompasses the demand for plastic fasteners from vehicle owners, repair shops, and service centers for maintenance, repair, and replacement purposes. As vehicles age or require repairs, the need for replacement plastic fasteners arises. The aftermarket segment is influenced by factors such as vehicle parc, vehicle maintenance practices, and consumer preferences. Plastic fastener manufacturers in the aftermarket segment focus on providing a wide range of fasteners that are compatible with various vehicle models and offer ease of installation, durability, and cost-effectiveness. They also work closely with distributors and retailers to ensure the availability of their products in the aftermarket channels.

Both the OEM and aftermarket segments contribute to the overall demand for automotive plastic fasteners. The OEM segment is driven by the production and sales of new vehicles, while the aftermarket segment is influenced by factors such as vehicle age, maintenance requirements, and consumer preferences. Manufacturers in the plastic fasteners market need to understand and cater to the needs of both segments to maintain a strong market presence and meet the diverse demands of customers. They focus on providing high-quality products, efficient distribution networks, and excellent customer service to OEMs and aftermarket customers alike.

Regional Insights

North America: The North American region holds a significant share in the global automotive plastic fasteners market. The region is home to major automotive manufacturers and has a well-established automotive industry. The demand for plastic fasteners in North America is driven by factors such as increasing vehicle production, stringent safety regulations.Asia Pacific: The Asia Pacific region is witnessing rapid growth in the automotive industry, making it a significant market for automotive plastic fasteners. Countries like China, Japan, and India are major contributors to the market in this region.

Middle East and Africa: The Middle East and Africa region have a smaller share in the global automotive plastic fasteners market. However, the region is witnessing growth due to increasing vehicle sales and the adoption of safety regulations.

In summary, the global automotive plastic fasteners market exhibits regional variations based on factors such as vehicle production, safety regulations, consumer preferences, and economic conditions. Each region presents unique opportunities and challenges for market players, and understanding regional insights is crucial for strategic decision-making and market expansion.

Report Scope

In this report, the Global Automotive Plastic Fasteners Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Plastic Fasteners Market, By Application:

- Interior

- Exterior

- Electronics

- Powertrain

- Chassis

- Wire Harnessing

Automotive Plastic Fasteners Market, By Demand Category:

- OEM

- Aftermarket

Automotive Plastic Fasteners Market, By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two-Wheelers

Automotive Plastic Fasteners Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Automotive Plastic Fasteners Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Automotive Plastic Fasteners Market report.This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

2. Research Methodology

2.1. Objective of the Study

2.2. Baseline Methodology

2.3. Key Industry Partners

2.4. Major Association and Secondary Sources

2.5. Forecasting Methodology

2.6. Data Triangulation & Validation

2.7. Assumptions and Limitations

3. Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

4. Impact of COVID-19 on Global Automotive Plastic Fasteners Market

5. Global Automotive Plastic Fasteners Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Application Market Share Analysis (Interior, Exterior, Electronics, Powertrain, Chassis, Wire Harnessing)

5.2.2. By Demand Category Market Share Analysis (OEM and Aftermarket)

5.2.3. By Vehicle Type Market Share Analysis (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Two-Wheelers)

5.2.4. By Regional Market Share Analysis

5.2.4.1. Asia-Pacific Market Share Analysis

5.2.4.2. Europe & CIS Market Share Analysis

5.2.4.3. North America Market Share Analysis

5.2.4.4. South America Market Share Analysis

5.2.4.5. Middle East & Africa Market Share Analysis

5.2.5. By Company Market Share Analysis (Top 5 Companies, Others - By Value, 2022)

5.3. Global Automotive Plastic Fasteners Market Mapping & Opportunity Assessment

5.3.1. By Application Market Mapping & Opportunity Assessment

5.3.2. By Demand Category Market Mapping & Opportunity Assessment

5.3.3. By Vehicle Type Market Mapping & Opportunity Assessment

5.3.4. By Regional Market Mapping & Opportunity Assessment

6. Asia-Pacific Automotive Plastic Fasteners Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Application Market Share Analysis

6.2.2. By Demand Category Market Share Analysis

6.2.3. By Vehicle Type Market Share Analysis

6.2.4. By Country Market Share Analysis

6.2.4.1. China Market Share Analysis

6.2.4.2. India Market Share Analysis

6.2.4.3. Japan Market Share Analysis

6.2.4.4. Indonesia Market Share Analysis

6.2.4.5. Thailand Market Share Analysis

6.2.4.6. South Korea Market Share Analysis

6.2.4.7. Australia Market Share Analysis

6.2.4.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Automotive Plastic Fasteners Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Application Market Share Analysis

6.3.1.2.2. By Demand Category Market Share Analysis

6.3.1.2.3. By Vehicle Type Market Share Analysis

6.3.2. India Automotive Plastic Fasteners Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Application Market Share Analysis

6.3.2.2.2. By Demand Category Market Share Analysis

6.3.2.2.3. By Vehicle Type Market Share Analysis

6.3.3. Japan Automotive Plastic Fasteners Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Application Market Share Analysis

6.3.3.2.2. By Demand Category Market Share Analysis

6.3.3.2.3. By Vehicle Type Market Share Analysis

6.3.4. Indonesia Automotive Plastic Fasteners Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Application Market Share Analysis

6.3.4.2.2. By Demand Category Market Share Analysis

6.3.4.2.3. By Vehicle Type Market Share Analysis

6.3.5. Thailand Automotive Plastic Fasteners Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Application Market Share Analysis

6.3.5.2.2. By Demand Category Market Share Analysis

6.3.5.2.3. By Vehicle Type Market Share Analysis

6.3.6. South Korea Automotive Plastic Fasteners Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Application Market Share Analysis

6.3.6.2.2. By Demand Category Market Share Analysis

6.3.6.2.3. By Vehicle Type Market Share Analysis

6.3.7. Australia Automotive Plastic Fasteners Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Application Market Share Analysis

6.3.7.2.2. By Demand Category Market Share Analysis

6.3.7.2.3. By Vehicle Type Market Share Analysis

7. Europe & CIS Automotive Plastic Fasteners Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Application Market Share Analysis

7.2.2. By Demand Category Market Share Analysis

7.2.3. By Vehicle Type Market Share Analysis

7.2.4. By Country Market Share Analysis

7.2.4.1. Germany Market Share Analysis

7.2.4.2. Spain Market Share Analysis

7.2.4.3. France Market Share Analysis

7.2.4.4. Russia Market Share Analysis

7.2.4.5. Italy Market Share Analysis

7.2.4.6. United Kingdom Market Share Analysis

7.2.4.7. Belgium Market Share Analysis

7.2.4.8. Rest of Europe & CIS Market Share Analysis

7.3. Europe & CIS: Country Analysis

7.3.1. Germany Automotive Plastic Fasteners Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Application Market Share Analysis

7.3.1.2.2. By Demand Category Market Share Analysis

7.3.1.2.3. By Vehicle Type Market Share Analysis

7.3.2. Spain Automotive Plastic Fasteners Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Application Market Share Analysis

7.3.2.2.2. By Demand Category Market Share Analysis

7.3.2.2.3. By Vehicle Type Market Share Analysis

7.3.3. France Automotive Plastic Fasteners Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Application Market Share Analysis

7.3.3.2.2. By Demand Category Market Share Analysis

7.3.3.2.3. By Vehicle Type Market Share Analysis

7.3.4. Russia Automotive Plastic Fasteners Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Application Market Share Analysis

7.3.4.2.2. By Demand Category Market Share Analysis

7.3.4.2.3. By Vehicle Type Market Share Analysis

7.3.5. Italy Automotive Plastic Fasteners Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Application Market Share Analysis

7.3.5.2.2. By Demand Category Market Share Analysis

7.3.5.2.3. By Vehicle Type Market Share Analysis

7.3.6. United Kingdom Automotive Plastic Fasteners Market Outlook

7.3.6.1. Market Size & Forecast

7.3.6.1.1. By Value

7.3.6.2. Market Share & Forecast

7.3.6.2.1. By Application Market Share Analysis

7.3.6.2.2. By Demand Category Market Share Analysis

7.3.6.2.3. By Vehicle Type Market Share Analysis

7.3.7. Belgium Automotive Plastic Fasteners Market Outlook

7.3.7.1. Market Size & Forecast

7.3.7.1.1. By Value

7.3.7.2. Market Share & Forecast

7.3.7.2.1. By Application Market Share Analysis

7.3.7.2.2. By Demand Category Market Share Analysis

7.3.7.2.3. By Vehicle Type Market Share Analysis

8. North America Automotive Plastic Fasteners Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Application Market Share Analysis

8.2.2. By Demand Category Market Share Analysis

8.2.3. By Vehicle Type Market Share Analysis

8.2.4. By Country Market Share Analysis

8.2.4.1. United States Market Share Analysis

8.2.4.2. Mexico Market Share Analysis

8.2.4.3. Canada Market Share Analysis

8.3. North America: Country Analysis

8.3.1. United States Automotive Plastic Fasteners Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Application Market Share Analysis

8.3.1.2.2. By Demand Category Market Share Analysis

8.3.1.2.3. By Vehicle Type Market Share Analysis

8.3.2. Mexico Automotive Plastic Fasteners Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Application Market Share Analysis

8.3.2.2.2. By Demand Category Market Share Analysis

8.3.2.2.3. By Vehicle Type Market Share Analysis

8.3.3. Canada Automotive Plastic Fasteners Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Application Market Share Analysis

8.3.3.2.2. By Demand Category Market Share Analysis

8.3.3.2.3. By Vehicle Type Market Share Analysis

9. South America Automotive Plastic Fasteners Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Application Market Share Analysis

9.2.2. By Demand Category Market Share Analysis

9.2.3. By Vehicle Type Market Share Analysis

9.2.4. By Country Market Share Analysis

9.2.4.1. Brazil Market Share Analysis

9.2.4.2. Argentina Market Share Analysis

9.2.4.3. Colombia Market Share Analysis

9.2.4.4. Rest of South America Market Share Analysis

9.3. South America: Country Analysis

9.3.1. Brazil Automotive Plastic Fasteners Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Application Market Share Analysis

9.3.1.2.2. By Demand Category Market Share Analysis

9.3.1.2.3. By Vehicle Type Market Share Analysis

9.3.2. Colombia Automotive Plastic Fasteners Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Application Market Share Analysis

9.3.2.2.2. By Demand Category Market Share Analysis

9.3.2.2.3. By Vehicle Type Market Share Analysis

9.3.3. Argentina Automotive Plastic Fasteners Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Application Market Share Analysis

9.3.3.2.2. By Demand Category Market Share Analysis

9.3.3.2.3. By Vehicle Type Market Share Analysis

10. Middle East & Africa Automotive Plastic Fasteners Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Application Market Share Analysis

10.2.2. By Demand Category Market Share Analysis

10.2.3. By Vehicle Type Market Share Analysis

10.2.4. By Country Market Share Analysis

10.2.4.1. Turkey Market Share Analysis

10.2.4.2. Iran Market Share Analysis

10.2.4.3. Saudi Arabia Market Share Analysis

10.2.4.4. UAE Market Share Analysis

10.2.4.5. Rest of Middle East & Africa Market Share Analysis

10.3. Middle East & Africa: Country Analysis

10.3.1. Turkey Automotive Plastic Fasteners Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Application Market Share Analysis

10.3.1.2.2. By Demand Category Market Share Analysis

10.3.1.2.3. By Vehicle Type Market Share Analysis

10.3.2. Iran Automotive Plastic Fasteners Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Application Market Share Analysis

10.3.2.2.2. By Demand Category Market Share Analysis

10.3.2.2.3. By Vehicle Type Market Share Analysis

10.3.3. Saudi Arabia Automotive Plastic Fasteners Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Application Market Share Analysis

10.3.3.2.2. By Demand Category Market Share Analysis

10.3.3.2.3. By Vehicle Type Market Share Analysis

10.3.4. UAE Automotive Plastic Fasteners Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Application Market Share Analysis

10.3.4.2.2. By Demand Category Market Share Analysis

10.3.4.2.3. By Vehicle Type Market Share Analysis

11. SWOT Analysis

11.1. Strength

11.2. Weakness

11.3. Opportunities

11.4. Threats

12. Market Dynamics

12.1. Market Drivers

12.2. Market Challenges

13. Market Trends and Developments

14. Competitive Landscape

14.1. Company Profiles (Up to 10 Major Companies)

14.1.1. Ford Fasteners, Inc

14.1.1.1. Company Details

14.1.1.2. Key Product Offered

14.1.1.3. Financials (As Per Availability)

14.1.1.4. Recent Developments

14.1.1.5. Key Management Personnel

14.1.2. Southern Fasteners & Supply, LLC

14.1.2.1. Company Details

14.1.2.2. Key Product Offered

14.1.2.3. Financials (As Per Availability)

14.1.2.4. Recent Developments

14.1.2.5. Key Management Personnel

14.1.3. Chicago Fastener, Inc

14.1.3.1. Company Details

14.1.3.2. Key Product Offered

14.1.3.3. Financials (As Per Availability)

14.1.3.4. Recent Developments

14.1.3.5. Key Management Personnel

14.1.4. National Bolt & Nut Corporation

14.1.4.1. Company Details

14.1.4.2. Key Product Offered

14.1.4.3. Financials (As Per Availability)

14.1.4.4. Recent Developments

14.1.4.5. Key Management Personnel

15. Strategic Recommendations

15.1. Key Focus Areas

15.1.1. Target Regions

15.1.2. Target Application

15.1.3. Target Demand Category

16. About Us & Disclaimer

Companies Mentioned

- Ford Fasteners, Inc

- Southern Fasteners & Supply, LLC

- Chicago Fastener, Inc

- National Bolt & Nut Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2024 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2.74 Billion |

| Forecasted Market Value ( USD | $ 4.32 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |