Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary drivers of the Global Air Cargo Container Market is the continuous growth in global trade and e-commerce. As online shopping and international trade expand, the demand for air cargo services increases, necessitating the use of standardized containers for secure and streamlined transport. The industry's reliance on just-in-time inventory management and rapid shipping solutions further contributes to the demand for efficient air cargo containers.

Technological advancements also shape the market landscape, with the integration of smart technologies for tracking and monitoring cargo. RFID (Radio-Frequency Identification) and IoT (Internet of Things) solutions are increasingly being incorporated into air cargo containers to enhance visibility and provide real-time information about the location, condition, and security of the shipped goods. This trend aligns with the broader industry goal of improving supply chain efficiency and transparency.

Moreover, the Global Air Cargo Container Market is influenced by sustainability considerations. With the aviation industry facing pressure to reduce its environmental impact, there is a growing focus on lightweight and eco-friendly container designs. Manufacturers are exploring materials and construction techniques that not only ensure the durability and security of cargo but also contribute to fuel efficiency, reducing the overall carbon footprint of air cargo transportation.

In terms of regional dynamics, key players in the market are often located in major aviation hubs such as North America, Europe, and Asia-Pacific. These regions are characterized by extensive air cargo networks and serve as strategic locations for manufacturing, maintenance, and repair operations. However, the market is also shaped by global partnerships and collaborations among airlines, cargo operators, and container manufacturers to streamline operations and enhance the compatibility of ULDs across different aircraft types.

Key Market Drivers

Global Trade Expansion

The continuous growth of global trade, fueled by increasing cross-border commerce and e-commerce activities, serves as a primary driver for the Global Air Cargo Container Market. As businesses seek efficient and rapid transportation solutions for their goods, the demand for standardized air cargo containers rises, ensuring streamlined processes and secure handling in the logistics chain.E-commerce Surge

The exponential growth of e-commerce, marked by the rise in online shopping and global supply chain networks, significantly contributes to the demand for air cargo containers. With consumers expecting faster deliveries and businesses adopting just-in-time inventory practices, air cargo containers play a pivotal role in meeting the time-sensitive shipping requirements of the e-commerce industry, driving the market's expansion.Technological Advancements

The integration of advanced technologies, such as Radio-Frequency Identification (RFID) and the Internet of Things (IoT), is a major driver shaping the Global Air Cargo Container Market. These technologies enhance container tracking, monitoring, and real-time data collection, providing stakeholders with unprecedented visibility into the movement and condition of cargo. This not only improves operational efficiency but also contributes to a more transparent and responsive supply chain.Logistics Efficiency

The quest for enhanced logistics efficiency is a driving force behind the adoption of standardized air cargo containers. These containers, with their consistent dimensions and compatibility across various aircraft, facilitate quicker loading and unloading processes, minimizing turnaround times for cargo aircraft. As logistics operators strive for efficiency gains, the market responds with innovations that address these demands.Sustainability Imperatives

Environmental sustainability is increasingly influencing the Global Air Cargo Container Market. Airlines and logistics companies are under growing pressure to reduce their carbon footprint, prompting a shift towards lightweight and eco-friendly container designs. Manufacturers are exploring materials that balance durability with environmental considerations, aligning with the broader industry goal of achieving greener transportation practices.Airfreight Demand Growth

The overall growth in airfreight demand, driven by a variety of industries such as pharmaceuticals, perishables, and high-value goods, is a significant driver for the air cargo container market. As industries increasingly rely on air transportation for time-sensitive and high-value cargo, the need for efficient, secure, and standardized containers becomes paramount, contributing to the market's expansion.Strategic Global Air Hubs

Major aviation hubs worldwide, particularly in regions such as North America, Europe, and Asia-Pacific, play a crucial role in driving the Global Air Cargo Container Market. These hubs serve as strategic locations for manufacturing, repair, and maintenance operations, fostering innovation and enabling efficient container management within extensive air cargo networks.Cross-Industry Collaborations

Collaborations and partnerships across the air cargo value chain, involving airlines, cargo operators, and container manufacturers, are instrumental in shaping the market. These partnerships aim to enhance compatibility, standardization, and interoperability of air cargo containers across different aircraft types, streamlining global cargo operations and contributing to the market's overall growth.Key Market Challenges

Economic Uncertainties

The Global Air Cargo Container Market faces challenges associated with economic uncertainties and fluctuations. Global economic conditions, including trade tensions, geopolitical conflicts, and unexpected events such as pandemics, impact airfreight demand. Uncertainties in economic outlooks can lead to fluctuations in demand for air cargo services, affecting the utilization of air cargo containers and posing challenges for market growth.Stringent Regulatory Compliance

Stringent regulatory standards and compliance requirements present a significant challenge for the air cargo container market. Adherence to diverse international regulations, safety standards, and security protocols demands continuous adaptation and innovation. Meeting these standards can involve substantial investments, impacting the cost structure and operational efficiency of air cargo container manufacturers and operators.Volatility in Fuel Prices

The market is susceptible to fluctuations in fuel prices, which directly impact the operational costs of air cargo transportation. Volatility in fuel prices can result in increased operational expenses for airlines and cargo operators, potentially leading to adjustments in airfreight pricing or a reduction in cargo volumes. This dynamic poses challenges for the financial viability and cost-effectiveness of air cargo container operations.Infrastructure Constraints

The Global Air Cargo Container Market faces challenges associated with airport infrastructure limitations. Inadequate ground facilities, outdated cargo handling systems, and congestion at airports can hinder the efficient movement of air cargo containers. The mismatch between the growing demand for airfreight services and the capacity of existing infrastructure poses operational challenges and limits the market's potential for expansion.Cargo Security Concerns

Ensuring the security of air cargo is a critical challenge for the market. The risk of theft, tampering, or illicit activities poses concerns for stakeholders in the air cargo container ecosystem. Adapting to evolving security protocols, implementing advanced tracking technologies, and addressing vulnerabilities in the supply chain are ongoing challenges to maintain the integrity and security of transported goods.Environmental Sustainability Pressures

While sustainability is a driver, it also presents challenges for the air cargo container market. Balancing the demand for eco-friendly container designs with the need for durability and safety is a complex task. Meeting environmental standards may involve trade-offs that impact container materials, manufacturing processes, and costs, requiring careful consideration and innovation.Rising Maintenance Costs

The maintenance and repair of air cargo containers incur significant costs for operators. Ensuring that containers meet regulatory standards, remain structurally sound, and incorporate technological upgrades requires ongoing investment. Rising maintenance costs can affect the overall operational expenses for airlines and cargo operators, influencing decisions on container fleet management and replacement.Global Supply Chain Disruptions

The susceptibility of the air cargo container market to global supply chain disruptions poses a considerable challenge. Events such as natural disasters, pandemics, or geopolitical tensions can disrupt the production and distribution of air cargo containers. These disruptions affect supply chain resilience, lead times, and the overall availability of containers, impacting the efficiency of air cargo operations worldwide.Key Market Trends

Digitalization and IoT Integration

A significant trend in the Global Air Cargo Container Market is the widespread adoption of digital technologies and the integration of Internet of Things (IoT) solutions. Container tracking, monitoring, and data analytics enhance visibility throughout the supply chain. Real-time information on cargo location, condition, and security not only optimizes operations but also contributes to a more responsive and transparent airfreight ecosystem.Smart Container Technologies

The market is witnessing a surge in the use of smart container technologies, including RFID (Radio-Frequency Identification) and sensor-equipped containers. These technologies enable precise monitoring of temperature, humidity, and other environmental factors, ensuring the integrity of sensitive cargo such as pharmaceuticals or perishables. The evolution of smart containers enhances cargo safety and quality during air transportation.Emphasis on Lightweight Materials

Lightweighting is a pervasive trend in the air cargo container market, driven by a dual focus on fuel efficiency and sustainability. Manufacturers are increasingly utilizing advanced lightweight materials, such as composite alloys and high-strength plastics, to reduce the weight of containers. This not only enhances fuel efficiency for airlines but also aligns with industry-wide efforts to lower the carbon footprint of air transportation.Customization for Specialized Cargo

There is a growing trend toward the customization of air cargo containers to accommodate specialized types of cargo. Containers designed for pharmaceuticals, electronics, or other high-value goods feature specialized interiors and climate control systems. This trend caters to the diverse needs of shippers and enhances the market's ability to handle a wide range of cargo types.Automation in Cargo Handling

Automation in cargo handling processes is transforming the air cargo container market. Automated systems for loading and unloading, robotics in cargo warehouses, and autonomous vehicles contribute to increased operational efficiency. These innovations not only reduce turnaround times but also minimize manual handling, improving overall safety and reducing the risk of damage to cargo and containers.Green Container Initiatives

Sustainability is a pervasive trend, leading to the development of eco-friendly and recyclable air cargo containers. Manufacturers are exploring materials and production processes with lower environmental impact. Green container initiatives align with the aviation industry's broader commitment to sustainable practices, offering a competitive edge to containers with reduced ecological footprints.Blockchain for Enhanced Security

The integration of blockchain technology is emerging as a trend addressing security concerns in the air cargo container market. Blockchain provides a secure and transparent record of transactions, enhancing traceability and reducing the risk of tampering or unauthorized access. This trend contributes to improved cargo security and reinforces trust throughout the supply chain.Collaborative Container Pooling

Collaborative container pooling arrangements are gaining traction, enabling multiple stakeholders to share and utilize a common pool of containers. This trend optimizes container utilization, reduces idle time, and enhances overall efficiency. Collaborative efforts among airlines, cargo operators, and logistics providers contribute to cost savings and address the dynamic nature of cargo demand.Segmental Insights

By Aircraft Type

The segment of air cargo containers associated with passenger aircraft plays a crucial role in maximizing the utilization of available cargo space in the lower compartments of these planes. These containers are designed to fit efficiently within the contours of passenger aircraft cargo holds, optimizing the stowage of various types of cargo while ensuring compliance with safety and weight distribution standards. Trends in this segment include the integration of lightweight materials to minimize the impact on fuel efficiency and advancements in digital tracking technologies for improved cargo visibility. Passenger aircraft cargo containers contribute significantly to the global air cargo network, supporting the transport of a diverse range of goods alongside passenger luggage.The air cargo container market for freighter aircraft addresses the unique requirements of dedicated cargo planes. Freighter aircraft play a pivotal role in transporting large volumes of goods, and the containers associated with this segment are tailored to accommodate diverse cargo types. These containers often feature specialized designs, such as temperature-controlled units for perishables or secure containers for high-value items. The trends in this segment include the customization of containers for specific cargo needs, the incorporation of IoT technologies to monitor sensitive shipments, and an emphasis on cargo security. Freighter aircraft containers are integral to the efficiency and flexibility of global logistics networks.

Containers designed for military aircraft cater to the distinctive needs of defense logistics, ensuring the secure and strategic transport of military equipment, supplies, and personnel. Military aircraft cargo containers are engineered to withstand rugged conditions and comply with stringent security protocols. Advanced features such as rapid loading and unloading systems, compatibility with military transport aircraft, and durability in harsh environments characterize this segment. Trends include innovations in container customization for specialized military equipment, the integration of smart technologies for real-time tracking, and a focus on meeting evolving military logistics requirements. The military aircraft container segment plays a critical role in supporting defense and humanitarian missions worldwide.

Regional Insights

North America remains a key region in the Global Air Cargo Container Market, driven by the presence of major aviation hubs and a robust logistics infrastructure. The United States stands out as a major player, hosting significant cargo airlines and manufacturers. The region experiences a high demand for air cargo services due to its strong industrial base and extensive global trade connections. Ongoing trends in North America include the adoption of advanced tracking technologies, customization of containers for specialized cargo, and a focus on sustainability initiatives to align with stringent environmental regulations.Europe plays a pivotal role in shaping the Global Air Cargo Container Market, with major airports and logistics hubs spread across countries such as Germany, the United Kingdom, and the Netherlands. The European market reflects a commitment to sustainability, leading to the development of eco-friendly container solutions. The region also emphasizes technological advancements, with a focus on smart container technologies and digitalization in cargo handling processes. Collaborative efforts among European countries contribute to efficient cross-border cargo movements and innovative solutions within the air cargo container sector.

The Asia-Pacific region is a dynamic and rapidly growing market for air cargo containers, propelled by the expanding economies of countries like China and India. The rise of e-commerce and increased consumer demand for goods have driven significant airfreight activity in the region. Asia-Pacific showcases trends such as the adoption of lightweight materials to enhance fuel efficiency, advancements in smart container technologies, and the development of customized solutions for diverse cargo types. The region's strategic geographical location positions it as a crucial player in global trade, influencing container designs and logistical strategies.

The Middle East, with major aviation hubs like Dubai and Doha, continues to be a strategic player in the Global Air Cargo Container Market. The region's strategic location facilitates air cargo transshipment, and its investment in state-of-the-art infrastructure drives innovation in cargo handling processes. The Middle East showcases a trend toward green container initiatives, aligning with global sustainability goals. In Africa, the air cargo container market is evolving, driven by efforts to modernize logistics infrastructure and address the unique challenges of the continent. Collaboration with international partners and the customization of containers for specific cargo needs characterize trends in these regions.

Report Scope

In this report, the Global Air Cargo Container Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Air Cargo Container Market, By Aircraft Type:

- Passenger

- Freighter

- Military

Air Cargo Container Market, By Container Type:

- Refrigerated

- Non-Refrigerated

Air Cargo Container Market, By Material:

- Metal

- Composite

Air Cargo Container Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Air Cargo Container Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Air Cargo Container Market report.This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

2. Research Methodology

2.1. Methodology Landscape

2.2. Objective of the Study

2.3. Baseline Methodology

2.4. Formulation of the Scope

2.5. Assumptions and Limitations

2.6. Sources of Research

2.7. Approach for the Market Study

2.8. Methodology Followed for Calculation of Market Size & Market Shares

2.9. Forecasting Methodology

3. Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

4. Impact of COVID-19 on Global Air Cargo Container Market

5. Global Air Cargo Container Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Aircraft Type Market Share Analysis (Passenger, Freighter, Military)

5.2.2. By Container Type Market Share Analysis (Refrigerated, Non-Refrigerated)

5.2.3. By Material Market Share Analysis (Metal, Composite)

5.2.4. By Regional Market Share Analysis

5.2.4.1. Asia-Pacific Market Share Analysis

5.2.4.2. Europe & CIS Market Share Analysis

5.2.4.3. North America Market Share Analysis

5.2.4.4. South America Market Share Analysis

5.2.4.5. Middle East & Africa Market Share Analysis

5.2.5. By Company Market Share Analysis (Top 5 Companies, Others - By Value, 2023)

5.3. Global Air Cargo Container Market Mapping & Opportunity Assessment

5.3.1. By Aircraft Type Market Mapping & Opportunity Assessment

5.3.2. By Container Type Market Mapping & Opportunity Assessment

5.3.3. By Material Market Mapping & Opportunity Assessment

5.3.4. By Regional Market Mapping & Opportunity Assessment

6. Asia-Pacific Air Cargo Container Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Aircraft Type Market Share Analysis

6.2.2. By Container Type Market Share Analysis

6.2.3. By Material Market Share Analysis

6.2.4. By Country Market Share Analysis

6.2.4.1. China Market Share Analysis

6.2.4.2. India Market Share Analysis

6.2.4.3. Japan Market Share Analysis

6.2.4.4. Indonesia Market Share Analysis

6.2.4.5. Thailand Market Share Analysis

6.2.4.6. South Korea Market Share Analysis

6.2.4.7. Australia Market Share Analysis

6.2.4.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Air Cargo Container Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Aircraft Type Market Share Analysis

6.3.1.2.2. By Container Type Market Share Analysis

6.3.1.2.3. By Material Market Share Analysis

6.3.2. India Air Cargo Container Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Aircraft Type Market Share Analysis

6.3.2.2.2. By Container Type Market Share Analysis

6.3.2.2.3. By Material Market Share Analysis

6.3.3. Japan Air Cargo Container Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Aircraft Type Market Share Analysis

6.3.3.2.2. By Container Type Market Share Analysis

6.3.3.2.3. By Material Market Share Analysis

6.3.4. Indonesia Air Cargo Container Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Aircraft Type Market Share Analysis

6.3.4.2.2. By Container Type Market Share Analysis

6.3.4.2.3. By Material Market Share Analysis

6.3.5. Thailand Air Cargo Container Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Aircraft Market Share Analysis

6.3.5.2.2. By Container Type Market Share Analysis

6.3.5.2.3. By Material Market Share Analysis

6.3.6. South Korea Air Cargo Container Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Aircraft Type Market Share Analysis

6.3.6.2.2. By Container Type Market Share Analysis

6.3.6.2.3. By Material Market Share Analysis

6.3.7. Australia Air Cargo Container Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Aircraft Type Market Share Analysis

6.3.7.2.2. By Container Type Market Share Analysis

6.3.7.2.3. By Material Market Share Analysis

7. Europe & CIS Air Cargo Container Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Aircraft Type Market Share Analysis

7.2.2. By Container Type Market Share Analysis

7.2.3. By Material Market Share Analysis

7.2.4. By Country Market Share Analysis

7.2.4.1. Germany Market Share Analysis

7.2.4.2. Spain Market Share Analysis

7.2.4.3. France Market Share Analysis

7.2.4.4. Russia Market Share Analysis

7.2.4.5. Italy Market Share Analysis

7.2.4.6. United Kingdom Market Share Analysis

7.2.4.7. Belgium Market Share Analysis

7.2.4.8. Rest of Europe & CIS Market Share Analysis

7.3. Europe & CIS: Country Analysis

7.3.1. Germany Air Cargo Container Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Aircraft Type Market Share Analysis

7.3.1.2.2. By Container Type Market Share Analysis

7.3.1.2.3. By Material Market Share Analysis

7.3.2. Spain Air Cargo Container Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Aircraft Type Market Share Analysis

7.3.2.2.2. By Container Type Market Share Analysis

7.3.2.2.3. By Material Market Share Analysis

7.3.3. France Air Cargo Container Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Aircraft Type Market Share Analysis

7.3.3.2.2. By Container Type Market Share Analysis

7.3.3.2.3. By Material Market Share Analysis

7.3.4. Russia Air Cargo Container Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Aircraft Type Market Share Analysis

7.3.4.2.2. By Container Type Market Share Analysis

7.3.4.2.3. By Material Market Share Analysis

7.3.5. Italy Air Cargo Container Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Aircraft Type Market Share Analysis

7.3.5.2.2. By Container Type Market Share Analysis

7.3.5.2.3. By Material Market Share Analysis

7.3.6. United Kingdom Air Cargo Container Market Outlook

7.3.6.1. Market Size & Forecast

7.3.6.1.1. By Value

7.3.6.2. Market Share & Forecast

7.3.6.2.1. By Aircraft Type Market Share Analysis

7.3.6.2.2. By Container Type Market Share Analysis

7.3.6.2.3. By Material Market Share Analysis

7.3.7. Belgium Air Cargo Container Market Outlook

7.3.7.1. Market Size & Forecast

7.3.7.1.1. By Value

7.3.7.2. Market Share & Forecast

7.3.7.2.1. By Aircraft Type Market Share Analysis

7.3.7.2.2. By Container Type Market Share Analysis

7.3.7.2.3. By Material Market Share Analysis

8. North America Air Cargo Container Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Aircraft Type Market Share Analysis

8.2.2. By Container Type Market Share Analysis

8.2.3. By Material Market Share Analysis

8.2.4. By Country Market Share Analysis

8.2.4.1. United States Market Share Analysis

8.2.4.2. Mexico Market Share Analysis

8.2.4.3. Canada Market Share Analysis

8.3. North America: Country Analysis

8.3.1. United States Air Cargo Container Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Aircraft Type Market Share Analysis

8.3.1.2.2. By Container Type Market Share Analysis

8.3.1.2.3. By Material Market Share Analysis

8.3.2. Mexico Air Cargo Container Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Aircraft Type Market Share Analysis

8.3.2.2.2. By Container Type Market Share Analysis

8.3.2.2.3. By Material Market Share Analysis

8.3.3. Canada Air Cargo Container Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Aircraft Type Market Share Analysis

8.3.3.2.2. By Container Type Market Share Analysis

8.3.3.2.3. By Material Market Share Analysis

9. South America Air Cargo Container Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Aircraft Type Market Share Analysis

9.2.2. By Container Type Market Share Analysis

9.2.3. By Material Market Share Analysis

9.2.4. By Country Market Share Analysis

9.2.4.1. Brazil Market Share Analysis

9.2.4.2. Argentina Market Share Analysis

9.2.4.3. Colombia Market Share Analysis

9.2.4.4. Rest of South America Market Share Analysis

9.3. South America: Country Analysis

9.3.1. Brazil Air Cargo Container Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Aircraft Type Market Share Analysis

9.3.1.2.2. By Container Type Market Share Analysis

9.3.1.2.3. By Material Market Share Analysis

9.3.2. Colombia Air Cargo Container Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Aircraft Type Market Share Analysis

9.3.2.2.2. By Container Type Market Share Analysis

9.3.2.2.3. By Material Market Share Analysis

9.3.3. Argentina Air Cargo Container Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Aircraft Type Market Share Analysis

9.3.3.2.2. By Container Type Market Share Analysis

9.3.3.2.3. By Material Market Share Analysis

10. Middle East & Africa Air Cargo Container Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Aircraft Type Market Share Analysis

10.2.2. By Container Type Market Share Analysis

10.2.3. By Material Market Share Analysis

10.2.4. By Country Market Share Analysis

10.2.4.1. Turkey Market Share Analysis

10.2.4.2. Iran Market Share Analysis

10.2.4.3. Saudi Arabia Market Share Analysis

10.2.4.4. UAE Market Share Analysis

10.2.4.5. Rest of Middle East & Africa Market Share Analysis

10.3. Middle East & Africa: Country Analysis

10.3.1. Turkey Air Cargo Container Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Aircraft Type Market Share Analysis

10.3.1.2.2. By Container Type Market Share Analysis

10.3.1.2.3. By Material Market Share Analysis

10.3.2. Iran Air Cargo Container Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Aircraft Type Market Share Analysis

10.3.2.2.2. By Container Type Market Share Analysis

10.3.2.2.3. By Material Market Share Analysis

10.3.3. Saudi Arabia Air Cargo Container Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Aircraft Type Market Share Analysis

10.3.3.2.2. By Container Type Market Share Analysis

10.3.3.2.3. By Material Market Share Analysis

10.3.4. UAE Air Cargo Container Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Aircraft Type Market Share Analysis

10.3.4.2.2. By Container Type Market Share Analysis

10.3.4.2.3. By Material Market Share Analysis

11. SWOT Analysis

11.1. Strength

11.2. Weakness

11.3. Opportunities

11.4. Threats

12. Market Dynamics

12.1. Market Drivers

12.2. Market Challenges

13. Market Trends and Developments

14. Competitive Landscape

14.1. Company Profiles (Up to 10 Major Companies)

14.1.1. Nordisk Aviation

14.1.1.1. Company Details

14.1.1.2. Key Product Offered

14.1.1.3. Financials (As Per Availability)

14.1.1.4. Recent Developments

14.1.1.5. Key Management Personnel

14.1.2. Granger Plastics

14.1.2.1. Company Details

14.1.2.2. Key Product Offered

14.1.2.3. Financials (As Per Availability)

14.1.2.4. Recent Developments

14.1.2.5. Key Management Personnel

14.1.3. Envirotainer

14.1.3.1. Company Details

14.1.3.2. Key Product Offered

14.1.3.3. Financials (As Per Availability)

14.1.3.4. Recent Developments

14.1.3.5. Key Management Personnel

14.1.4. Safran Aerosystems

14.1.4.1. Company Details

14.1.4.2. Key Product Offered

14.1.4.3. Financials (As Per Availability)

14.1.4.4. Recent Developments

14.1.4.5. Key Management Personnel

14.1.5. VRR Aviation

14.1.5.1. Company Details

14.1.5.2. Key Product Offered

14.1.5.3. Financials (As Per Availability)

14.1.5.4. Recent Developments

14.1.5.5. Key Management Personnel

14.1.6. ACL Airshop

14.1.6.1. Company Details

14.1.6.2. Key Product Offered

14.1.6.3. Financials (As Per Availability)

14.1.6.4. Recent Developments

14.1.6.5. Key Management Personnel

14.1.7. Unilode

14.1.7.1. Company Details

14.1.7.2. Key Product Offered

14.1.7.3. Financials (As Per Availability)

14.1.7.4. Recent Developments

14.1.7.5. Key Management Personnel

14.1.8. CHEP

14.1.8.1. Company Details

14.1.8.2. Key Product Offered

14.1.8.3. Financials (As Per Availability)

14.1.8.4. Recent Developments

14.1.8.5. Key Management Personnel

15. Strategic Recommendations

15.1. Key Focus Areas

15.1.1. Target Regions

15.1.2. Target Aircraft Type

15.1.3. Target Container Type

16. About Us & Disclaimer

Companies Mentioned

- Nordisk Aviation

- Granger Plastics

- Envirotainer

- Safran Aerosystems

- VRR Aviation

- ACL Airshop

- Unilode

- CHEP

Table Information

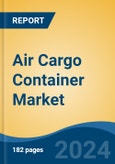

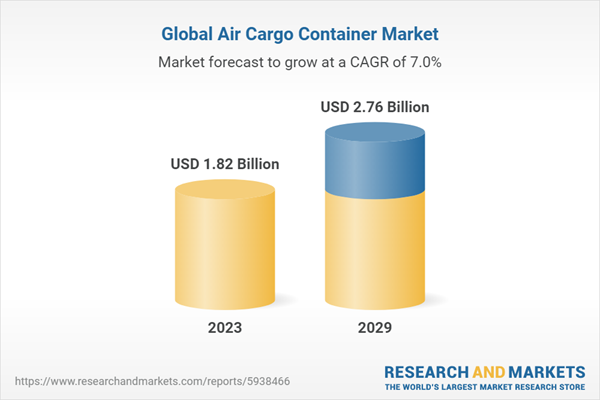

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.82 Billion |

| Forecasted Market Value ( USD | $ 2.76 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |