Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Recent technological advancements have led to the development of lightweight and durable wheels that can contribute to more fuel-efficient aircraft, an important consideration given the global focus on reducing carbon emissions. The market is witnessing an increased demand for these materials as companies and governments look to optimize performance while minimizing environmental impact.

Geographically, the market is well-represented across North America, Europe, Asia-Pacific, and other regions, with North America often leading in market share due to its large aerospace industry and presence of key aircraft manufacturers and suppliers. Europe follows closely, with its strong defense sector and rigorous research and development efforts. The Asia-Pacific region is rapidly emerging as a significant market due to growing aerospace activities and increasing defense budgets in countries like India and China.

Competition within the A&D wheel market is fierce, with prominent companies such as Safran, UTC Aerospace Systems, and Meggitt PLC leading the pack. These companies continually strive for product innovation and strategic alliances to maintain and enhance their market positions. In terms of market drivers, there is a continuous demand for wheels from the commercial aviation sector due to the rising number of passengers and an increase in global air traffic. Defense expenditure also plays a key role as military vehicles require specialized wheels that can operate in challenging terrains. However, the market dynamics are subject to the cyclical nature of the aerospace industry, regulatory compliances, and the global economic climate. Any downturn in the aviation sector can significantly impact the A&D wheel market.

Also, the industry is tightly regulated to ensure the highest level of safety, requiring manufacturers to continually invest in R&D and adhere to quality standards, which can pose as barriers to entry for new players. As the A&D industry moves towards more sustainable practices, the wheel market is expected to evolve as well, with increased investment in research and development for environmentally friendly and energy-efficient solutions. Innovations such as advanced composite materials and improved aerodynamic designs are anticipated to shape the future of the A&D wheel market.

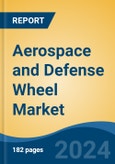

In conclusion, the Aerospace and Defense wheel market remains a critical niche within the broader aviation industry. With technological progression and heightened emphasis on efficiency and sustainability, the market is poised for growth, driven by advancing commercial and military aerospace endeavors. However, it must navigate the challenges of economic fluctuations, regulatory demands, and innovation pressures to sustain its trajectory.

Market Drivers

Advancements in Material Technologies

A significant driver in the global aerospace and defense wheel market is the continuous advancement in material technologies. The materials used in the manufacturing of aerospace wheels play a crucial role in determining their performance, durability, and weight. As the industry seeks to enhance fuel efficiency, reduce emissions, and improve overall aircraft performance, there is a growing emphasis on lightweight and high-strength materials.Advanced materials such as titanium alloys, carbon fiber composites, and lightweight aluminum alloys are increasingly employed in the construction of aerospace and defense wheels. These materials offer a favorable strength-to-weight ratio, contributing to reduced overall aircraft weight without compromising structural integrity. The adoption of innovative materials aligns with the broader industry trend towards lightweighting, addressing the demand for more fuel-efficient and environmentally sustainable aircraft.

Moreover, advancements in material technologies contribute to the development of wheels capable of withstanding extreme conditions, including high loads, temperature variations, and mechanical stress. This is particularly crucial in military applications where the wheels must endure harsh environments during takeoff and landing operations. The continuous evolution of material technologies remains a driving force behind the improvement of aerospace and defense wheel capabilities.

Increasing Demand for Fuel-Efficient and Environmentally Friendly Aircraft

The global aerospace industry is experiencing a paradigm shift towards more fuel-efficient and environmentally friendly aircraft. With the aviation sector facing increasing scrutiny regarding its environmental impact, there is a growing emphasis on designing and manufacturing aircraft with improved fuel efficiency and reduced carbon emissions. Aerospace wheels, being integral components of an aircraft's landing gear, are crucial in achieving these goals.Fuel efficiency is a key consideration for airlines seeking to minimize operational costs and comply with stringent environmental regulations. The weight of an aircraft directly impacts its fuel consumption, and lightweight wheels contribute to overall weight reduction. As a result, there is a heightened demand for aerospace and defense wheels that leverage advanced materials and design innovations to optimize weight while maintaining structural integrity.

Additionally, the aerospace industry is exploring technologies such as electric and hybrid propulsion systems. These advancements require wheels that can handle the specific demands of these emerging aircraft types. Manufacturers in the aerospace and defense wheel market are responding to this trend by developing wheels that align with the industry's commitment to sustainability and environmental responsibility.

Growth in Commercial and Military Aircraft Fleets

The increasing size of commercial and military aircraft fleets globally serves as a significant driver for the aerospace and defense wheel market. The expansion of commercial air travel, driven by factors such as rising passenger demand and economic growth, leads to a growing need for new aircraft. Similarly, the modernization and upgrading of military aircraft fleets contribute to the demand for advanced aerospace wheels.Commercial aircraft, ranging from regional jets to long-haul airliners, require reliable and high-performance wheels to support safe takeoff, landing, and taxiing operations. As airlines seek to enhance operational efficiency and passenger comfort, they invest in new aircraft featuring state-of-the-art wheel technologies. This demand extends to the military sector, where modernization efforts necessitate wheels capable of meeting the unique requirements of military aircraft, including tactical considerations and rapid deployment capabilities.

The growth in aircraft fleets also translates to an increased need for aftermarket services, including wheel replacement and maintenance. Airlines and military operators often upgrade or replace wheels to ensure compliance with evolving safety standards and to benefit from the latest technological advancements. This ongoing cycle of fleet expansion and modernization propels the aerospace and defense wheel market forward.

Technological Innovations in Landing Gear Systems

Advancements in landing gear systems, of which wheels are a critical component, drive innovation in the aerospace and defense wheel market. Landing gear plays a crucial role in an aircraft's safe takeoff and landing, absorbing the impact of landings and providing stability during ground operations. Technological innovations in landing gear, including wheels, focus on improving overall performance, safety, and reliability. One notable innovation is the development of electrically actuated landing gear systems. These systems leverage electric or electro-hydraulic actuators for deploying and retracting the landing gear, replacing traditional hydraulic systems. Electric landing gear systems offer benefits such as reduced weight, lower maintenance requirements, and enhanced reliability. Aerospace and defense wheels designed for compatibility with these advanced landing gear systems must meet specific performance and safety standards.Furthermore, developments in sensor technologies and data analytics contribute to the creation of smart or condition-based monitoring systems for landing gear. These systems provide real-time data on the health and performance of wheels, enabling proactive maintenance and minimizing downtime. The integration of such technologies into aerospace and defense wheels reflects the industry's commitment to enhancing operational efficiency and safety.

Key Market Challenges

Stringent Regulatory Compliance and Certification Standards

One of the primary challenges faced by the global aerospace and defense wheel market is the stringent regulatory compliance and certification standards imposed by aviation authorities worldwide. Regulatory bodies such as the Federal Aviation Administration (FAA) in the United States, the European Union Aviation Safety Agency (EASA) in Europe, and others set rigorous standards to ensure the safety, reliability, and performance of aerospace components, including wheels.Meeting these standards involves extensive testing and certification processes, which can be time-consuming and resource-intensive for manufacturers. The challenges arise from the need to adhere to evolving regulatory requirements and demonstrate compliance with a myriad of stringent specifications. Any deviation from these standards can lead to delays in product certification and market entry, affecting the competitiveness of aerospace and defense wheel manufacturers.

Moreover, as technology advances and new materials are introduced, adapting to updated regulatory frameworks becomes a perpetual challenge. Manufacturers must invest in research and development to ensure their products not only meet current standards but can also anticipate and adapt to future regulatory changes. This challenge is further compounded by the international nature of the aerospace industry, requiring compliance with varying standards across different regions.

Increasing Complexity of Aircraft Systems

The growing complexity of modern aircraft systems poses a significant challenge to the aerospace and defense wheel market. As aircraft become more technologically advanced, integrating sophisticated avionics, electronic control systems, and innovative materials, the demands placed on landing gear, including wheels, intensify. This complexity stems from the need to support a wide range of aircraft sizes and types, from small regional jets to large commercial airliners and military aircraft with varying operational requirements.The challenge for aerospace and defense wheel manufacturers is to design and produce wheels that can seamlessly integrate into these complex aircraft systems. Compatibility with advanced landing gear systems, such as electrically actuated systems and sensor-equipped smart landing gear, becomes crucial. The need to accommodate diverse aircraft configurations, weight considerations, and specialized mission requirements complicates the development of standardized wheel solutions, requiring customization for different platforms.

Additionally, the increased use of composite materials in modern aircraft poses challenges for traditional wheel designs, as composites present unique characteristics and demands that may differ from those of traditional aluminum or steel materials. Manufacturers must navigate these complexities to deliver wheels that not only meet the performance requirements of modern aircraft but also address the specific challenges posed by the evolving landscape of aerospace technologies.

Weight Constraints and Fuel Efficiency Demands

Weight constraints and the continuous pursuit of fuel efficiency are perennial challenges for the aerospace and defense wheel market. Aircraft weight directly impacts fuel consumption, operational costs, and environmental sustainability. As the industry strives to design and manufacture lighter aircraft for improved fuel efficiency and reduced emissions, landing gear components, including wheels, are under pressure to contribute to weight savings without compromising structural integrity and safety.The challenge lies in achieving a delicate balance between reducing weight and maintaining the strength and durability required for safe and reliable landing gear operations. Advanced materials, such as titanium alloys and composite materials, offer weight-saving advantages but often come with higher production costs and manufacturing complexities. Additionally, there is a constant need to explore innovative design approaches and manufacturing processes that can further optimize the weight of aerospace and defense wheels.

Moreover, the demand for increased fuel efficiency extends beyond commercial aviation to military aircraft, where mission range and endurance are critical considerations. Military operations often require aircraft to operate in austere environments, and the weight of landing gear components can impact factors such as aircraft range, payload capacity, and deployment capabilities. Balancing these considerations while meeting stringent safety and performance standards represents an ongoing challenge for the aerospace and defense wheel market.

Cost Pressures and Budgetary Constraints

Cost pressures and budgetary constraints are significant challenges facing the global aerospace and defense wheel market. The aerospace industry operates in a highly competitive environment, and manufacturers face intense cost scrutiny from both commercial airlines and military procurement agencies. Additionally, fluctuations in raw material prices, supply chain disruptions, and geopolitical factors can impact the cost of manufacturing aerospace and defense wheels.The challenge for manufacturers is to develop cost-effective solutions without compromising safety, reliability, or performance. Advanced materials and manufacturing processes, while offering advantages in terms of weight savings and durability, often come with higher production costs. Striking a balance between incorporating innovative technologies and meeting budgetary constraints requires a strategic approach to cost management throughout the entire product lifecycle.

Furthermore, the competitive nature of the aerospace market puts downward pressure on product prices, requiring manufacturers to operate with slim profit margins. This challenge is especially pronounced in the aftermarket segment, where airlines and military operators seek cost-effective wheel replacement and maintenance solutions. Aerospace and defense wheel manufacturers must invest in efficiency improvements, supply chain optimization, and innovative cost-control measures to navigate these economic challenges successfully.

Key Market Trends

Adoption of Advanced Materials for Lightweighting

A prominent trend in the global aerospace and defense wheel market is the widespread adoption of advanced materials to achieve lightweighting. Aircraft manufacturers are increasingly focused on developing lighter, more fuel-efficient aircraft to meet environmental regulations and improve overall operational efficiency. As a critical component of an aircraft's landing gear, wheels play a crucial role in contributing to weight reduction.Traditionally, aerospace and defense wheels were primarily manufactured using materials like steel and aluminum alloys. However, the industry is transitioning towards advanced materials, including titanium alloys and composite materials. Titanium alloys offer a favorable strength-to-weight ratio, allowing for weight reduction without compromising structural integrity. Composite materials, such as carbon fiber-reinforced polymers, provide a further leap in lightweighting, offering high strength coupled with significant weight savings.

The adoption of advanced materials aligns with the broader trend of developing more electric and hybrid aircraft, where every component's weight is a critical factor. Manufacturers in the aerospace and defense wheel market are investing in research and development to optimize the use of these materials, ensuring they meet stringent safety standards while contributing to the overall weight reduction goals of the aerospace industry.

Integration of Smart Technologies for Condition Monitoring

The integration of smart technologies for condition monitoring is a notable trend shaping the aerospace and defense wheel market. With the rise of Industry 4.0 and the Internet of Things (IoT), there is a growing emphasis on incorporating sensors, connectivity, and data analytics into various aerospace components, including wheels. Smart or condition-based monitoring systems provide real-time insights into the health and performance of wheels, enabling proactive maintenance and minimizing downtime.These smart technologies involve the deployment of sensors on aerospace wheels to collect data on parameters such as temperature, vibration, and wear. The data generated by these sensors is then transmitted to centralized monitoring systems, allowing operators to monitor the condition of wheels in real-time. Advanced analytics algorithms can analyze this data to predict potential issues, optimize maintenance schedules, and enhance overall operational efficiency. The integration of condition monitoring technologies addresses the industry's focus on predictive maintenance, reducing unscheduled downtime, and improving safety. Aerospace and defense wheel manufacturers are incorporating these technologies into their products to offer value-added solutions to operators, enhancing the reliability and performance of wheels throughout their operational life.

Increased Focus on Sustainable and Eco-Friendly Solutions

Sustainability is a key trend influencing the global aerospace and defense wheel market. With the aviation industry facing heightened scrutiny regarding its environmental impact, there is a growing emphasis on developing sustainable and eco-friendly solutions. Manufacturers are exploring materials, manufacturing processes, and end-of-life considerations that align with broader environmental goals.One aspect of sustainability in the aerospace and defense wheel market involves the use of recyclable and eco-friendly materials. Manufacturers are evaluating alternative materials that have minimal environmental impact and can be recycled at the end of a wheel's life cycle. This trend is in line with the broader industry's commitment to circular economy principles and reducing the ecological footprint of aerospace components. Additionally, the focus on sustainability extends to manufacturing processes. Companies are adopting cleaner and more energy-efficient manufacturing methods to reduce their overall environmental impact. This includes exploring technologies like additive manufacturing (3D printing) that can minimize material waste and energy consumption during production.

As airlines and defense agencies increasingly prioritize sustainability in their operations, aerospace and defense wheel manufacturers are responding by offering products and solutions that align with these environmental considerations. This trend is expected to intensify as the industry continues to explore innovative ways to balance economic viability with environmental responsibility.

Growing Demand for Electric and Hybrid Aircraft

The global push towards electric and hybrid aircraft is a transformative trend impacting the aerospace and defense wheel market. Electric and hybrid propulsion systems are gaining prominence as the industry seeks to reduce its reliance on traditional aviation fuels and mitigate environmental impact. These innovative aircraft designs present specific challenges and opportunities for landing gear components, including wheels.Electric and hybrid aircraft often feature different propulsion architectures, including distributed electric propulsion and hybrid-electric systems. The landing gear, including wheels, must be adapted to accommodate the unique characteristics of these propulsion systems. For example, electric aircraft may have different power requirements for taxiing, requiring wheels capable of functioning as part of the overall electric propulsion system.

The demand for aerospace and defense wheels that can meet the requirements of electric and hybrid aircraft is driving innovation in wheel design and manufacturing. Manufacturers are developing wheels that are not only lightweight but also compatible with the specific demands of electric and hybrid propulsion, such as regenerative braking systems and integrated power distribution.

Emphasis on Additive Manufacturing and Design Optimization

The aerospace and defense wheel market is experiencing a paradigm shift with the increasing emphasis on additive manufacturing and design optimization. Additive manufacturing, commonly known as 3D printing, offers new possibilities for designing and producing complex geometries with improved efficiency. This technology allows for the creation of intricate wheel designs that were previously challenging or impossible using traditional manufacturing methods. Additive manufacturing enables designers to optimize the internal structure of wheels, reducing weight while maintaining structural integrity. This aligns with the industry's overall goal of lightweighting to improve fuel efficiency and reduce emissions. Moreover, the flexibility offered by additive manufacturing allows for on-demand production, reducing lead times and inventory costs for manufacturers.Design optimization goes hand in hand with additive manufacturing, allowing engineers to explore innovative shapes and structures that maximize performance. Computational tools and simulations play a crucial role in the design process, enabling manufacturers to analyze and refine wheel designs before physical prototypes are produced. The trend towards additive manufacturing and design optimization signifies a shift towards more agile and innovative manufacturing processes in the aerospace and defense wheel market. As technology continues to evolve, manufacturers are leveraging these advancements to offer wheels that meet the stringent performance requirements of modern aircraft while embracing the principles of efficiency and sustainability.

Segmental Insights

Aircraft Type Analysis

The aerospace and defense wheel market encompasses a diverse array of aircraft types, each with its own set of characteristics and market dynamics. Commercial Aircraft are typically designed for the transportation of passengers and cargo over long distances at high speeds, driving demand for wheels that can withstand heavy loads and provide reliability for frequent landings and take-offs. Meanwhile, Regional Aircraft often operate short-haul flights and require wheels that offer durability in a range of runway conditions. General Aircraft, which include private planes and small charters, necessitate wheels that are cost-effective and suitable for lower-intensity operations. Finally, Military Aircraft wheels are engineered to meet the rigorous demands of military operations, needing to support high-performance landings in varying and often rough terrains. Each segment presents unique challenges and opportunities for manufacturers in the aerospace wheel market.Regional Insights

In recent years, the global aerospace and defense wheel market has witnessed significant growth due to the increasing demand for aircraft in both commercial and defense sectors. The Asia-Pacific region, in particular, is experiencing a surge in market size, fueled by expanding air fleets and modernization initiatives within emerging economies such as China and India. The region's growth is driven by factors such as rising air traffic, growing economic prosperity, and strategic investments in defense capabilities.Meanwhile, North America continues to dominate the market share, bolstered by a robust aerospace industry, ongoing investments in defense infrastructure, and key market players focusing on innovation and technology advancements. The presence of established manufacturers and suppliers who are steadfast in their R&D efforts further cements this region's leading position.

Europe remains competitive owing to its strong focus on aerospace technologies and the presence of major industry players. European firms prioritize sustainability and efficiency, leading to advancements in lightweight and durable wheel designs that are set to redefine industry standards.

Each region brings its own unique trends and challenges to the aerospace and defense wheel market, reflecting diverse economic landscapes and policy environments which are key to understanding the market's future trajectory.

Report Scope

In this report, the Global Aerospace and Defense Wheel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Aerospace and Defense Wheel Market, By Aircraft Type:

- Commercial Aircraft

- Regional Aircraft

- General Aircraft

- Military Aircraft

Aerospace and Defense Wheel Market, By End Use:

- OEM

- Aftermarket

Aerospace and Defense Wheel Market, By Region:

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- South Korea

- Australia

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Turkey

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aerospace and Defense Wheel Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Aerospace and Defense Wheel market report.This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

2. Research Methodology

2.1. Methodology Landscape

2.2. Objective of the Study

2.3. Baseline Methodology

2.4. Formulation of the Scope

2.5. Assumptions and Limitations

2.6. Sources of Research

2.7. Approach for the Market Study

2.8. Methodology Followed for Calculation of Market Size & Market Shares

2.9. Forecasting Methodology

3. Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

4. Impact of COVID-19 on Global Aerospace and Defense Wheel Market

5. Global Aerospace and Defense Wheel Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Aircraft Type Market Share Analysis (Commercial Aircraft, Regional Aircraft, General Aircraft, and Military Aircraft)

5.2.2. By End Use Market Share Analysis (OEM, Aftermarket)

5.2.3. By Regional Market Share Analysis

5.2.3.1. Asia-Pacific Market Share Analysis

5.2.3.2. Europe & CIS Market Share Analysis

5.2.3.3. North America Market Share Analysis

5.2.3.4. South America Market Share Analysis

5.2.3.5. Middle East & Africa Market Share Analysis

5.2.4. By Company Market Share Analysis (Top 5 Companies, Others - By Value, 2023)

5.3. Global Aerospace and Defense Wheel Market Mapping & Opportunity Assessment

5.3.1. By Aircraft Type Market Mapping & Opportunity Assessment

5.3.2. By End Use Market Mapping & Opportunity Assessment

5.3.3. By Regional Market Mapping & Opportunity Assessment

6. Asia-Pacific Aerospace and Defense Wheel Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Aircraft Type Market Share Analysis

6.2.2. By End Use Market Share Analysis

6.2.3. By Country Market Share Analysis

6.2.3.1. China Market Share Analysis

6.2.3.2. India Market Share Analysis

6.2.3.3. Japan Market Share Analysis

6.2.3.4. Indonesia Market Share Analysis

6.2.3.5. Thailand Market Share Analysis

6.2.3.6. South Korea Market Share Analysis

6.2.3.7. Australia Market Share Analysis

6.2.3.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Aerospace and Defense Wheel Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Aircraft Type Market Share Analysis

6.3.1.2.2. By End Use Market Share Analysis

6.3.2. India Aerospace and Defense Wheel Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Aircraft Type Market Share Analysis

6.3.2.2.2. By End Use Market Share Analysis

6.3.3. Japan Aerospace and Defense Wheel Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Aircraft Type Market Share Analysis

6.3.3.2.2. By End Use Market Share Analysis

6.3.4. Indonesia Aerospace and Defense Wheel Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Aircraft Type Market Share Analysis

6.3.4.2.2. By End Use Market Share Analysis

6.3.5. Thailand Aerospace and Defense Wheel Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Aircraft Type Market Share Analysis

6.3.5.2.2. By End Use Market Share Analysis

6.3.6. South Korea Aerospace and Defense Wheel Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Aircraft Type Market Share Analysis

6.3.6.2.2. By End Use Market Share Analysis

6.3.7. Australia Aerospace and Defense Wheel Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Aircraft Type Market Share Analysis

6.3.7.2.2. By End Use Market Share Analysis

7. Europe & CIS Aerospace and Defense Wheel Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Aircraft Type Market Share Analysis

7.2.2. By End Use Market Share Analysis

7.2.3. By Country Market Share Analysis

7.2.3.1. Germany Market Share Analysis

7.2.3.2. Spain Market Share Analysis

7.2.3.3. France Market Share Analysis

7.2.3.4. Russia Market Share Analysis

7.2.3.5. Italy Market Share Analysis

7.2.3.6. United Kingdom Market Share Analysis

7.2.3.7. Belgium Market Share Analysis

7.2.3.8. Rest of Europe & CIS Market Share Analysis

7.3. Europe & CIS: Country Analysis

7.3.1. Germany Aerospace and Defense Wheel Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Aircraft Type Market Share Analysis

7.3.1.2.2. By End Use Market Share Analysis

7.3.2. Spain Aerospace and Defense Wheel Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Aircraft Type Market Share Analysis

7.3.2.2.2. By End Use Market Share Analysis

7.3.3. France Aerospace and Defense Wheel Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Aircraft Type Market Share Analysis

7.3.3.2.2. By End Use Market Share Analysis

7.3.4. Russia Aerospace and Defense Wheel Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Aircraft Type Market Share Analysis

7.3.4.2.2. By End Use Market Share Analysis

7.3.5. Italy Aerospace and Defense Wheel Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Aircraft Type Market Share Analysis

7.3.5.2.2. By End Use Market Share Analysis

7.3.6. United Kingdom Aerospace and Defense Wheel Market Outlook

7.3.6.1. Market Size & Forecast

7.3.6.1.1. By Value

7.3.6.2. Market Share & Forecast

7.3.6.2.1. By Aircraft Type Market Share Analysis

7.3.6.2.2. By End Use Market Share Analysis

7.3.7. Belgium Aerospace and Defense Wheel Market Outlook

7.3.7.1. Market Size & Forecast

7.3.7.1.1. By Value

7.3.7.2. Market Share & Forecast

7.3.7.2.1. By Aircraft Type Market Share Analysis

7.3.7.2.2. By End Use Market Share Analysis

8. North America Aerospace and Defense Wheel Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Aircraft Type Market Share Analysis

8.2.2. By End Use Market Share Analysis

8.2.3. By Country Market Share Analysis

8.2.3.1. United States Market Share Analysis

8.2.3.2. Mexico Market Share Analysis

8.2.3.3. Canada Market Share Analysis

8.3. North America: Country Analysis

8.3.1. United States Aerospace and Defense Wheel Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Aircraft Type Market Share Analysis

8.3.1.2.2. By End Use Market Share Analysis

8.3.2. Mexico Aerospace and Defense Wheel Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Aircraft Type Market Share Analysis

8.3.2.2.2. By End Use Market Share Analysis

8.3.3. Canada Aerospace and Defense Wheel Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Aircraft Type Market Share Analysis

8.3.3.2.2. By End Use Market Share Analysis

9. South America Aerospace and Defense Wheel Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Aircraft Type Market Share Analysis

9.2.2. By End Use Market Share Analysis

9.2.3. By Country Market Share Analysis

9.2.3.1. Brazil Market Share Analysis

9.2.3.2. Argentina Market Share Analysis

9.2.3.3. Colombia Market Share Analysis

9.2.3.4. Rest of South America Market Share Analysis

9.3. South America: Country Analysis

9.3.1. Brazil Aerospace and Defense Wheel Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Aircraft Type Market Share Analysis

9.3.1.2.2. By End Use Market Share Analysis

9.3.2. Colombia Aerospace and Defense Wheel Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Aircraft Type Market Share Analysis

9.3.2.2.2. By End Use Market Share Analysis

9.3.3. Argentina Aerospace and Defense Wheel Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Aircraft Type Market Share Analysis

9.3.3.2.2. By End Use Market Share Analysis

10. Middle East & Africa Aerospace and Defense Wheel Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Aircraft Type Market Share Analysis

10.2.2. By End Use Market Share Analysis

10.2.3. By Country Market Share Analysis

10.2.3.1. South Africa Market Share Analysis

10.2.3.2. Turkey Market Share Analysis

10.2.3.3. Saudi Arabia Market Share Analysis

10.2.3.4. UAE Market Share Analysis

10.2.3.5. Rest of Middle East & Africa Market Share Analysis

10.3. Middle East & Africa: Country Analysis

10.3.1. South Africa Aerospace and Defense Wheel Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Aircraft Type Market Share Analysis

10.3.1.2.2. By End Use Market Share Analysis

10.3.2. Turkey Aerospace and Defense Wheel Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Aircraft Type Market Share Analysis

10.3.2.2.2. By End Use Market Share Analysis

10.3.3. Saudi Arabia Aerospace and Defense Wheel Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Aircraft Type Market Share Analysis

10.3.3.2.2. By End Use Market Share Analysis

10.3.4. UAE Aerospace and Defense Wheel Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Aircraft Type Market Share Analysis

10.3.4.2.2. By End Use Market Share Analysis

11. SWOT Analysis

11.1. Strength

11.2. Weakness

11.3. Opportunities

11.4. Threats

12. Market Dynamics

12.1. Market Drivers

12.2. Market Challenges

13. Market Trends and Developments

14. Competitive Landscape

14.1. Company Profiles (Up to 10 Major Companies)

14.1.1. Meggitt Aircraft Braking Systems

14.1.1.1. Company Details

14.1.1.2. Key Product Offered

14.1.1.3. Financials (As Per Availability)

14.1.1.4. Recent Developments

14.1.1.5. Key Management Personnel

14.1.2. Honeywell Aerospace

14.1.2.1. Company Details

14.1.2.2. Key Product Offered

14.1.2.3. Financials (As Per Availability)

14.1.2.4. Recent Developments

14.1.2.5. Key Management Personnel

14.1.3. Parker

14.1.3.1. Company Details

14.1.3.2. Key Product Offered

14.1.3.3. Financials (As Per Availability)

14.1.3.4. Recent Developments

14.1.3.5. Key Management Personnel

14.1.4. Safran Landing Systems

14.1.4.1. Company Details

14.1.4.2. Key Product Offered

14.1.4.3. Financials (As Per Availability)

14.1.4.4. Recent Developments

14.1.4.5. Key Management Personnel

14.1.5. UTC Aerospace Systems.

14.1.5.1. Company Details

14.1.5.2. Key Product Offered

14.1.5.3. Financials (As Per Availability)

14.1.5.4. Recent Developments

14.1.5.5. Key Management Personnel

14.1.6. Boeing

14.1.6.1. Company Details

14.1.6.2. Key Product Offered

14.1.6.3. Financials (As Per Availability)

14.1.6.4. Recent Developments

14.1.6.5. Key Management Personnel

14.1.7. Airbus

14.1.7.1. Company Details

14.1.7.2. Key Product Offered

14.1.7.3. Financials (As Per Availability)

14.1.7.4. Recent Developments

14.1.7.5. Key Management Personnel

14.1.8. Bombardier.

14.1.8.1. Company Details

14.1.8.2. Key Product Offered

14.1.8.3. Financials (As Per Availability)

14.1.8.4. Recent Developments

14.1.8.5. Key Management Personnel

14.1.9. Embraer

14.1.9.1. Company Details

14.1.9.2. Key Product Offered

14.1.9.3. Financials (As Per Availability)

14.1.9.4. Recent Developments

14.1.9.5. Key Management Personnel

14.1.10. ATR

14.1.10.1. Company Details

14.1.10.2. Key Product Offered

14.1.10.3. Financials (As Per Availability)

14.1.10.4. Recent Developments

14.1.10.5. Key Management Personnel

15. Strategic Recommendations

15.1. Key Focus Areas

15.1.1. Target Regions

15.1.2. Target End Use

15.1.3. Target Aircraft Type

16. About Us & Disclaimer

Companies Mentioned

- Meggitt Aircraft Braking Systems

- Honeywell Aerospace

- Parker

- Safran Landing Systems

- UTC Aerospace Systems.

- Boeing

- Airbus

- Bombardier

- Embraer

- ATR

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.03 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |