Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market players in the global drone insurance sector are focusing on strategic partnerships and collaborations to enhance their offerings and expand their market presence. Additionally, advancements in technology, such as the integration of artificial intelligence and data analytics, are being leveraged to assess risks more accurately and streamline the insurance process. With the continuous evolution of drone technology and the increasing integration of drones into everyday business operations, the global drone insurance market is expected to witness sustained growth. As industries continue to embrace drone technology for efficiency and cost-effectiveness, the demand for comprehensive and tailored insurance solutions will likely drive further innovation in the drone insurance sector.

Market Drivers

Increased Drone Adoption Across Industries

One of the primary drivers of the global drone insurance market is the widespread adoption of drones across various industries. Drones are being utilized for diverse applications, including aerial photography, agriculture, infrastructure inspection, surveillance, and delivery services. As industries integrate drones into their operations to enhance efficiency and productivity, the risk landscape evolves, necessitating insurance coverage. The growing use of drones in commercial applications, such as e-commerce deliveries, emergency response, and agriculture, has led to an increased demand for insurance solutions that address the specific risks associated with these use cases.Regulatory Environment and Compliance

The regulatory landscape significantly influences the drone insurance market. Governments worldwide are implementing and refining regulations to ensure the safe and responsible use of drones. Compliance with these regulations is a critical factor for drone operators, and insurance coverage often plays a vital role in meeting regulatory requirements. Insurance providers are closely monitoring and adapting to changes in drone regulations, offering policies that align with the evolving legal frameworks. The dynamic nature of regulatory requirements presents both challenges and opportunities for the drone insurance market, as insurers must stay agile in responding to shifting compliance standards while ensuring that their policies effectively cover the associated risks.Emergence of Innovative Insurance Solutions

The drone insurance market is witnessing the development of innovative solutions tailored to the unique risks posed by drone operations. Insurers are increasingly offering comprehensive coverage beyond traditional liability aspects. Policies may include coverage for physical damage to drones, theft, cyber liability, and even coverage for third-party bodily injury. To address the dynamic nature of the drone industry, some insurance providers are incorporating emerging technologies like artificial intelligence and data analytics into their offerings. These technologies enable insurers to assess risks more accurately, streamline underwriting processes, and offer customized policies based on the specific needs of drone operators.Strategic Partnerships and Collaborations

Collaboration and partnerships among insurance companies, drone manufacturers, technology providers, and regulatory bodies play a crucial role in driving the growth of the drone insurance market. Insurers are forming strategic alliances to enhance their market presence, expand their offerings, and stay at the forefront of technological advancements. Partnerships with drone manufacturers allow insurers to gain insights into the technical aspects of drones and tailor their policies accordingly. Moreover, collaborations with technology companies enable the integration of advanced tools for risk assessment and claims processing. As the drone ecosystem becomes more interconnected, these partnerships become essential for providing holistic and effective insurance solutions.Technological Advancements in Risk Assessment

The integration of advanced technologies, such as artificial intelligence (AI) and data analytics, is revolutionizing the way insurers assess and manage risks associated with drone operations. AI-powered algorithms can analyze vast amounts of data to identify patterns and trends, enabling insurers to make more informed decisions about underwriting and pricing. This technology also facilitates real-time risk assessment, allowing insurers to dynamically adjust coverage based on changing circumstances. Additionally, the use of drones themselves for risk assessment is becoming more prevalent. Insurers leverage drone technology to conduct aerial inspections, assess damages, and gather data for accurate claims processing. These technological advancements not only enhance the efficiency of insurance processes but also contribute to the overall risk management strategies for drone operators.In conclusion, the global drone insurance market is influenced by a combination of factors, including increased drone adoption, regulatory developments, the emergence of innovative insurance solutions, strategic collaborations, and technological advancements. As the drone industry continues to evolve, the insurance market is expected to adapt and expand, providing comprehensive coverage to meet the evolving needs of drone operators across various sectors.

Key Market Challenges

Uncertain and Evolving Regulatory Landscape

The regulatory environment for drones is continually evolving as governments worldwide seek to strike a balance between encouraging innovation and ensuring safety and security. The lack of standardized global regulations poses a challenge for insurers in developing consistent and universally applicable policies. Different countries may have varying requirements for drone operations, including insurance coverage mandates. Insurers must navigate these complex and sometimes conflicting regulatory frameworks to provide coverage that aligns with the specific needs of drone operators. The dynamic nature of drone regulations further complicates the underwriting process, requiring insurers to stay agile and adapt their policies to changes in the legal landscape.Risk Assessment and Modeling Complexity

Drones operate in diverse environments and are used for a wide range of applications, each presenting unique risks. Assessing and modeling these risks accurately is a complex task for insurance providers. The lack of historical data for certain drone use cases makes it challenging to develop actuarial models and predict potential losses accurately. Additionally, the rapid evolution of drone technology introduces new risks that may not be fully understood or adequately assessed by traditional risk models. Insurers need to invest in advanced technologies such as artificial intelligence and data analytics to improve risk assessment capabilities. The complexity of risk modeling is further compounded by factors such as weather conditions, airspace congestion, and human factors, requiring insurers to continually refine their models to reflect the evolving drone landscape.Limited Standardization of Coverage

The absence of standardized coverage across the drone insurance market poses challenges for both insurers and drone operators. Policies offered by different insurers may vary significantly in terms of coverage, exclusions, and limits. This lack of standardization can lead to confusion among drone operators seeking insurance, as well as challenges in comparing and evaluating different policies. Standardization efforts are essential to provide clarity and consistency in coverage, making it easier for drone operators to understand their insurance options. Industry collaboration and the development of standardized policy templates could contribute to a more transparent and accessible drone insurance market, fostering better understanding and trust among stakeholders.Emerging Threats and Cybersecurity Risks

As drones become more integrated into various industries, the potential for emerging threats and cybersecurity risks increases. Drones are susceptible to hacking, data breaches, and unauthorized access, posing risks not only to the physical safety of the drone but also to the sensitive data they may carry. Insurers must grapple with the challenge of developing policies that address these cybersecurity risks comprehensively. Cyber insurance for drones is a relatively new and evolving field, requiring insurers to stay ahead of emerging threats and continuously update their coverage to address the evolving nature of cyber risks associated with drone operations. The interconnected nature of the drone ecosystem and the reliance on data-driven technologies make cybersecurity a critical aspect of risk management for insurers and drone operators alike.Public Perception and Acceptance

Public perception of drones and concerns about their safety and privacy impact the broader acceptance and integration of drones into society. Negative incidents involving drones, such as collisions or privacy breaches, can influence public opinion and contribute to skepticism and resistance. Insurance providers must navigate this challenge by addressing public concerns through clear communication about the safety measures in place and the role of insurance in mitigating risks. Building trust with the public is essential for the continued growth of the drone industry and, consequently, the drone insurance market. Moreover, insurers need to be proactive in educating the public about the benefits of drones and the risk mitigation measures in place to foster a more positive perception of drone technology.In conclusion, the global drone insurance market faces challenges related to the uncertain regulatory landscape, the complexity of risk assessment, limited standardization of coverage, emerging cybersecurity risks, and public perception. Addressing these challenges requires collaboration among industry stakeholders, investments in advanced technologies, and a proactive approach to adapting policies to the evolving dynamics of the drone industry. As the drone ecosystem continues to mature, overcoming these challenges will be crucial for insurers to provide effective coverage and support the responsible and widespread integration of drones into various sectors.

Key Market Trends

Customized Coverage and Tailored Policies

A significant trend in the drone insurance market is the shift towards offering more customized coverage and tailored policies. Insurers are recognizing the diverse applications of drones across various industries, each presenting unique risks. As a result, insurance providers are moving away from one-size-fits-all policies and are increasingly working with drone operators to develop bespoke coverage that aligns with specific operational needs. This trend allows for a more precise assessment of risks and ensures that drone operators have coverage that addresses the specific challenges associated with their use cases, whether it's agriculture, construction, or drone delivery services.Integration of Telematics and Data Analytics

The integration of telematics and data analytics is becoming a prominent trend in the drone insurance market. Telematics technology involves the use of sensors and GPS devices on drones to collect real-time data about their flight patterns, operational conditions, and overall performance. Insurers leverage this data to gain insights into risk factors, assess pilot behavior, and refine underwriting processes. Data analytics, powered by artificial intelligence and machine learning, enables insurers to analyze vast datasets efficiently. This trend not only enhances risk assessment capabilities but also facilitates the development of usage-based insurance (UBI) models, where premiums are determined based on actual drone usage patterns and behaviors.Collaboration with Drone Manufacturers and Technology Providers

Collaborations between insurance companies and drone manufacturers or technology providers are on the rise. Insurers recognize the value of partnering with industry stakeholders to gain a deeper understanding of drone technology, enhance risk assessment capabilities, and stay at the forefront of industry advancements. These partnerships allow insurers to incorporate technological innovations, such as drone health monitoring systems and safety features, into their coverage offerings. Collaborations also enable insurers to access real-time data from drone operations, improving their ability to assess risks and provide more accurate and up-to-date coverage to drone operators.Blockchain Technology for Enhanced Transparency

Blockchain technology is emerging as a trend in the drone insurance market, offering enhanced transparency and efficiency in policy management and claims processing. Blockchain provides a decentralized and tamper-resistant ledger, allowing for secure and transparent recording of drone-related transactions and data. Insurers can use blockchain to streamline the verification of drone flight logs, pilot certifications, and insurance policies. This technology enhances trust among stakeholders by providing an immutable record of information. Additionally, blockchain can facilitate faster and more transparent claims processing, reducing the administrative burden and ensuring a more efficient resolution of insurance claims in the event of an incident involving a drone.Rise of On-Demand and Pay-Per-Flight Insurance Models

The drone insurance market is experiencing a shift towards more flexible and on-demand insurance models. Traditional annual policies may not align with the sporadic and project-based nature of many drone operations. As a response, insurers are introducing on-demand and pay-per-flight insurance options. These models allow drone operators to purchase coverage for specific flights or periods, providing a cost-effective and flexible approach to insurance. This trend is particularly relevant for industries where drone usage is intermittent or project-specific, such as in construction, event coverage, or infrastructure inspections. On-demand models empower drone operators to tailor insurance coverage to their immediate needs, contributing to cost efficiency and better risk management.In conclusion, recent trends in the global drone insurance market reflect a shift towards more customized coverage, the integration of advanced technologies like telematics and blockchain, increased collaboration with industry stakeholders, and the emergence of flexible insurance models. As the drone industry continues to grow and diversify, these trends are likely to shape the evolution of the drone insurance market, providing more effective and responsive coverage solutions for the unique risks associated with drone operations across various sectors.

Segmental Insights

Type Insights

The global drone insurance market is experiencing a notable surge in the demand for liability coverage, driven by the increasing awareness of potential risks associated with drone operations. As drones become integral to a wide range of industries, including agriculture, construction, and delivery services, the need for coverage that addresses third-party liabilities is becoming paramount. Liability coverage in drone insurance typically includes protection against damages or injuries caused to third parties, including property damage or bodily harm resulting from drone operations. With the potential for accidents such as collisions, equipment malfunctions, or unexpected flight deviations, businesses and drone operators are recognizing the importance of robust liability coverage to mitigate the financial repercussions of unforeseen incidents.The rising demand for liability coverage is also influenced by regulatory requirements in many regions. Authorities often mandate that drone operators carry liability insurance to ensure compensation for third-party damages in case of accidents or mishaps. This regulatory push, combined with the growing realization of the financial implications of liability claims, is fueling the increased adoption of liability coverage within the global drone insurance market. As industries continue to leverage drone technology for various applications, the demand for comprehensive liability coverage is expected to remain a key driver in shaping the landscape of the drone insurance market.

Application Insights

The global drone insurance market is witnessing a significant upswing in demand from the commercial segment, as businesses increasingly integrate drones into their operations for various purposes. Drones are being employed across industries such as agriculture, construction, real estate, and logistics, driving the need for tailored insurance solutions that cater to the unique risks associated with these applications. Commercial drone operators recognize the importance of mitigating potential financial losses arising from accidents, equipment failures, or third-party liabilities. As a result, there is a growing awareness that comprehensive insurance coverage is not only a regulatory necessity but also a strategic investment to safeguard assets and ensure business continuity.The surge in demand from the commercial segment is fueled by the expanding use cases for drones, ranging from aerial surveys and inspections to monitoring and surveillance. Companies leveraging drone technology for tasks like infrastructure inspection or precision agriculture are seeking insurance coverage that addresses specific operational risks. Additionally, as the commercial drone market matures, insurance providers are responding by offering more specialized and flexible policies to meet the evolving needs of businesses relying on drones. This trend underscores the crucial role that insurance plays in facilitating the widespread adoption of drones across industries and supporting the growth of the commercial drone market.

Regional Insights

The North America region is witnessing a substantial surge in demand within the global drone insurance market, reflecting the rapid adoption and integration of drone technology across various sectors. The United States, in particular, has emerged as a key driver of this trend, with businesses and industries recognizing the diverse applications of drones and the associated need for comprehensive insurance coverage. In North America, drones are being employed for tasks such as aerial surveying, precision agriculture, infrastructure inspection, and even package delivery. The region's robust regulatory framework, with the Federal Aviation Administration (FAA) playing a central role, has prompted businesses to prioritize insurance coverage to comply with regulations and mitigate risks.The rising demand for drone insurance in North America can be attributed to the increasing awareness of potential liabilities, property damage, and personal injury risks associated with drone operations. As the commercial drone market continues to expand, industries across the region are seeking specialized insurance solutions that address their specific needs. The comprehensive nature of coverage, including liability protection and coverage for physical damage to drones, aligns with the risk mitigation strategies adopted by businesses in North America. This trend is likely to persist as drone technology becomes more ingrained in everyday business operations, solidifying North America's position as a significant contributor to the growth of the global drone insurance market.

Report Scope

In this report, the Global Drone Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Drone Insurance Market, By Type:

- Liability Coverage

- Hull Damage

- Theft Coverage

- Loss or Flyaway Coverage

- Payload Coverage

- Ground Equipment Coverage

- Others

Drone Insurance Market, By Pricing:

- Hourly

- Monthly

- Annually

Drone Insurance Market, By Application:

- Residential

- Commercial

Drone Insurance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- Egypt

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Drone Insurance Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Drone Insurance Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thimble Insurance

- Avion Insurance

- REIN

- Coverdrone

- Driessen Assuradeuren

- Embroker

- Moonrock Insurance

- InsureTech Connect

- Global Aerospace

- Towergate

Table Information

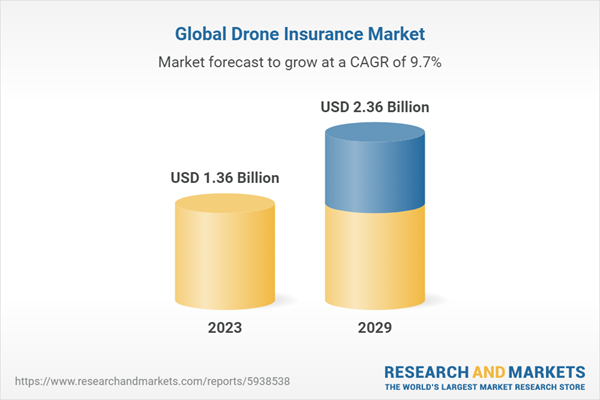

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.36 Billion |

| Forecasted Market Value ( USD | $ 2.36 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |