Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Wet shaving offers several advantages over other hair removal methods. It provides a close, smooth shave with minimal irritation when done correctly. Wet shaving enthusiasts often argue that it offers a more luxurious and tactile experience compared to electric razors or cartridge razors.

In recent years, global wet shave culture has seen a resurgence in popularity. Traditional shaving techniques, including the use of safety razors and straight razors, have gained a dedicated following among those seeking a sustainable, cost-effective, and eco-friendly alternative to disposable razors. Wet shaving has also become a hobby for many, with a thriving community of enthusiasts sharing tips, product reviews, and grooming rituals.

Moreover, the wet shaving industry has expanded to include a wide range of artisanal shaving products, from high-quality razors and brushes to artisanal shaving soaps and creams. This industry has embraced both modern innovations and time-tested traditions, catering to a diverse market of wet shaving aficionados and newcomers alike.

Key Market Drivers

Sustainability and Environmental Concerns

One of the most significant drivers behind the resurgence of wet shaving on a global scale is a growing awareness of sustainability and environmental issues. Traditional wet shaving methods are inherently more eco-friendly compared to disposable razors and cartridges. Disposable razors generate substantial plastic waste, contributing to the global plastic pollution crisis. In contrast, traditional wet shaving equipment, such as safety razors and straight razors, are durable and designed for long-term use, reducing the need for frequent replacements and decreasing the overall environmental impact.Moreover, traditional wet shaving typically employs shaving soaps or creams packaged in recyclable or biodegradable materials, further aligning with environmentally conscious consumer choices. As consumers become increasingly concerned about their ecological footprint, the sustainability aspect of wet shaving continues to attract a growing number of individuals seeking a greener grooming alternative.

Quality and Performance

Another driving force behind the global wet shave industry is the quest for superior quality and performance. Wet shaving enthusiasts often argue that traditional methods provide a closer, smoother shave with less skin irritation compared to electric or cartridge razors. Safety razors, in particular, are prized for their precision and ability to minimize ingrown hairs and razor bumps. This emphasis on shaving efficacy and comfort has led many consumers to explore wet shaving as a means of elevating their grooming experience.Manufacturers have responded by producing high-quality wet shaving products, including premium razors, brushes, and artisanal shaving creams. This focus on quality has elevated the wet shaving market, attracting discerning consumers who are willing to invest in products that deliver a superior shaving experience. The performance-driven nature of wet shaving fosters innovation, ensuring that the industry continues to evolve and offer cutting-edge solutions to consumers.

Cultural and Retro Revival

The revival of traditional wet shaving methods has also been driven by a cultural and retro resurgence. Wet shaving harks back to an era when grooming was a ritual, and traditional craftsmanship was highly valued. This nostalgia for a bygone era, coupled with a desire for a slower, more deliberate grooming experience, has resonated with individuals seeking to reconnect with a sense of authenticity and tradition in their daily routines.This revival has been further fueled by popular culture, including movies and television series set in historical contexts, which often feature characters sporting well-groomed beards and mustaches. Additionally, the "barbershop revival" trend has played a role in romanticizing the traditional art of wet shaving, as more people seek out classic barbershops that offer straight razor shaves and traditional grooming services.

The cultural appeal of wet shaving extends to the aesthetic aspect of the practice, with many enthusiasts appreciating the craftsmanship and elegance of traditional shaving equipment, from beautifully designed razors to intricately crafted brush handles. This cultural and retro revival has created a sense of nostalgia and reverence for wet shaving, attracting new generations to this time-honored grooming ritual.

Community and Education

The global wet shave community and its emphasis on education and sharing have significantly contributed to the growth of this industry. Enthusiasts, often referred to as "wet shavers," have created a tight-knit global community where they exchange knowledge, experiences, and tips. Online forums, social media groups, and YouTube channels dedicated to wet shaving have flourished, providing platforms for enthusiasts to discuss techniques, review products, and showcase their shaving rituals.This sense of community and shared learning has demystified wet shaving for newcomers, making it more accessible and less intimidating. As a result, individuals who were previously unfamiliar with traditional wet shaving methods have been encouraged to try it for themselves. The online presence of experienced wet shavers has served as a valuable resource for those seeking guidance on equipment selection, shaving techniques, and product recommendations.

Manufacturers and artisans within the wet shaving industry have also embraced this community-driven approach, often collaborating with influencers and enthusiasts to create exclusive products and designs. The focus on education and community-building ensures that the wet shaving industry continues to attract newcomers and fosters a sense of camaraderie among enthusiasts worldwide.

Key Market Challenges

Competition from Disposable and Cartridge Razors

One of the primary challenges for the wet shave industry is competition from disposable and cartridge razors. Many consumers opt for these convenient and easy-to-use razors, which are widely available in supermarkets and drugstores. Disposable and cartridge razors are perceived as low-maintenance options that don't require the use of shaving cream or a brush, making them attractive choices for individuals seeking a quick and hassle-free shaving experience.To counter this competition, the wet shave industry must emphasize the unique benefits of traditional wet shaving, such as the closer shave and reduced environmental impact. Additionally, manufacturers should continue to innovate by creating user-friendly safety razors and enhancing the overall wet shaving experience to attract consumers who may be hesitant to switch from their current shaving methods.

Environmental Concerns and Packaging

While traditional wet shaving is often touted for its eco-friendliness compared to disposable razors, the industry still grapples with certain environmental challenges. For instance, some wet shaving products come in packaging that may not be easily recyclable or biodegradable. Shaving soap containers, for example, are typically made of plastic or non-recyclable materials, which can contribute to plastic waste.Manufacturers need to address these concerns by adopting more sustainable packaging solutions, such as using recyclable or biodegradable materials. Additionally, educating consumers about the environmental benefits of wet shaving and proper disposal methods for used razor blades can help reduce the overall ecological footprint of the industry.

Limited Market Awareness and Education

A significant challenge faced by the global wet shave industry is the limited awareness and education among potential consumers. Many individuals, especially younger generations, are not familiar with traditional wet shaving techniques, razors, and related products. This lack of awareness can hinder the industry's growth, as potential customers may be hesitant to explore an unfamiliar grooming method.To overcome this challenge, the industry should invest in educational initiatives that highlight the benefits of wet shaving, including its sustainability, superior shaving experience, and cost-effectiveness in the long run. Collaborations with influencers, grooming experts, and barbershops can help spread awareness and provide hands-on demonstrations of wet shaving techniques. Online resources, such as video tutorials and informative articles, can also play a crucial role in educating consumers about the advantages of traditional wet shaving.

Market Saturation and Niche Appeal

While the wet shave industry has experienced a resurgence in recent years, it remains a niche market compared to disposable and cartridge razors. Market saturation can be a challenge as manufacturers and artisans within the industry compete for a limited pool of enthusiasts and newcomers interested in traditional wet shaving.To address this challenge, the industry can diversify its product offerings to cater to a broader audience. This includes developing a range of razors and shaving products at different price points to accommodate consumers with varying budgets. Furthermore, the industry can explore partnerships with mainstream retailers to increase visibility and accessibility of wet shaving products.

The niche appeal of wet shaving also presents an opportunity for the industry to maintain a sense of exclusivity and craftsmanship. Emphasizing the artisanal and heritage aspects of wet shaving can attract discerning consumers who appreciate the quality and authenticity of traditional grooming products.

Key Market Trends

Sustainability and Eco-Friendly Practices

Sustainability is a prominent trend in the global wet shave industry. As consumers become more environmentally conscious, they are seeking grooming alternatives that minimize waste and reduce their ecological footprint. Traditional wet shaving methods align with these values, as they generate less plastic waste compared to disposable and cartridge razors.A key sustainability trend in wet shaving is the adoption of reusable and durable shaving equipment. Safety razors, made from materials like stainless steel or brass, are gaining popularity due to their longevity and recyclability. These razors provide a close shave and reduce the need for frequent replacement, making them a cost-effective and eco-friendly choice.

Additionally, shaving soaps and creams are being offered in eco-conscious packaging, such as recyclable or biodegradable containers. Some manufacturers are also exploring innovative refill systems to minimize packaging waste.

Sustainable wet shaving practices extend to blade disposal. Initiatives to promote safe blade disposal, such as blade banks or take-back programs, are emerging to address the proper disposal of used razor blades.

Customization and Personalization

Personalization is a growing trend in the wet shave industry, as consumers seek grooming products tailored to their unique needs and preferences. Manufacturers are responding by offering a wide range of customizable options.One notable aspect of this trend is the availability of artisanal shaving soaps and creams in various scents and formulations. Customers can choose products with specific ingredients that cater to their skin type or fragrance preferences. Additionally, some artisans offer bespoke shaving soap options, allowing customers to request custom scent blends.

Razor customization is also on the rise. Some companies offer customizable safety razors with interchangeable handles and adjustable blade gaps, allowing users to fine-tune their shaving experience for optimal comfort and efficiency. Engraving and personalization services for razor handles are gaining popularity as well, providing customers with a unique and personalized grooming tool.

Furthermore, subscription services are incorporating personalization by curating shaving kits tailored to individual preferences. These kits often include razors, blades, and grooming products chosen based on a customer's grooming needs and style.

Digital and E-commerce Integration

The digital landscape is playing a significant role in the wet shave industry. E-commerce platforms have become the primary sales channel for many wet shaving products, allowing consumers to browse, purchase, and receive grooming supplies conveniently online.Online retailers and marketplaces offer a wide selection of wet shaving products, making it easier for consumers to explore various brands and product offerings. Many manufacturers and artisans also maintain a strong online presence, using websites and social media to showcase their products, provide grooming tips, and engage with the wet shaving community.

Digital marketing and influencer collaborations have become essential strategies for promoting wet shaving products. Brands often partner with grooming enthusiasts, barbers, and influencers who share their experiences and recommendations with a global audience through blogs, YouTube channels, and social media platforms.

Subscription services, which deliver shaving essentials directly to customers' doors on a regular basis, have also gained momentum. These services offer convenience and personalized grooming experiences through online quizzes and customer profiles.

Rise of Women in Wet Shaving

While traditional wet shaving has historically been associated with men, there is a growing trend of women embracing wet shaving as an effective and eco-friendly hair removal method. Women are discovering the benefits of safety razors and straight razors for achieving a close and smooth shave.Manufacturers have responded by creating safety razors designed with women in mind, featuring elegant and ergonomic designs. Some companies also offer feminine-themed razors and grooming products.

The wet shaving community has become more inclusive, with women sharing their experiences and tips through social media and online forums. This trend reflects a shift in gender norms and a desire for sustainable and cost-effective grooming alternatives among women.

Segmental Insights

Product Insights

Disposable razors are indeed a prominent product segment within the wet shave industry. Their surging popularity is underpinned by their user-friendly design, making them a go-to choice for many consumers seeking a hassle-free shaving experience. The disposability factor eliminates the need for blade sharpening or maintenance, which is especially appealing to those looking for a convenient grooming option.Moreover, the affordability of disposable razors is a key selling point, making them accessible to a wide range of consumers, including budget-conscious individuals. The market offers a plethora of disposable razor options, from basic single-blade designs to multi-blade cartridges with additional features, catering to different shaving preferences and needs.

However, it's essential to acknowledge the environmental implications of this growth. Disposable razors are typically made of plastic, contributing to plastic waste concerns. As sustainability gains momentum in consumer choices, addressing these environmental challenges will be critical for the continued success of the disposable razor segment in the wet shave industry. Manufacturers may need to explore more eco-friendly materials and disposal solutions to align with evolving consumer values.

Application Insights

The household segment is emerging as the fastest-growing category in the wet shave industry. This trend reflects a shift in consumer behavior, as more individuals are choosing to shave at home rather than relying on professional barber services. Factors such as convenience, cost-effectiveness, and hygiene concerns have contributed to the rise of household wet shaving. The availability of high-quality safety razors, straight razors, and grooming products for home use has also played a pivotal role in this growth. With consumers increasingly adopting DIY grooming routines, the household segment is expected to continue its expansion within the wet shave industry.Regional Insights

North America stands as the dominant market in the wet shave industry. This region exhibits a strong grooming culture and a robust market for wet shaving products. The United States, in particular, drives this dominance with a thriving community of wet shaving enthusiasts and a diverse market for razors, shaving creams, and related products. Factors like consumer awareness, a preference for high-quality grooming experiences, and the presence of well-established manufacturers contribute to North America's leadership in the wet shave sector. The region's commitment to sustainability and a growing focus on artisanal and customized grooming options further solidify its prominence in the industry.Report Scope

In this report, the global Wet Shave market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Wet Shave Market, By Product:

- Disposable Razors

- Non-disposable Razors

- Razor Cartridges

- Blades

- Shaving Lotions & Creams

- Others

Wet Shave Market, By Application:

- Household

- Salons & Spa

- Others

Wet Shave Market, By Sales Channel:

- Departmental Stores

- Hypermarkets/Supermarkets

- Multi-Branded Stores

- Online

- Others

Wet Shave Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wet Shave Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Wet Shave market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Johnson & Johnson

- The Procter & Gamble Company

- Beiersdorf AG

- Edwin Jagger Limited

- Unilever PLC

- Godrej Consumer Products Limited

- D.R. Harris & Co., Ltd.

- Taylor of Old Bond Street

- Edgewell Personal Care Company

- Raymond Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2024 |

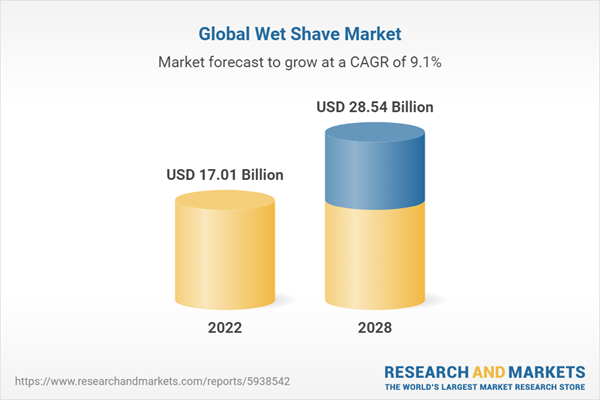

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 17.01 Billion |

| Forecasted Market Value ( USD | $ 28.54 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |