Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Surgical snares are used in various medical disciplines, including gastroenterology, urology, and gynecology, for minimally invasive and endoscopic procedures. This market has experienced significant growth in recent years, owing to a rising prevalence of chronic diseases and an aging global population, which has led to an increased demand for surgical interventions. Moreover, advancements in technology have resulted in more sophisticated and efficient surgical snares, enhancing the overall patient experience and the capabilities of medical professionals.

Key factors driving the growth of the global surgical snares market include the increasing incidence of conditions such as gastrointestinal tumors, colorectal polyps, and bladder cancer, which necessitate surgical removal. Additionally, the shift towards minimally invasive surgical techniques has fostered the adoption of surgical snares due to their ability to facilitate precise, targeted tissue removal while minimizing patient trauma. The market is also influenced by the expansion of healthcare infrastructure in emerging economies, leading to a greater availability of advanced medical equipment.

Key Market Drivers

Growing Incidence of Chronic Diseases

The growing incidence of chronic diseases is a significant driver behind the expansion of the global surgical snares market. Chronic diseases, such as colorectal polyps, gastrointestinal tumors, and bladder cancer, are on the rise globally. These conditions often necessitate surgical interventions for diagnosis, treatment, or removal of abnormal tissues and growths. The increasing prevalence of chronic diseases is primarily attributed to factors like lifestyle changes, aging populations, and environmental factors. As these conditions become more common, the demand for precise and effective surgical procedures using tools like surgical snares has surged.Chronic diseases, particularly in gastroenterology and oncology, have seen a substantial increase in diagnoses due to advancements in diagnostic techniques and early detection methods. Early identification of abnormalities, such as polyps or tumors, enables healthcare providers to intervene at an earlier stage, often resulting in less invasive and more successful treatment options. Surgical snares play a pivotal role in this process by allowing healthcare professionals to remove abnormal tissues with precision, minimizing the impact on surrounding healthy tissue.

Key Market Challenges

Regulatory Compliance and Approval

Manufacturers of surgical snares must adhere to stringent regulatory requirements imposed by health authorities such as the Food and Drug Administration (FDA) in the United States or the Conformité Européenne (CE) mark in Europe. These regulations are designed to ensure the safety and efficacy of medical devices, including surgical snares. Meeting these requirements demands meticulous documentation, rigorous testing, and adherence to Good Manufacturing Practices (GMP). The time and resources required for this compliance can significantly delay the introduction of new products to the market.Gaining regulatory approvals for surgical snares can be a protracted and costly process. This delay can hinder manufacturers' ability to swiftly bring their innovative products to healthcare providers and patients in need. Moreover, the unpredictability of approval timelines can create challenges in planning and resource allocation for companies operating in the surgical snares market.

The surgical snares market is a global one, with companies looking to expand their reach to various regions. However, regulatory requirements can vary from one country to another, leading to additional complexities in compliance. Adapting products to meet the regulatory standards of different regions adds to the time and cost of market entry.

Key Market Trends

Increasing Healthcare Expenditure

The increasing expenditure in healthcare is a pivotal driver behind the growth of the global surgical snares market. Healthcare systems worldwide are experiencing a notable upswing in funding, driven by several factors, such as the growing awareness of health and wellness, rising disposable incomes, and government initiatives to improve healthcare access and quality. As healthcare budgets expand, a larger portion of these funds is allocated toward acquiring advanced medical equipment, including surgical snares.The rise in healthcare expenditure directly impacts the demand for surgical snares, which play an integral role in modern surgical interventions. These instruments are crucial for the precise and minimally invasive removal of abnormal tissues and growths during various medical procedures, aligning with the global trend toward less invasive surgical techniques. As healthcare providers invest in state-of-the-art equipment to enhance patient care and surgical outcomes, surgical snares become indispensable tools in their armamentarium.

Key Market Players

- Medtronic Plc

- Boston Scientific Corporation

- Medline Industries, Inc.

- Olympus Corporation

- Cook Medical Inc.

- CONMED Corporation

- Merit Medical Systems

- Avalign Technologies

- Hill-Rom Holdings, Inc.

- Sklar Surgical Instruments.

Report Scope:

In this report, the Global Surgical Snares Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Surgical Snares Market, By Usability:

- Single use

- Reusable

Surgical Snares Market, By Application:

- GI Endoscope

- Laparoscopy

- Urology Endoscopy

- Gynecology

- Endoscopy

- Arthroscopy

- Bronchoscopy

- Mediastinoscopy

- Laryngoscopy

- Others

Surgical Snares Market, By End-use:

- Hospitals

- Ambulatory Surgical Centers

- Others

Surgical Snares Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Surgical Snares Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Medtronic Plc

- Boston Scientific Corporation

- Medline Industries, Inc.

- Olympus Corporation

- Cook Medical Inc.

- CONMED Corporation

- Merit Medical Systems

- Avalign Technologies

- Hill-Rom Holdings, Inc.

- Sklar Surgical Instruments

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | March 2025 |

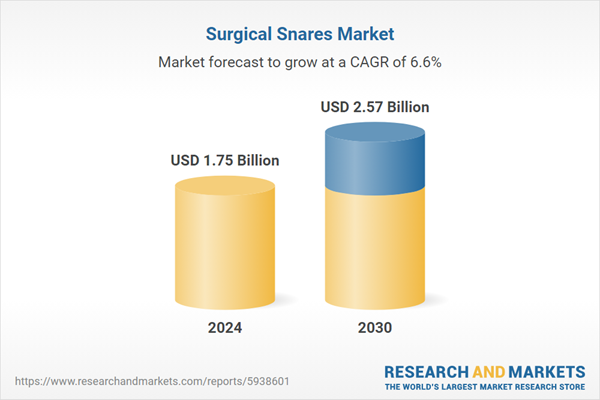

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.75 Billion |

| Forecasted Market Value ( USD | $ 2.57 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |