Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

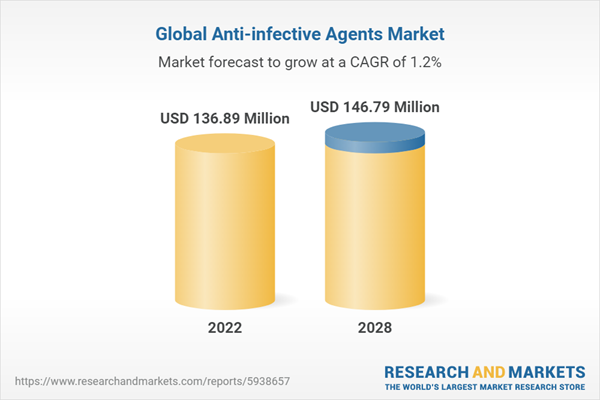

The market for anti-infective agents is substantial and continues to grow steadily. The exact size varies over time, influenced by factors such as emerging infectious diseases, population demographics, and evolving treatment paradigms. The market's growth is driven by the constant need for effective treatments to combat infectious diseases and emerging pathogens.

Key Market Drivers

Rising Infectious Disease Burden

The rising infectious disease burden serves as a paramount market driver for the growth of the Global Anti-infective Agents Market. The continual prevalence of infectious diseases, such as bacterial, viral, fungal, and parasitic infections, underscores the pressing need for effective anti-infective agents. These diseases pose significant public health challenges and necessitate the availability of a wide range of pharmaceuticals to combat them. Pathogens, including bacteria and viruses, evolve and develop resistance to existing treatments. This necessitates ongoing research and development of new anti-infective agents to keep pace with the changing nature of infectious diseases. Market growth is fueled by the need to address these evolving threats.The rise of antimicrobial resistance (AMR) in pathogens is a critical concern. AMR reduces the efficacy of commonly used antibiotics and antiviral drugs, rendering many treatments less effective. The market must respond by developing novel anti-infective agents that can overcome these resistance mechanisms. Outbreaks of infectious diseases, such as COVID-19, Ebola, or seasonal influenza, can quickly become global health threats. This highlights the necessity for a robust pipeline of anti-infective medications to manage and contain these outbreaks, both in terms of treatment and prevention. Developing nations often bear a significant burden of infectious diseases. These regions require affordable and accessible anti-infective agents to address diseases that disproportionately affect their populations. This market driver emphasizes the importance of affordability and availability.

Advancements in Drug Development

Advancements in drug development play a pivotal role as a market driver for the growth of the Global Anti-infective Agents Market. Advancements in drug development have led to the creation of more targeted anti-infective therapies. These drugs are designed to specifically target the underlying mechanisms of infection, which can lead to increased efficacy and reduced side effects.The concept of precision medicine has gained prominence. Through genetic and molecular profiling, clinicians can better match anti-infective agents with the unique characteristics of the infectious agent and the patient. This personalized approach enhances treatment outcomes.

Advancements have enabled the development of anti-infective agents that are more specific in their action, reducing the collateral damage to beneficial microorganisms. This aligns with the principles of antimicrobial stewardship, which aim to optimize antimicrobial use and combat resistance. Drug development has explored combination therapies that involve using multiple anti-infective agents simultaneously. These combinations can enhance efficacy, prevent resistance, and address infections with multiple causative agents. The discovery of novel mechanisms of action for anti-infective agents has opened new avenues for drug development. These mechanisms can target infections that were previously difficult to treat, such as biofilm-related infections or intracellular pathogens.

Global Pandemic Preparedness

Global pandemic preparedness serves as a significant market driver for the growth of the Global Anti-infective Agents Market. The emergence of global pandemics, such as the COVID-19 pandemic, highlights the urgent need for effective anti-infective agents. These outbreaks underscore the importance of having a robust pipeline of treatments to manage and mitigate the impact of such events. Governments and international health organizations actively build and maintain stockpiles of anti-infective agents for pandemic preparedness. This strategic stockpiling not only ensures the availability of treatments during a pandemic but also stimulates demand for these pharmaceuticals.In the face of pandemics, governments allocate significant funding for research and development of new anti-infective agents and the enhancement of existing treatments. This funding accelerates the development of innovative pharmaceuticals, boosting the market. Regulatory agencies often expedite the approval processes for anti-infective agents during pandemics to ensure rapid deployment. These accelerated pathways enable pharmaceutical companies to bring their products to market more quickly. Pandemic preparedness involves not only treatment options but also the development of vaccines and prophylactic therapies. Pharmaceutical companies invest in the research and development of vaccines and therapies to prevent the spread of infectious diseases, contributing to market growth.

Aging Population and Chronic Diseases

The aging population and the prevalence of chronic diseases are significant market drivers for the growth of the Global Anti-infective Agents Market. As individuals age, their immune systems tend to weaken, making them more susceptible to infections. Elderly populations are at a higher risk of contracting both common and opportunistic infections, necessitating the availability of effective anti-infective agents. Chronic diseases, such as diabetes, cardiovascular disease, and cancer, are often associated with a higher risk of infections. Managing these chronic conditions frequently involves the use of anti-infective agents to prevent and treat secondary infections.Advances in healthcare have led to longer life expectancies. While this is a positive development, it also means that individuals are living longer with various chronic conditions, which can lead to more frequent and complex infectious disease scenarios. Older individuals often experience polymorbidity (having multiple concurrent health conditions) and multimorbidity (having two or more chronic diseases). These complex health profiles require tailored treatment approaches, often involving anti-infective agents alongside other medications. The aging population tends to have higher healthcare utilization rates, including hospitalization and long-term care. These settings frequently require the use of anti-infective agents to manage and prevent infections, driving the demand for such pharmaceuticals.

Key Market Challenges

Antimicrobial Resistance (AMR)Antimicrobial resistance (AMR) is a critical and escalating global health challenge. Many pathogens have developed resistance to commonly used anti-infective agents, rendering them less effective or even obsolete. This resistance makes it increasingly difficult to treat infectious diseases, resulting in longer hospital stays, higher mortality rates, and increased healthcare costs.

AMR hampers the market's growth by reducing the efficacy of existing anti-infective agents, thereby limiting treatment options. Pharmaceutical companies are forced to invest in research and development to create new drugs, which is a time-consuming and costly process. Additionally, stringent regulations surrounding AMR require close monitoring and stewardship to prevent overuse and misuse of antibiotics, which can further affect market dynamics.

Drug Development Challenges

Developing new anti-infective agents is a complex and resource-intensive process. Many drugs fail at various stages of development, leading to significant costs for pharmaceutical companies. The emergence of drug-resistant strains and a lack of financial incentives can also deter investment in this sector.The challenges in drug development, including high costs and a lengthy timeline, can slow down the introduction of innovative anti-infective agents to the market. Furthermore, the relative lack of investment in this area due to lower profit margins compared to chronic disease treatments can limit the number of new drugs in the pipeline, affecting market growth.

Regulatory and Market Access Hurdles

Regulatory approval processes for anti-infective agents can be time-consuming and demanding, especially when it comes to demonstrating efficacy and safety. Moreover, market access challenges, such as reimbursement policies and pricing pressures, can hinder the adoption of new drugs.The regulatory hurdles can delay the availability of anti-infective agents, which can be a significant issue in cases of infectious disease outbreaks. Pricing and reimbursement challenges can make it difficult for patients to access these medications, limiting their market reach and growth potential.

Key Market Trends

Antimicrobial Stewardship Programs

Antimicrobial stewardship programs are becoming increasingly prominent in healthcare settings. These programs focus on optimizing the use of anti-infective agents to ensure that patients receive the most appropriate and effective treatments while minimizing the risk of antimicrobial resistance. They involve monitoring, guidelines, and interventions to promote responsible and evidence-based use of antibiotics and other anti-infective drugs.Antimicrobial stewardship is a crucial trend as it not only addresses the growing problem of antimicrobial resistance but also influences the choice of anti-infective agents. These programs encourage the development and utilization of narrower-spectrum antibiotics and innovative therapies, which align with the principles of responsible antibiotic use. As such programs expand, they can have a profound impact on the market by shaping the demand for more targeted and effective treatments.

Rapid Diagnostics and Precision Medicine

Rapid diagnostic technologies, such as point-of-care tests and advanced molecular diagnostics, are revolutionizing the diagnosis of infectious diseases. These tests enable quicker and more accurate identification of pathogens, aiding in the selection of appropriate anti-infective agents. Additionally, precision medicine approaches are gaining traction, with treatments tailored to the specific characteristics of the infectious agent and the patient.The adoption of rapid diagnostics and precision medicine is a major trend that enhances the effectiveness of anti-infective agents. By enabling faster and more accurate diagnoses, these technologies support the timely administration of the most suitable treatments. Furthermore, precision medicine contributes to improved patient outcomes by aligning therapy with individual patient factors, such as genetics, immune status, and comorbidities. These trends are reshaping the market by promoting a more personalized and targeted approach to infectious disease management.

Focus on Rare and Neglected Diseases

The Global Anti-infective Agents Market is witnessing a growing interest in addressing rare and neglected infectious diseases. While these diseases may have a lower prevalence, they can be devastating, particularly in underserved populations. Pharmaceutical companies, encouraged by regulatory incentives and global health organizations, are investing in research and development for anti-infective agents to combat these diseases.The focus on rare and neglected infectious diseases is a significant trend with both humanitarian and market implications. It expands the scope of the market by promoting the development of treatments for conditions that have traditionally received limited attention. This trend aligns with global health initiatives aimed at reducing health disparities and improving access to effective anti-infective agents for all populations. Additionally, these efforts can result in new market opportunities, particularly when orphan drug designations and incentives are granted to support the development of these treatments.

Segmental Insights

Type Insights

Based on the category of Type, the Antiviral segment emerged as the dominant player in the global market for Anti-infective Agents in 2022. The Antiviral segment has showcased substantial market size and consistent growth potential. This is primarily due to the high prevalence of viral infections, including HIV, hepatitis, and influenza, which necessitate effective antiviral agents for treatment and prevention.The world's recent experiences with pandemics, such as the COVID-19 outbreak, have highlighted the critical importance of antiviral agents. Governments and healthcare organizations worldwide have increased their focus on building stockpiles of antiviral medications to be prepared for potential viral threats, which bolsters the demand for antiviral drugs. Antiviral drug research and development have benefited from significant technological advancements. This has led to the discovery of more effective and targeted antiviral treatments with reduced side effects, which further fuels the growth of this segment. The development of vaccines for viral infections often goes hand-in-hand with antiviral drug research. While vaccines are essential for prevention, antiviral agents are crucial for treatment, especially in cases where vaccines are not yet available or effective. The synergy between vaccine development and antiviral drug research propels the segment's dominance. Antiviral drugs have global health implications, given the cross-border spread of infectious diseases. Governments and international health organizations recognize the significance of antiviral agents in controlling outbreaks, making them a focal point in the battle against global health threats. These factors are expected to drive the growth of this segment.

Route of Administration Insight

Based on the category of Route of Administration, the Oral segment emerged as the dominant player in the global market for Anti-infective Agents in 2022. The Oral segment's dominance is primarily rooted in its convenience and high patient compliance. Oral medications are relatively easy to administer, making them a preferred choice for both healthcare providers and patients. This convenience encourages individuals to adhere to treatment regimens, which is crucial for combating infections effectively.Many anti-infective agents are available in oral formulations, including tablets, capsules, and suspensions. This broad range of options provides healthcare professionals with flexibility in choosing the most suitable treatment for patients, considering factors such as age, medical condition, and preferences. Oral administration typically involves lower healthcare costs compared to other routes of administration, such as intravenous (IV) or intramuscular (IM) injections. This cost-effectiveness makes oral medications more accessible to a broader patient population, contributing to the segment's dominance.

The ability to administer oral medications outside of a hospital or clinical setting is a significant advantage. Many anti-infective agents can be prescribed for outpatient use, allowing patients to manage their infections without extended hospital stays. This aligns with the global trend toward ambulatory care and reduces the burden on healthcare facilities. The oral route is particularly advantageous for pediatric and geriatric patients. Children and older adults may find it challenging to tolerate injections, making oral medications a preferred choice for these demographics. Pediatric formulations are often available in liquid or chewable forms for ease of administration. These factors are expected to drive the growth of this segment.

Distribution Channel Insights

The hospital pharmacies segment is projected to experience rapid growth during the forecast period. Hospital pharmacies play a pivotal role in providing anti-infective agents, particularly in a hospital's institutional setting. Hospitals are often the first point of contact for patients with severe infections, and as a result, these facilities demand a significant volume of anti-infective medications. This institutional demand inherently strengthens the position of hospital pharmacies in the market.Hospital pharmacists possess specialized knowledge and expertise in managing complex drug regimens, including anti-infective agents. They collaborate closely with healthcare providers to ensure that patients receive the most appropriate and effective treatments. This expertise is especially crucial when dealing with severe or resistant infections.

Many anti-infective agents, particularly those used to treat severe or life-threatening infections, are administered via intravenous routes. Hospital pharmacies are well-equipped to handle the preparation, storage, and administration of IV medications. This aligns with the preference for IV administration in hospital settings, which enhances the significance of hospital pharmacies in the market. Hospitals are the primary providers of inpatient care, and many infections require continuous or extended treatment regimens. Hospital pharmacies are central to this process, providing intravenous infusions and closely monitoring patients' progress. Their role in managing these complex cases further solidifies their dominance in the anti-infective market. During infectious disease outbreaks or public health emergencies, hospital pharmacies are at the forefront of responding to surges in demand for anti-infective agents. Their ability to swiftly procure, manage, and distribute these medications is crucial for public health. These factors collectively contribute to the growth of this segment.

Regional Insights

North America emerged as the dominant player in the global Anti-infective Agents market in 2022, holding the largest market share in terms of value. The regional market is experiencing notable growth, driven by several pivotal factors. These include the presence of advanced healthcare infrastructure, a growing level of awareness among healthcare professionals and clinicians, and a strong commitment from the government to enhance public health awareness and education. This commitment is evident through various initiatives aimed at promoting infection prevention, vaccination programs, and the responsible use of antibiotics. Furthermore, the market benefits from favorable reimbursement policies and the substantial purchasing power of the population, particularly for high-cost pharmaceuticals, which collectively contribute to the positive trajectory of market expansion.The Asia-Pacific market is poised to be the fastest-growing market, offering lucrative growth opportunities for Anti-infective Agents players during the forecast period. Factors such as The regional market's significant expansion can be credited to several key factors, including the robust presence of generic pharmaceutical companies, a notable upswing in economic stability, and a steady increase in disposable income levels among the populace. Furthermore, the burgeoning aging demographic and their heightened vulnerability to infections are anticipated to serve as significant drivers for the continued growth of the regional market in the forthcoming years.

Report Scope

In this report, the Global Anti-infective Agents Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Anti-infective Agents Market, By Type:

- Antibacterials

- Antivirals

- Antifungals

Anti-infective Agents Market, By Route of Administration:

- Topical

- Oral

- IV

- Others

Anti-infective Agents Market, By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- E-stores

- Hypermarkets/supermarkets

Anti-infective Agents Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Anti-infective Agents Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Anti-infective Agents market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Pfizer Inc.

- Abbott Inc.

- Gilead Sciences, Inc.

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- B. Braun SE

- Xellia Pharmaceuticals Inc

- Mankind Pharma Ltd.

- Bayer AG

- AstraZeneca Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2024 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 136.89 Million |

| Forecasted Market Value ( USD | $ 146.79 Million |

| Compound Annual Growth Rate | 1.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |