Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Strict environmental regulations and safety concerns regarding flammability and volatile organic compound emissions from solvent-based pigments pose a significant challenge to market expansion. Despite these hurdles, industrial demand for the material's feedstock remains strong. According to the Metal Powder Industries Federation, North American aluminum powder shipments for 2024 rose by 22.6% to 26,303 metric tons, as reported in 2025. This increase underscores the resilient demand for aluminum particulates even amidst the regulatory pressures affecting the wider chemical and coatings industries.

Market Drivers

The escalating demand for automotive OEM and refinish coatings serves as a major growth engine, as manufacturers rely on metallic flakes to deliver premium visuals and corrosion protection. The transition to electric vehicles further amplifies this need, requiring specialized, lightweight coatings that leverage aluminium pigments for thermal management and unique branding. This trend is bolstered by a rebound in vehicle production rates; according to the European Automobile Manufacturers’ Association's February 2024 report, EU passenger car production rose by 11.3% in 2023, indicating a strong revitalization in manufacturing that depends on these coating systems.Simultaneously, the growth of global construction and infrastructure projects drives market adoption, specifically through reflective roof coatings and durable exterior facade paints. These pigments are crucial for creating energy-efficient materials that reflect solar radiation and lower cooling costs in commercial buildings. In an August 2024 report by the Aluminum Association, 62% of construction professionals surveyed anticipated their aluminum usage would increase. Furthermore, consistent raw material availability supports this demand, with the International Aluminium Institute reporting that global primary aluminium production reached 6.13 million metric tonnes in May 2024, ensuring a steady feedstock supply.

Market Challenges

Stringent environmental regulations concerning volatile organic compound emissions and flammability risks represent major obstacles for the global aluminium pigments market. Authorities are imposing stricter limitations on solvent-based coatings, forcing a transition to waterborne alternatives. This shift creates technical difficulties, as aluminium flakes react with water to release hydrogen gas, necessitating costly encapsulation technologies to prevent package bloating. As a result, manufacturers incur higher research and development expenses and operational challenges in maintaining the aesthetic quality typically associated with restricted solvent-based grades while ensuring compliance.These safety requirements also create logistical burdens that reduce profit margins. Classifying solvent-rich aluminium pastes as hazardous materials requires specialized storage, explosion-proof equipment, and compliant transport, all of which increase overhead costs compared to non-hazardous options. This regulatory environment constrains the market's capacity to fully utilize available raw materials. For example, the International Aluminium Institute reported global primary aluminium production of 66.5 million tonnes between January and November 2024. Despite this abundant feedstock, strict compliance standards hinder the seamless expansion of standard pigment applications in heavily regulated regions.

Market Trends

The industry is witnessing a shift toward chrome-like finishes as alternatives to electroplating, driven by regulations banning hazardous hexavalent chromium. Manufacturers are increasingly adopting Physical Vapor Deposition (PVD) aluminium pigments, which offer a mirror-like appearance without the environmental hazards of galvanic plating. This transition is particularly strong in sectors prioritizing sustainable, high-end metallic effects. The segment's growth is highlighted by Altana AG's March 2025 report, which noted that its ECKART division reached sales of €434 million in 2024, a 24% increase supported by the strategic acquisition of Silberline to strengthen manufacturing capabilities.Concurrently, the development of radar-transparent pigments for autonomous vehicles has emerged as a high priority. As automakers integrate ADAS sensors behind vehicle fascias, traditional conductive aluminium pigments are being substituted with non-conductive metallic flakes to prevent signal interference. This innovation permits OEMs to preserve metallic aesthetics while guaranteeing sensor performance. The sustained demand for such finishes is reflected in Axalta Coating Systems' December 2025 report, which revealed that Gray - a primary color for these advanced pigments - retained its position as a top choice, holding a 22% share of the global automotive market.

Key Players Profiled in the Aluminium Pigments Market

- Asahi Kasei Corporation

- BASF SE

- Carl Schlenk AG

- Carlfors Bruk

- DIC CORPORATION

- Hefei Sunrise Aluminium Pigments Co. Ltd.

- Metaflake Ltd.

- Nippon Light Metal Holdings Co.

- SILBERLINE MANUFACTURING CO. INC.

- Sun Chemical Source

Report Scope

In this report, the Global Aluminium Pigments Market has been segmented into the following categories:Aluminium Pigments Market, by Form:

- Powder

- Pellets

- Paste

- Others

Aluminium Pigments Market, by End User:

- Paints and Coatings

- Personal Care

- Printing Inks

- Plastics

- Others

Aluminium Pigments Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aluminium Pigments Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aluminium Pigments market report include:- Asahi Kasei Corporation

- BASF SE

- Carl Schlenk AG

- Carlfors Bruk

- DIC CORPORATION

- Hefei Sunrise Aluminium Pigments Co. Ltd

- Metaflake Ltd.

- Nippon Light Metal Holdings Co.

- SILBERLINE MANUFACTURING CO. INC.

- Sun Chemical Source

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

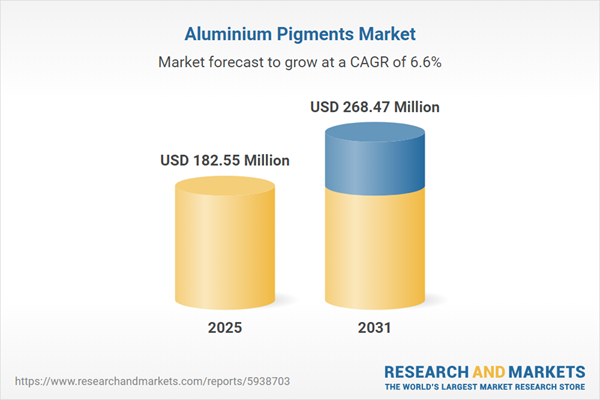

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 182.55 Million |

| Forecasted Market Value ( USD | $ 268.47 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |