Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to FAO, By 2050, aquaculture is projected to expand and intensify further, almost doubling its current production. To sustain such production levels, large volumes of feed will be needed in terms of affordable protein, essential amino acid, additives, omega-3 fatty acids, key minerals, vitamins and energy sources. This will require the sourcing of additional raw materials that are currently either not available or otherwise used.

Key Market Drivers

Increasing Demand in Water Treatment

The increasing demand in water treatment stands as a pivotal driver propelling the growth of the Global Algaecides Market. This driver is underpinned by various factors and considerations within the realm of water management and environmental preservation. The escalating levels of water pollution, driven by industrial discharges, agricultural runoff, and untreated sewage, have heightened the risk of eutrophication. Eutrophication occurs when excess nutrients, particularly phosphorus and nitrogen, stimulate the rapid growth of algae in water bodies. This not only poses ecological threats but also jeopardizes the quality of water for human consumption. As a result, there is an augmented need for effective algaecides to mitigate and prevent algal blooms in diverse water sources, ranging from lakes and rivers to reservoirs and drinking water supplies.Municipalities and industrial facilities worldwide are increasingly investing in advanced water treatment technologies to ensure the delivery of safe and potable water to urban populations. Algae, if left uncontrolled, can compromise the efficiency of water treatment processes and lead to the production of water with undesirable taste and odor. Algaecides play a crucial role in maintaining the effectiveness of water treatment plants by preventing algae-related issues, including clogging of filters and interference with disinfection processes. Stringent environmental regulations and water quality standards set by regulatory bodies necessitate the implementation of effective measures to control and eliminate contaminants in water bodies. The use of algaecides aligns with these regulatory requirements, ensuring that water resources meet specified quality parameters. The adherence to such standards is not only a legal imperative for municipalities and industries but is also a reflection of the growing awareness and commitment to environmental stewardship.

The demand for algaecides is not limited to utilities and industries; it extends to recreational areas such as swimming pools, ponds, and lakes. Algal blooms in these settings not only affect water aesthetics but can also pose health risks to individuals engaging in recreational activities. The leisure and hospitality sector, recognizing the importance of maintaining pristine water conditions, contributes to the demand for algaecides to enhance the safety and enjoyment of recreational water facilities. The global population is on a trajectory of continuous growth, accompanied by rapid urbanization. As urban centers expand, the demand for clean and safe water escalates. The treatment of water for consumption, sanitation, and industrial processes becomes paramount. Algaecides emerge as a critical component in this scenario, ensuring that water treatment infrastructures operate efficiently and meet the increasing demand for high-quality water.

Key Market Challenges

Environmental Concerns and Regulatory Scrutiny

Algaecides, like any chemical agents, can raise environmental concerns due to their potential impact on non-target organisms and ecosystems. Regulatory bodies globally are increasingly scrutinizing the use of chemical substances in water treatment and agriculture. Stricter regulations may be imposed on algaecides to ensure their safety, efficacy, and minimal environmental harm. Regulatory compliance may necessitate the development and adoption of environmentally friendly algaecide formulations. Increased scrutiny can lead to a longer and more rigorous approval process for new algaecide products, potentially slowing down market entry.Investment in research and development for eco-friendly algaecide formulations. Collaboration with regulatory authorities to establish and adhere to industry best practices.

Key Market Trends

Rising Demand for Sustainable and Environmentally Friendly Formulations

There is a discernible shift in market demand towards algaecide formulations that are not only effective in algae control but also environmentally sustainable. As environmental awareness increases, end-users in agriculture, aquaculture, and water treatment industries seek algaecides that minimize ecological impact, biodegrade efficiently, and adhere to stringent regulatory standards. Increased research and development efforts to create innovative, eco-friendly algaecide formulations. Market differentiation based on the environmental sustainability of algaecide products.Development of bio-based algaecides using natural compounds. Utilization of advanced nanotechnology for targeted and eco-friendly algal control.

Integration of Digital Technologies for Precision Algae Management

The incorporation of digital technologies, including remote sensing, data analytics, and monitoring systems, is becoming prevalent for precise and efficient algae management. Digital solutions enable real-time monitoring of water quality, algal bloom detection, and the timely application of algaecides. This trend aligns with the broader concept of precision agriculture and water management. Improved efficiency and accuracy in algaecide application. Enhanced data-driven decision-making for targeted algae control.Integration of satellite imagery and sensors for early detection of algal blooms. Use of artificial intelligence algorithms to analyze data and predict optimal algaecide application times.

Key Market Players

- BASF SE

- Lonza AG

- SePRO Corporation

- BioSafe Systems, LLC

- N. Jonas & Company, Inc.

- UPL Ltd.

- Phoenix Products Co.

- Weifang Maochen Chemical Co., Ltd.

- Airmax Corp

- Oreq Corp

Report Scope:

In this report, the Global Algaecides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Algaecides Market, By Type:

- Copper Sulfate

- Quaternary Ammonium Compounds

- Chelated Copper

- Peroxyacetic Acid & Hydrogen Dioxide

- Dyes & Colorants

- Others

Algaecides Market, By Mode of Action:

- Non-Selective

- Selective

Algaecides Market, By Application:

- Surface Water Treatment

- Aquaculture

- Sport & Recreational Centers

- Agriculture

- Others

Algaecides Market, By Form:

- Liquid

- Dry

Algaecides Market, By Distribution Channel:

- Direct

- Indirect

Algaecides Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Algaecides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Lonza AG

- SePRO Corporation

- BioSafe Systems, LLC

- N. Jonas & Company, Inc.

- UPL Ltd.

- Phoenix Products Co.

- Weifang Maochen Chemical Co., Ltd.

- Airmax Corp

- Oreq Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2025 |

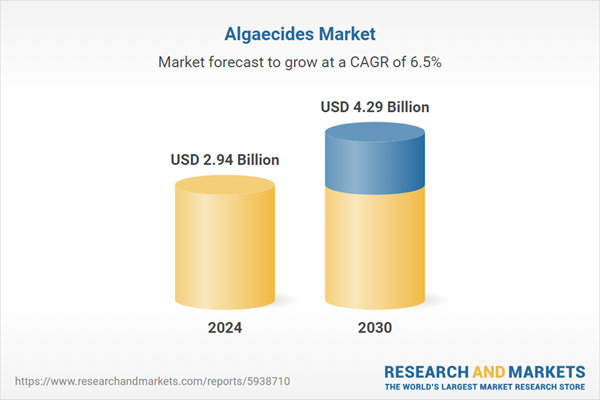

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.94 Billion |

| Forecasted Market Value ( USD | $ 4.29 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |