The COVID-19 outbreak is expected to have a significant impact on the practice management system market as there is a huge surge in the COVID-19 infected patients and these solutions are expected to aid in the smooth workflow during the treatment process. Given this, most of the key players are involved in launching new products for the management of healthcare systems during the pandemic. For instance, in March 2020, Innovaccer launched COVID-19 Management System, which enables providers with free telehealth services and analytics to assess risk profiles and triage the influx at medical practices and primary care clinics during the pandemic. Thus, owing to the aforementioned factors, the studied market is expected to be significantly impacted due to COVID-19.

The main drivers for the growth of the practice management systems market include the need to increase the efficiency of current medical practices and institutions, saving time and resources in the long term, and high return on investment. Electronic data is a rapidly emerging topic in the healthcare IT market. Since its inception, the healthcare industry has generated large amounts of data driven by record keeping, compliance and regulatory requirements, and patient care. Several researchers and experts have suggested that by better integrating big data, healthcare can save a huge amount of money for everyone every year. Traditionally, doctors spend most of their time handling paperwork.

Medical practice management systems are becoming increasingly popular, as they enhance the ability to meet important regulatory requirements and ensure the completion of key regulatory data elements by the physician just with a notification alert, along with enhancing the ability to reduce time and resources needed for entry of details, manually. Additionally, these systems also provide improved and more accurate billing procedures and insurance details, and alerts for obtaining advance beneficiary notice that minimizes claim denials. Hence, the usage of medical practice management software saves time and resources in the long run, which acts as a driver for the market's growth. hence, the launch of new softwares in the market is expeted to drive the studied market during study period.

Along with this, other factors, such as high return on investments and the need to increase the efficiency of current medical practices and institutions, are likely to boost the market growth over the forecast period. However, the lack of skilled IT professionals in Healthcare, along with high maintenance and security cost is expected to hinder the studied market growth.

Practice Management Systems (PMS) Market Trends

The Cloud-Based Sub-segment in Mode of Delivery Segment is Expected to Witness a Healthy Growth Over the Forecast period

Modernization of operations and approaches in medical practice, by utilization of technological solutions, such as medical practice management software, has improved healthcare organizations. Cloud-based software systems help in storing the data on external servers, making it accessible via the web, as it requires only a computer with an internet connection to access the data. Cloud-based delivery in medical practice management helps healthcare providers to automate day-to-day medical tasks. The installation cost for Cloud-based systems is lower than the on-premises systems and this software eradicates the need for in-house maintenance, which is expected to be the prime factor driving their increasing demand.Cloud-based medical practice management is particularly useful for small- to medium-sized practices since there are no large hardware expenditures, and the software expense is consistent with a low subscription rate. The cloud-based delivery model makes the software extremely flexible, regarding scalability (pay-as-you-go storage utilization). It simplifies and consolidates storage resources to reduce costs and enhance workflow, by eliminating departmental silos of clinical information. The storage and server power for the organization are hosted off-premise. The cloud vendor provides all the off-premise system support resources. The cloud infrastructure also guarantees true disaster recovery and business continuity solutions, to support the quality of patient care. Hence, cloud-based services are expected to continue to witness a significant demand.

Additionally, in August 2020, the Urology cloud, an Electronic Health Record, was launched by WRS Health, which enables Urologists to manage their practice and maximize their workflows efficiently and profitably. Moreover, in July 2021, Practice EHR, a leading provider of cost-effective, cloud-based medical practice solutions, announced the launch of its enterprise practice management solution, Practice EHR Enterprise. The software solution provides robust functionality that streamlines the medical billing workflow and improves financial performance and productivity for hospitals, medical practices, and medical billing companies.

Cloud-based medical practice management is cost and time-effective and improves patient satisfaction, as it is accessible to medical professionals. Hence, with an increasing need for efficient medical practices and institutions, the market studied is expected to witness significant growth during the forecast period.

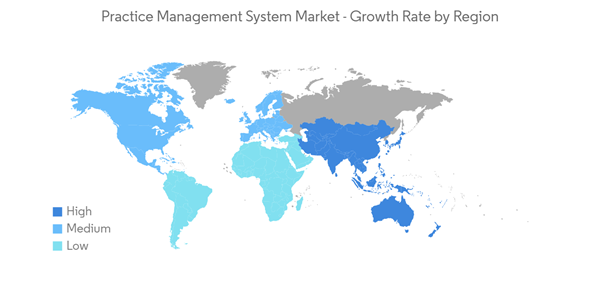

North America Holds the Major Share and is Expected to Dominate the Market Over the Forecast Period

North America is expected to dominate the market owing to the presence of better healthcare infrastructure and a rising geriatric population. Medical practice management in the United States helps in every aspect of healthcare accounts, billing, appointments, and insurance details of the patients. In the United States, most of medical practice management software systems are designed for small to medium-sized medical facilities. Some of the medical practice management software is used by third-party medical billing companies for healthcare facilities. Medical practice management software is often used for administrative and financial matters of medical care facilities and providers. Government funding is likely to speed up the adoption of medical practice management by healthcare providers and change the way players operate, across the sector. Hence, the increasing adoption of a patient-centric approach by healthcare payers, the need to increase the efficiency of current medical practices and institutions, time and resource saving in the long run, and high return on investments are the major factors driving the market studied during the forecast period in the North American region.Additionally, government funding is likely to speed up the adoption of medical practice management by healthcare providers and change the way players operate across the sector. Medical practice management adoption is widespread across most hospitals and at the state level. Brevium, a SaaS company in the healthcare technology sector, announced that it extended the integration of its software with one of the premier electronic practice management systems in the United States, Nextech, on January 2021.

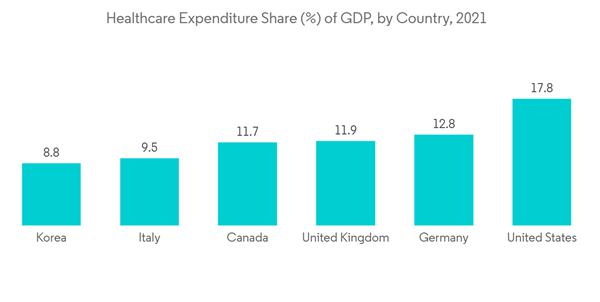

Furthermore, the rising healthcare investment and the surge in adoption of big data analytics among end-users in the healthcare industry will also be expected to boost the market growth in the region. According to the United States Centers for Medicare & Medicaid Services National Health Expenditure Data 2020, the healthcare expenditure grew by up to 9.7% to USD 4.1 trillion in 2020 and accounted for around 19.7% of the gross domestic product. The expenditure is projected to reach USD 6.2 trillion by 2028. Thus, the aforementioned factors are expected to drive the market growth in the region over the forecast period.

Practice Management Systems (PMS) Industry Overview

The market studied is a moderately competitive market owing to the presence of many small and large market players. Some of the market players of the practice management system market are Allscripts Healthcare Solutions Inc., Athenahealth, CareCloud Corporation, eClinicalWorks, Advanced-Data Systems Corporation, GE Company (GE Healthcare), Greenway Health LLC, McKesson Corporation, and NextGen Healthcare Informations Systems LLC among others. the major players are evolving through various strategies such as acquisitions and collaborations, along with new product launches to secure the position in the global market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.