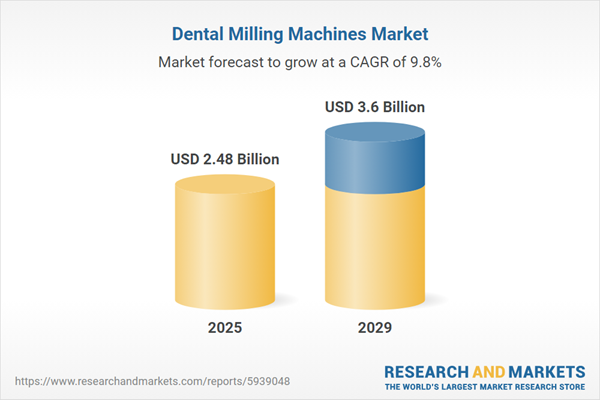

The dental milling machines market size is expected to see strong growth in the next few years. It will grow to $3.6 billion in 2029 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to growing demand for customized restorations, expansion of dental tourism, rise in cosmetic dentistry procedures, aging population and dental implants, integration of intraoral scanning. Major trends in the forecast period include focus on user-friendly interfaces, shift towards eco-friendly solutions, demand for compact and portable machines, emphasis on workflow efficiency, growth in dental labs and clinics.

The anticipated growth in the dental milling machine market is expected to be fueled by the rising prevalence of dental problems. Dental problems encompass various ailments affecting oral health, such as cavities, tooth erosion, gum infections, and disorders, which can cause discomfort and difficulty in eating. Dental milling machines play a crucial role in the precise fabrication of dental restorations, including crowns, bridges, veneers, and implant components. For example, as of November 2022, the World Health Organization estimated that globally, approximately 2 billion people are affected by dental caries in permanent teeth, and around 514 million children are dealing with caries in primary teeth. Additionally, a survey by the ADA Health Policy Institute in March 2021 reported an increase in teeth clenching, grinding, chipped teeth, cracked teeth, and temporomandibular joint dysfunction symptoms, including headaches and jaw pain, as reported by 71%, 63%, and 62% of dentists, respectively. Consequently, the rising prevalence of dental problems is a driving factor for the growth of the dental milling machine market.

The rise in dental tourism is anticipated to drive the growth of the dental milling machine market in the future. Dental tourism involves individuals traveling to different countries or regions to obtain dental care and services. Dental milling machines are vital to dental tourism as they enhance the efficiency, precision, and quality of dental procedures, making them an essential part of the dental tourism experience. For example, in December 2022, a survey by the Dental Defence Society, a UK-based dental defense organization, revealed that 95% of responding UK dentists had treated patients who sought care abroad, and 86% had seen patients who encountered issues as a result. Consequently, the growth of dental tourism is fueling the expansion of the dental milling machine market.

The dental milling machine market is witnessing a prominent trend in the adoption of technological advancements, with major companies in the sector actively incorporating innovative technologies to maintain their market positions. An illustration of this trend is evident in the actions of Amann Girrbach AG, a US-based manufacturer of laboratory units for dental technicians and dental labs, which introduced Ceramill Motion 3 in February 2022. This hybrid device represents a breakthrough in denture fabrication by enhancing convenience and digitality. Positioned as the world's most intelligent hybrid machine, Ceramill Motion 3 integrates an end-to-end digital workflow with exceptional production quality, a diverse range of materials, and indications. The machine offers remote access, allowing users to monitor manufacturing processes, access customer support, and process orders swiftly and securely. The inclusion of integrated analysis functions enables ongoing analysis and optimization of laboratory procedures.

Major players in the dental milling machine market are strategically focusing on the development of innovative solutions, such as dry milling machines designed for discs. Dry milling machines for discs are utilized in the dental field for fabricating dental prosthetics and restorations. In February 2023, vhf camfacture AG, a Germany-based CNC milling machine manufacturing company, announced the launch of the E5 Dry Milling Machine. Tailored as a 5-axis milling machine for discs, it ensures the highest precision for complex indications. Operating without the need for compressed air, this milling machine is employed in practice labs and laboratories.

In August 2022, Deutsche Beteiligungs AG (DBAG), a Germany-based public investment firm, acquired a one-fifth stake in VHF camfacture AG for an undisclosed amount. This strategic move positions DBAG to strengthen business operations and meet growth objectives structurally. The acquisition is expected to facilitate international expansion and prepare for capital market involvement. VHF camfacture AG is a German company specializing in the manufacture of milling and grinding machines, tools, and software for dental laboratories.

Major companies operating in the dental milling machines market include 3M Company, Zimmer Biomet Dental, Datron AG, Dentsply Sirona, Institut Straumann AG, James R. Glidewell Dental Ceramics Inc., Ivoclar Vivadent AG, Planmeca Oy, Renishaw PLC, Nobel Biocare, 3Shape A/S, Interdent d.o.o., Roland DGA Corporation, COLTENE Holding AG, KaVo Dental, Dentium Co. Ltd., Amann Girrbach AG, VOCO GmbH, DentalEZ Inc., GC Corporation, iMes-iCore GmbH, BEGO Bremer Goldschlagerei, Whip Mix Corporation, Zirkonzahn AG, Roders GmbH, Wieland Dental + Technik GmbH & Co. KG, bredent medical GmbH & Co.KG, Kuraray Noritake Dental Inc, Dentatus AB, Shofu Dental Corporation, Mecanumeric SAS.

North America was the largest region in the dental milling machines market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the dental milling machines market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental milling machines market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Dental milling machines are precision cutting devices in dentistry controlled by computers, used to intricately carve dental restorations from diverse materials based on digital designs. These machines facilitate the accurate and efficient fabrication of dental prosthetics, employing computer-guided mechanisms to mill and grind three-dimensional objects according to digital files.

Two main types of dental milling machines are in-lab milling machines and in-office milling machines. In-lab milling machines are utilized in dental laboratories to produce dental restorations such as crowns and bridges. They come in various sizes, including tabletop, benchtop, and standalone, and incorporate different technologies such as CAD or CAM milling machines and copying milling machines. These machines serve various applications such as bridges, crowns, dentures, veneers, inlays, or onlays. They find application across different end-users, including dental hospitals and clinics, dental laboratories, and other dental facilities.

The dental milling machine market research report is one of a series of new reports that provides dental milling machine market statistics, including dental milling machine industry global market size, regional shares, competitors with a dental milling machine market share, detailed dental milling machine market segments, market trends and opportunities, and any further data you may need to thrive in the dental milling machine industry. This dental milling machine market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The dental milling machine market consists of sales of dry dental milling machines, wet dental milling machines, combination dry and wet models of dental milling machines. Values in this market are factory gate values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Milling Machines Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental milling machines market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental milling machines? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental milling machines market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: In-Lab Milling Machines; in-Office Milling Machines2) By Size: Tabletop; Bench-Top; Standalone

3) By Technology: CAD or CAM Milling Machines; Copying Milling Machines

4) By Application: Bridges; Crowns; Dentures; Veneers; Inlays or Onlays

5) By End-User: Dental Hospitals and Clinics; Dental Laboratories; Other End-Users

Subsegments:

1) By in-Lab Milling Machines: Desktop Milling Machines; Large-Scale Milling Machines; Multi-Tasking Milling Machines2) By in-Office Milling Machines: Chairside Milling Machines; Compact Milling Machines

Key Companies Mentioned: 3M Company; Zimmer Biomet Dental; Datron AG; Dentsply Sirona; Institut Straumann AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Dental Milling Machines market report include:- 3M Company

- Zimmer Biomet Dental

- Datron AG

- Dentsply Sirona

- Institut Straumann AG

- James R. Glidewell Dental Ceramics Inc.

- Ivoclar Vivadent AG

- Planmeca Oy

- Renishaw PLC

- Nobel Biocare

- 3Shape A/S

- Interdent d.o.o.

- Roland DGA Corporation

- COLTENE Holding AG

- KaVo Dental

- Dentium Co. Ltd.

- Amann Girrbach AG

- VOCO GmbH

- DentalEZ Inc.

- GC Corporation

- iMes-iCore GmbH

- BEGO Bremer Goldschlagerei

- Whip Mix Corporation

- Zirkonzahn AG

- Roders GmbH

- Wieland Dental + Technik GmbH & Co. KG

- bredent medical GmbH & Co.KG

- Kuraray Noritake Dental Inc

- Dentatus AB

- Shofu Dental Corporation

- Mecanumeric SAS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.48 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |