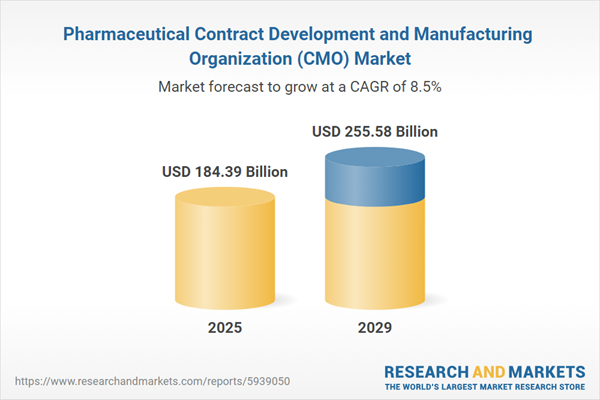

The pharmaceutical contract development and manufacturing organization (CMO) market size is expected to see strong growth in the next few years. It will grow to $255.58 billion in 2029 at a compound annual growth rate (CAGR) of 8.5%. The growth in the forecast period can be attributed to increasing government support, increase in healthcare access, increase in investments and increase in biopharmaceutical development will drive the market. Major trends in the forecast period include increased focus on sustainability, focus on integration of artificial intelligence and digitalization, innovative products with focus on resilience, increasing investments and strategic partnerships and collaborations among market players.

The forecast of 8.5% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper U.S. biotech firms by increasing the cost of outsourced formulation development and sterile fill-finish services from contract manufacturing organizations in Ireland and India, thereby delaying clinical trials and raising drug development costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The expansion of the pharmaceutical contract development and manufacturing market is fueled by the global increase in demand for medicines. The heightened prevalence of diseases, coupled with the desire for longer lifespans, has led to a surge in the demand for medications. This, in turn, has prompted pharmaceutical companies to intensify the production of existing drugs and augment their research and development (R&D) investments to facilitate the creation of new drugs. In response to these demands, pharmaceutical companies are engaging in collaborations with contract manufacturing organizations (CMOs) as a strategic approach to reducing operational costs, thereby fostering an elevated demand for the pharmaceutical contract development and manufacturing market. According to Alkermes PLC, a biopharmaceutical company, pharmaceutical contract manufacturing is becoming a strategic choice for companies of varying sizes, from large enterprises to smaller specialty pharma entities, driven by the imperative to cut costs.

The anticipated growth in the pharmaceutical contract development and manufacturing market is further propelled by the escalating phenomenon of patent expiration. Patent expiration signifies the conclusion of the legally protected exclusive rights granted to an inventor or patent holder for a specified duration, allowing them to make, sell, or use the invention. Pharmaceutical contract development and manufacturing play a crucial role in facilitating the rapid development and production of generic drugs, enabling their entry into the market upon the expiration of patents. For example, in 2023, DrugPatentWatch, a US-based web service platform, reports that a total of 37 drugs are set to face patent expirations, paving the way for generic market entry. Consequently, the increasing patent expiration is a significant driver for the pharmaceutical contract development and manufacturing market.

Pharmaceutical contract development and manufacturing companies are actively engaging in acquisitions and forming strategic alliances to strengthen their market presence. This trend reflects a strategic focus on expanding global market reach, meeting client requirements, enhancing production capabilities, and gaining access to cutting-edge technology and new services. The heightened frequency of merger and acquisition activities has led to the consolidation of contract service providers within the industry. For example, in July 2022, Pharma Nobis, a US-based provider of contract manufacturing and private label services, acquired Fagron’s U.S. contract manufacturing business. This strategic move allows Pharma Nobis to extend contract manufacturing and private label services to American retailers and consumer healthcare corporations, with Fagron retaining a 20% ownership stake in the company.

Leading companies in the pharmaceutical contract development and manufacturing market are innovating their service portfolios to cater to evolving industry needs. One such offering is the DevPack, a service designed to optimize processes across multiple partners and create a standardized dataset for development process steps. ASM Research Chemicals, a Germany-based company providing contract research and manufacturing services, launched the DevPack service in May 2023. Tailored for active pharmaceutical ingredients (APIs) manufacturing, DevPack streamlines API research, development, and scale-up. It is particularly beneficial for Contract Manufacturing Organizations (CMOs) and pharmaceutical firms aiming for rapid early-stage manufacturing route development, along with supporting analytical development and regulatory submissions.

In August 2022, Catalent, Inc., a US-based provider of delivery technologies, development, and drug manufacturing, completed the acquisition of Metrics Contract Services for $475 million. This strategic move enhances Catalent's capabilities in working with highly potent chemicals and strengthens its expertise in integrated oral solid formulation research, production, and packaging. The acquisition is aimed at assisting clients in streamlining and expediting their processes. Metrics Contract Services is a US-based pharmaceutical contract development and manufacturing organization.

Major companies operating in the pharmaceutical contract development and manufacturing organization (CMO) market include Lonza Group, Catalent Inc, WuXi AppTec Inc., Pfizer Inc, Recipharm AB, Almac Group, Aenova Group, Baxter International Inc, SGS Life Science Services SA, Jubilant Pharmova Ltd, Dishman Pharmaceuticals, Kemwell Pvt. Ltd., Nipro Corp., CMIC Group, Sawai Pharmaceutical Co., Ltd, IDT Australia Limited, Aurigene Pharmaceutical Services Limited, Vetter Pharma International GMBH, Consort Medical PLC, Siegfried Holding AG, Evonik Industries, NextPharma, Royal DSM N.V, HAUPT Pharma AG, Boehringer Ingelheim International GmbH, Famar, OTC-PharmNEUCA, Farmacol, Polska Grupa Farmaceutyczna, Polpharma, TZMO, AbbVie Inc, Merck & Co Inc, Amgen Inc, Gilead Sciences Inc, Regeneron Pharmaceuticals Inc, Vertex Pharmaceuticals Inc, Johnson & Johnson, Eurofarma Laboratórios S.A., Ache Laboratórios Farmacêuticos S.A., Blanver Farmoquímica e Farmacêutica S.A., Prati-Donaduzzi, União Química Farmacêutica Nacional S.A, Laboratorios Richmond S.A.C.I.F., Bago S.A., Elea Laboratories S.A.C.I. y F., Gador S.A., LIFEPharma, Neopharm, Gulf Pharmaceutical Industries JULPHA, NewBridge Pharmaceuticals Limited, Aspen Pharmacare Holdings Limited, Adcock Ingram Holdings Limited, Pharma-Q (Pty) Ltd, Vital Health Foods, EIPICO (Egyptian International Pharmaceutical Industries Company), Pharco Pharmaceuticals.

North America was the largest region in the global pharmaceutical contract development and manufacturing market in 2024. The Middle East is expected to be the fastest-growing region in the global pharmaceutical contract development and manufacturing market during the forecast period. The regions covered in the pharmaceutical contract development and manufacturing organization (cmo) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pharmaceutical contract development and manufacturing organization (CMO) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The pharmaceutical contract development and manufacturing market research report is one of a series of new reports that provides pharmaceutical contract development and manufacturing market statistics, including pharmaceutical contract development and manufacturing industry global market size, regional shares, competitors' pharmaceutical contract development and manufacturing market share, detailed pharmaceutical contract development and manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the pharmaceutical contract development and manufacturing industry. This pharmaceutical contract development and manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Pharmaceutical Contract Development and Manufacturing (CDMO) involves businesses that provide services for drug research and manufacturing in the pharmaceutical sector. Pharmaceutical companies can choose to outsource drug development and production by partnering with CDMOs. Full-service CDMOs are capable of managing every stage of the process, accommodating clients who wish to outsource specific steps in their workflow. The services provided are tailored to the specific requirements of each client.

Pharmaceutical Contract Development and Manufacturing Organizations (CMO) primarily offer contract manufacturing services and contract research services. Contract manufacturing services involve outsourcing manufacturing processes or goods production to a third-party company, commonly known as a contract manufacturer. The research phases encompass preclinical, phase I, phase II, phase III, and phase IV. End-use sectors for CDMOs include large pharmaceutical companies, generic pharmaceutical companies, and small to medium-sized pharmaceutical companies.

The pharmaceutical contract development and manufacturing market includes revenues earned by entities by providing drug development and manufacturing services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Pharmaceutical Contract Development and Manufacturing Organization (CMO) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pharmaceutical contract development and manufacturing organization (cmo) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pharmaceutical contract development and manufacturing organization (cmo)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The pharmaceutical contract development and manufacturing organization (cmo) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Contract Manufacturing Services, Contract Research Services2) By Research Phase: Preclinical, Phase I, Phase II, Phase III, Phase IV

2) By End User: Big Pharmaceutical Companies, Generic Pharmaceutical Companies, Small and Medium-Sized Pharmaceutical Companies

Subsegments:

1) By Contract Manufacturing Services: Active Pharmaceutical Ingredient (API) Manufacturing; Formulation Development; Finished Dosage Form Manufacturing; Packaging Services; Supply Chain Management2) By Contract Research Services: Preclinical Research Services; Clinical Trial Management; Regulatory Affairs Consulting; Biostatistics and Data Management; Analytical and Testing Services

Companies Mentioned: Lonza Group; Catalent Inc; WuXi AppTec Inc.; Pfizer Inc; Recipharm AB; Almac Group; Aenova Group; Baxter International Inc; SGS Life Science Services SA; Jubilant Pharmova Ltd; Dishman Pharmaceuticals; Kemwell Pvt. Ltd.; Nipro Corp.; CMIC Group; Sawai Pharmaceutical Co., Ltd; IDT Australia Limited; Aurigene Pharmaceutical Services Limited; Vetter Pharma International GMBH; Consort Medical PLC; Siegfried Holding AG; Evonik Industries; NextPharma; Royal DSM N.V; HAUPT Pharma AG; Boehringer Ingelheim International GmbH; Famar; OTC-PharmNEUCA; Farmacol; Polska Grupa Farmaceutyczna; Polpharma; TZMO; AbbVie Inc; Merck & Co Inc; Amgen Inc; Gilead Sciences Inc; Regeneron Pharmaceuticals Inc; Vertex Pharmaceuticals Inc; Johnson & Johnson; Eurofarma Laboratórios S.A.; Ache Laboratórios Farmacêuticos S.A.; Blanver Farmoquímica e Farmacêutica S.A.; Prati-Donaduzzi; União Química Farmacêutica Nacional S.A; Laboratorios Richmond S.A.C.I.F.; Bago S.A.; Elea Laboratories S.A.C.I. y F.; Gador S.A.; LIFEPharma; Neopharm; Gulf Pharmaceutical Industries JULPHA; NewBridge Pharmaceuticals Limited; Aspen Pharmacare Holdings Limited; Adcock Ingram Holdings Limited; Pharma-Q (Pty) Ltd; Vital Health Foods; EIPICO (Egyptian International Pharmaceutical Industries Company); Pharco Pharmaceuticals

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Pharmaceutical Contract Development and Manufacturing Organization (CMO) market report include:- Lonza Group

- Catalent Inc

- WuXi AppTec Inc.

- Pfizer Inc

- Recipharm AB

- Almac Group

- Aenova Group

- Baxter International Inc

- SGS Life Science Services SA

- Jubilant Pharmova Ltd

- Dishman Pharmaceuticals

- Kemwell Pvt. Ltd.

- Nipro Corp.

- CMIC Group

- Sawai Pharmaceutical Co., Ltd

- IDT Australia Limited

- Aurigene Pharmaceutical Services Limited

- Vetter Pharma International GMBH

- Consort Medical PLC

- Siegfried Holding AG

- Evonik Industries

- NextPharma

- Royal DSM N.V

- HAUPT Pharma AG

- Boehringer Ingelheim International GmbH

- Famar

- OTC-PharmNEUCA

- Farmacol

- Polska Grupa Farmaceutyczna

- Polpharma

- TZMO

- AbbVie Inc

- Merck & Co Inc

- Amgen Inc

- Gilead Sciences Inc

- Regeneron Pharmaceuticals Inc

- Vertex Pharmaceuticals Inc

- Johnson & Johnson

- Eurofarma Laboratórios S.A.

- Ache Laboratórios Farmacêuticos S.A.

- Blanver Farmoquímica e Farmacêutica S.A.

- Prati-Donaduzzi

- União Química Farmacêutica Nacional S.A

- Laboratorios Richmond S.A.C.I.F.

- Bago S.A.

- Elea Laboratories S.A.C.I. y F.

- Gador S.A.

- LIFEPharma

- Neopharm

- Gulf Pharmaceutical Industries JULPHA

- NewBridge Pharmaceuticals Limited

- Aspen Pharmacare Holdings Limited

- Adcock Ingram Holdings Limited

- Pharma-Q (Pty) Ltd

- Vital Health Foods

- EIPICO (Egyptian International Pharmaceutical Industries Company)

- Pharco Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 184.39 Billion |

| Forecasted Market Value ( USD | $ 255.58 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 57 |