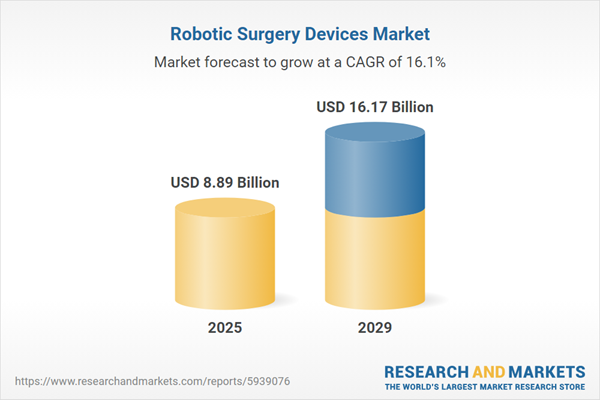

The robotic surgery devices market size is expected to see rapid growth in the next few years. It will grow to $16.17 billion in 2029 at a compound annual growth rate (CAGR) of 16.1%. The growth in the forecast period can be attributed to increasing product launches, minimally invasive surgeries, increasing prevalence of chronic diseases and rise in healthcare expenditure will drive the growth. Major trends in the forecast period include in-vivo robots in surgery services, new technology development, increase in merger and acquisition activities, nanobots in surgery services and artificial intelligence in robotic surgery services.

The growing demand for minimally invasive technology is driving the expansion of the robotic surgery devices market. Minimally invasive (MI) surgery devices utilize imaging and catheter technologies that can be easily inserted into various parts of the body. Robotic surgery procedures are typically associated with minimally invasive techniques and are primarily employed in heart, laparoscopic, orthopedic, gynecological, and urological surgeries. These robotic surgeries were developed to reduce patient hospital length of stay (LOS), minimize pain, lower complications, shorten recovery time, and decrease the need for reoperations. For instance, in June 2024, the American Society of Plastic Surgeons, a US-based specialty organization, reported a 7 percent growth in minimally invasive procedures in 2023, which outpaced surgical procedures by 2 percent. Notably, neuromodulator injections and hyaluronic acid fillers each saw over 9 million and 5 million treatments, respectively. As consumer preferences shift, hospitals are increasingly adopting robotic surgery devices to enhance value and provide cost-effective surgical options.

The anticipated growth of the robotic surgery devices market is further driven by the rising incidence of chronic diseases. Chronic diseases, characterized by their prolonged and persistent nature, are witnessing an increasing application of robotic surgery devices. These devices, with their ability to offer minimally invasive procedures, reduce complications, and improve surgical precision, are proving to be valuable tools in managing and treating chronic conditions across various medical specialties. For example, in September 2022, the World Health Organization reported 41 million deaths globally, with 74% attributed to non-communicable diseases (NCDs) or chronic diseases each year. Cardiovascular diseases accounted for 17.9 million deaths, cancer for 9.3 million deaths, chronic respiratory diseases for 4.1 million deaths, and diabetes for 2 million deaths. Consequently, the increasing incidence of chronic diseases is a significant factor propelling the growth of the robotic surgery devices market.

The progress in surgical products and technologies within the healthcare industry is generating increased opportunities in the robotic surgery devices market. Substantial investments in research and development (R&D) are empowering investors to deliver customer value through the production of cutting-edge medical-surgical products, including robotic surgery devices utilizing the latest technologies. The integration of robotic systems equipped with optical imaging, surgical tools, instruments, and accessories is simplifying surgical procedures. Various surgical advances are contributing significant value to the healthcare industry, such as 3-D high-definition endoscope devices for brain surgery, smart surgical glasses with video cameras and head-mounted monitors for live surgery observation, surgical robots with artificial intelligence functioning as doctors, humanoid robots for critical eye and brain surgeries, and remote robotics enabling surgery assistance from remote locations. Thus, robotic surgery devices play a pivotal role in the healthcare industry, driven by technological advancements and innovations.

Leading companies in the robotic surgery devices market are actively innovating new products to enhance their market profitability. An example is the introduction of R-One+, a medical robot system designed for heart surgery. In May 2023, Robocath, a France-based medical technology company, launched R-One+, aiming to improve treatment precision, safety, reduce radiation exposure, and enhance overall patient experience. The robotic platform, operated through a tablet and joystick, empowers interventional cardiologists to perform coronary angioplasties. This development represents a notable advancement in interventional cardiology, providing doctors with a tool to enhance patient outcomes and minimize risks during treatments.

In November 2022, SS Innovations International Inc., a US-based medical technology company, acquired Avra Medical Robotics for an undisclosed amount. This strategic acquisition expands SS Innovations' capability to offer a broader range of surgical robotic systems to a global audience. Avra Medical Robotics, known for its distinctive robotic platform in aesthetics, enhances SS Innovations' presence in that market segment. Avra Medical Robotics, a US-based medical technology company specializing in the manufacture of robotic surgery devices, aligns with SS Innovations' commitment to innovation and growth in the healthcare industry.

Major companies operating in the robotic surgery devices market include Intuitive Surgical Inc., Stryker Corporation, Medtronic plc, Smith & Nephew plc, Johnson & Johnson, TransEnterix, Inc., Zimmer Biomet Holdings, Inc., Auris Health, Inc., CMR Surgical Ltd., Verb Surgical Inc., Renishaw plc, Think Surgical, Inc., Corindus Vascular Robotics, Inc., Mazor Robotics Ltd., Titan Medical Inc., Accuray Incorporated, OMNI Life Science, Inc., Virtual Incision Corporation, Medrobotics Corporation, Preceyes BV, Microbot Medical Inc., Asensus Surgical, Inc., Avatera Medical GmbH, Medicaroid Corporation, Hansen Medical, Inc., Edge Surgical, Inc., Synaptive Medical, Aesculap, Inc., Verb Surgical.

North America was the largest region in the robotic surgery devices market in 2024. Western Europe was the second largest market in global robotic surgery devices market. The regions covered in the robotic surgery devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the robotic surgery devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Robotic surgery devices play a crucial role in enabling doctors to execute intricate minimally invasive procedures with precision and adaptability.

The primary offerings within the robotic surgery devices market include robotic systems, instruments and accessories, as well as services. The services, also known as robot-assisted surgery services, are delivered by the robotic systems. These devices find application in various surgical categories such as urological surgery, gynecological surgery, orthopedic surgery, neurosurgery, and others. These advanced tools are utilized in both hospital settings and ambulatory surgery centers.

The robotic surgery devices market research report is one of a series of new reports that provides robotic surgery devices market statistics, including robotic surgery devices industry global market size, regional shares, competitors with a robotic surgery devices market share, detailed robotic surgery devices market segments, market trends and opportunities, and any further data you may need to thrive in the robotic surgery devices industry. This robotic surgery devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Robotic surgery equipment market consist of sales of robotic systems, instruments and accessories that are used for robotic surgeries. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Robotic Surgery Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on robotic surgery devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for robotic surgery devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The robotic surgery devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Robotic systems, Instruments & Accessories, Services2) By Application: General Surgery, Urological Surgery, Gynecological Surgery, Orthopaedics Surgery, Neurosurgery and Other Applications.

3) By End-Use: Hospitals and Ambulatory Surgery Centers (Ascs).

Subsegments:

1) By Robotic Systems: Surgical Robotic Systems; Teleoperated Robotic Systems; Autonomous Robotic Systems2) By Instruments and Accessories: Surgical Instruments; Endoscopes; Vision Systems; Energy Devices

3) By Services: Maintenance and Repair Services; Training and Support Services; Consulting Services

Key Companies Mentioned: Intuitive Surgical Inc.; Stryker Corporation; Medtronic plc; Smith & Nephew plc; Johnson & Johnson

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Intuitive Surgical Inc.

- Stryker Corporation

- Medtronic plc

- Smith & Nephew plc

- Johnson & Johnson

- TransEnterix, Inc.

- Zimmer Biomet Holdings, Inc.

- Auris Health, Inc.

- CMR Surgical Ltd.

- Verb Surgical Inc.

- Renishaw plc

- Think Surgical, Inc.

- Corindus Vascular Robotics, Inc.

- Mazor Robotics Ltd.

- Titan Medical Inc.

- Accuray Incorporated

- OMNI Life Science, Inc.

- Virtual Incision Corporation

- Medrobotics Corporation

- Preceyes BV

- Microbot Medical Inc.

- Asensus Surgical, Inc.

- Avatera Medical GmbH

- Medicaroid Corporation

- Hansen Medical, Inc.

- Edge Surgical, Inc.

- Synaptive Medical

- Aesculap, Inc.

- Verb Surgical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.89 Billion |

| Forecasted Market Value ( USD | $ 16.17 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |