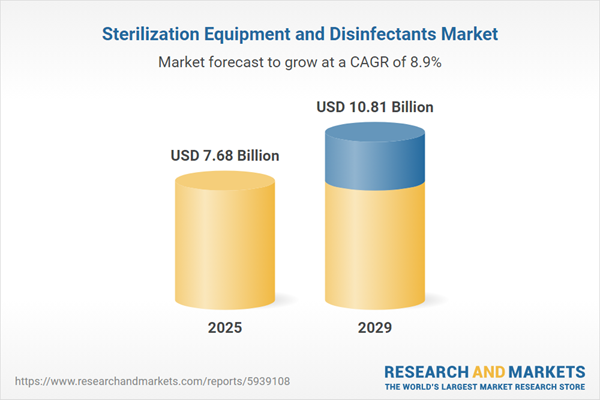

The sterilization equipment and disinfectants market size is expected to see strong growth in the next few years. It will grow to $10.81 billion in 2029 at a compound annual growth rate (CAGR) of 8.9%. The growth in the forecast period can be attributed to government support, an increasing prevalence of chronic diseases, rapid growth in the elderly population and a rising incidence of hospital-acquired infections (hais) will drive the market growth. Major trends in the forecast period include new product launches, focus on disinfection robots, mergers and acquisitions, new facility expansions, technology advancements, partnerships and collaborations and increasing investments.

Government regulations aimed at combating the COVID-19 situation are anticipated to foster market growth in the forecast period. The US Environmental Protection Agency (EPA) has expedited the review process for submissions from disinfectant manufacturers seeking to add claims for emerging viral pathogens to existing surface disinfectant labels. Additionally, the EPA has addressed supply chain challenges by enhancing flexibility in procuring inert and some active ingredients listed in List N - 'Disinfectants for Use against SARS-CoV-2,' even without prior agency approval. Manufacturers now have the liberty to release disinfectants after notifying the changes in formulation and manufacturing facilities, eliminating the need to wait for US EPA approval. The EPA has also established platforms to identify and safeguard consumers against fraudulent claims related to COVID-19 Disinfectants. Government initiatives in response to COVID-19 aim to enhance production, approval processes, and consumer safety, while mitigating supply chain challenges, thereby boosting revenue in the sterilization equipment and disinfectants market.

The rising number of surgical procedures is expected to drive the growth of the sterilization equipment and disinfectants market in the future. Surgical procedures involve medical treatments that require making incisions or utilizing minimally invasive techniques to access and address various conditions or diseases within the human body. Sterilization equipment and disinfectants play a vital role in these procedures by ensuring infection control, patient safety, regulatory compliance, cost savings, and overall improved healthcare outcomes. For example, in April 2024, the British Association of Aesthetic Plastic Surgeons, a UK-based professional organization, reported that a total of 25,972 surgical procedures were performed in 2023, with women accounting for 93% of all cosmetic surgeries and men making up the remaining 7%. Consequently, the increasing number of surgical procedures is fueling the growth of the sterilization equipment and disinfectants market.

The market is expected to experience a boost during the forecast period due to sustainable solutions such as the repeat sterilization of medical equipment, including personal protective equipment (PPE). Given the shortage of PPE supply to hospitals treating COVID-19 patients, some companies have introduced the concept of repeat sterilization for used PPE such as gowns and masks. In October 2023, the US Food and Drug Administration (FDA) announced the acceptance of sterilization standards and technical information reports (TIRs) to promote innovation in medical device sterilization procedures. Recent initiatives by Ed include the design and validation of a new cleanroom and an epidemiological risk analysis for a reusable oral medical device. Similarly, the Battelle Memorial Institute, a non-profit research organization, aims to reuse N95 respirator masks through sterilization, provided the masks are not made of cellulose. Battelle has received $400 million in funding from the Defense Logistics Agency under US HHS to facilitate N95 decontamination across 60 sites in the USA. Given the scarcity of PPE, the decontamination or sterilization of PPE, rather than replacement, is expected to emerge as a significant growth area in the market.

Manufacturers of sterilization equipment and disinfectants are channeling investments into research and development to create eco-friendly disinfectants. Traditional disinfectants typically contain liquid chemicals derived from alcohols, aldehydes, ammonium compounds, oxidizing agents, and phenolics, which may accumulate toxic chemicals while eliminating germs. Eco-friendly products, on the other hand, are formulated without such chemical concoctions and are made using natural or chemical-free compositions. For instance, in 2022, Clorox Company, a US-based consumer and professional products manufacturer, introduced Clorox EcoClean, featuring an EPA-certified Design for the Environment (DfE) disinfectant cleaner and EPA-certified Safer Choice cleaners. These products adhere to stringent standards set by the U.S. EPA, ensuring that all ingredients have been reviewed for human health and environmental safety. This line of eco-conscious cleaners and disinfectants offers a more sustainable solution for professionals to maintain cleanliness and health in public spaces.

In August 2023, Steris Plc, an Ireland-based medical equipment company, acquired surgical instrumentation assets from Becton, Dickinson and Company for $540 million. This acquisition allows Steris to gain assets related to surgical instrumentation, laparoscopic instrumentation, and sterilization containers from BD. Additionally, the deal includes the transfer of three manufacturing facilities located in St. Louis, Cleveland, and Tuttlingen, Germany. Becton, Dickinson and Company is a US-based medical technology firm that manufactures and sells medical devices, instrument systems, and reagents.

Major companies operating in the sterilization equipment and disinfectants market include Steris Plc, Getinge AB, Advanced Sterilization Products, Sotera Health LLC, Belimed AG, 3M company, Fortive Corporation, SHINVA MEDICAL INSTRUMENT CO., LTD., CISA Production Srl, Tuttnauer, Sterility Equipment India Private Limited, Stericox Sterilizer Systems India, Udono Limited, Xi'an Sterilization Equipment Manufacturing Co. Ltd, J&J Medical Pty. Ltd, Matachana, Systec GmbH, Merck KGaA, Sartorius AG, Reckitt Benckiser Group plc, Ecolab Inc, Stryker, Becton Dickinson, Cantel Medical Corporation, Spic and Span, Barbicide, Touch Land, 4e Global, Vim, Microban, Benefect, Kimberly-Clark, Procter & Gamble Co, Zep, Inc., Noxilizer, Inc, E-BEAM Services, Inc, Clorox, S C Johnson, MMM Group, Matachana Group, Dentsply Sirona MENA, A-Dec Inc, Steelco S.p.A, Medivators Inc, MELAG, Cardinal Health, WH Group, Planmeca, SciCan Ltd.

Asia-Pacific was the largest region in the sterilization equipment and disinfectants market in 2024. North America was the second largest region in the sterilization equipment and disinfectants market report. The regions covered in the sterilization equipment and disinfectants market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the sterilization equipment and disinfectants market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Sterilization equipment consists of devices designed to eliminate all microorganisms from surfaces or instruments, whereas disinfectants are chemical agents that reduce or destroy harmful microbes on surfaces or in liquids. Both sterilization equipment and disinfectants are crucial in healthcare and laboratory environments, as they ensure the safety and cleanliness of instruments and settings by effectively eradicating harmful pathogens.

The primary categories in the market for sterilization equipment and disinfectants include sterilization equipment and disinfectants themselves. Disinfectants serve as agents for disinfecting various items and can be applied through physical, chemical, or mechanical methods. The end-users of these products encompass hospitals and clinics, pharmaceutical companies, as well as clinical laboratories.

The sterilization equipment and disinfectants market research report is one of a series of new reports that provides sterilization equipment and disinfectants market statistics, including sterilization equipment and disinfectants industry global market size, regional shares, competitors with a sterilization equipment and disinfectants market share, detailed sterilization equipment and disinfectants market segments, market trends and opportunities, and any further data you may need to thrive in the sterilization equipment and disinfectants industry. This sterilization equipment and disinfectants market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The sterilization equipment and disinfectants market consist of sales of autoclaves, hot air ovens, filtration and radiation sterilization equipment, and disinfectant chemicals. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Sterilization Equipment and Disinfectants Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on sterilization equipment and disinfectants market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for sterilization equipment and disinfectants? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The sterilization equipment and disinfectants market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Sterilization Equipment, Disinfectants2) By Method: Physical Method, Chemical Method, Mechanical Method

3) By End Use: Hospitals and Clinics, Clinical Laboratories, Pharmaceutical Companies, Other Industries, Non-Industrial Use

Subsegments:

1) By Sterilization Equipment: Autoclaves (Steam Sterilizers); Ethylene Oxide Sterilizers; Dry Heat Sterilizers; Plasma Sterilizers; Radiation Sterilizers (Gamma and Electron Beam)2) By Disinfectants: Alcohol-Based Disinfectants; Chlorine Compounds; Quaternary Ammonium Compounds (Quats); Hydrogen Peroxide-Based Disinfectants; Phenolic Disinfectants

Key Companies Mentioned: Steris Plc; Getinge AB; Advanced Sterilization Products; Sotera Health LLC; Belimed AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Steris Plc

- Getinge AB

- Advanced Sterilization Products

- Sotera Health LLC

- Belimed AG

- 3M company

- Fortive Corporation

- SHINVA MEDICAL INSTRUMENT CO., LTD.

- CISA Production Srl

- Tuttnauer

- Sterility Equipment India Private Limited

- Stericox Sterilizer Systems India

- Udono Limited

- Xi'an Sterilization Equipment Manufacturing Co. Ltd

- J&J Medical Pty. Ltd

- Matachana

- Systec GmbH

- Merck KGaA

- Sartorius AG

- Reckitt Benckiser Group plc

- Ecolab Inc

- Stryker

- Becton Dickinson

- Cantel Medical Corporation

- Spic and Span

- Barbicide

- Touch Land

- 4e Global

- Vim

- Microban

- Benefect

- Kimberly-Clark

- Procter & Gamble Co

- Zep, Inc.

- Noxilizer, Inc

- E-BEAM Services, Inc

- Clorox

- S C Johnson

- MMM Group

- Matachana Group

- Dentsply Sirona MENA

- A-Dec Inc

- Steelco S.p.A

- Medivators Inc

- MELAG

- Cardinal Health

- WH Group

- Planmeca

- SciCan Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.68 Billion |

| Forecasted Market Value ( USD | $ 10.81 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 49 |