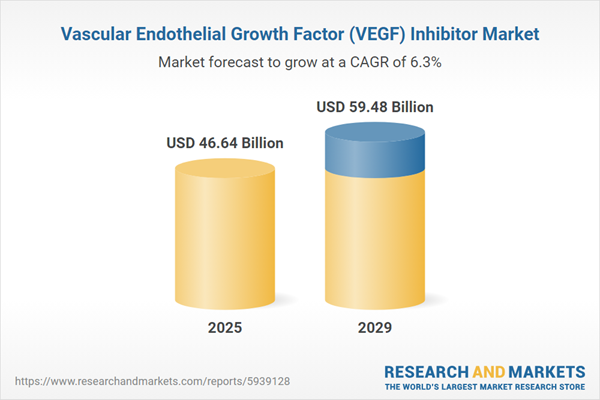

The vascular endothelial growth factor (VEGF) inhibitor market size is expected to see strong growth in the next few years. It will grow to $59.48 billion in 2029 at a compound annual growth rate (CAGR) of 6.3%. The growth in the forecast period can be attributed to increasing prevalence of cancer, rising prevalence of age-related macular degeneration (AMD), rise in healthcare expenditure, high potential of emerging economies, high penetration of the biosimilar drugs and increasing geriatric population. Major trends in the forecast period include offering combination therapies to patients in order to combat advanced cancers and improve patient life, focusing on strategic collaborations to boost innovations and establish category leadership, investing extensively in R&D activities for the development of effective and innovative drugs, focusing on the production of biosimilars in order to cater to a wider market by making treatment more affordable and focusing on reducing dosages for wet age-related macular degeneration (AMD) in order to improve patient welfare.

The rising prevalence of cancer and macular degeneration is expected to drive the growth of the VEGF inhibitor market. For example, in January 2023, a report by the American Cancer Society, a U.S.-based health organization, projected approximately 59,610 new cases of leukemia across all types and around 23,710 related fatalities in 2023 in the United States. Additionally, acute myeloid leukemia (AML) is expected to account for an estimated 20,380 new cases and about 11,310 deaths. Thus, the increasing prevalence of both cancer and macular degeneration is anticipated to support growth in the vascular endothelial growth factor (VEGF) inhibitor market over the forecast period.

The expanding geriatric population is likely to further drive the VEGF inhibitor market’s growth. Defined as individuals aged 65 and above, the geriatric population has increased healthcare needs due to age-related changes. This demographic is growing as advancements in healthcare, improved living conditions, and better chronic disease management increase life expectancy. VEGF inhibitors are particularly beneficial for older adults, targeting age-associated diseases, including certain cancers and ocular conditions, which are more common in this age group. For instance, in October 2022, a report by the World Health Organization (WHO), a Switzerland-based international public health agency, projected that one in six people globally will be aged 60 or older by 2030, with this number reaching 2.1 billion by 2050. Consequently, the increasing aging population is expected to boost demand in the VEGF inhibitor market.

Key players in the VEGF inhibitor industry are increasingly engaging in collaborations and partnerships to broaden their product portfolios by developing new treatments. Product portfolio expansion is a strategic approach enabling companies to grow their businesses and increase market share by meeting consumer demand. This development process encompasses the stages of conceptualization, design, creation, and marketing of newly introduced or rebranded products or services. For example, in April 2024, Santen Pharmaceutical Co. Ltd., a Japan-based pharmaceutical firm, partnered with Bayer Yakuhin, a Japanese pharmaceutical and life sciences company, to launch the Ophthalmic VEGF Inhibitor Eylea 8mg Solution for Intravitreal Injection at a concentration of 114.3 mg/mL. This treatment targets conditions like age-related macular degeneration (nAMD) and diabetic macular edema (DME), both of which can cause vision loss. With a higher concentration than prior versions, Eylea 8mg offers an extended dosing interval of up to 16 weeks, minimizing the need for frequent injections while ensuring continued efficacy and safety. This partnership aims to expand the availability of this advanced ophthalmic solution, reducing the treatment burden on patients and setting a new standard of care.

Major companies in the VEGF inhibitors market are dedicated to introducing innovative products through collaborations to maximize their revenues. Collaborative innovation involves developing new ideas, products, or services through partnerships with external entities such as customers, suppliers, and other stakeholders. For instance, in June 2022, Biogen Inc., a US-based biotechnology company, and Samsung Bioepis Co. Ltd., a South Korea-based biopharmaceutical company, jointly launched BYOOVIZ (ranibizumab-nuna), a biosimilar referencing LUCENTIS (ranibizumab). BYOOVIZ, the first ophthalmology biosimilar in the United States, offers expanded alternatives and cost reduction for existing anti-VEGF treatments. It can be used to treat conditions such as Myopic Choroidal Neovascularization (mCNV), Macular Edema Following Retinal Vein Occlusion (RVO), and Neovascular (Wet) Age-Related Macular Degeneration (AMD), as it is a vascular endothelial growth factor (VEGF) inhibitor.

In January 2023, Takeda Pharmaceutical Company Limited, a Japan-based pharmaceutical company, acquired the worldwide license for Fruquintinib, a highly selective oral VEGFR1/2/3 tyrosine kinase inhibitor, from HUTCHMED Limited for an undisclosed amount. Under the agreement, Takeda gains exclusive global rights to develop and market fruquintinib for all indications and regions outside mainland China, Hong Kong, and Macau. HUTCHMED Limited, a China-based pharmaceutical company, specializes in the development of vascular endothelial growth factor receptor (VEGFR) 1/2/3.

Major companies operating in the vascular endothelial growth factor (VEGF) inhibitor market include F. Hoffmann-La Roche AG, Bayer AG, Regeneron Pharmaceuticals Inc., AstraZeneca Plc., Novartis AG, Pfizer Inc., Eli Lilly and Company, Exelixis Inc., Amgen Inc., Sanofi S.A., Cipla Limited, Biocon, Dr. Reddy's Laboratories, Chi-Med, Innovent Biologics, Daiichi Sankyo, Chugai Pharmaceutical Co. Ltd, Boehringer Ingelheim International GmbH, GlaxoSmithKline plc, Ipsen, Oxurion, Pharmstandard Group, Zentiva, Coherus BioSciences Inc., AVEO pharmaceuticals, Eisai Co. Ltd.

North America was the largest region in the vascular endothelial growth factor (VEGF) inhibitor market in 2024. Middle East is expected to be the fastest-growing region in the vascular endothelial growth factor (VEGF) inhibitor market share during the forecast period. The regions covered in the vascular endothelial growth factor (VEGF) inhibitor market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vascular endothelial growth factor (VEGF) inhibitor market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

A Vascular Endothelial Growth Factor (VEGF) inhibitor is a substance that hinders programmed cell death by acting as an anti-apoptotic factor for hematopoietic cells. VEGF, a growth factor, promotes vascular permeability, potentially facilitating the spread of tumors through the bloodstream and enhancing their access to oxygen and nutrients.

The primary categories of VEGF inhibitors include Avastin, Tecentriq, Cometriq, Eylea, and others. Avastin is a medication designed to assist individuals with wet age-related macular degeneration (AMD). Additionally, it is utilized to treat diabetic eye issues and other retinal conditions. Administered into the eye, Avastin helps delay the loss of eyesight associated with certain disorders. Various routes of administration, including oral and intravenous, are employed in the fields of oncology, ophthalmology, and other medical domains.

The vascular endothelial growth factor (VEGF) inhibitor market research report is one of a series of new reports that provides vascular endothelial growth factor (VEGF) inhibitor market statistics, including vascular endothelial growth factor (VEGF) inhibitor industry global market size, regional shares, competitors with a vascular endothelial growth factor (VEGF) inhibitor market share, detailed vascular endothelial growth factor (VEGF) inhibitor market segments, market trends and opportunities, and any further data you may need to thrive in the vascular endothelial growth factor (VEGF) inhibitor industry. This vascular endothelial growth factor (VEGF) inhibitor market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The vascular endothelial growth factor (VEGF) inhibitor market consists of sales of nexavar, sunitinib, nilotinib, pazopanib, and dasatinib. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Vascular Endothelial Growth Factor (VEGF) Inhibitor Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vascular endothelial growth factor (vegf) inhibitor market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vascular endothelial growth factor (vegf) inhibitor? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The vascular endothelial growth factor (vegf) inhibitor market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drugs Type: Avastin, Tecentriq, Lucentis, Tagrisso, Cometriq, Eylea, Other Drug Types2) By Route of Administration: Oral, Intravenous, Intravitreal

3) By Application: Oncology, Ophthalmology, Other Applications

Subsegments:

1) By Avastin: Oncology Applications; Ophthalmology Applications2) By Tecentriq: Non-Small Cell Lung Cancer; Small Cell Lung Cancer; Bladder Cancer; Triple-Negative Breast Cancer

3) By Lucentis: Wet Age-Related Macular Degeneration (AMD); Diabetic Retinopathy; Retinal Vein Occlusion

4) By Tagrisso: First-Line Treatment; Second-Line Treatment

5) By Cometriq: Medullary Thyroid Cancer; Renal Cell Carcinoma

6) By Eylea: Wet Age-Related Macular Degeneration (AMD); Diabetic Macular Edema (DME); Retinal Vein Occlusion (RVO)

7) By Other Drug Types: Immuno-Oncology Drugs; Anti-Angiogenic Agents; Other Monoclonal Antibodies

Key Companies Mentioned: F. Hoffmann-La Roche AG; Bayer AG; Regeneron Pharmaceuticals Inc.; AstraZeneca Plc.; Novartis AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche AG

- Bayer AG

- Regeneron Pharmaceuticals Inc.

- AstraZeneca Plc.

- Novartis AG

- Pfizer Inc.

- Eli Lilly and Company

- Exelixis Inc.

- Amgen Inc.

- Sanofi S.A.

- Cipla Limited

- Biocon

- Dr. Reddy's Laboratories

- Chi-Med

- Innovent Biologics

- Daiichi Sankyo

- Chugai Pharmaceutical Co. Ltd

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline plc

- Ipsen

- Oxurion

- Pharmstandard Group

- Zentiva

- Coherus BioSciences Inc.

- AVEO pharmaceuticals

- Eisai Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 46.64 Billion |

| Forecasted Market Value ( USD | $ 59.48 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |