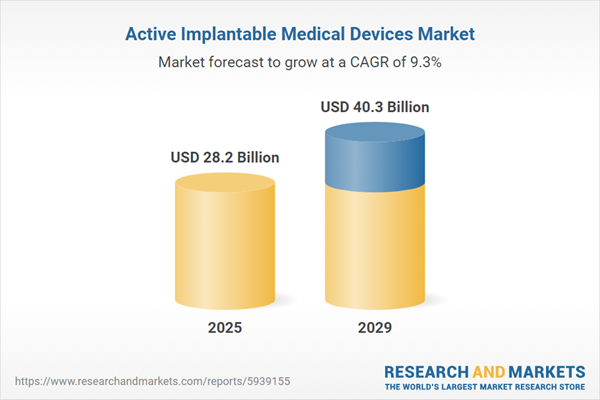

The active implantable medical devices market size is expected to see strong growth in the next few years. It will grow to $40.3 billion in 2029 at a compound annual growth rate (CAGR) of 9.3%. The growth in the forecast period can be attributed to the elderly population, government support, and the increasing burden of neurological diseases. Major trends in the forecast period include launching new active implantable medical devices, partnerships and collaborations, integration of wireless technologies for implantable medical device charging, and integration of artificial intelligence (AI) to improve their product offerings and to stay competitive in the market.

The active implantable medical devices market is poised for growth, driven by the increasing prevalence of cardiovascular diseases (CVD). Cardiovascular diseases encompass a range of conditions affecting the heart or blood vessels, often associated with factors such as atherosclerosis and an elevated risk of blood clots. Active implantable medical devices play a crucial role in regulating or monitoring irregular heartbeats in individuals with specific heart rhythm problems or heart failure. The surge in the incidence of cardiovascular diseases, notably due to the formation of fatty deposits and an increased risk of blood clots, is expected to propel the demand for active implantable medical devices. The rise in the geriatric population further contributes to this demand. According to a report published by the American College of Cardiology in August 2022, cardiovascular risk factors are projected to increase significantly from 2025 to 2060, with substantial proportional increases in diabetes, dyslipidemia, hypertension, and obesity. The anticipated growth in cardiovascular diseases, particularly in stroke and heart failure, underscores the pivotal role of active implantable medical devices in addressing these health challenges.

Government support is anticipated to play a pivotal role in driving the growth of the active implantable medical devices market. Governments are increasingly focusing on efforts to raise public awareness regarding available medical devices and equipment, influencing the overall expansion of the market. For instance, in February 2023, the UK government pledged to boost investment, with a specific focus on entities responsible for approving medical devices and ensuring their conformity with new regulatory requirements. Similarly, in June 2022, the Romanian government initiated the National Agency for Health Infrastructure Development, aiming to enhance coherence in investments related to health infrastructure. The support and initiatives from governments worldwide are expected to contribute significantly to the growth of the active implantable medical devices market.

Major companies in the active implantable medical device market are concentrating on product innovation, such as Polyether Ether Ketone (PEEK) cranial implants, to gain a competitive advantage. PEEK cranial implants are sophisticated medical devices used for the surgical repair of cranial defects. For example, in April 2022, CureTech, an Oman-based medical manufacturing company, launched a Polyether Ether Ketone (PEEK) cranial implant. PEEK is favored for various implantable medical devices due to its biocompatibility and mechanical properties. This high-performance thermoplastic polymer is biocompatible, radiolucent, and possesses a modulus of elasticity similar to that of bone, making it suitable for orthopedic applications like spinal fusion, joint replacement, and trauma surgery.

Companies in the active implantable medical device market are also focused on developing technological advancements such as implantable PEEK filament to improve customization, enhance patient outcomes, and streamline production processes. Implantable PEEK filament is a specialized material created for making medical implants using additive manufacturing techniques. For instance, in March 2023, Invibio, a U.K.-based provider of high-performance implantable biomaterials, launched PEEK-OPTIMA AM filament. This filament is composed of implantable polyetheretherketone (PEEK) known for its biocompatibility and mechanical strength, making it ideal for implantable medical devices. The new filament is optimized for fused filament fabrication (FFF) and aims to enhance the production of medical devices, specifically designed for 3D printing applications in the medical field.

In December 2023, TekniPlex Healthcare, a U.S.-based manufacturer of medical device components, acquired Seisa Medical for an undisclosed amount. This acquisition allows TekniPlex to bolster its medical technology solutions platform, particularly in the minimally invasive and interventional therapy sectors. Seisa Medical is a U.S.-based manufacturer of active implantable medical devices.

Major companies operating in the active implantable medical devices market include Medtronic PLC, Boston Scientific Corporation, Cochlear Limited, Abbott Laboratories, Sonova Holding AG, MED-EL Medical Electronics, Livanova PLC, Biotronik Se & Co., Kg, MicroPort Scientific Corporation, Envoy Medical Corporation, Pregna International, Johari Digital Healthcare Limited, Renalyx Health Systems, Medprime Technologies, Comofi Medtech, Dynamed Equipments, Aurolab, Unicorn Denmart Limited, Lepu Medical Technology Company, Calon Cardio, Better Medical Technology, Beijing Aeonmed Co., Ltd, BONSS MEDICAL, Koninklijke Philips N.V., Berlin Heals Holding AG, CorWave SA, Philips Healthcare, Draegerwerk AG, Getinge Group, Ceryx Medical, MEDICO s.r.l., Medical-Łomża Sp. z o.o., Panop CZ, Medplant LLC, P.H.U. Medical, ProVeterináře, Johnson & Johnson, Baxter, Stryker, Axio Biosolutions, Cirtec Medical, Masimo, Teleflex Inc, NAGL MedTech, B Braun Argentina, Braile Biomedica Ltd, Megadyne Argentina, Embramed Industria e Comercio de Produtos Hospitalares Ltd, Arabian Medical Enterprises LLC, Zahrawi Group, Al Burak Medical Services, Lodox Systems, Glenmed Healthcare Solutions (PTY) Ltd, Lepeke Medical Group, LTE Medical Solutions.

North America was the largest region in the active implantable medical devices market in 2024. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the active implantable medical devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the active implantable medical devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Active implantable medical devices (AIMDs) are entirely or partially embedded medical tools intended for diagnostic or therapeutic purposes, engineered to be permanently positioned within the human body.

These devices encompass a range of products including cardiac pacemakers, implantable cardioverter defibrillators (ICDs), nerve stimulators, cochlear implants, ventricular assist devices, among others. For instance, an implantable cardioverter-defibrillator (ICD) is a small, battery-powered device inserted into the chest to detect and regulate abnormal heart rhythms. They serve diverse applications such as cardiovascular, neurological treatments, aiding hearing impairment, and are employed by various end-users including hospitals, specialized clinics, and ambulatory surgical centers.

The active implantable medical devices market research report is one of a series of new reports that provides active implantable medical devices market statistics, including active implantable medical devices industry global market size, regional shares, competitors with an active implantable medical devices market share, detailed active implantable medical devices market segments, market trends and opportunities, and any further data you may need to thrive in the active implantable medical devices industry. This active implantable medical devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The active implanted medical devices market consists of sales of active implanted medical devices with components such as battery packs, controllers, implant kits, leads, programmers, and refill kits. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Active Implantable Medical Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on active implantable medical devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for active implantable medical devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The active implantable medical devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Cardiac Pacemakers, Implantable Cardioverter Defibrillators (ICD), Nerve Simulators, Cochlear Implants, Ventricular Assist Devices, Other Products2) By Application: Cardiovascular, Neurological, Hearing Impairment, Other Applications

3) By End User: Hospitals, Specialty Clinics, Ambulatory Surgical Centers

Subsegments:

1) By Cardiac Pacemakers: Single Chamber Pacemakers; Dual Chamber Pacemakers; Biventricular Pacemakers2) By Implantable Cardioverter Defibrillators (ICD): Transvenous ICDs; Subcutaneous ICDs

3) By Nerve Stimulators: Spinal Cord Stimulators; Peripheral Nerve Stimulators; Deep Brain Stimulators

4) By Cochlear Implants: Single-Electrode Cochlear Implants; Multichannel Cochlear Implants

5) By Ventricular Assist Devices: Left Ventricular Assist Devices (LVAD); Right Ventricular Assist Devices (RVAD); Bi-Ventricular Assist Devices (BiVAD)

6) By Other Products: Neurostimulators for Pain Management; Implantable Drug Delivery Systems; Implantable Blood Pressure Monitors

Key Companies Mentioned: Medtronic PLC; Boston Scientific Corporation; Cochlear Limited; Abbott Laboratories; Sonova Holding AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Medtronic PLC

- Boston Scientific Corporation

- Cochlear Limited

- Abbott Laboratories

- Sonova Holding AG

- MED-EL Medical Electronics

- Livanova PLC

- Biotronik Se & Co., Kg

- MicroPort Scientific Corporation

- Envoy Medical Corporation

- Pregna International

- Johari Digital Healthcare Limited

- Renalyx Health Systems

- Medprime Technologies

- Comofi Medtech

- Dynamed Equipments

- Aurolab

- Unicorn Denmart Limited

- Lepu Medical Technology Company

- Calon Cardio

- Better Medical Technology

- Beijing Aeonmed Co., Ltd

- BONSS MEDICAL

- Koninklijke Philips N.V.

- Berlin Heals Holding AG

- CorWave SA

- Philips Healthcare

- Draegerwerk AG

- Getinge Group

- Ceryx Medical

- MEDICO s.r.l.

- Medical-Łomża Sp. z o.o.

- Panop CZ

- Medplant LLC

- P.H.U. Medical

- ProVeterináře

- Johnson & Johnson

- Baxter

- Stryker

- Axio Biosolutions

- Cirtec Medical

- Masimo

- Teleflex Inc

- NAGL MedTech

- B Braun Argentina

- Braile Biomedica Ltd

- Megadyne Argentina

- Embramed Industria e Comercio de Produtos Hospitalares Ltd

- Arabian Medical Enterprises LLC

- Zahrawi Group

- Al Burak Medical Services

- Lodox Systems

- Glenmed Healthcare Solutions (PTY) Ltd

- Lepeke Medical Group

- LTE Medical Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 28.2 Billion |

| Forecasted Market Value ( USD | $ 40.3 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 55 |