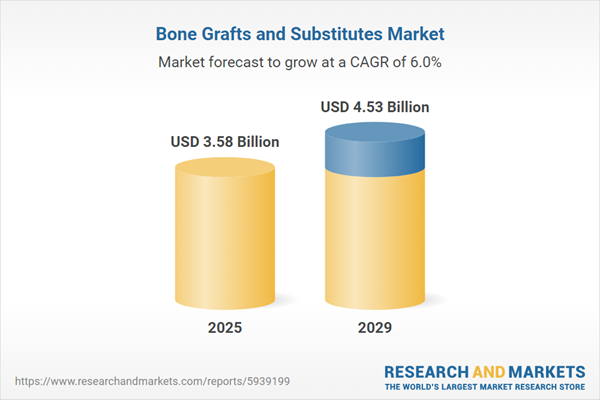

The bone grafts and substitutes market size is expected to see strong growth in the next few years. It will grow to $4.53 billion in 2029 at a compound annual growth rate (CAGR) of 6%. The growth in the forecast period can be attributed to rising geriatric population, rising incidences of road accidents and sports injuries, increase in demand for joint reconstruction disorders and rising number of diabetes-related amputations. Major trends in the forecast period include new product launches, 3D-printed bone grafts, and partnerships and collaborations.

The increasing prevalence of musculoskeletal disorders, including conditions such as osteoporosis and tendonitis, is anticipated to drive the growth of the bone grafts and substitutes market. Musculoskeletal disorders encompass a range of injuries and conditions affecting the body's movement and musculoskeletal system, impacting muscles, nerves, tendons, joints, cartilage, and spinal discs. This surge in musculoskeletal disorders has led to a heightened demand for bone grafts and substitutes. Notably, in March 2022, a Pediatric Orthopedic Consultant at the Indian Spinal Injuries Centre in Delhi reported a significant 50% increase in Pediatric Orthopaedic Cases, attributing this rise to poor posture among students during online classes. Consequently, the escalating incidence of musculoskeletal disorders is expected to contribute to the growing demand for products in the bone grafts and substitutes market.

The continuous rise in road accidents and sports injuries is poised to be a significant driver for the bone grafts and substitutes market. Factors such as speeding, lack of safety gear usage, increased vehicle numbers, inadequate road infrastructure, growing sports activities, the inherent risk in sports, and other contributing factors have led to a surge in road accidents and sports injuries. These incidents often result in fractures and disabilities that necessitate the use of bone grafts and substitutes for effective treatment. As an illustration, the projected number of road accidents per one million inhabitants in the United States is expected to surpass 7,100 by 2025. Consequently, the increasing prevalence of road accidents and sports injuries is expected to be a key factor propelling the growth of the bone grafts and substitutes market.

New product innovations have emerged as a significant trend gaining traction in the bone grafts and substitutes market. Major companies in this sector are concentrating on product innovations to satisfy consumer demand. For instance, in June 2023, BONESUPPORT, a Sweden-based medical technology firm, launched CERAMENT G, an antibiotic-eluting bone graft substitute that features enhanced usability, reduced environmental impact, and an extended shelf life. This innovative product maintains the same composition, mechanism of action, and clinical results as its predecessors while incorporating notable improvements. The new kit is 28% smaller and includes surface-sterile components, optimizing surgical workflows and increasing efficiency for surgical teams. Additionally, the shelf life has been extended to three years, providing extra convenience.

Leading companies in the bone grafts and substitutes market are pursuing a strategic partnership approach to enhance technological integration and broaden market reach. A strategic partnership generally refers to a collaborative relationship between two or more organizations that combines their resources, expertise, and efforts to achieve shared goals or objectives. For example, in March 2022, Biocomposites, a UK-based medical technology firm, partnered with Zimmer Biomet, a US-based medical technology company specializing in the design, manufacturing, and marketing of orthopedic products, to enhance the U.S. orthopedic market by utilizing Zimmer Biomet's distribution network. This collaboration aimed to offer the upgraded Genex Bone Graft Substitute, which features a new closed-mixing system and improved delivery options, ultimately facilitating optimal bone remodeling and surgical efficiency.

In October 2022, Geistlich, a Switzerland-based medical technology company, acquired Lynch Biologics for an undisclosed amount. This acquisition allows Geistlich to enhance its portfolio by integrating Lynch Biologics' innovative products and research capabilities, thereby improving its offerings in bone healing and graft efficacy for treating osteoarthritis while expanding its presence in the minimally invasive trauma market. Lynch Biologics is a US-based biotechnology company specializing in the development and manufacturing of advanced regenerative medicine products.

Major companies operating in the bone grafts and substitutes market include Medtronic plc, Stryker Corporation, Smith & Nephew, Johnson & Johnson, Zimmer Biomet, Baxter International Inc., SeaSpine, Integra Lifesciences Holdings Corporation, NuVasive Inc., Orthofix Holdings Inc., Bioconcept Dental Implants, NovaBone India, Straumann, Kamal Medtech, Geistlich Bio-Oss, Lindare Medical, Hospital Innovations, Bioimplon, Exabone GmbH, Mathys AG, Dentsply Sirona Inc, Danaher Corp, Arthrex Inc, Graftys, Osseocon Biomateriais, Einco Biomaterial, Bionnovation, Medbone Biomaterials, CoreBone, Datum Dental, OK Coral, Dentakay Dental Clinic, Turkeyana Clinic, Keystone Dental, Allosource, DePuy Synthes, Wright Medical Group N.V.

North America was the largest region in the bone grafts and substitutes market in 2024. The regions covered in the bone grafts and substitutes market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the bone grafts and substitutes market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Bone grafts and substitutes are procedures used to address bone defects by filling them with either bone grafts or substitutes. These procedures are often necessary in trauma and orthopedic surgeries. Bone grafting involves integrating donor bone tissue with the recipient's new bone, aiding bone growth naturally and restoring lost bone tissue. They not only replace lost bone but also facilitate bone regeneration and facial contour restoration.

The primary types of bone grafts and substitutes include allografts, synthetics, and xenografts. Allografts involve tissue donation from the same species as the recipient and are frequently used in spinal fusion surgeries. These procedures find applications in spinal fusion, trauma, craniomaxillofacial, joint reconstruction, dental bone grafting, and are utilized across various medical settings such as hospitals and surgical centers.

The bone grafts and substitutes market research report is one of a series of new reports that provides bone grafts and substitutes market statistics, including bone grafts and substitutes industry global market size, regional shares, competitors with a bone grafts and substitutes market share, detailed bone grafts and substitutes market segments, market trends and opportunities, and any further data you may need to thrive in the bone grafts and substitutes industry. This bone grafts and substitutes market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future state of the industry.

The bone grafts and substitutes market consists of sales of xenograft tissue, alloplast bone graft, autograft tissue, and allograft tissue. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Bone Grafts and Substitutes Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on bone grafts and substitutes market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for bone grafts and substitutes? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The bone grafts and substitutes market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Material: Allograft, Synthetic, Xenograft2) By Application: Spinal Fusion, Trauma, Craniomaxillofacial, Joint Reconstruction, Dental Bone Grafting, Other Applications

3) By End User: Hospitals and Clinics, Surgical Centers, Other End-Users

Subsegments:

1) By Allograft: Demineralized Bone Matrix (DBM); Fresh Frozen Allografts; Freeze-Dried Allografts2) By Synthetic: Ceramic-Based; Polymer-Based; Composite-Based; Bone Morphogenetic Proteins (BMPs)

3) By Xenograft: Bovine-Derived Grafts; Porcine-Derived Grafts; Other Animal-Derived Sources

Key Companies Mentioned: Medtronic plc; Stryker Corporation; Smith & Nephew; Johnson & Johnson; Zimmer Biomet

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Medtronic plc

- Stryker Corporation

- Smith & Nephew

- Johnson & Johnson

- Zimmer Biomet

- Baxter International Inc.

- SeaSpine

- Integra Lifesciences Holdings Corporation

- NuVasive Inc.

- Orthofix Holdings Inc.

- Bioconcept Dental Implants

- NovaBone India

- Straumann

- Kamal Medtech

- Geistlich Bio-Oss

- Lindare Medical

- Hospital Innovations

- Bioimplon

- Exabone GmbH

- Mathys AG

- Dentsply Sirona Inc

- Danaher Corp

- Arthrex Inc

- Graftys

- Osseocon Biomateriais

- Einco Biomaterial

- Bionnovation

- Medbone Biomaterials

- CoreBone

- Datum Dental

- OK Coral

- Dentakay Dental Clinic

- Turkeyana Clinic

- Keystone Dental

- Allosource

- DePuy Synthes

- Wright Medical Group N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.58 Billion |

| Forecasted Market Value ( USD | $ 4.53 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |