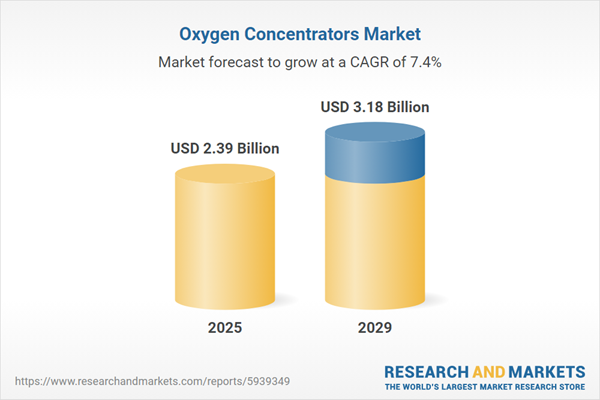

The oxygen concentrators market size is expected to see strong growth in the next few years. It will grow to $3.18 billion in 2029 at a compound annual growth rate (CAGR) of 7.4%. The growth in the forecast period can be attributed to the increasing elderly population, increasing focus on home healthcare, increasing healthcare access, and technological advancements. Major trends in the forecast period include the development of smart oxygen concentrators, and portable oxygen concentrators, a rise in partnerships and acquisitions, technological advancements, new payment plans, and an increasing number of patent filings.

The growth of the oxygen concentrators market is propelled by the increasing prevalence of respiratory disorders worldwide. Chronic respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) are widespread globally. In February 2023, the American Lung Association reported that over 34 million Americans are affected by chronic lung illnesses such as asthma or COPD. Furthermore, more than 25 million Americans, including over 4 million children, experience breathing difficulties due to asthma. Consequently, the rising incidence of respiratory disorders is a key factor driving the expansion of the oxygen concentrators market.

The rising emphasis on home healthcare worldwide is driving the growth of the oxygen concentrators market in the upcoming period. Home healthcare refers to health services provided at home for illnesses or injuries and is often more affordable, convenient, and equally effective compared to hospitals or skilled nursing facilities (SNFs). An oxygen concentrator is a medical device that supplies supplemental oxygen at home for individuals whose oxygen levels drop too low due to health conditions. Those in urgent need of oxygen can easily set up an oxygen concentrator at home. For example, a survey conducted by Vivalink, a U.S.-based digital health technology company specializing in remote data capture for healthcare and clinical trials, revealed that the adoption of remote patient monitoring among healthcare providers jumped from 20% in 2021 to 81% in 2023. Among pulmonologists surveyed, 84.62% currently utilize remote monitoring, with 81.8% planning to increase its use by 2024. Therefore, the growing preference for home healthcare is significantly contributing to market expansion.

Companies in the oxygen concentrators market are increasingly investing in technologies like artificial intelligence and affordable portable devices to enhance the functionality of these concentrators. The pandemic has led to a surge in demand for portable, low-cost oxygen concentrators. For example, in March 2024, Drive DeVilbiss Healthcare, a leading U.S. manufacturer of durable medical equipment, collaborated with Sanrai International, a U.S. company specializing in innovative medical equipment, to launch the PulmO2 10L Oxygen Concentrator. This device is designed to be energy-efficient and durable, making it well-suited for use in challenging clinical environments. The PulmO2 aims to provide reliable oxygen therapy, especially in low-resource settings, and is expected to significantly reduce energy costs compared to traditional 10L concentrators.

Oxygen concentrator manufacturers are increasingly developing smart concentrators equipped with sensors, voice guidance, interconnected apps, and digital platforms aimed at analyzing usage patterns and measuring peak respiratory flow rates. This digital connectivity enables patients to link their concentrators to mobile phones or personal computers, allowing them to set timely alarms for managing their daily dosage. As a result, companies can enhance patients’ oxygen therapies by ensuring adherence to prescriptions and monitoring their conditions effectively. The use of such smart concentrators helps reduce emergency hospitalizations and organizes treatment plans more efficiently. For instance, in October 2022, O2 Concepts, a leading U.S. provider of innovative portable oxygen concentrators, launched the Oxlife Liberty, a revolutionary portable oxygen concentrator (POC) designed to improve the delivery of oxygen therapy. The Oxlife Liberty stands out as the first wearable POC offering both continuous flow and pulse dose oxygen delivery, with continuous flow rates ranging from 0.5 to 1.5 liters per minute (LPM) and pulse settings from 1 to 9.

In January 2022, NOVAIR, a manufacturer based in France specializing in on-site gas production systems, acquired OGSI (Oxygen Generating Systems International) for an undisclosed sum. This acquisition strengthens NOVAIR's market position and broadens its product offerings, particularly in critical applications such as disaster preparedness, healthcare, and semiconductor manufacturing. OGSI is a U.S.-based manufacturer of industrial and medical oxygen generators.

Major companies operating in the oxygen concentrators market include Inogen Inc, Koninklijke Philips N.V, Invacare Corporation, CAIRE Inc, O2 Concepts LLC, Nidek Medical Products Inc., Precision Medical Inc, Drive Devilbiss Healthcare Ltd, 3B Medical Inc, BPL, Evox Oxygen Concentrators, Nanjing Everich Medicare Import & Export Co. Ltd, AngelBiss Medical Technology Co. Ltd, Hefei DX Medical Co. Ltd, Longfian Scitech Co. Ltd, Air Liquide Sanita Service, Pure O2, Heinen + Lowenstein GmbH & Co. KG, DeVilbiss Healthcare GmbH, Chart Industries Inc, White Martins, Linde Plc, ResMed.

North America was the largest region in the oxygen concentrators market in 2024. Europe was the second-largest region in the oxygen concentrators market. The regions covered in the oxygen concentrators market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the oxygen concentrators market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Oxygen concentrators are devices designed to extract nitrogen and oxygen from the ambient air, delivering pure oxygen to patients. They are primarily employed for providing oxygen to individuals with respiratory diseases.

The primary types of oxygen concentrators are portable and stationary. Portable oxygen concentrators are smaller, more mobile, cost-effective, and easily transportable from one location to another. Different technologies are utilized, including pulse dose, continuous flow, and others. These oxygen concentrators find application in various medical conditions such as chronic obstructive pulmonary disease (COPD), lung cancer, pneumonia, and other respiratory system diseases. They are utilized by hospitals, home care services, and other healthcare settings.

The oxygen concentrators market research report is one of a series of new reports that provides oxygen concentrators market statistics, including oxygen concentrators industry global market size, regional shares, competitors with an oxygen concentrators market share, detailed oxygen concentrators market segments, market trends and opportunities, and any further data you may need to thrive in the oxygen concentrators industry. This oxygen concentrators market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The oxygen concentrators market consists of sales of Compressed gas systems, Portable oxygen concentrators (POCs), and Liquid oxygen systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Oxygen Concentrators Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on oxygen concentrators market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for oxygen concentrators? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The oxygen concentrators market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Portable, Stationary2) By Technology: Pulse Dose, Continuous Flow

3) By Application: Chronic Obstructive Pulmonary Disease (COPD), Lung Cancer, Pneumonia, Other Applications

4) By End User: Hospitals, Home Care, Other End Users

Subsegments:

1) By Portable: Battery-Operated Portable Concentrators; Travel-Friendly Models; Compact and Lightweight Designs2) By Stationary: Continuous Flow Concentrators; Pulse Dose Concentrators; High-Flow Stationary Models

Key Companies Mentioned: Inogen Inc; Koninklijke Philips N.V; Invacare Corporation; CAIRE Inc; O2 Concepts LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Inogen Inc

- Koninklijke Philips N.V

- Invacare Corporation

- CAIRE Inc

- O2 Concepts LLC

- Nidek Medical Products Inc.

- Precision Medical Inc

- Drive Devilbiss Healthcare Ltd

- 3B Medical Inc

- BPL

- Evox Oxygen Concentrators

- Nanjing Everich Medicare Import & Export Co. Ltd

- AngelBiss Medical Technology Co. Ltd

- Hefei DX Medical Co. Ltd

- Longfian Scitech Co. Ltd

- Air Liquide Sanita Service

- Pure O2

- Heinen + Lowenstein GmbH & Co. KG

- DeVilbiss Healthcare GmbH

- Chart Industries Inc

- White Martins

- Linde Plc

- ResMed

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.39 Billion |

| Forecasted Market Value ( USD | $ 3.18 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |