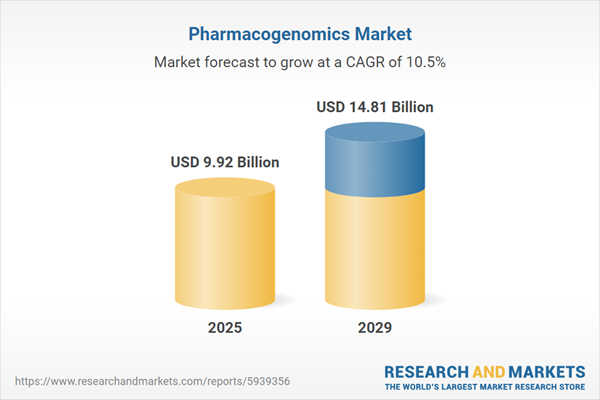

The pharmacogenomics market size is expected to see rapid growth in the next few years. It will grow to $14.81 billion in 2029 at a compound annual growth rate (CAGR) of 10.5%. The growth in the forecast period can be attributed to the increasing aging population, the increasing chronic diseases, the rising population and the increasing demand for cancer treatment. Major trends in the forecast period include launch of genome editing solution for deeper analysis of advanced therapies, focus on integration of artificial intelligence (AI) in genomics to analyze genetic data, growing advancements in metagenomics, strategic partnerships and collaborations among market players, introduction of three-dimensional (3D) genomics to study influences on gene expression and function, new product innovations with focus on infectious diseases and gene editing and development of psychotropic pharmacogenomics test for informed decisions.

The growing demand for precision medicine is fueling the expansion of the pharmacogenomics market. Precision medicine, a healthcare model focused on personalized treatment tailored to specific patient subsets, is gaining traction, especially in advanced areas such as oncology. Its applications extend beyond late-stage diseases to encompass rare and genetic conditions. Precision medicine aims to integrate genetic and environmental information to tailor treatments for specific diseases and responses. A Linchpinseo article from March 2022 indicates a 1/3 increase in precision medicine investment by leading pharmaceutical companies over the next five years. In the USA, where 30 million people with type 2 diabetes are diagnosed and treated, precision medicine offers individualized treatment, reshaping current practices. The rising demand for precision medicine is a key driver propelling the pharmacogenomics market.

The pharmacogenomics market is expected to experience growth due to the increasing prevalence of chronic diseases. Chronic diseases, persistent over an extended period, pose a significant global health challenge. Pharmacogenomics provides a personalized treatment approach, considering individual genetic variations influencing drug responses. According to the World Health Organization's September 2023 report, non-communicable diseases (NCDs) or chronic diseases account for 74% of the 41 million annual deaths worldwide. Cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes contribute significantly to this burden. The upward trend in chronic diseases is a major factor propelling the pharmacogenomics market.

Technological advancement is becoming a prominent trend in the pharmacogenomics market. Pharmaceutical manufacturers are exploring various methods for pharmacogenomics analysis to deliver cost-effective solutions for screening known polymorphisms and discovering novel variants. For example, in May 2022, Invitae, a US-based medical laboratory organization, launched its expanded Pharmacogenomics Panel. This panel, which includes the Mental Health Panel, offers insights into genetic responses to medications across several specialties, such as primary care, cardiology, and oncology. With nearly 25% of patients experiencing atypical drug responses due to genetic factors, pharmacogenomics (PGx) testing is poised to become a standard practice. To ensure effective integration into healthcare, there is a need for enhanced support to help providers understand and apply PGx testing within their clinical environments.

Companies in the pharmacogenomics market are concentrating on the development of innovative solutions for infectious disease diagnosis and gene editing to fortify their market standing. For instance, in March 2022, Thermo Fisher Scientific Inc., a U.S.-based supplier of analytical instruments and life sciences solutions, introduced the latest generation of its SeqStudio Flex Series Genetic Analyzer. This innovative tool, leveraging Capillary Electrophoresis (CE) technology, enhances research in infectious disease diagnosis and gene editing. The SeqStudio Flex Genetic Analyzer, available in 8- and 24-capillary configurations, delivers high-quality data and reliable performance across various applications.

In June 2023, Genomenon, a U.S.-based genomics intelligence company, acquired Boston Genetics for an undisclosed amount. This strategic acquisition combines Genomenon's AI-powered genomic platform with Boston Genetics' genetic scientists to comprehensively curate the human genome. The acquisition strengthens clinical diagnostic and pharmaceutical drug development programs by providing valuable insights into the genomic drivers of genetic diseases and oncology. Additionally, it establishes a genomics data service arm for Genomenon, offering cost-effective variant curation team extensions for genetic testing labs, expediting turnaround times. Boston Genetics, a genomics interpretation and curation company based in the U.S., is part of this acquisition.

Major companies operating in the pharmacogenomics market include Illumina Inc, Eurofins Scientific, Myriad Genetics Inc, PerkinElmer Inc, Centogene N.V, Invitae Corporation, Genomind, Pacific Biosciences of California Inc, Oneome LLC, Admera Health, MapMyGenome, Positive Bioscience, Xcode Life Sciences, Xcelris Labs, Takeda Pharmaceutical Company Limited, Garvan Institute of Medical Research, 3D Medicines Inc, Berry Genomics, BGI, GenomiCare Biotechnology, Bayer AG, GlaxoSmithKline plc (GSK), F Hoffmann-La Roche AG, Merck KGaA, QIAGEN N.V, Centro de Genoma e Biologia de Sistemas (CGBS), Dasa Group, Datar Cancer Genetics Limited, MedGenome Labs, 23andMe, Color Genomics, Pathway Genomics, Laboratório Richet, Laboratório Exame, Genomika Diagnósticos.

North America was the largest region in the pharmacogenomics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the pharmacogenomics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pharmacogenomics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Pharmacogenomics is a research field that explores how a patient's genes influence their response to medications. Its ultimate goal is to assist doctors in selecting the most appropriate drugs and doses tailored to each individual. Pharmacogenomics is instrumental in developing personalized drugs to address various health conditions, including cardiovascular disease, Alzheimer's disease, cancer, and asthma. The term 'pharmacogenomics marker' refers to a precise medical treatment approach for individuals or specific groups.

Key technologies employed in the pharmacogenomics market include next-generation sequencing (NGS), polymerase chain reaction, gel electrophoresis, mass spectrometry, microarray, and others. NGS, a massively parallel sequencing technology, offers ultra-high throughput, scalability, and speed, enabling the determination of nucleotide order in entire genomes or specific DNA/RNA regions. Pharmacogenomics applications span neurological diseases, infectious diseases, oncology, cardiovascular diseases, pain management, and various other areas. End-users encompass hospitals and clinics, research institutions, academic institutes, and others.

The pharmacogenomics market research report is one of a series of new reports that provides pharmacogenomics market statistics, including pharmacogenomics industry global market size, regional shares, competitors with a pharmacogenomics market share, detailed pharmacogenomics market segments, market trends and opportunities, and any further data you may need to thrive in the pharmacogenomics industry. This pharmacogenomics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The pharmacogenomics market includes revenues earned by entities by PennCNV,QuantiSNP, GenoCN and Nexus.The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Pharmacogenomics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pharmacogenomics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pharmacogenomics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pharmacogenomics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Technology: Next Generation Sequencing, Polymerase Chain Reaction, Gel Electrophoresis, Mass Spectrometry, Microarray, Other Technologies2) By Application: Neurological Diseases, Infectious Diseases, Oncology, Cardiovascular Diseases, Pain Management, Other Applications

3) By End User: Hospitals and Clinics, Research Institutions, Academic Institutes, Other End Users

Subsegments:

1) By Next Generation Sequencing (NGS): Whole Genome Sequencing; Targeted Sequencing; Exome Sequencing2) By Polymerase Chain Reaction (PCR): Quantitative PCR (qPCR); Reverse Transcription PCR (RT-PCR); Digital PCR

3) By Gel Electrophoresis: Agarose Gel Electrophoresis; Polyacrylamide Gel Electrophoresis; Capillary Gel Electrophoresis

4) By Mass Spectrometry: LC-MS/MS (Liquid Chromatography-Tandem Mass Spectrometry); MALDI-TOF MS (Matrix-Assisted Laser Desorption/Ionization Time of Flight); HRMS (High-Resolution Mass Spectrometry)

5) By Microarray: SNP Microarrays; Expression Microarrays; Comparative Genomic Hybridization (CGH) Arrays

6) By Other Technologies: Sanger Sequencing; CRISPR-Based Technologies; Bioinformatics Tools

Key Companies Mentioned: Illumina Inc; Eurofins Scientific; Myriad Genetics Inc; PerkinElmer Inc; Centogene N.V

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Illumina Inc

- Eurofins Scientific

- Myriad Genetics Inc

- PerkinElmer Inc

- Centogene N.V

- Invitae Corporation

- Genomind

- Pacific Biosciences of California Inc

- Oneome LLC

- Admera Health

- MapMyGenome

- Positive Bioscience

- Xcode Life Sciences

- Xcelris Labs

- Takeda Pharmaceutical Company Limited

- Garvan Institute of Medical Research

- 3D Medicines Inc

- Berry Genomics

- BGI

- GenomiCare Biotechnology

- Bayer AG

- GlaxoSmithKline plc (GSK)

- F Hoffmann-La Roche AG

- Merck KGaA

- QIAGEN N.V

- Centro de Genoma e Biologia de Sistemas (CGBS)

- Dasa Group

- Datar Cancer Genetics Limited

- MedGenome Labs

- 23andMe

- Color Genomics

- Pathway Genomics

- Laboratório Richet

- Laboratório Exame

- Genomika Diagnósticos

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.92 Billion |

| Forecasted Market Value ( USD | $ 14.81 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |