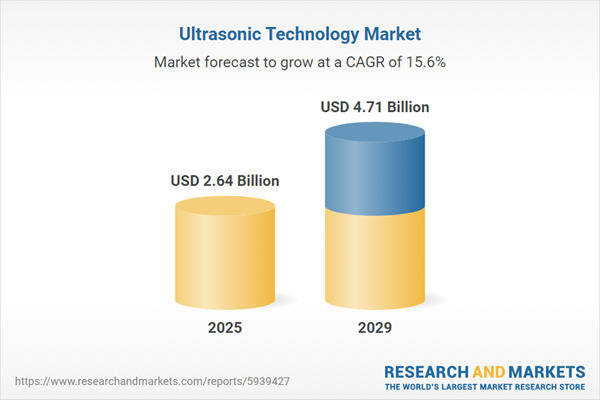

The ultrasonic technology market size is expected to see rapid growth in the next few years. It will grow to $4.71 billion in 2029 at a compound annual growth rate (CAGR) of 15.6%. The growth in the forecast period can be attributed to the increasing prevalence of chronic illness, the increasing aging population, the growth in the retail sector and the rising public concerns related to optimal food safety and quality. Major trends in the forecast period include focus on use of artificial intelligence (ai), focus on 3d ultrasound technology, launch of compact portable ultrasound, increasing investments, product innovations and strategic partnerships and collaborations.

The anticipated growth of the ultrasonic technology market is driven by the expanding demand from the medical sector. The healthcare sector, encompassing businesses involved in medical services, equipment manufacturing, pharmaceuticals, health coverage, and other facets of healthcare provision, plays a pivotal role. In medicine, ultrasonic technology, commonly known as sonography, is extensively employed, particularly in ultrasound imaging. Moreover, ultrasound finds applications in non-destructive testing to identify concealed flaws in products and structures. As per PolicyAdvice, a notable insurance company, global healthcare spending is projected to reach $10 trillion by 2022. Exemplifying this trend, McKesson, with an annual revenue of $208.3 billion, stands as the largest healthcare firm in the United States. Consequently, the escalating demand from the medical sector significantly propels the growth of the ultrasonic technology market.

The growth of the ultrasonic technology market is further fueled by the increasing prevalence of chronic illnesses. The rising incidence of chronic diseases has led to a surge in demand for imaging tools, with ultrasound playing a crucial role in early disease detection, thereby reducing treatment costs. The frequency of chronic diseases is on the rise, resulting in elevated demand for healthcare services, including increased patient visits, hospital admissions, and surgeries. According to the National Library of Medicine, a US-based institution, the population aged 50 and older with at least one chronic disease in the USA is anticipated to surge by 99.5%, reaching 142.66 million by 2050, up from 71.522 million in 2020. Hence, the increasing prevalence of chronic illnesses is a key driver expected to propel the growth of the ultrasonic technology market in the forecast period.

A prominent trend in the ultrasound technology market is the increasing adoption of artificial intelligence (AI), revolutionizing the interpretation and utilization of medical images. AI is instrumental in converting medical images into data that is high-throughput and amenable to mining. Illustratively, in February 2023, Samsung, a South Korea-based manufacturing conglomerate, introduced the Hera W10 Elite, a women's health ultrasound system. This advanced system incorporates visualization features, AI-aided tools, and clinical applications tailored for Obstetrics and Gynecology. It offers 2D and 3D visualizations of microcirculatory and slow blood, featuring an Advanced MV (microvascular)-Flow feature and a larger organic light-emitting diode (OLED) display for improved characterization of diverse ultrasound images.

Major companies in the ultrasonic technology market are focused on developing innovative diagnostic ultrasound system solutions to enhance imaging quality, improve patient safety, and streamline workflow efficiency. These solutions involve medical imaging technologies that use high-frequency sound waves to create images of internal body structures. For example, in February 2024, FUJIFILM, a Japan-based imaging and information technology company, launched the ALOKA ARIETTA 850 Diagnostic Ultrasound System, a state-of-the-art endoscopic ultrasound technology, available at Fortis Hospital in Bengaluru. This system improves diagnostic accuracy for gastrointestinal diseases, featuring high-definition imaging and enabling minimally invasive procedures like pancreatic cyst drainage. The launch highlights FUJIFILM's commitment to advancing healthcare outcomes through innovative medical technologies, particularly in cancer staging and critical diagnoses.

In July 2024, GE HealthCare Technologies Inc., a US-based innovator in medical technology and digital solutions, acquired the clinical artificial intelligence (AI) software business from Intelligent Ultrasound for $51 million. This acquisition aims to enhance GE HealthCare's capabilities in clinical AI by integrating Intelligent Ultrasound's advanced software solutions, thereby improving diagnostic accuracy and efficiency in medical imaging for healthcare providers. Intelligent Ultrasound Group PLC is a UK-based company that specializes in ultrasound software.

Major companies operating in the ultrasonic technology market include Emerson Electric, Siemens AG, Koninklijke Philips N.V., Olympus Corporation, General Electric Company, Crest Ultrasonics Corp., Honeywell International Inc, Rockwell Automation Inc., Pepperl+Fuchs AG, Omron Corporation, Emcolite Ultrasonics, Paavan Electronic Industries, Nanjing AMIS Medical Technology Co. Ltd, Novalion Medical Instrument Co. Ltd, Guangzhou Happycare Electronics Co. Ltd, Shenzhen Bondway Electronics Co. Ltd, Guangzhou Medsinglong Medical Equipment Co. Ltd, Hilsonic, Canongate Technology Ltd, Cambridge Ultrasonics, Telsonic AG, DGM, Ultratecno, Sonotec, Roop Ultrasonic, Elma Ultrasonic, L&R Ultrasonics, Coltene-Whaledent, Omegasonics, Ultrasonic Power Corporation, Sonicor, Gesswein, Contrinex, STULZ, Abdul Latif Jameel Health, PulseNmore, Dallah Health Company, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Mindray Medical International Limited, Omega Africa Agencies (Pty) Ltd, Specmed Medical Services, Autowatch, Selective Instrumentation, Controlare and Diel (Pty) Ltd.

Asia-Pacific was the largest region in the ultrasonic technology market in 2024. The regions covered in the ultrasonic technology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the ultrasonic technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Ultrasonic technology involves transmitting digital data using sound waves that are either barely audible or completely inaudible. Its applications primarily include object detection and distance measurement.

Various types of ultrasound technology include ultrasonic proximity sensors, ultrasonic retro-reflective sensors, and ultrasonic through-beam sensors. Ultrasonic proximity sensors find application in packaging for object detection and distance measurement purposes. The technology branches into ultrasonic medical, processing, and testing technologies, used in welding, cleaning, inspections, and diverse applications. It is extensively employed across sectors such as automotive, food and beverage, medical and healthcare, aerospace and defense, industrial, and others.

The ultrasonic technology market research report is one of a series of new reports that provides ultrasonic technology market statistics, including ultrasonic technology industry global market size, regional shares, competitors with an ultrasonic technology market share, detailed ultrasonic technology market segments, market trends and opportunities, and any further data you may need to thrive in the ultrasonic technology industry. This ultrasonic technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The ultrasonic technology market includes revenues earned by entities by cubic sensors, cylindrical sensors, chemically resistant ultrasonic sensors, hygienic sensors and double sheet sensors. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Ultrasonic Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on ultrasonic technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for ultrasonic technology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The ultrasonic technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Ultrasonic Proximity Sensor, Ultrasonic Retro-Reflective Sensor, Ultrasonic Through-Beam Sensor, Other Types2) By Technology: Ultrasonic Medical Technology, Ultrasonic Processing Technology, Ultrasonic Testing Technolog, Other Technologies

3) By Application: Welding, Cleaning, Inspections, Other Applications

4) By End User: Automotive, Food and beverage, Medical and healthcare, Aerospace and defense, Industrial, Other End Users

Subsegments:

1) By Ultrasonic Proximity Sensor: Non-Contact Ultrasonic Proximity Sensors; Short-Range Ultrasonic Proximity Sensors2) By Ultrasonic Retro-Reflective Sensor: Fixed Ultrasonic Retro-Reflective Sensors; Adjustable Ultrasonic Retro-Reflective Sensors

3) By Ultrasonic Through-Beam Sensor: Transmitter-Receiver Through-Beam Sensors; Reflective Through-Beam Sensors

4) By Other Types: Ultrasonic Flow Meters; Ultrasonic Cleaning Equipment; Ultrasonic Thickness Gauges

Key Companies Mentioned: Emerson Electric; Siemens AG; Koninklijke Philips N.V.; Olympus Corporation; General Electric Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Emerson Electric

- Siemens AG

- Koninklijke Philips N.V.

- Olympus Corporation

- General Electric Company

- Crest Ultrasonics Corp.

- Honeywell International Inc

- Rockwell Automation Inc.

- Pepperl+Fuchs AG

- Omron Corporation

- Emcolite Ultrasonics

- Paavan Electronic Industries

- Nanjing AMIS Medical Technology Co. Ltd

- Novalion Medical Instrument Co. Ltd

- Guangzhou Happycare Electronics Co. Ltd

- Shenzhen Bondway Electronics Co. Ltd

- Guangzhou Medsinglong Medical Equipment Co. Ltd

- Hilsonic

- Canongate Technology Ltd

- Cambridge Ultrasonics

- Telsonic AG

- DGM

- Ultratecno

- Sonotec

- Roop Ultrasonic

- Elma Ultrasonic

- L&R Ultrasonics

- Coltene-Whaledent

- Omegasonics

- Ultrasonic Power Corporation

- Sonicor

- Gesswein

- Contrinex

- STULZ

- Abdul Latif Jameel Health

- PulseNmore

- Dallah Health Company

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Mindray Medical International Limited

- Omega Africa Agencies (Pty) Ltd

- Specmed Medical Services

- Autowatch

- Selective Instrumentation

- Controlare and Diel (Pty) Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.64 Billion |

| Forecasted Market Value ( USD | $ 4.71 Billion |

| Compound Annual Growth Rate | 15.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 45 |