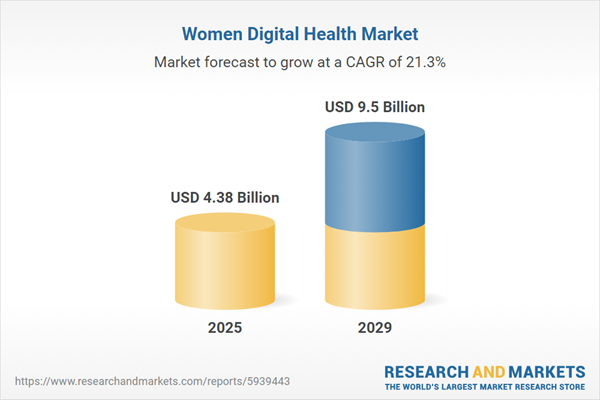

The women's digital health market size is expected to see exponential growth in the next few years. It will grow to $9.5 billion in 2029 at a compound annual growth rate (CAGR) of 21.3%. The growth in the forecast period can be attributed to increasing use of digital health solutions, rising chronic diseases among women, increase in preventive healthcare practices, and rapid urbanization. Major trends in the forecast period include focusing on artificial intelligence (ai) to provide reliable services to their customers and to strengthen their market position, focusing on launching new women’s healthcare programs to provide digital services in the market, focusing on offering new healthcare mobile apps to provide reliable services to their customers and focusing on increasing their investments to expand their product portfolio and drive revenues.

The growth of women's digital health is expected to be propelled by the increasing penetration of smartphones. Smartphone penetration, representing the percentage of the population that owns and uses smartphones, has facilitated the widespread use of smartphone apps in women's health. These apps offer a diverse range of health information, enabling women to track menstrual cycles, manage pregnancy, and monitor fertility. With the growing prevalence of mobile devices, women can conveniently access health information and resources, fostering a proactive approach to managing their well-being. As of March 2022, there are 5.22 billion mobile users worldwide, constituting 66% of the global population, according to We Are Social, a US-based socially-led creative agency. In Australia, as of April 2022, 79.60% of the total population uses smartphones, and the number of smartphone users is projected to reach 2.8 million by 2022, as reported by Catch Connect, an Australia-based mobile plans provider. The increasing penetration of smartphones is a key driver for the growth of women's digital health.

The growing prevalence of chronic diseases among women is anticipated to contribute significantly to the expansion of the women's digital health market. Chronic diseases, lasting for three months or more and worsening over time, have led to an increasing adoption of digital health tools for managing these conditions in the realm of women's digital health. According to the ACS (American Chemical Society) Journal in January 2023, the estimated number of new cancer cases in women rose from 927,910 in 2021 to 934,870 in 2022. The escalating number of chronic diseases among women is expected to generate a heightened demand for women's digital health solutions, marking a crucial trend in the industry.

Major companies in the women’s digital health market are focusing on delivering technologically advanced solutions, such as the digital health passport initiative, to improve access to personalized healthcare. This initiative refers to a digital platform that enables individuals to manage and share their health information securely and efficiently. For instance, in July 2024, Algorand, a Singapore-based foundation, and the Self-Employed Women’s Association (SEWA) launched a Digital Health Passport initiative aimed at enhancing healthcare access for women in the informal economy. As part of Algorand's AlgoBharat effort in India, this initiative utilizes blockchain technology to create secure, tamper-proof records of women’s health credentials. Women can access their digital health passports through SEWA Shakti Kendras, which will assist them in navigating health services and enrolling in programs like Ayushman Bharat.

Women's digital health companies are increasingly turning to artificial intelligence (AI) to deliver reliable services and strengthen their market positions. AI plays a crucial role in improving the early detection and diagnosis of various women's health conditions, including breast cancer, cervical cancer, and maternal mortality. AI algorithms analyze medical images, such as mammograms and ultrasounds, to identify potential abnormalities and provide early warning signs. A case in point is Alife Health, a US-based fertility technology company, which, in October 2022, introduced Alife Assist, a new AI software platform designed to assist fertility clinics in optimizing and supporting clinical decision-making during critical stages of the in vitro fertilization (IVF) process. This platform furnishes personalized insights and recommendations to clinicians, aiding them in making informed decisions about patient care. Furthermore, the platform assists patients in navigating and understanding the IVF process through a free iPhone app, offering information and tracking capabilities to enhance the overall patient experience. The integration of AI in women's digital health reflects a commitment to advancing healthcare solutions for women through cutting-edge technology.

In March 2023, Maven Clinic, a US-based women's and family health company, acquired Naytal for an undisclosed amount. This acquisition is intended to enhance women’s and family health services in the U.K. and Europe by integrating Naytal's specialized offerings, which include access to over 25 healthcare specialties, into Maven's platform. This integration aims to provide improved and timely support for Maven's expanding membership in these regions. Naytal is a UK-based online clinic that offers women instant, affordable access to health experts, including midwives and breastfeeding consultants.

Major companies operating in the women's digital health market include Flo Health Inc, Garmin Ltd, Natural Cycles, Nuvo, Elvie,Advantia Health, Bellabeat, Clue by Biowink, MobileODT Ltd., Glow, Pristyn Care, Celes Care, Veera Health, curara, Beijing Amcare Medical Management Co Ltd, Ping An Good Doctor, Jianke, Biowink GmbH, Ava AG, Babylon Health, Hims & Hers Health, Inc, The Women's Wellness Centre, Elara Health, myGynaeDoc, Maven Clinic, Kindbody, Allara Health, Tia, BioMilq, Oula, Elvie, 1DOC3, doc-doc, Hera Med Ltd, Vezeeta, Altibbi, Okadoc, Health at Hand, DabaDoc, Meddy, Healthigo, Flying Doctors, bimaAFYA.

North America was the largest region in the women's digital health market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the women's digital health market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the women's digital health market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Women's digital health encompasses the utilization of digital technologies to address the specific health needs and concerns of women. These technologies are designed to enhance healthcare accessibility, empower women to manage their health actively, and deliver personalized care.

Key types of women's digital health solutions include mobile apps, wearable devices, diagnostic tools, instruments, and services. Mobile applications are software designed to operate on mobile devices such as smartphones and tablets. These digital health tools integrate components such as software, hardware, and services, targeting areas such as reproductive health, pregnancy and nursing care, pelvic care, and overall healthcare and wellness.

The women's digital health market research report is one of a series of new reports that provides women's digital health market statistics, including women's digital health industry global market size, regional shares, competitors with a women's digital health market share, detailed women's digital health market segments, market trends and opportunities, and any further data you may need to thrive in the women's digital health industry. This women's digital health market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The women's digital health market consists of revenues earned by entities by providing services such as telemedicine platforms, online communities and support groups that provide information and resources on women's health, digital health coaching and personalized wellness programs and electronic health records and patient portals. The market value includes the value of related goods sold by the service provider or included within the service offering. The women's digital health market also includes sales of fitness trackers and smart watches that track menstrual cycles, fertility, pregnancy, and breastfeeding. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Women's Digital Health Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on women's digital health market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for women's digital health? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The women's digital health market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Mobile Apps, Wearable Devices, Diagnostic Tools, Other Types Consumable, Instruments, Services2) By Component: Software, Services, Hardware

3) By Application: Reproductive Health, General Healthcare, Wellness, Pregnancy, Nursing Care, Pelvic Care

Subsegments:

1) By Mobile Apps: Health and Fitness Apps; Menstrual Tracking Apps; Mental Health Apps; Pregnancy and Parenting Apps2) By Wearable Devices: Fitness Trackers; Smartwatches; Health Monitoring Devices

3) By Diagnostic Tools: At-home Testing Kits; Telehealth Platforms for Diagnostics; Remote Monitoring Tools

4) By Other Types Consumable: Health Supplements; Wellness Products; Personal Care Products

5) By Instruments: Health Monitoring Devices; Diagnostic Tools

6) Services: Telemedicine Services; Health Coaching Platforms; Educational Services

Key Companies Mentioned: Flo Health Inc; Garmin Ltd; Natural Cycles; Nuvo; Elvie

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Flo Health Inc

- Garmin Ltd

- Natural Cycles

- Nuvo

- Elvie

- Advantia Health

- Bellabeat

- Clue by Biowink

- MobileODT Ltd.

- Glow

- Pristyn Care

- Celes Care

- Veera Health

- curara

- Beijing Amcare Medical Management Co Ltd

- Ping An Good Doctor

- Jianke

- Biowink GmbH

- Ava AG

- Babylon Health

- Hims & Hers Health, Inc

- The Women's Wellness Centre

- Elara Health

- myGynaeDoc

- Maven Clinic

- Kindbody

- Allara Health

- Tia

- BioMilq

- Oula

- Elvie

- 1DOC3

- doc-doc

- Hera Med Ltd

- Vezeeta

- Altibbi

- Okadoc

- Health at Hand

- DabaDoc

- Meddy

- Healthigo

- Flying Doctors

- bimaAFYA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.38 Billion |

| Forecasted Market Value ( USD | $ 9.5 Billion |

| Compound Annual Growth Rate | 21.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 43 |