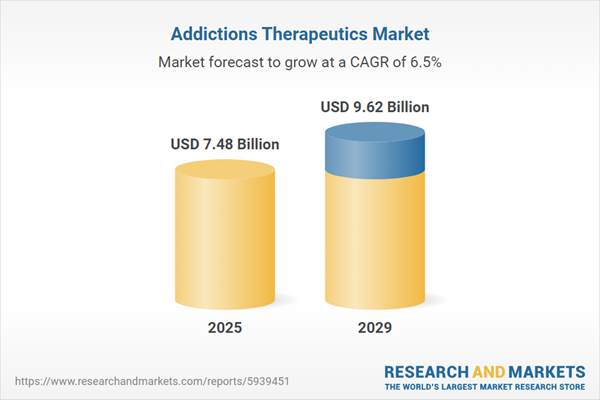

The addictions therapeutics market size is expected to see strong growth in the next few years. It will grow to $9.62 billion in 2029 at a compound annual growth rate (CAGR) of 6.5%. The growth in the forecast period can be attributed to rising drug awareness campaigns, emergence of synthetic drugs and new psychoactive substances, changing lifestyles and stress factors, expanding rehabilitation facilities, integration of telehealth services in addiction treatment. Major trends in the forecast period include technological advancements in diagnostics, neuroscientific advances, partnerships and collaborations between pharmaceutical companies and other stakeholders to address addiction issues, innovative drug launch for addictions therapeutics.

The projected rise in alcohol consumption stands as a significant driver propelling the growth of the addiction therapeutics market. Alcohol consumption entails the intake of beverages containing ethyl alcohol, and addiction therapeutics aim to address alcohol-related addiction by moderating its depressive effects and reinstating the balance between neurotransmitters. These therapeutics help reduce alcohol cravings, alleviate withdrawal symptoms such as insomnia, anxiety, and restlessness, thereby encouraging reduced alcohol consumption. Notably, a report by Statistics Canada in February 2023 revealed a noteworthy surge in alcoholic beverage sales at retail outlets and liquor authorities, reaching $26.1 billion for the fiscal year ending March 31, 2022 - an increase of 2.4% from the previous year. Wine sales also experienced a 2.1% uptick, reaching $8.1 billion in the same period. Beer constituted 34.9% of total alcohol sales value in 2021-2022, followed by wine at 31.3%, spirits at 25.8%, and ciders and coolers at 8%. Consequently, the escalating alcohol consumption is fueling the demand for addiction therapeutics.

The burgeoning healthcare expenditure globally is poised to foster the expansion of the addiction therapeutics market. Healthcare expenditure encompasses the financial resources directed towards healthcare-related goods and services over a specific period, contributing significantly to the growth of addiction therapeutics. Increased healthcare expenditure facilitates improved treatment accessibility, supports research and development initiatives, promotes the adoption of innovative therapies, and enhances comprehensive healthcare services for substance use disorders. As illustrated by the 2021-2030 National Health Expenditure (NHE) report from the Centers for Medicare & Medicaid Services in March 2022, the projected growth indicates an average annual increase of 5.1% in national health spending between 2021 and 2030, culminating in nearly $6.8 trillion. Notably, Medicare spending is expected to rise by 7.2% annually, while Medicaid spending will grow at a 5.6% annual rate from 2021 to 2030. This upsurge in healthcare expenditure serves as a driving force propelling the expansion of the addiction therapeutics market.

Prominent players within the addiction therapeutics market are actively pioneering innovative solutions, particularly drugs aimed at addressing cocaine use disorders (CUD), to cater to broader customer bases, amplify sales, and augment revenue streams. Drugs developed for CUD are specifically crafted medications intended to assist individuals grappling with cocaine addiction or dependence. An exemplar in this domain unfolded in January 2023 when Tempero Bio, a US-based biopharmaceutical firm, revealed the FDA's approval for TMP-301, its investigational candidate. This distinct product distinguishes itself as a metabotropic glutamate receptor 5 (mGluR5) negative allosteric modulator (NAM), uniquely tailored to combat CUD. TMP-301's standout characteristics lie in its potency, selectivity, and oral availability, aimed at effectively curbing the hyperactive glutamate signaling associated with CUD.

Key industry players within the addiction therapeutics sector are strategically embracing partnerships to tackle nicotine addiction through smartphone interventions. Strategic partnerships denote collaborative endeavors wherein companies synergize their strengths and resources for mutual advantages and success. For instance, in January 2022, Pfizer Inc., a US-based pharmaceutical and biotechnology giant, entered into a partnership with Alex Therapeutics, a Sweden-based entity specializing in digital therapeutics. The primary focus of this collaboration revolves around a digital therapeutic designed to combat nicotine addiction via smartphone intervention. Developed by Alex Therapeutics in alignment with the specifications of the German healthcare system alongside Pfizer Germany, the medical device represents the crux of this partnership. Leveraging Alex Therapeutics' AI-powered digital therapeutics platform, the Alex DTx Platform, this collaboration integrates evidence-based psychological approaches, notably Cognitive Behavioral Therapy (CBT) and Acceptance and Commitment Therapy (ACT), with artificial intelligence. The platform offers personalized standalone treatments, aiming to address unmet needs among patients on a global scale. This strategic alliance signifies a concerted effort to revolutionize addiction therapeutics using digital interventions, potentially reshaping nicotine addiction treatments.

In March 2023, Indivior, a US-based pharmaceutical company, completed the acquisition of Opiant Pharmaceuticals Inc for an estimated $145 million. This strategic move is intended to enhance Indivior's portfolio in investigational opioid overdose therapy, fortify its scientific research capabilities, and further expand its offerings in the field of addiction treatment. Opiant Pharmaceuticals Inc., a US-based biopharmaceutical company specializing in medicines for addiction and drug overdose.

Major companies operating in the addictions therapeutics market include Pfizer Inc., Novartis AG, Teva Pharmaceutical Industries Ltd., Mylan N.V., Bausch Health Companies Inc., Sun Pharmaceutical Industries Limited, Perrigo Company plc, Purdue Pharma L.P., Dr. Reddy's Laboratories Ltd., Cipla Inc., Hikma Pharmaceuticals plc, Amneal Pharmaceuticals Inc., Mallinckrodt Plc, Alkermes plc., Glenmark Pharmaceuticals Limited, Indivior plc., Lannett Company Inc., BioDelivery Sciences International Inc., Insys Therapeutics Inc., Camurus AB, Orexo AB, Elite Pharmaceuticals Inc., Braeburn Inc., Titan Pharmaceuticals Inc., BioCorRx Inc.

North America was the largest region in the addictions therapeutics market in 2024. The regions covered in the addictions therapeutics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the addictions therapeutics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Addiction therapeutics encompasses the medications, treatments, and management strategies designed to address various forms of addiction, assisting individuals in overcoming substance use disorders (SUDs) and other addictive behaviors. The approach involves a combination of medications and therapeutic interventions, including group and individual therapy sessions, aimed at preventing substance misuse and supporting recovery.

Key addiction therapeutics include medications such as buprenorphine, naltrexone, bupropion, disulfiram, nicotine replacement products, varenicline, and others. For instance, buprenorphine is a semi-synthetic narcotic analgesic used to mimic the effects of opioid medicines, helping to prevent withdrawal symptoms when an individual discontinues opioid use. Different types of addiction therapeutics cater to specific substance dependencies, including opioid addiction treatment, alcohol addiction treatment, nicotine addiction treatment, and treatments for other substance addictions. These therapeutic interventions can be implemented in various treatment centers, including inpatient treatment centers, residential treatment centers, and outpatient treatment centers. Distribution channels for addiction therapeutics encompass hospital pharmacies, medical stores, and others. These therapeutic solutions are accessible through public, private, and government healthcare settings, contributing to comprehensive and widespread addiction treatment and recovery efforts.

The addictions therapeutics market research report is one of a series of new reports that provides addictions therapeutics market statistics, including addictions therapeutics industry global market size, regional shares, competitors with a addictions therapeutics market share, detailed addictions therapeutics market segments, market trends and opportunities, and any further data you may need to thrive in the addictions therapeutics industry. This addictions therapeutics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The addiction therapeutics market consists of revenues earned by entities by providing cognitive behavioral therapy, contingency management for addiction, rational emotive behavior therapy (REBT), motivational interviewing, family therapy for addiction, facilitation therapy for addiction, eye movement desensitization and reprocessing (EMDR), dialectical behavior therapy, matrix model for addiction and person-centered therapy. The market value includes the value of related goods sold by the service provider or included within the service offering. The addiction therapeutics market also includes sales of suboxone, methadone, naltrexone, antidepressants, and acamprosate. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Addictions Therapeutics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on addictions therapeutics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for addictions therapeutics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The addictions therapeutics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Type: Buprenorphine; Naltrexone; Bupropion; Disulfiram; Nicotine Replacement Products; Varenicline; Other Drugs2) By Treatment Type: Opioid Addiction Treatment; Alcohol Addiction Treatment; Nicotine Addiction Treatment; Other Substance Addiction Treatment

3) By Treatment Center: Inpatient Treatment Center; Residential Treatment Center; Outpatient Treatment Center

4) By Distribution Channel: Hospital Pharmacies; Medical Stores; Other Distribution Channel

5) By Application: Public; Private; Government

Subsegments:

1) By Buprenorphine: Subutex; Suboxone2) By Naltrexone: Oral Naltrexone; Extended-Release Naltrexone (Vivitrol)

3) By Bupropion: Wellbutrin; Zyban

4) By Disulfiram: Antabuse

5) By Nicotine Replacement Products: Nicotine Patches; Nicotine Gum; Nicotine Inhalers; Nicotine Lozenges

6) By Varenicline: Chantix (Champix)

7) By Other Drugs: Acamprosate; Topiramate; Gabapentin

Key Companies Mentioned: Pfizer Inc.; Novartis AG; Teva Pharmaceutical Industries Ltd.; Mylan N.V.; Bausch Health Companies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Bausch Health Companies Inc.

- Sun Pharmaceutical Industries Limited

- Perrigo Company plc

- Purdue Pharma L.P.

- Dr. Reddy's Laboratories Ltd.

- Cipla Inc.

- Hikma Pharmaceuticals plc

- Amneal Pharmaceuticals Inc.

- Mallinckrodt Plc

- Alkermes plc.

- Glenmark Pharmaceuticals Limited

- Indivior plc.

- Lannett Company Inc.

- BioDelivery Sciences International Inc.

- Insys Therapeutics Inc.

- Camurus AB

- Orexo AB

- Elite Pharmaceuticals Inc.

- Braeburn Inc.

- Titan Pharmaceuticals Inc.

- BioCorRx Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.48 Billion |

| Forecasted Market Value ( USD | $ 9.62 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |