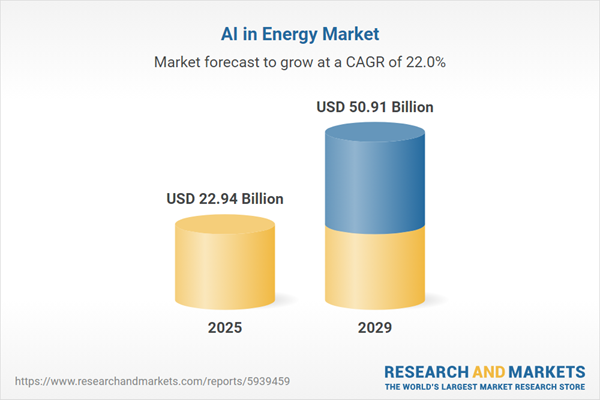

The AI in energy market size is expected to see exponential growth in the next few years. It will grow to $50.91 billion in 2029 at a compound annual growth rate (CAGR) of 22%. The growth in the forecast period can be attributed to decentralized energy systems, energy storage management, smart cities and infrastructure, electrification of transportation, integration of edge computing. Major trends in the forecast period include energy efficiency analytics, autonomous energy infrastructure, cybersecurity solutions, virtual power plants, edge ai for energy management.

The growing adoption of microgrids is anticipated to drive the expansion of AI in the energy market in the coming years. A microgrid is a localized energy system that can operate independently or in conjunction with the main power grid. These microgrids are crucial for integrating and optimizing AI technology within the energy sector, facilitating intelligent energy management, grid optimization, and the incorporation of renewable energy sources. They support various AI applications in energy, such as demand response, load balancing, and renewable energy integration. As the utilization of microgrids increases, AI in the energy market is experiencing substantial growth. For instance, in September 2024, the Energy Trends report published by the Department for Energy Security and Net Zero, a UK-based ministerial department, revealed that installed capacity grew by 3.9 percent (2.1 GW) in the second quarter of 2024 compared to the same quarter in 2023, reaching a total of 57.5 GW. Therefore, the rising use of microgrids is expected to propel the growth of AI in the energy market moving forward.

The burgeoning demand for energy asset management is projected to steer the expansion of AI integration in the energy market. Energy asset management encapsulates a comprehensive and strategic approach aimed at overseeing, optimizing, and maximizing the performance and efficiency of energy-related assets within an organization or across various facilities. Leveraging artificial intelligence (AI), energy asset management delves into analyzing extensive datasets from energy assets, forecasting demand patterns, optimizing energy production and consumption, detecting anomalies, and implementing real-time adjustments. For instance, statistics from the International Energy Agency (IEA) in July 2023 unveiled a global increase of 2.4% in electricity generation in 2022, totaling around 700 terawatt-hours (TWh), underscoring the growing necessity for energy asset management. Consequently, the escalating demand for energy asset management is anticipated to drive the proliferation of AI within the energy market.

Advancements in technology stand out as a prominent and burgeoning trend in the AI-driven energy market. Leading entities within this sphere are actively embracing novel technologies to fortify their market standing. An illustration of this is Telefonaktiebolaget LM Ericsson, a Sweden-based IT services and consulting company, which, in February 2022, unveiled an AI-powered Energy Infrastructure Operations system. This innovative energy management system aids communications service providers in curtailing energy consumption across their network infrastructure through the utilization of artificial intelligence and sophisticated data analytics. Harnessing AI capabilities, this system targets a reduction of energy-related operational expenses (OPEX) by 15%, a corresponding decrease in passive infrastructure-related site visits by 15%, and a 30% mitigation of outages attributed to energy issues. This strategic approach not only trims OPEX and carbon emissions for communications service providers but also maximizes energy efficiency and site availability by leveraging AI and data analytics.

Significant players within the AI-powered energy market are spearheading innovation through the introduction of groundbreaking technologies, such as the Pangu Mine Model, marking the world's initial large-scale AI model commercially accessible within the energy sector. Tailored to tackle challenges prevalent in both the mining and broader energy domains, the Pangu Mine Model deploys expansive AI models in industrial production. For instance, in July 2023, Shandong Energy Group Co. Ltd., a China-based coal mining company, YunDing Tech Co. Ltd., a China-based network technology firm, and Huawei Technologies Co. Ltd., a China-based manufacturing entity, collaborated on the launch of the Pangu Mine Model. This model encompasses features such as decoupled operation management, intelligent production capabilities, on-site data processing, extensive scalability, and the ability to learn and analyze from limited data samples. The model's core objective is to elevate the intelligence quotient within energy applications within the mining industry by broadening the spectrum of AI applications in various scenarios. The continuous utilization of AI aims to foster automation, enhance efficiency, decrease labor intensity, and elevate safety in energy utilization specifically for mining purposes.

In June 2022, Schneider Electric SE, a French electrical and electronics manufacturing company, successfully acquired AutoGrid Systems Inc. for an undisclosed amount. This strategic acquisition positions Schneider Electric to broaden its reach into new regions and offer energy companies across the globe the necessary tools to integrate over 1,000 GW of distributed and renewable energy resources into the grid. AutoGrid Systems Inc., based in the United States, is a software company specializing in AI-driven software designed to enhance the intelligence of distributed energy resources. The software facilitates prediction, optimization, and real-time control of energy resources.

Major companies operating in the AI in energy market include Google, Microsoft Corporation, Engie SA, Huawei Technologies Co Ltd., Siemens AG, General Electric Company, Intel Corporation, International Business Machines Corporation, Iberdrola, Cisco Systems Inc., Schneider Electric SE, Honeywell International Inc., Flex Ltd., ABB Ltd, Duke Energy Corporation, Nvidia Corporation, Alpiq Holding AG, ATOS SE, Enel Green Power S.p.A., Databricks Inc., C3 AI, Uptake Technologies, Sentient Energy Inc., AutoGrid Systems Inc., Arundo Analytics Inc., Bidgely Inc., Verdigris Technologies, Greenbird Integration Technology AS, AppOrchid Inc., Ecube Labs Co. Ltd.

North America was the largest region in AI in the energy market in 2024. Asia-pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the ai in energy market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the ai in energy market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

AI in energy refers to the application of artificial intelligence (AI) technologies and techniques within the energy sector to enhance efficiency, optimize operations, and improve decision-making processes. This includes various aspects such as data analysis, grid management and security, and demand response. AI is utilized in the energy sector to maximize the recycling of materials used in renewable energy systems, including solar panels, wind turbines, and hydroelectric dams.

The primary offerings in the field of AI in energy include support services, hardware, AI-as-a-service, and software. Support services encompass a range of activities and resources provided to individuals, organizations, or customers to assist them with their needs, address issues, and ensure satisfaction. The technology can be deployed through on-premises and cloud deployment modes. AI in energy finds applications in diverse areas, including demand response management, fleet and asset management, renewable energy management, precision drilling, demand forecasting, infrastructure management, and more. End-users of AI in energy include entities involved in energy transmission, energy generation, energy distribution, utilities, and other related sectors.

The AI in energy market research report is one of a series of new reports that provides AI in energy market statistics, including the AI in energy industry global market size, regional shares, competitors with a AI in energy market share, detailed AI in energy market segments, market trends, and opportunities, and any further data you may need to thrive in the AI in energy industry. This AI in energy market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The AI in the energy market consists of revenues earned by entities by providing services such as smart grid operations and robotics. The market value includes the value of related goods sold by the service provider or included within the service offering. The AI in the energy market also includes sales of PyTorch integration and analog device simulators. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

AI in Energy Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on ai in energy market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for ai in energy? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The ai in energy market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Offering: Support Services; Hardware; AI-As-a-Service; Software2) By Deployment: On-Premise; Cloud

3) By Application: Demand Response Management; Fleet and Asset Management; Renewable Energy Management; Precision Drilling; Demand Forecasting; Infrastructure Management; Other Applications

4) By End User: Energy Transmission; Energy Generation; Energy Distribution; Utilities; Other End Users

Subsegments:

1) By Support Services: Consulting Services; Implementation Services; Maintenance and Support Services2) By Hardware: AI-Powered Sensors; Smart Meters; Edge Computing Devices

3) By AI-As-a-Service: Machine Learning Platforms; Data Analytics Services; Model Training and Development Services

4) By Software: Energy Management Software; Predictive Maintenance Software; Demand Response Software; Grid Management Software

Key Companies Mentioned: Google; Microsoft Corporation; Engie SA; Huawei Technologies Co Ltd.; Siemens AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Microsoft Corporation

- Engie SA

- Huawei Technologies Co Ltd.

- Siemens AG

- General Electric Company

- Intel Corporation

- International Business Machines Corporation

- Iberdrola

- Cisco Systems Inc.

- Schneider Electric SE

- Honeywell International Inc.

- Flex Ltd.

- ABB Ltd

- Duke Energy Corporation

- Nvidia Corporation

- Alpiq Holding AG

- ATOS SE

- Enel Green Power S.p.A.

- Databricks Inc.

- C3 AI

- Uptake Technologies

- Sentient Energy Inc.

- AutoGrid Systems Inc.

- Arundo Analytics Inc.

- Bidgely Inc.

- Verdigris Technologies

- Greenbird Integration Technology AS

- AppOrchid Inc.

- Ecube Labs Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 22.94 Billion |

| Forecasted Market Value ( USD | $ 50.91 Billion |

| Compound Annual Growth Rate | 22.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |