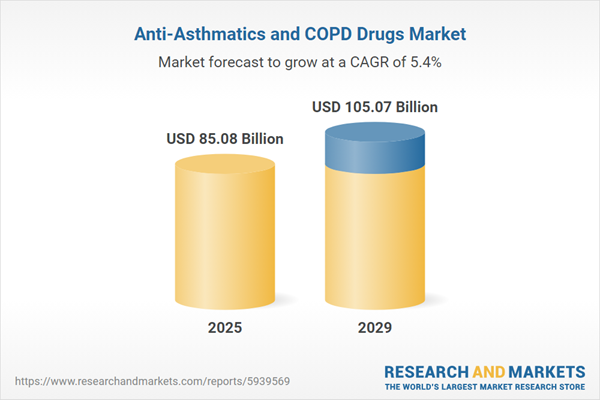

The anti-asthmatics and copd drugs market size is expected to see strong growth in the next few years. It will grow to $105.07 billion in 2029 at a compound annual growth rate (CAGR) of 5.4%. The growth in the forecast period can be attributed to the increased popularity of e-cigarettes/ vaping, rising obesity levels, technology, a large pool of undiagnosed population, use of anti-asthmatics and COPD drugs to treat COVID-19 patients, and increasing consumption of fats. Major trends in the forecast period include developing probiotic drugs for asthma, developing anti-il-5 drugs to expand their business portfolio, launching new innovative products to focus on establishing their market position and sustaining their position among the intense competition in the market, investing more in developing bioelectric medicines, focus on increasing the number of collaborations, providing customized treatments, and developing combination drugs to offer better result, developing biologics to capitalize on the growing demand for biologics.

The forecast of 5.4% growth over the next five years reflects a slight reduction of 0.2% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff escalations are likely to burden U.S. pulmonary clinics by driving up costs oflong-acting beta-2 agonist and long-acting muscarinic antagonist combination inhalers sourced from the UK and Switzerland, exacerbating chronic respiratory disease management expenses and increasing pulmonology care burdens. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

Modifiable risk factors such as smoking, sedentary lifestyles, and unhealthy dietary habits significantly contribute to driving the anti-asthmatics and copd drugs market. While smoking rates are declining globally, certain developing nations such as China, India, Indonesia, and Nigeria are witnessing an upward trend in smoking prevalence. For example, Indonesia is anticipated to see a rise of 24 million tobacco smokers by 2025, while Nigeria is expected to witness an increase of 7 million smokers. Additionally, China holds over 40% of global cigarette consumption. Unhealthy dietary practices, especially high consumption of fats and saturated fatty acids prevalent in high-income countries such as the USA and Europe, contribute to the risk factors associated with Asthma and COPD. WHO data highlights that in developed countries, over 35% of energy intake comes from fats, in contrast to less than 20% in low-income countries and below 25% in lower-middle-income countries.

The prevalence of asthmatic disorders is anticipated to be a driving force behind the growth of the anti-asthmatics and COPD drugs market. Asthma, a chronic condition characterized by airway inflammation and constriction, has shown an upward trend in cases, prompting the identification and development of new medications to manage these disorders. For example, based on data from the National Health Interview Survey (NHIS) in April 2022, approximately 42.7% of children aged 18 or younger and 52.9% of children under 5 years old were reported to have asthma in the United States in 2020. This rise in asthmatic cases is expected to stimulate the continuous development of innovative drugs, further propelling the anti-asthmatics and copd drugs market.

Numerous inhalers devoid of chlorofluorocarbons (CFCs) are presently accessible for managing asthma and chronic obstructive pulmonary disease (COPD). While these products might not be formally designated as direct replacements for CFC Metered Dose Inhalers, they can be considered beneficial medications for many patients, potentially eliminating the necessity for specific CFC Metered Dose Inhalers. The determination of official alternatives will be made by the FDA, employing criteria established via notice-and-comment rulemaking processes.

Major players within the anti-asthmatics and COPD drugs market are driving innovation with products such as the dose combination (FDC) drug, Indacaterol plus Mometasone, aiming to enhance their market position. This FDC medication, administered via the Breezhaler device, represents a once-daily treatment designed for ongoing asthma management in patients. Glenmark Pharmaceuticals, for instance, introduced the novel FDC drug named Indamet in India in June 2022. Available in three variations, Indamet maintains a consistent dose of 150 mcg of Indacaterol while varying Mometasone doses (80 mcg, 160 mcg, and 320 mcg strengths) to address uncontrollable asthma cases.

The trend toward combination therapies for asthma and COPD treatment is on the rise, showcasing greater efficacy in patient-reported outcomes (PROs) compared to monotherapies. Combinations such as short-acting beta-agonists (SABA) coupled with short-acting muscarinic antagonists (SAMA) have demonstrated superior effects on lung function when compared to individual medications. Similarly, the utilization of long-acting beta-agonists (LABA) paired with long-acting muscarinic antagonists (LAMA) has shown improved lung function in comparison to long-acting monotherapy bronchodilators.

Major companies operating in the anti-asthmatics and COPD drugs market include GlaxoSmithKline plc, AstraZeneca plc, Boehringer Ingelheim GmbH, F. Hoffmann-La Roche Ltd., Novartis AG, Sanofi S.A., Chiesi Farmaceutici S.p.A., Teva Pharmaceutical Industries Limited, Merck & Co. Inc., Sumitomo Dainippon Pharma Co. Ltd., China National Pharmaceutical Group Co. Ltd. (Sinopharm), Shanghai Acebright Pharmaceuticals Group Co. Ltd., Jiangsu Hengrui Medicine Co. Ltd, Hanmi Pharmaceutical, Cipla Limited, Aurobindo Pharma Limited, KYORIN Holdings Inc., Nichi-Iko Pharmaceutical Co. Ltd., Otsuka Pharmaceutical Co. Ltd., Daewoong Pharmaceutical Co. Ltd, Shanghai Anovent Pharma, China Meheco Group Co. Ltd., Lupin Limited, ASGEN Pharmaceutical Co. Ltd, Abbott Laboratories, Pfizer, Vectura Group, Bristol Myers Squibb, Apotex Inc., EMS Pharma, Hypermarcas, Ache, Eurofarma, Bayer, Biolab Farmaceuticad, Cristalia, Libbs, Julphar, Neopharma, Adcock Ingram, Aspen Nigeria.

North America was the largest region in the anti-asthmatics and COPD drugs market in 2024. Middle East is expected to be the fastest-growing region in the global anti-asthmatics and COPD drugs market during the forecast period. The regions covered in the anti-asthmatics and COPD drugs market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the anti-asthmatics and COPD drugs market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The anti-asthmatics and chronic obstructive pulmonary disease (COPD) market research report are one of a series of new reports that provides anti-asthmatics and chronic obstructive pulmonary disease (COPD) market statistics, including anti-asthmatics and chronic obstructive pulmonary disease (COPD) industry global market size, regional shares, competitors with an anti-asthmatics and chronic obstructive pulmonary disease (COPD) market share, detailed anti-asthmatics and chronic obstructive pulmonary disease (COPD) market segments, market trends and opportunities, and any further data you may need to thrive in the anti-asthmatics and chronic obstructive pulmonary disease (COPD) industry. These anti-asthmatics and chronic obstructive pulmonary disease (COPD) market research report deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Anti-asthmatic and chronic obstructive pulmonary disease (COPD) drugs are medications designed to alleviate the frequency of acute attacks in conditions such as asthma, emphysema, chronic bronchitis, and nocturnal awakenings.

The primary classes of drugs in anti-asthmatics and COPD include bronchodilators, anti-inflammatory drugs, monoclonal antibodies, and combination drugs. Bronchodilators stimulate the bronchi and bronchioles, reducing respiratory airway resistance and enhancing lung airflow. Various types of bronchodilators include anti-histamine drugs, long-acting β2-agonists (LABA), inhaled corticosteroids, short-acting muscarinic receptor antagonists (Samas), and other combinations of anti-asthmatics and COPD drugs. These medications are utilized by asthma and COPD patients and are distributed through diverse channels such as hospital pharmacies, private clinics, drug stores, retail pharmacies, and e-commerce platforms.

The anti-asthmatic and chronic obstructive pulmonary disease market consists of corticosteroid, bronchodilator, fluticasone and salmeterol. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Anti-Asthmatics and COPD Drugs Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on anti-asthmatics and copd drugs market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for anti-asthmatics and copd drugs? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The anti-asthmatics and copd drugs market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Class: Bronchodilators, Anti-Inflammatory Drugs, Monoclonal Antibodies, Combination Drugs2) By Distribution Channel: Hospital Pharmacies, General Pharmacies, Online Retailers

3) By End User: Asthma Patients, COPD Patients

4) By Therapy: Preventive, Curative

5) By Route of Administration: Oral, Inhaled, Intravenous, Subcutaneous

6) By Age Group: Below 5, 5-14, 15-60, Above 60

Subsegments:

1) By Bronchodilators: Short-Acting Beta-Agonists (SABAs); Long-Acting Beta-Agonists (LABAs); Anticholinergics (Short-Acting and Long-Acting); Methylxanthines2) By Anti-Inflammatory Drugs: Corticosteroids (Inhaled and Systemic); Leukotriene Modifiers; Phosphodiesterase-4 Inhibitors

3) By Monoclonal Antibodies: Anti-IgE Antibodies; Anti-IL-5 Antibodies; Anti-IL-4 or IL-13 Antibodies

4) By Combination Drugs: Combination Bronchodilator Inhalers (LABA + LAMA); Inhaled Corticosteroid + Long-Acting Beta-Agonist (ICS + LABA)

Companies Mentioned: GlaxoSmithKline plc; AstraZeneca plc; Boehringer Ingelheim GmbH; F. Hoffmann-La Roche Ltd.; Novartis AG; Sanofi S.A.; Chiesi Farmaceutici S.p.A.; Teva Pharmaceutical Industries Limited; Merck & Co. Inc.; Sumitomo Dainippon Pharma Co. Ltd.; China National Pharmaceutical Group Co. Ltd. (Sinopharm); Shanghai Acebright Pharmaceuticals Group Co. Ltd.; Jiangsu Hengrui Medicine Co. Ltd; Hanmi Pharmaceutical; Cipla Limited; Aurobindo Pharma Limited; KYORIN Holdings Inc.; Nichi-Iko Pharmaceutical Co. Ltd.; Otsuka Pharmaceutical Co. Ltd.; Daewoong Pharmaceutical Co. Ltd; Shanghai Anovent Pharma; China Meheco Group Co. Ltd.; Lupin Limited; ASGEN Pharmaceutical Co. Ltd; Abbott Laboratories; Pfizer; Vectura Group; Bristol Myers Squibb; Apotex Inc.; EMS Pharma; Hypermarcas; Ache; Eurofarma; Bayer; Biolab Farmaceuticad; Cristalia; Libbs; Julphar; Neopharma; Adcock Ingram; Aspen Nigeria

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Anti-Asthmatics and COPD Drugs market report include:- GlaxoSmithKline plc

- AstraZeneca plc

- Boehringer Ingelheim GmbH

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- Sanofi S.A.

- Chiesi Farmaceutici S.p.A.

- Teva Pharmaceutical Industries Limited

- Merck & Co. Inc.

- Sumitomo Dainippon Pharma Co. Ltd.

- China National Pharmaceutical Group Co. Ltd. (Sinopharm)

- Shanghai Acebright Pharmaceuticals Group Co. Ltd.

- Jiangsu Hengrui Medicine Co. Ltd

- Hanmi Pharmaceutical

- Cipla Limited

- Aurobindo Pharma Limited

- KYORIN Holdings Inc.

- Nichi-Iko Pharmaceutical Co. Ltd.

- Otsuka Pharmaceutical Co. Ltd.

- Daewoong Pharmaceutical Co. Ltd

- Shanghai Anovent Pharma

- China Meheco Group Co. Ltd.

- Lupin Limited

- ASGEN Pharmaceutical Co. Ltd

- Abbott Laboratories

- Pfizer

- Vectura Group

- Bristol Myers Squibb

- Apotex Inc.

- EMS Pharma

- Hypermarcas

- Ache

- Eurofarma

- Bayer

- Biolab Farmaceuticad

- Cristalia

- Libbs

- Julphar

- Neopharma

- Adcock Ingram

- Aspen Nigeria

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 85.08 Billion |

| Forecasted Market Value ( USD | $ 105.07 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 42 |