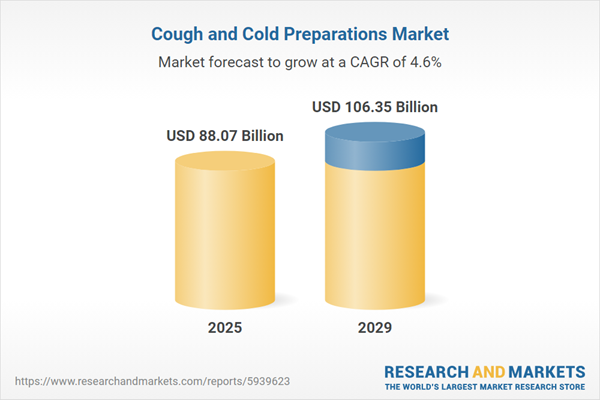

The cough and cold preparations market size is expected to see steady growth in the next few years. It will grow to $106.35 billion in 2029 at a compound annual growth rate (CAGR) of 4.6%. The growth in the forecast period can be attributed to the increased popularity of e-cigarettes/ vaping, rising obesity levels, large pool of undiagnosed population, and government initiatives. Major trends in the forecast period include the use of probiotics to treat asthma, advanced bronchodilators launched, new product launches, mergers and collaborations in the market, increasing demand for personalized medicines, demand for aerosol respiratory drugs, the rise of generic respiratory drugs, and combination drug therapy to treat COPD.

The forecast of 4.4% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions could hinder U.S. retail pharmacies by inflating prices of combination cough/cold preparations manufactured in India and Mexico, resulting in reduced OTC symptom relief options and higher seasonal healthcare costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The growth of the cough and cold preparations market is anticipated to be fueled by the rising incidence of allergies in the forecast period. Respiratory allergies, including those triggered by pollen, dust, mold, and pet dander, are on the ascent due to contaminated outdoor and indoor air. Cough and cold preparations are commonly used to address allergies that manifest as coughs and respiratory issues. For example, the European Academy of Allergy and Clinical Immunology projects that by 2025, one in every three people in the European Union will be affected by allergies. This surge in respiratory allergies is expected to drive demand for cough and cold preparations, positively influencing market growth.

The growing geriatric population is anticipated to drive the expansion of the cough and cold preparations market in the coming years. The geriatric population refers to the ratio of individuals aged 65 and older to those aged 18 to 64 who are employed. Older adults generally have weaker immune systems, making them more prone to respiratory infections, such as coughs and colds. This increased susceptibility creates a higher demand for cough and cold remedies. For example, a report published by the US-based Pew Research Center Organization in January 2024 stated that the geriatric population is projected to grow from 0.2% in 2024 to 0.5% in 2054. Thus, the rise in the geriatric population is propelling the growth of the cough and cold preparations market.

Advancements in technologies are playing a pivotal role in shaping the global pharmaceutical sector, and this impact extends to cold and cough preparations. As outlined in a global life sciences report by Deloitte, various cutting-edge technologies are driving the life sciences sector, including the pharmaceutical domain. Some of these transformative technologies include AI, robotic automation, the Internet of Medical Things (IoMT), blockchain, DIY diagnostics, virtual care, mobility in drug delivery and clinical trials, genomics, next-generation therapies, cloud computing, Real-World Evidence (RWE), and data-driven precision medicine. AI technology is being harnessed for diagnoses, treatment planning, patient monitoring, and drug discovery. The IoMT is facilitating the emergence of new business models and enhancing customer experiences. Biomarkers, which are biological indicators objectively measured and evaluated for various processes, are increasingly being utilized in the drug development process to expedite product launches.

Leading companies in the cough and cold preparations market are introducing new products, such as clean over-the-counter (OTC) kids' medicine, to address the growing consumer demand for safer, natural, and effective remedies. Clean OTC kids' medicine refers to non-prescription medications specifically designed for children, focusing on natural and minimal ingredient formulations. These products aim to relieve common cold and cough symptoms while avoiding harmful additives, appealing to parents who prioritize safe options for their children. For instance, in September 2023, Genexa, a U.S.-based pharmaceutical company, launched two new clean OTC medicines: Kids’ Multi-Symptom Cold and Flu and the Kids Daytime Nighttime Cough Relief Value Pack, providing effective relief from common cold and flu symptoms in children. The Multi-Symptom Cold & Flu formulation temporarily suppresses cough, reduces fever, and relieves minor aches and pains without artificial ingredients, making it a cleaner choice for parents mindful of additives. Additionally, the Daytime and Nighttime Cough Relief Value Pack provides tailored options for non-drowsy daytime relief and nighttime comfort, ensuring comprehensive care around the clock.

The cold and cough preparations market is subject to regulatory oversight by authorities, such as the Food and Drug Administration (FDA) in the United States. An example of regulatory action is the FDA's restriction on the use of codeine in children. Codeine, although approved for pain and cough treatment, poses serious risks, including the potential for slowed or difficult breathing, and can be fatal. The FDA has recognized a higher risk of these adverse effects in children under the age of 12, leading to restrictions on the use of codeine even in some older children. Single-ingredient codeine is FDA-approved solely for use in adults. Additionally, the FDA recommends against the use of codeine in breastfeeding mothers due to the potential harm it may pose to their infants. This regulatory intervention reflects a commitment to ensuring the safety of pharmaceutical products, especially those intended for vulnerable populations such as children and breastfeeding mothers.

Major companies operating in the cough and cold preparations market include Johnson & Johnson, GlaxoSmithKline plc, Procter & Gamble, Bayer AG, Reckitt Benckiser Group plc, Novartis AG, Perrigo Company, Sun Pharmaceutical Industries Ltd., Prestige Consumer Healthcare, Blackmores Limited, AFT Pharmaceuticals, Dexa Medica, Glenmark Pharmaceuticals Limited, Wockhardt Ltd, Apnar Pharma LP, Hanmi Pharmaceutical, Cipla Limited, Aurobindo Pharma Limited, KYORIN Holdings, Inc, Nichi-Iko Pharmaceutical Co., Ltd, Otsuka Pharmaceutical Co., Ltd., China National Pharmaceutical Group Co., Ltd, Shanghai Anovent Pharma, Shanghai Acebright Pharmaceuticals Group Co., Ltd, China Meheco Group Co., Ltd., Merck & Co, Abbott Laboratories, Boehringer Ingelheim, Roche Holding AG, Vectura Group, Pfizer, Mylan, Teva Pharmaceutical Industries Ltd, Sanofi, W. K. Buckley Limited, BENYLIN, Sanfer, PROBIOMED, PiSA, EMS Pharma, Hypermarcas, Ache, Eurofarma, Biolab Farmaceuticad, Cristalia, Libbs, AstraZeneca, Neopharma, Regal Pharmaceuticals, Adcock Ingram, Aspen Pharmacare.

North America was the largest region in the cold and cough preparation market share in 2024. Middle East is expected to be the fastest-growing region in the global cough and cold preparations market during the forecast period. The regions covered in the cough and cold preparations market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cough and cold preparations market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The cold and cough preparations market research report is one of a series of new reports that provides cold and cough preparations market statistics, including cold and cough preparations industry global market size, regional shares, competitors with a cold and cough preparations market share, detailed cold and cough preparations market segments, market trends and opportunities, and any further data you may need to thrive in the cold and cough preparations industry. This cold and cough preparations market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Cold and cough preparations encompass medications designed to alleviate symptoms associated with these conditions. These drugs target receptors where the infecting virus attaches, countering the receptor's action, eradicating viral infection, and reducing congestion by breaking down mucus and expanding constricted bronchioles.

Primary drug categories in cold and cough preparations consist of antihistamines, expectorants, bronchodilators, decongestants, antibiotics, and other similar treatments. Antihistamines mitigate histamine's effects and are commonly used to address allergies. Varieties include bronchodilators, anticholinergic, and pulmonary antihypertensives. These medications are available in various forms such as oral syrups, tablets, nasal drops, lozenges, and others. Distribution occurs through hospital pharmacies, retail pharmacies, drug stores, and similar channels.

The cold and cough preparations market consists of sales of dextromethorphan, guaifenesin, and phenylephrine. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Cough and Cold Preparations Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cough and cold preparations market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cough and cold preparations? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The cough and cold preparations market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Type: Antihistamines, Expectorants, Bronchodilators, Decongestants, Antibiotics, Other Drug Types.2) By Dosage Type: Oral Syrups, Tablets or Pills, Nasal Drops, Lozenges, Other Dosage Types

3) By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Drug Stores, Other Distribution Channels

Subsegments:

1) By Antihistamines: First-Generation Antihistamines; Second-Generation Antihistamines; Combination Antihistamines2) By Expectorants: Guaifenesin; Potassium Iodide; Combination Expectorants (with other active ingredients)

3) By Bronchodilators: Short-Acting Beta-Agonists (SABAs); Long-Acting Beta-Agonists (LABAs); Anticholinergic Bronchodilators

4) By Decongestants: Oral Decongestants; Nasal Decongestants

5) By Antibiotics: Amoxicillin; Azithromycin; Cephalosporins

6) By Other Drug Types: Cough Suppressants; Antipyretics; Herbal Remedies

Companies Mentioned: Johnson & Johnson; GlaxoSmithKline plc; Procter & Gamble; Bayer AG; Reckitt Benckiser Group plc; Novartis AG; Perrigo Company; Sun Pharmaceutical Industries Ltd.; Prestige Consumer Healthcare; Blackmores Limited; AFT Pharmaceuticals; Dexa Medica; Glenmark Pharmaceuticals Limited; Wockhardt Ltd; Apnar Pharma LP; Hanmi Pharmaceutical; Cipla Limited; Aurobindo Pharma Limited; KYORIN Holdings, Inc; Nichi-Iko Pharmaceutical Co., Ltd; Otsuka Pharmaceutical Co., Ltd.; China National Pharmaceutical Group Co., Ltd; Shanghai Anovent Pharma; Shanghai Acebright Pharmaceuticals Group Co., Ltd; China Meheco Group Co., Ltd.; Merck & Co; Abbott Laboratories; Boehringer Ingelheim; Roche Holding AG; Vectura Group; Pfizer; Mylan; Teva Pharmaceutical Industries Ltd; Sanofi; W. K. Buckley Limited; BENYLIN; Sanfer; PROBIOMED; PiSA; EMS Pharma; Hypermarcas; Ache; Eurofarma; Biolab Farmaceuticad; Cristalia; Libbs; AstraZeneca; Neopharma; Regal Pharmaceuticals; Adcock Ingram; Aspen Pharmacare

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Cough and Cold Preparations market report include:- Johnson & Johnson

- GlaxoSmithKline plc

- Procter & Gamble

- Bayer AG

- Reckitt Benckiser Group plc

- Novartis AG

- Perrigo Company

- Sun Pharmaceutical Industries Ltd.

- Prestige Consumer Healthcare

- Blackmores Limited

- AFT Pharmaceuticals

- Dexa Medica

- Glenmark Pharmaceuticals Limited

- Wockhardt Ltd

- Apnar Pharma LP

- Hanmi Pharmaceutical

- Cipla Limited

- Aurobindo Pharma Limited

- KYORIN Holdings, Inc

- Nichi-Iko Pharmaceutical Co., Ltd

- Otsuka Pharmaceutical Co., Ltd.

- China National Pharmaceutical Group Co., Ltd

- Shanghai Anovent Pharma

- Shanghai Acebright Pharmaceuticals Group Co., Ltd

- China Meheco Group Co., Ltd.

- Merck & Co

- Abbott Laboratories

- Boehringer Ingelheim

- Roche Holding AG

- Vectura Group

- Pfizer

- Mylan

- Teva Pharmaceutical Industries Ltd

- Sanofi

- W. K. Buckley Limited

- BENYLIN

- Sanfer

- PROBIOMED

- PiSA

- EMS Pharma

- Hypermarcas

- Ache

- Eurofarma

- Biolab Farmaceuticad

- Cristalia

- Libbs

- AstraZeneca

- Neopharma

- Regal Pharmaceuticals

- Adcock Ingram

- Aspen Pharmacare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 88.07 Billion |

| Forecasted Market Value ( USD | $ 106.35 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 52 |