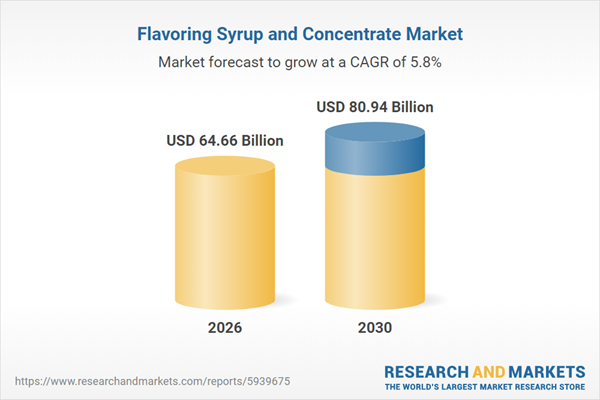

The flavoring syrup and concentrate market size is expected to see strong growth in the next few years. It will grow to $80.94 billion in 2030 at a compound annual growth rate (CAGR) of 5.8%. The growth in the forecast period can be attributed to increasing demand for clean-label flavoring products, expansion of functional beverage formulations, rising innovation in reduced-sugar recipes, growing e-commerce distribution of specialty syrups, increasing adoption of premium flavor concentrates. Major trends in the forecast period include growing demand for customizable flavor solutions, expansion of low-sugar and sugar-free syrups, rising use of natural and organic flavor concentrates, increasing application in beverage and dairy products, premiumization of artisanal syrup products.

The growing e-commerce sector is expected to drive growth in the flavoring syrup and concentrate market. E-commerce, which refers to buying and selling goods and services online, is expanding due to increased internet access, mobile device usage, convenient shopping, faster delivery options, and a wider product selection. Online platforms facilitate the sale and distribution of flavoring syrups and concentrates, giving consumers access to a variety of flavors from global brands and allowing businesses to reach a broader audience. For example, in August 2023, the United States Census Bureau reported that e-commerce sales in the second quarter of 2023 increased by 7.5% compared to the same period in 2022, while overall retail sales grew by 0.6%. Online stores accounted for 15.4% of all sales in Q2 2023. Therefore, the expansion of e-commerce is boosting the flavoring syrup and concentrate market.

The growth of the food service industry is also expected to propel the flavoring syrup and concentrate market. The food service industry includes businesses involved in the preparation and distribution of food outside the home. Flavored syrups are widely used in this sector to enhance the taste of food and beverages. For instance, in February 2025, the Manufacturer, a UK-based information company, reported that food production in Q4 2024 was valued at $37.9 billion (£28.4 billion), marking an 8.3% increase compared to Q4 2023, partly driven by productivity improvements contributing $2.87 billion (£2.15 billion). Therefore, the expansion of the food service industry supports demand for flavoring syrups and concentrates.

Major companies in the market are concentrating on launching new flavors, such as pancake-inspired IHOP syrup, to meet changing consumer preferences and enhance the overall breakfast experience. Pancake-inspired IHOP syrup refers to the signature syrups provided by the International House of Pancakes (IHOP), a US-based multinational pancake house chain, specifically designed to complement their pancakes and other breakfast dishes. For example, in July 2024, Kraft Heinz Company, a US-based food manufacturer, introduced IHOP Original and Butter Pecan Syrups. These syrups are crafted to bring the beloved flavors of pancakes into homes, allowing consumers to recreate a restaurant-quality breakfast experience. The Original Syrup is formulated to pair well with pancakes, waffles, and French toast, while the Butter Pecan Syrup offers a rich, nutty flavor that adds a unique twist to traditional breakfast items. Both syrups are made without high-fructose corn syrup and use the same flavor ingredients found in IHOP restaurants, ensuring quality and authenticity.

Major companies operating in the flavoring syrup and concentrate market are International Flavors & Fragrances Inc, Kerry Group plc, Monin Inc, Concord Foods LLC, R Torre & Company Inc, Small Hand Foods, Rasna Private Limited, Feroze Foods And Flavours, Ajinomoto Co Inc, Givaudan, Doehler Natural Food & Beverage Ingredients, Fuerst Day Lawson, Tate & Lyle, Toschi Vignola, Cargill, Sensient Technologies, Archer Daniels Midland Company, Symrise, ASR Group, Sunny Sky Products, Amoretti, WILD Flavors, Frutarom Group, Florasynth, Trofina Food, Nettari, Fruit Fusion.

Asia-Pacific was the largest region in the flavoring syrup and concentrate market in 2025. North America was the second-largest region in the flavoring syrup and concentrate market. The regions covered in the flavoring syrup and concentrate market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the flavoring syrup and concentrate market report are China, India, Japan, Australia, Indonesia, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, Taiwan, New Zealand, UK, Germany, France, Italy, Spain, Austria, Belgium, Denmark, Finland, Ireland, Netherlands, Norway, Portugal, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The flavoring syrup and concentrate market consists of sales of fruit syrup, honey, chocolate syrup, maple syrup, sugarcane molasses, sugarbeets molasses, apple butter spread, honey spread, chocolate spread, pectin, sweeteners, essence, olive spread, garlic butter spread, nut spread. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Flavoring Syrup and Concentrate Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses flavoring syrup and concentrate market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase::

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for flavoring syrup and concentrate? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The flavoring syrup and concentrate market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Report Scope

Markets Covered:

1) By Product Type: Flavoring Syrups; Flavoring Concentrates2) By Concentrate Type: Fruit Flavor Concentrates; Beverage Flavor Concentrates; Dairy Flavor Concentrates; Bakery and Confectionery Flavor Concentrates; Natural Flavor Concentrates; Artificial Flavor Concentrates

3) By Flavor Profile: Fruit; Chocolate and Cocoa; Vanilla; Coffee; Caramel; Herbs and Botanicals; Spices and Seasonings; Other Flavors

4) By Nature: Natural; Synthetic

5) By Distribution Channel: Supermarkets and Hypermarkets; Convenience Stores; Food and Beverage Specialty Stores; Online and E-Commerce; Other Distribution Channels

6) By Application: Beverages; Dairy and Frozen Desserts; Confectionery; Bakery; Foodservice and HoReCa; Household and Home Use; Other Food Applications

Subsegments:

1) By Flavoring Syrups: Fruit-Flavored Syrups; Chocolate & Cocoa Syrups; Vanilla Syrups; Coffee Syrups; Caramel Syrups; Maple-Style Syrups; Herbal & Botanical Syrups; Sugar-Free or Low-Calorie Flavoring Syrups2) By Flavoring Concentrates: Fruit Flavor Concentrates; Beverage Flavor Concentrates; Dairy Flavor Concentrates; Bakery & Confectionery Flavor Concentrates; Natural Flavor Concentrates; Artificial or Synthetic Flavor Concentrates; High-Intensity Flavor Concentrates

Companies Mentioned: International Flavors & Fragrances Inc; Kerry Group plc; Monin Inc; Concord Foods LLC; R Torre & Company Inc; Small Hand Foods; Rasna Private Limited; Feroze Foods and Flavours; Ajinomoto Co Inc; Givaudan; Doehler Natural Food & Beverage Ingredients; Fuerst Day Lawson; Tate & Lyle; Toschi Vignola; Cargill; Sensient Technologies; Archer Daniels Midland Company; Symrise; ASR Group; Sunny Sky Products; Amoretti; WILD Flavors; Frutarom Group; Florasynth; Trofina Food; Nettari; Fruit Fusion

Countries: China; India; Japan; Australia; Indonesia; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; Taiwan; New Zealand; UK; Germany; France; Italy; Spain; Austria; Belgium; Denmark; Finland; Ireland; Netherlands; Norway; Portugal; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Flavoring Syrup and Concentrate market report include:- International Flavors & Fragrances Inc

- Kerry Group plc

- Monin Inc

- Concord Foods LLC

- R Torre & Company Inc

- Small Hand Foods

- Rasna Private Limited

- Feroze Foods And Flavours

- Ajinomoto Co Inc

- Givaudan

- Doehler Natural Food & Beverage Ingredients

- Fuerst Day Lawson

- Tate & Lyle

- Toschi Vignola

- Cargill

- Sensient Technologies

- Archer Daniels Midland Company

- Symrise

- ASR Group

- Sunny Sky Products

- Amoretti

- WILD Flavors

- Frutarom Group

- Florasynth

- Trofina Food

- Nettari

- Fruit Fusion

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 64.66 Billion |

| Forecasted Market Value ( USD | $ 80.94 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |