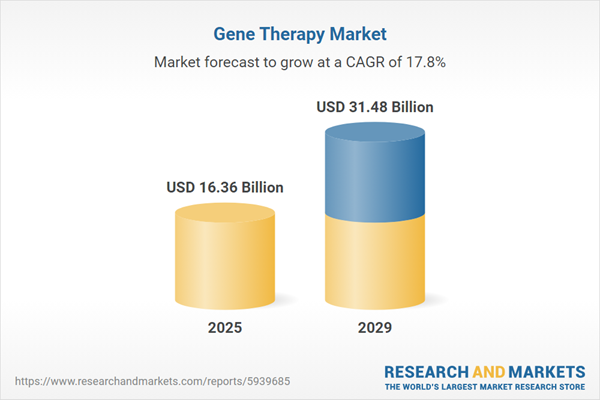

The gene therapy market size is expected to see rapid growth in the next few years. It will grow to $31.48 billion in 2029 at a compound annual growth rate (CAGR) of 17.8%. The growth in the forecast period can be attributed to an increasing number of cancer cases, a growing aging population, increasing research and development spending in the pharmaceutical sector and a rising focus on gene therapy will drive the market. Major trends in the forecast period include enhancing business operations through securing regulatory approvals, strengthening business activities through strategic collaborations and partnerships, expanding business capabilities through strategic acquisitions and strengthening operational capabilities through business expansions.

The forecast of 17.8% growth over the next five years remains unchanged from the previous projection for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade restrictions could hinder U.S. advanced medicine by inflating prices of adeno-associated virus vectors and clustered regularly interspaced short palindromic repeats-Cas9 components sourced from the UK and France, resulting in delayed clinical trials for genetic disorders and higher orphan drug development costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The gene therapy market is experiencing growth due to a significant increase in the incidence of cancer and other target diseases, necessitating effective treatments. The global rise in cancer cases is expected to contribute to the expansion of the gene therapy market in the forecast period. As of January 2022, the American Cancer Society predicts approximately 1.9 million new cancer diagnoses and 609,360 cancer-related deaths in the United States, highlighting the urgency for advanced treatments. Lung, prostate, bowel, and female breast cancer collectively account for 43 percent of all new cancer cases worldwide. The escalating global cancer incidence is poised to drive demand for gene therapy as an effective treatment, involving the introduction of new genes to induce cell death or slow cancer growth.

The increasing investment in the healthcare industry is set to fuel the growth of the gene therapy market. Healthcare industry investment encompasses allocating funds to companies involved in medical services, manufacturing medical equipment or drugs, offering medical insurance, and contributing to the healthcare sector. This investment plays a pivotal role in the gene therapy industry, as pharmaceutical companies strategically invest to enhance patent portfolios and secure lucrative partnerships. Such investments are instrumental in the development of innovative gene therapy products. For instance, based on the 2021-2030 National Health Expenditure (NHE) report by the Centers for Medicare & Medicaid Services, national health spending is projected to grow by an average of 5.1% annually, reaching nearly $6.8 trillion between 2021 and 2030. Moreover, Medicare spending is expected to increase at a 7.2% annual rate, while Medicaid spending is projected to rise by 5.6% annually. Hence, the increasing healthcare industry investment serves as a driving force behind the growth of the gene therapy market.

Machine learning and artificial intelligence (AI) are gradually gaining traction in the gene therapy market. AI involves simulating human intelligence in machines, Programd to exhibit natural intelligence. As a subset of AI, machine learning supports gene therapy companies in conducting comprehensive data analysis, providing insights into tumor and immune cell interactions, and delivering more accurate evaluations of tissue samples, resolving disputes among different evaluators. For example, in May 2023, Form Bio, a US-based life sciences-focused software company, introduced FORMsightAI, an innovative AI-based solution set designed to predict and optimize manufacturing outputs of cell and gene therapy constructs. This full-service solution combines adaptive AI models, Form Bio's foundational platform, and a proficient team of computational life sciences experts. FORMsightAI addresses common challenges faced by cell and gene therapy developers, including construct truncations and manufacturing contaminations, leading to improved manufacturing yields, shortened timelines to market, and enhanced therapeutic safety.

Leading companies in the gene therapy market are concentrating on developing advanced products, such as adeno-associated virus (AAV) vectors, to improve the precision and effectiveness of gene delivery for treating various genetic disorders. An AAV vector is a commonly utilized tool in gene therapy designed to introduce genetic material into cells. For example, in April 2024, Pfizer Inc., a global biopharmaceutical company based in the US, received approval from the Food and Drug Administration (FDA) for BEQVEZ (fidanacogene elaparvovec-dzkt). This gene therapy targets adults with moderate to severe hemophilia B, a genetic bleeding disorder caused by a deficiency in clotting factor IX (FIX), which can result in excessive bleeding. The therapy employs an AAV vector to deliver a functional copy of the FIX gene directly into liver cells, facilitating the natural production of this essential clotting factor.

In September 2023, Regeneron Pharmaceuticals Inc., a US-based biotechnology company, acquired Decibel Therapeutics, Inc. for an undisclosed amount. This acquisition enhances Regeneron's gene therapy capabilities, particularly in addressing hearing loss, and reflects its commitment to advancing genetic medicines through innovative therapeutic offerings. Decibel Therapeutics Inc. is a clinical-stage biotechnology company based in the US that develops gene therapies for treating hearing and balance disorders.

Major companies operating in the gene therapy market include UniQure NV, REGENXBIO Inc., Bristol-Myers Squibb, BioMarin Pharmaceuticals Inc., Jazz Pharmaceuticals Inc., Biocon, Cipla, EdiGene Inc, Takeda Pharmaceutical, Daiichi Sankyo Company, Mitsubishi Tanabe Pharma, Merck, GE Healthcare, Lonza, Pfizer, Cellular Biomedicine Group, GenScript, Albumedix Ltd, Catalent, Freeline Therapeutics, DiNAQOR AG, Vivet Therapeutics, Allergan, Amgen, Biocad, Celgene Corporation, Johnson & Johnson, Eli Lilly and Company, AstraZeneca, Bayer AG, Juno Therapeutics, Allogene Therapeutics, Bluebird Bio, Regen BioPharma, Bellicum, Biotchpharma, BrainStorm Cell Therapeutics, Pluristem, Sanofi.

North America was the largest region in the gene therapy market in 2024. The regions covered in the gene therapy market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the gene therapy market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The gene therapy market research report is one of a series of new reports that provides gene therapy market statistics, including gene therapy industry global market size, regional shares, competitors with a gene therapy market share, detailed gene therapy market segments, market trends and opportunities, and any further data you may need to thrive in the gene therapy industry. This gene therapy market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Gene therapy is an approach to treating or curing diseases by modifying an individual's DNA. The mechanisms of gene treatments vary and may involve introducing a healthy copy of a gene to replace a disease-causing one or deactivating a defective gene responsible for an illness.

The primary types of gene therapy include germline therapy and somatic cell therapy. Germline therapy, also known as germline gene therapy, focuses on modifying the genes in germline cells - sperm and egg cells or their precursors. This type of genetic intervention aims to bring about changes at the hereditary level. Different vectors, such as viral vectors, non-viral vectors, and others, are utilized in gene therapy. The application of gene therapy extends to various sectors, including biopharmaceutical companies, research institutes, and other end users. It is employed in addressing conditions related to oncology, orphan diseases, knee osteoarthritis, and neurological disorders.

The gene therapy market includes revenues earned by entities by replacing a disease-causing gene with a healthy copy of the gene and inactivating a disease-causing gene that is not functioning properly. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Gene Therapy Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on gene therapy market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for gene therapy? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The gene therapy market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Gene Therapy Type: Germline Therapy, Somatic Cell Therapy2) By Vector: Viral Vector, Non-Viral Vector

3) By Application: Oncology, Orphan Disease, Knee Osteoarthritis, Neurological Disorders

4) By End Users: Biopharmaceutical Companies, Research Institutes, Other End Users

Subsegments:

1) By Germline Therapy: Inherited Disease Treatment; Genetic Modification of Embryos; Gene Editing Techniques; Ethical and Regulatory Considerations2) By Somatic Cell Therapy: Cancer Gene Therapy; Monogenic Disorder Treatment; Gene Replacement Therapy; RNA-Based Therapies; Gene Editing Techniques

Companies Mentioned: UniQure NV; REGENXBIO Inc.; Bristol-Myers Squibb; BioMarin Pharmaceuticals Inc.; Jazz Pharmaceuticals Inc.; Biocon; Cipla; EdiGene Inc; Takeda Pharmaceutical; Daiichi Sankyo Company; Mitsubishi Tanabe Pharma; Merck; GE Healthcare; Lonza; Pfizer; Cellular Biomedicine Group; GenScript; Albumedix Ltd; Catalent; Freeline Therapeutics; DiNAQOR AG; Vivet Therapeutics; Allergan; Amgen; Biocad; Celgene Corporation; Johnson & Johnson; Eli Lilly and Company; AstraZeneca; Bayer AG; Juno Therapeutics; Allogene Therapeutics; Bluebird Bio; Regen BioPharma; Bellicum; Biotchpharma; BrainStorm Cell Therapeutics; Pluristem; Sanofi

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Gene Therapy market report include:- UniQure NV

- REGENXBIO Inc.

- Bristol-Myers Squibb

- BioMarin Pharmaceuticals Inc.

- Jazz Pharmaceuticals Inc.

- Biocon

- Cipla

- EdiGene Inc

- Takeda Pharmaceutical

- Daiichi Sankyo Company

- Mitsubishi Tanabe Pharma

- Merck

- GE Healthcare

- Lonza

- Pfizer

- Cellular Biomedicine Group

- GenScript

- Albumedix Ltd

- Catalent

- Freeline Therapeutics

- DiNAQOR AG

- Vivet Therapeutics

- Allergan

- Amgen

- Biocad

- Celgene Corporation

- Johnson & Johnson

- Eli Lilly and Company

- AstraZeneca

- Bayer AG

- Juno Therapeutics

- Allogene Therapeutics

- Bluebird Bio

- Regen BioPharma

- Bellicum

- Biotchpharma

- BrainStorm Cell Therapeutics

- Pluristem

- Sanofi

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 16.36 Billion |

| Forecasted Market Value ( USD | $ 31.48 Billion |

| Compound Annual Growth Rate | 17.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 40 |