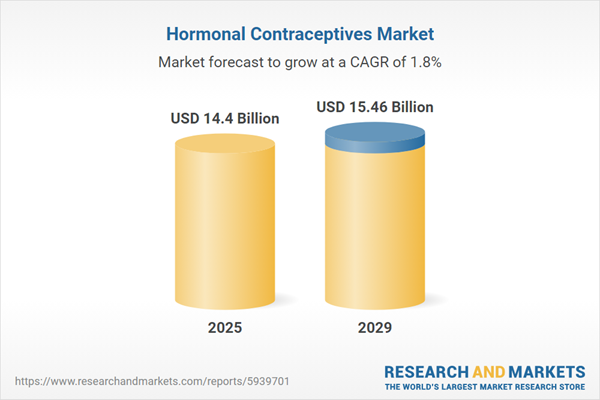

The hormonal contraceptives market size is expected to see marginal growth in the next few years. It will grow to $15.46 billion in 2029 at a compound annual growth rate (CAGR) of 1.8%. The growth in the forecast period can be attributed to the increasing awareness on family planning, increasing research and development spending, rise in healthcare expenditure, increasing collaborations between agencies. Major trends in the forecast period include investing in longer lasting vaginal rings, investing in AI solutions to improve medication adherence, launching new innovative products, investing in environmental friendly estrogen profile, investing in improved progestogen only birth control pills, continue to investing in long-term delivery drugs systems.

The forecast of 1.8% growth over the next five years remains unchanged from the previous projection for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. The imposition of tariffs could disrupt U.S. reproductive health by increasing prices of ethinyl estradiol/norgestimate formulations and contraceptive implant devices sourced from the Netherlands and Puerto Rico, reducing family planning options and raising women's healthcare costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The heightened awareness surrounding hormonal contraceptives has empowered individuals to make well-informed decisions aligned with their reproductive goals and lifestyles. This increased awareness enables individuals to make choices that better suit their family planning and lifestyle preferences. In September 2023, the World Health Organization (WHO) reported that global contraception prevalence, including any method, reached 65% in 2022, with modern contraceptive methods at 58.7% among married women in a union. Additionally, the global demand for family planning among women increased from 900 million to nearly 1.1 billion in 2021, with a projected global satisfaction rate of 77.5% among women aged 15-49 in 2022. This elevated awareness significantly propels the hormonal contraceptives market.

The escalating rate of unplanned pregnancies is anticipated to drive the growth of the hormonal contraceptive market. Unplanned pregnancies, categorized as unwanted or unplanned, pose a significant global challenge. Hormonal contraceptives offer a reliable and convenient solution to prevent unplanned pregnancies, giving individuals and couples greater control over family planning. According to the United Nations Population Fund in March 2022, there were 121 million unintended pregnancies globally each year, with Afghanistan projected to experience 4.8 million unintended pregnancies in 2025. Thus, the increasing rate of unplanned pregnancies is expected to fuel the growth of the hormonal contraceptives market.

Companies are innovating by introducing chewable, low-dose oral contraceptives to reduce side effects and enhance daily regimen adherence. The availability of chewable contraceptives as an over-the-counter product aims to improve patient compliance and minimize side effects. Leading companies, such as Lupin Pharmaceuticals, Walter Chilcott, and Watson Pharmaceuticals, are actively participating in this initiative.

Major companies in the hormonal contraceptives market are developing advanced products, such as nonprescription daily oral contraceptives, to improve accessibility and convenience for users. A nonprescription daily oral contraceptive is a type of birth control pill that can be purchased without a prescription from a healthcare provider. For example, in July 2023, Perrigo Company PLC, a US-based manufacturer of private label over-the-counter pharmaceuticals, received approval from the Food and Drug Administration (FDA), a US federal agency responsible for protecting public health, for Opill. Opill is the first nonprescription daily oral contraceptive available to consumers without a prescription. The launch of Opill represents a significant advancement in reproductive health, allowing individuals to access effective birth control without the obstacles of needing a prescription or a healthcare appointment.

Major companies operating in the hormonal contraceptives market include Bayer AG, Merck & Co. Inc, Viatris, Gedeon Richter, AbbVie, Pfizer, Teva Pharmaceuticals, Mayne Pharma Group Limited, Lupin Limited, HLL Lifecare Limited, Amneal Pharmaceuticals, DKT International, Piramal Pharma Limited, Allergan, Afaxys Inc., Agile Therapeutic, Cipla Limited, Glenmark Pharmaceuticals, Novartis AG, Sun Pharmaceutical Industries Ltd., Apothecus Pharmaceutical Corporation, Famy care, Mylan Laboratories.

North America was the largest region in the hormonal contraceptives market share in 2024. Middle East is expected to be the fastest-growing region in the global hormonal contraceptives market analysis during the forecast period. The regions covered in the hormonal contraceptives market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hormonal contraceptives market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The hormonal contraceptives market research report is one of a series of new reports that provides hormonal contraceptives market statistics, including hormonal contraceptives industry global market size, regional shares, competitors with a hormonal contraceptives market share, detailed hormonal contraceptives market segments, market trends and opportunities, and any further data you may need to thrive in the hormonal contraceptives industry. This hormonal contraceptive market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Hormonal contraceptives are a form of birth control that utilizes hormones to prevent pregnancy. There are various types, some of which are reversible, while others are permanent. Certain varieties may also offer protection against sexually transmitted diseases (STDs).

The primary categories of products in oral contraceptive pills include injectable birth control, emergency contraceptive pills, vaginal rings, and others. Oral contraceptive pills, also known as birth control pills, are a class of synthetic steroid hormones that inhibit the release of follicle-stimulating hormone (FSH) and luteinizing hormone (LH) from the anterior lobe of the pituitary gland in the female body. These pills come in different hormonal compositions, including progestin-only and combined hormones, and find applications in hospitals, homecare settings, gynecology centers, clinics, and ambulatory surgical centers. Distribution channels for these products include drug stores, gynecology or fertility clinics, e-commerce, and others.

The hormonal contraceptive market includes revenues earned by entities by blocking the release of eggs from the ovaries and thinning the lining of the uterus to prevent pregnancy. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Hormonal Contraceptives Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hormonal contraceptives market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hormonal contraceptives? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The hormonal contraceptives market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Pills, Injectable Birth Control, Vaginal Rings, Others2) By End User: Hospitals, Homecare Settings, Gynecology Centers, Clinics, Ambulatory Surgical Centers

3) By Hormones: Progestin-Only, Combined Hormones

4) By Distribution Channel: Drug Stores, Gynecology or Fertility Clinics, E-Commerce, Other Distribution Channels

Subsegments:

1) By Pills: Combined Oral Contraceptives (COCs); Progestin-Only Pills (POPs); Emergency Contraceptive Pills2) By Injectable Birth Control: Depot Medroxyprogesterone Acetate (DMPA); Combination Injectable Contraceptives; Subdermal Implants

3) By Vaginal Rings: NuvaRing; Annovera; Other Hormonal Vaginal Rings

4) By Others: Transdermal Patches; Intrauterine Devices (IUDs) with Hormones; Hormonal Implants; Contraceptive Tablets for Men

Companies Mentioned: Bayer AG; Merck & Co. Inc; Viatris; Gedeon Richter; AbbVie; Pfizer; Teva Pharmaceuticals; Mayne Pharma Group Limited; Lupin Limited; HLL Lifecare Limited; Amneal Pharmaceuticals; DKT International; Piramal Pharma Limited; Allergan; Afaxys Inc.; Agile Therapeutic; Cipla Limited; Glenmark Pharmaceuticals; Novartis AG; Sun Pharmaceutical Industries Ltd.; Apothecus Pharmaceutical Corporation; Famy care; Mylan Laboratories

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Hormonal Contraceptives market report include:- Bayer AG

- Merck & Co. Inc

- Viatris

- Gedeon Richter

- AbbVie

- Pfizer

- Teva Pharmaceuticals

- Mayne Pharma Group Limited

- Lupin Limited

- HLL Lifecare Limited

- Amneal Pharmaceuticals

- DKT International

- Piramal Pharma Limited

- Allergan

- Afaxys Inc.

- Agile Therapeutic

- Cipla Limited

- Glenmark Pharmaceuticals

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

- Apothecus Pharmaceutical Corporation

- Famy care

- Mylan Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14.4 Billion |

| Forecasted Market Value ( USD | $ 15.46 Billion |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |