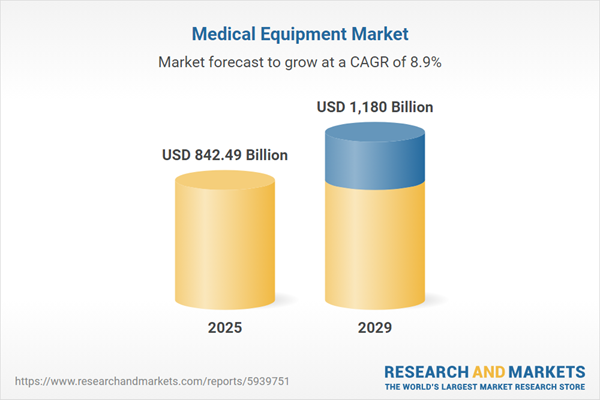

The medical equipment market size is expected to see strong growth in the next few years. It will grow to $1.18 trillion in 2029 at a compound annual growth rate (CAGR) of 8.9%. The growth in the forecast period can be attributed to rapid growth in the elderly population, an increasing prevalence of chronic diseases and government support. Major trends in the forecast period include developing new technological solutions, focusing on expansion of medical equipment manufacturing facilities, focusing on expansion of medical equipment manufacturing facilities, focusing on partnerships and collaborations, focusing on cardiovascular devices manufacturing and focusing on hybrid imaging technologies.

The growing prevalence of cardiovascular diseases is anticipated to drive growth in the medical equipment market. Cardiovascular disease (CVD) encompasses conditions that affect the heart or blood vessels, often associated with fatty deposits within the arteries (atherosclerosis) and an increased risk of blood clots. Various medical devices are essential for the prevention, diagnosis, and treatment of cardiovascular diseases. For example, in May 2024, the Centers for Disease Control and Prevention, a U.S.-based government agency, reported that in 2022, heart disease led to the deaths of 702,880 people, accounting for 1 in every 5 fatalities. Annually, around 805,000 people in the U.S. suffer a heart attack, with 605,000 being first-time cases, while 200,000 occur in individuals with a history of heart attacks. Therefore, the rising incidence of cardiovascular diseases is set to propel medical equipment market growth moving forward.

The shift toward sedentary jobs, hectic lifestyles, and evolving consumer habits is influencing the global disease profile, particularly for non-communicable diseases (NCDs) such as cancer, diabetes, and cardiovascular conditions. Extended work hours, reduced physical activity, and unhealthy dietary and drinking habits are significant contributors to chronic diseases like diabetes, increasing demand for medical devices used in diagnosing, prognosing, and treating these conditions. For instance, in September 2023, the World Health Organization, a Switzerland-based United Nations agency, reported that NCDs account for 41 million deaths annually, representing 74% of all deaths worldwide. These factors are expected to enlarge the global patient pool, thereby driving market growth throughout the forecast period.

Leading companies in the medical equipment market are actively innovating new products to enhance their market profitability, such as the EasyFuse Dynamic Compression System. This system, introduced by Stryker Corporation in May 2022, is a comprehensive super-elastic nitinol staple system designed for quick and easy fixation in high-demand applications of the foot and ankle. Engineered to simplify surgical procedures, the EasyFuse system provides robust dynamic-compression implants while minimizing surgical waste. It features an exceptionally broad staple bridge for even force distribution and consistent implant strength.

Healthcare service providers have access to device performance and patient data, aiding in enhanced patient monitoring and overall care quality. Some companies are integrating medical device data with Electronic Medical Records (EMR) to improve transparency and collaboration. With the increasing prevalence of consumer wearables, patient data volumes are on the rise, prompting companies to invest in data management, warehousing, and security technologies. For instance, Medtronic Plc launched a tool to enhance their cardiac devices, securely transferring device data to doctors for monitoring critical health indicators in their patients.

Major companies operating in the medical equipment market include Medtronic Inc, Abbott Laboratories, Johnson & Johnson, Siemens AG, Becton Dickinson and Company(BD), STRYKER CORPORATION, Cardinal Health, Danaher Corporation, Boston Scientific Corporation, Koninklijke Philips N.V., SCHILLER Healthcare India Pvt. Ltd, GE Healthcare, Covidien Healthcare India Private Limited, Philips Healthcare India, Fisher & Paykel Healthcare India Private Limited, Smiths Medical India Pvt Ltd, Agappe Diagnostics Ltd, ARKRAY Healthcare Pvt. Ltd, Accord Medical Products Private Limited, Shinva Medical Instrument Company Limited, Shandong WeiGao Group Medical Polymer Company Limited, Lepu Medical Technology Company (Beijing) Co., Ltd, Yuwell - Jiangsu Yuyue Medical Equipment & Supply Co., Ltd, Shanghai Runda Medical Technology Co., Ltd, Terumo Corporation, Olympus Medical Systems Corporation, Canon Medical Systems Corporation, Hitachi Group, Nihon Koden Corporation, Sanko Manufacturing Co., Ltd, Fukuda Denshi, Metran Co. Ltd, Clarity Medical, Welcare Industries S.P.A, F.L. Medical S.r.l, Empire MEDICAL UK LTD, Europlaz Technologies Ltd, Alfa-Med LLC, Medplant LLC, Medical-Łomża Sp. z o.o., P.H.U. Medical, ProVeterináře, Panop CZ, Baxter, SunMed, Beckman Coulter, Draegerwerk AG, Getinge Group, Masimo, Teleflex Inc, Nipro Medical Ltda, LINET Brazil, Fotoptica Ltda, Leistung Engineering Pvt. Ltd, Saudi Mais Co. for Medical Products (SMMP), Life Pulse Medical Co, Watan, AlKawashef, 3BY Ltd, Qatari German Medical Devices Co, Israeli Hospitals Ltd, CAPS Medical, Amana Healthcare (Pty) Ltd, CapeRay, TiTaMED (Pty) Ltd, Sinapi Biomedical, Egyptian Medical And Environment Group, ResMed Inc.

North America was the largest region in the global medical equipment market in 2024. Asia-Pacific was the second largest region in the global medical equipment market. The regions covered in the medical equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical equipment market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The medical equipment market consists of sales of devices used in the diagnosis, treatment and monitoring of medical conditions. The market includes diagnostic devices, imaging devices, surgical devices and patient monitoring devices. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Medical equipment encompasses instruments, apparatus, or machines utilized in the prevention, diagnosis, or treatment of illnesses or diseases, as well as in detecting, measuring, restoring, correcting, or modifying the structure or function of the body for health purposes.

The primary categories of medical equipment include in-vitro diagnostics, dental supplies and equipment, ophthalmic devices, diagnostic imaging equipment, cardiovascular devices, hospital supplies, surgical equipment, orthopedic devices, patient monitoring devices, diabetes care devices, nephrology and urology devices, ENT devices, anesthesia and respiratory devices, neurology devices, and wound care devices. In-vitro diagnostics involve tests conducted on samples such as blood or tissue extracted from the human body. These diagnostics identify diseases or conditions and play a crucial role in monitoring overall health for the purpose of curing, treating, or preventing diseases. Expenditures in this field can be both public and private, with products ranging from Instruments Or Equipment to disposables. The end users include hospitals and clinics, homecare services, diagnostic centers, and others.

The medical equipment market research report is one of a series of new reports that provides medical equipment market statistics, including medical equipment industry global market size, regional shares, competitors with a medical equipment market share, detailed medical equipment market segments, market trends and opportunities, and any further data you may need to thrive in the medical equipment industry. This medical equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: In-Vitro Diagnostics, Dental Equipment and Supplies, Ophthalmic Devices, Diagnostic Imaging Equipment, Cardiovascular Devices, Hospital Supplies, Surgical Equipment, Orthopedic Devices, Patient Monitoring Devices, Others2) By Type of Expenditure: Public, Private

3) By Product: Instruments and Equipment, Disposables and Consumables

4) By End User: Hospitals and Clinics, Homecare and Diagnostic Centers, Other End Users

Subsegments:

1) By in-Vitro Diagnostics: Clinical Chemistry; Immunoassay; Molecular Diagnostics; Hematology; Microbiology2) By Dental Equipment and Supplies: Dental Instruments; Dental Implants; Dental Chairs and Equipment; Orthodontic Supplies; Dental Consumables

3) By Ophthalmic Devices: Contact Lenses; Intraocular Lenses; Ophthalmic Lasers; Diagnostic Devices; Surgical Devices

4) By Diagnostic Imaging Equipment: X-Ray Systems; Ultrasound Systems; MRI Systems; CT Scanners; Nuclear Imaging Systems

5) By Cardiovascular Devices: Cardiac Rhythm Management Devices; Catheters; Heart Valves; Stents; Cardiac Assist Devices

6) By Hospital Supplies: Disposables; Sterilization Equipment; Surgical Masks and Gowns; IV Solutions and Administration Sets; Diagnostic Strips

7) By Surgical Equipment: Surgical Instruments; Electrosurgical Devices; Robotic Surgery Systems; Surgical Sutures and Staplers; Minimally Invasive Surgery Devices

8) By Orthopedic Devices: Joint Replacement Devices; Trauma Fixation Devices; Spinal Implants; Orthopedic Braces and Supports; Arthroscopy Devices

9) By Patient Monitoring Devices: Vital Signs Monitors; Remote Patient Monitoring Devices; Fetal and Neonatal Monitors; Cardiac Monitoring Devices; Multi-Parameter Monitors

10) By Others: Blood Glucose Meters; Insulin Delivery Devices; Continuous Glucose Monitoring Systems (CGMs); Lancets and Strips; Dialysis Equipment (Hemodialysis, Peritoneal Dialysis); Urinary Catheters; Stone Management Devices.

Key Companies Mentioned: Medtronic Inc; Abbott Laboratories; Johnson & Johnson; Siemens AG; Becton Dickinson and Company(BD)

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Medtronic Inc

- Abbott Laboratories

- Johnson & Johnson

- Siemens AG

- Becton Dickinson and Company(BD)

- STRYKER CORPORATION

- Cardinal Health

- Danaher Corporation

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- SCHILLER Healthcare India Pvt. Ltd

- GE Healthcare

- Covidien Healthcare India Private Limited

- Philips Healthcare India

- Fisher & Paykel Healthcare India Private Limited

- Smiths Medical India Pvt Ltd

- Agappe Diagnostics Ltd

- ARKRAY Healthcare Pvt. Ltd

- Accord Medical Products Private Limited

- Shinva Medical Instrument Company Limited

- Shandong WeiGao Group Medical Polymer Company Limited

- Lepu Medical Technology Company (Beijing) Co., Ltd

- Yuwell - Jiangsu Yuyue Medical Equipment & Supply Co., Ltd

- Shanghai Runda Medical Technology Co., Ltd

- Terumo Corporation

- Olympus Medical Systems Corporation

- Canon Medical Systems Corporation

- Hitachi Group

- Nihon Koden Corporation

- Sanko Manufacturing Co., Ltd

- Fukuda Denshi

- Metran Co. Ltd

- Clarity Medical

- Welcare Industries S.P.A

- F.L. Medical S.r.l

- Empire MEDICAL UK LTD

- Europlaz Technologies Ltd

- Alfa-Med LLC

- Medplant LLC

- Medical-Łomża Sp. z o.o.

- P.H.U. Medical

- ProVeterináře

- Panop CZ

- Baxter

- SunMed

- Beckman Coulter

- Draegerwerk AG

- Getinge Group

- Masimo

- Teleflex Inc

- Nipro Medical Ltda

- LINET Brazil

- Fotoptica Ltda

- Leistung Engineering Pvt. Ltd

- Saudi Mais Co. for Medical Products (SMMP)

- Life Pulse Medical Co

- Watan

- AlKawashef

- 3BY Ltd

- Qatari German Medical Devices Co

- Israeli Hospitals Ltd

- CAPS Medical

- Amana Healthcare (Pty) Ltd

- CapeRay

- TiTaMED (Pty) Ltd

- Sinapi Biomedical

- Egyptian Medical And Environment Group

- ResMed Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 500 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 842.49 Billion |

| Forecasted Market Value ( USD | $ 1180 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 68 |