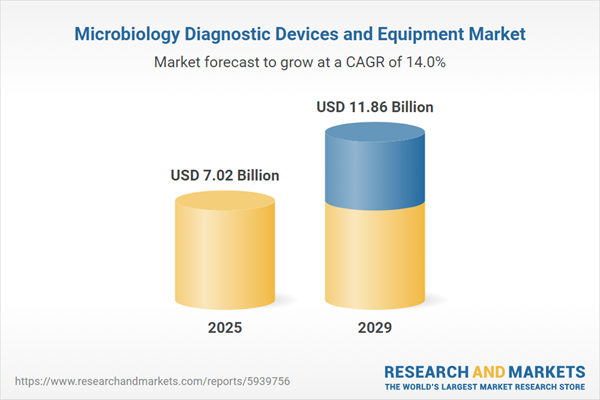

The microbiology diagnostic devices and equipment market size is expected to see rapid growth in the next few years. It will grow to $11.86 billion in 2029 at a compound annual growth rate (CAGR) of 14%. The growth in the forecast period can be attributed to rise in funding, aging population, an increase in healthcare access and a rapid rise in various bacterial and viral epidemics. Major trends in the forecast period include growing adoption of predictive diagnostics, automation in the field of microbiology diagnostics, next generation microbial testing and increasing mergers and acquisitions.

The growth of the microbiology diagnostic devices market is being propelled by increased funding from both public and private investments in medical devices. The surge in investments reflects the growing confidence of various private and public stakeholders in microbiology diagnostic devices, signaling a positive trend and fostering market growth. For instance, MedTech news reported that the private equity industry invested $111.8 billion (approximately $151 billion) in the healthTech industry. Globally, 96 deals valued at $40.8 billion were completed in the medTech vertical. This heightened investment focus on digital health technologies, artificial intelligence, non-invasive monitoring capabilities, gene therapy and regenerative medicines technologies, and customized 3D printing of medical devices is anticipated to drive the microbiology diagnostic devices market.

The increasing prevalence of chronic diseases is expected to contribute significantly to the growth of the microbiology diagnostic devices and equipment market in the foreseeable future. Chronic diseases, characterized by long-lasting or persistent medical conditions, are on the rise and necessitate effective management through the detection, treatment, and prevention of microbial infections and associated complications. According to the World Health Organization (WHO), chronic diseases account for 74% of global deaths, with conditions such as cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes contributing to the majority of fatalities. This growing prevalence of chronic diseases is a key driver for the microbiology diagnostic devices and equipment market.

Next-Generation Sequencing (NGS) technologies are gaining prominence in the microbiology diagnostic devices market due to their cost-effectiveness, sensitivity in detecting low-frequency variants, and comprehensive genomic coverage. NGS, also known as high throughput sequencing or Massively Parallel Sequencing (MPS), offers the ability to sequence hundreds to thousands of genes or gene regions and detect novel resistance genes (ARG) in bacteria. BioMérieux's collaboration with Illumina resulted in the development of bioMérieux EpiSeq, an NGS service facilitating epidemiological monitoring of bacterial infections and outbreak monitoring in hospitals. Notable NGS technologies include Illumina (Solexa) sequencing, Roche 454 sequencing, Ion torrent Proton / PGM sequencing, and SOLiD sequencing.

Major companies in the microbiology diagnostic devices and equipment market are introducing innovative systems, such as third-generation total lab automation (TLA) systems, to enhance laboratory testing efficiency, accuracy, and cost-effectiveness. These advanced TLA systems automate various laboratory tasks, from specimen processing and plating to incubation, imaging, and culture reading. Becton, Dickinson, and Company (BD) launched third-generation TLA systems in January 2023, featuring a modular design, a robotic track system, advanced informatics solutions, and integration of artificial intelligence (AI). This system is customizable for a variety of tasks in a microbiology laboratory, making it a valuable tool for laboratories seeking improved efficiency, cost reduction, and enhanced patient care.

In April 2022, DCN Dx, a US-based manufacturer and developer of point-of-use tests, acquired Biomed Diagnostics to strengthen its position in the point-of-use testing and sampling markets for both humans and animals. Biomed Diagnostics is a US-based microbiological testing company.

Major companies operating in the microbiology diagnostic devices and equipment market include Danaher, Abbott Laboratories, Thermo Fisher Scientific, Becton Dickinson and Company, Biomerieux, Bio-Rad Laboratories Inc., Roche, Bruker Corporation, Merck KGaA, Johnson & Johnson, Simens Healthcare, Beckman Coulter Inc., Ortho Clinical Diagnostics, Sysmex Corporation, Siemens Healthineers, TestLine Clinical Diagnostics s.r.o., Cepheid, Hologic, Bayer AG, Meridian Bioscience, Qiagen N.V., Immunodiagnostic Systems Holdings PLC, Mesa Biotech Inc., PerkinElmer Inc., Neogen Corporation.

North America was the largest region in the microbiology diagnostics devices and equipment market in 2024. Asia-Pacific was the second largest region in the global microbiology diagnostic devices and equipment market. The regions covered in the microbiology diagnostic devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the microbiology diagnostic devices and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Microbiology diagnostics devices and equipment constitute a comprehensive category encompassing various items utilized in microbiology laboratories for the diagnosis of infectious diseases through the examination of pathogens. These devices and equipment include microscopes, slides, test tubes, Petri dishes, growth media (liquid and solid), inoculation loops, pipettes, tips, incubators, autoclaves, and laminar flow hoods. Some pieces of equipment, such as microscopes and hoods, are permanent fixtures, while others, such as pipette tips, are disposable.

The primary types of microbiology diagnostic devices and equipment comprise laboratory instruments, microbiology analyzers, and reagents and consumables. Laboratory instruments encompass items such as incubators, gram stainers, bacterial colony counters, petri dish fillers, and automated culture systems, which are essential for laboratory operations. Reagents include pathogen-specific kits and general reagents used across various end-users, including diagnostic laboratories, hospitals, and others.

The microbiology diagnostics devices and equipment market research report is one of a series of new reports that provides microbiology diagnostics devices and equipment market statistics, including microbiology diagnostics devices and equipment industry global market size, regional shares, competitors with a microbiology diagnostics devices and equipment market share, detailed microbiology diagnostics devices and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the microbiology diagnostics devices and equipment industry. This microbiology diagnostics devices and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The microbiology diagnostic devices and equipment consists of sales of instruments such as incubators, autoclave sterilizers, anaerobic culture systems, blood culture systems, gram strainers, microscopes, mass spectrometers, molecular diagnostic instruments, reagents pathogen-specific kits, and general reagents for microbiology diagnostic. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Microbiology Diagnostic Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on microbiology diagnostic devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for microbiology diagnostic devices and equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The microbiology diagnostic devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Laboratory Instruments, Microbiology Analyzers, Reagents and Consumables2) By Reagents: Pathogen-Specific Kits, General Reagents

3) By End-User: Diagnostic Laboratories, Hospitals, Other End-Users

Subsegments:

1) By Laboratory Instruments: Incubators; Autoclaves and Sterilizers; Refrigerators and Freezers; Centrifuges; Microscopes2) By Microbiology Analyzers: Automated Microbiology Analyzers; Polymerase Chain Reaction (PCR) Analyzers; Mass Spectrometers; Immunoassay Analyzers; Flow Cytometers

3) By Reagents and Consumables: Culture Media; Stains and Dyes; Reagent Kits; Sample Collection Devices; Test Strips and Kits For Specific Pathogens

Key Companies Mentioned: Danaher; Abbott Laboratories; Thermo Fisher Scientific; Becton Dickinson and Company; Biomerieux

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Danaher

- Abbott Laboratories

- Thermo Fisher Scientific

- Becton Dickinson and Company

- Biomerieux

- Bio-Rad Laboratories Inc.

- Roche

- Bruker Corporation

- Merck KGaA

- Johnson & Johnson

- Simens Healthcare

- Beckman Coulter Inc.

- Ortho Clinical Diagnostics

- Sysmex Corporation

- Siemens Healthineers

- TestLine Clinical Diagnostics s.r.o.

- Cepheid

- Hologic

- Bayer AG

- Meridian Bioscience

- Qiagen N.V.

- Immunodiagnostic Systems Holdings PLC

- Mesa Biotech Inc.

- PerkinElmer Inc.

- Neogen Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.02 Billion |

| Forecasted Market Value ( USD | $ 11.86 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |