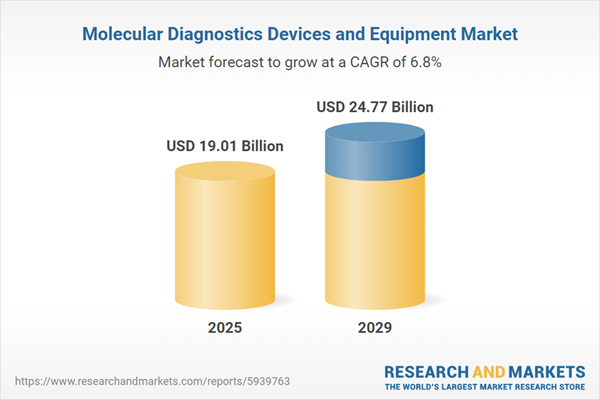

The molecular diagnostics devices and equipment market size is expected to see strong growth in the next few years. It will grow to $24.77 billion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to rapid rise in various bacterial and viral epidemics, aging population, increase in healthcare access, rising prevalence of chronic diseases and increasing demand for molecular diagnostic devices and equipment due to COVID-19. Major trends in the forecast period include automation in the field of molecular diagnostics, use of artificial intelligence, increased demand for molecular diagnostic devices in studying rare diseases, growing adoption of big data, next generation sequencing for newborn screening, and point-of-care molecular diagnostics (POC mdx).

The increasing incidence of infectious diseases is expected to drive the growth of the molecular diagnostic devices and equipment market in the future. Infectious diseases are illnesses caused by pathogenic microorganisms, such as bacteria, viruses, fungi, or parasites, which can be transmitted between individuals or from animals to humans. Factors contributing to the rise in infectious diseases include antimicrobial resistance, globalization and travel, urbanization, socioeconomic disparities, and an aging population. Molecular diagnostic devices and equipment are critical tools for the detection and management of these diseases. For example, in March 2023, the Office for National Statistics, a UK government department, reported that during the week ending March 17, 2023, the UK recorded 619 deaths related to COVID-19, an increase from 605 the previous week. During that week, COVID-19 deaths accounted for 4.5% of all deaths in the UK, a slight decrease from 4.6% the week before. Thus, the rising incidence of infectious diseases is propelling the growth of the molecular diagnostic devices and equipment market.

The increasing incidence of chronic diseases is anticipated to drive the future growth of the molecular diagnostics devices and equipment market. Chronic diseases, or non-communicable diseases (NCDs), are persistent health conditions that progress slowly and endure for an extended period. Molecular diagnostics devices and equipment play a crucial role in the diagnosis, monitoring, and management of chronic diseases by enabling healthcare professionals to analyze genetic, molecular, and biochemical markers associated with these conditions. For instance, in March 2022, The National Center for Biotechnology Information reported that 21% of the elderly population in India has at least one chronic disease, with hypertension and diabetes accounting for about 68% of all chronic diseases. This highlights the significant role of molecular diagnostics in managing chronic conditions.

Key players in the molecular diagnostic industry are focusing on developing automated solutions for devices and equipment used in molecular diagnostic processes. Automation enhances productivity and consistency in the diagnostic process, providing reliable and efficient test results compared to manual testing. Nanotechnology-based solutions, such as the Oral Fluid Nano Sensor Test (OFNASET) for detecting oral cancer biomarkers in saliva, are being utilized. To align with the trend of automation and accuracy, Roche introduced cobas connection modules (CCM) to improve scalability and sample-flow efficiency by enabling the automatic movement of samples between different systems and instruments, creating a fully automated workflow.

Major companies in the molecular diagnostics devices and equipment market are innovating by developing products such as high-throughput sample-to-result instruments for molecular diagnostics. ELITechGroup, for instance, launched a high-throughput sample-to-result instrument in April 2023, based on its proven extraction and assay technology. The instrument allows continuous loading of samples and reagents with real random-access capability, providing users with the flexibility to run different PCR reagents, protocols, and sample matrices in parallel.

In February 2022, Tulip Diagnostics, an India-based manufacturing company, acquired Biosense Technologies for an undisclosed amount. With this acquisition, Tulip Diagnostics aims to improve its point-of-care testing capabilities and expand its product portfolio. Biosense Technologies, also based in India, specializes in developing innovative molecular diagnostic devices that enhance disease detection and offer personalized healthcare solutions.

Major companies operating in the molecular diagnostics devices and equipment market include F. Hoffmann-La Roche Ltd, QIAGEN N.V., Abbott Laboratories, Danaher Corporation, Biomérieux, Becton Dickinson & Co, Siemens Healthineers AG, Grifols S.A., Sysmex Corporation, Abbott India Limited, Qiagen India Pvt Ltd, Biocartis, Bio-Techne India Private Limited, Cleaver Scientific, Zhejiang Di'an Diagnostics Technology Co. Ltd, ADICON Clinical Laboratories, Guangzhou Kingmed Diagnostics Center Co. Ltd., Kindstar Global, BGI-Shenzhen, OriGene Technologies, Bayer AG, Johnson & Johnson, Nippon Becton Dickinson Company, QuantuMDx, Yourgene Health, Genefirst, Interlabservis, GeneMe, TestLine, Clinical Diagnostics s.r.o, Hologic Inc., Illumina Inc., Novartis AG, Cepheid Inc., Admera Health, Agilent technologies Inc., AutoGenomics, Bio-Red Laboratories Inc, Ortho Clinical Diagnostics Inc, Sysmex Middle East FZ-LLC, QIAGEN SA (Pty) Ltd.

Asia-Pacific was the largest region in the global molecular diagnostics devices (or) equipment market in 2024. Western Europe was the second largest market in molecular diagnostics devices (or) equipment market. The regions covered in the molecular diagnostics devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the molecular diagnostics devices and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Molecular diagnostics devices are utilized for the diagnosis of infectious diseases and screening by detecting specific sequences in DNA or RNA. These devices aid in providing more accurate therapeutic interventions, especially in the early stages of a disease.

The main products of molecular diagnostics devices include instruments, reagents, and consumables. Reagents, in this context, refer to substances used to cause a chemical reaction, often employed to indicate the presence of another substance. Various technologies are involved in molecular diagnostics, such as DNA (deoxyribonucleic acid) sequencing, polymerase chain reaction, isothermal nucleic acid amplification technology, transcription-mediated amplification (TMA), in situ hybridization, microarrays, mass spectrometry, and others such as southern blotting, northern blotting, and electrophoresis. These technologies find applications in cancer diagnosis, pharmacogenomics, genetic testing, infectious disease detection, prenatal screening, neurological disease analysis, and cardiovascular disease assessment. Molecular diagnostics devices are used by various end-users, including diagnostic laboratories, hospitals, and others such as nursing homes, blood banks, and point-of-care facilities.

The molecular diagnostics devices (or) equipment market research report is one of a series of new reports that provides molecular diagnostics devices (or) equipment market statistics, including molecular diagnostics devices (or) equipment industry global market size, regional shares, competitors with a molecular diagnostics devices (or) equipment market share, detailed molecular diagnostics devices (or) equipment market segments, market trends and opportunities, and any further data you may need to thrive in the molecular diagnostics devices (or) equipment industry. This molecular diagnostics devices (or) equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The molecular diagnostics devices and equipment market consist of sales of thermocycler, single particle mass spectrometers, time-of-flight mass spectrometer (TOF) and others that are used to detect pathogen and infectious diseases. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. This market is segmented into instruments, reagents, and consumables.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Molecular Diagnostics Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on molecular diagnostics devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for molecular diagnostics devices and equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The molecular diagnostics devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Instruments, Reagents and Consumables, Software2) By Technology: DNA(Deoxyribonucleic acid) sequencing, Polymerase chain reaction, Isothermal Nucleic Acid Amplification Technology, Transcription Mediated Amplification (TMA), in situ hybridization, Microarrays, Mass spectrometry, Other Technologies

3) By Application: Cancer, Pharmacogenomics, Genetic testing, Infectious disease, Prenatal, Other Applications

4) By End User: Diagnostic laboratories, Hospitals, Other End Users

Subsegments:

1) By Instruments: Polymerase Chain Reaction (PCR) Machines; Nucleic Acid Analyzers; DNA Sequencers; Microarrays2) By Reagents and Consumables: PCR Reagents; DNA Probes and Primers; Sample Preparation Kits; Control and Calibration Materials

3) By Software: Data Analysis Software; Laboratory Information Management Systems (LIMS); Bioinformatics Software; Integration Software For Instrumentation

Key Companies Mentioned: F. Hoffmann-La Roche Ltd; QIAGEN N.V.; Abbott Laboratories; Danaher Corporation; Biomérieux

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

- Abbott Laboratories

- Danaher Corporation

- Biomérieux

- Becton Dickinson & Co

- Siemens Healthineers AG

- Grifols S.A.

- Sysmex Corporation

- Abbott India Limited

- Qiagen India Pvt Ltd

- Biocartis

- Bio-Techne India Private Limited

- Cleaver Scientific

- Zhejiang Di'an Diagnostics Technology Co. Ltd

- ADICON Clinical Laboratories

- Guangzhou Kingmed Diagnostics Center Co. Ltd.

- Kindstar Global

- BGI-Shenzhen

- OriGene Technologies

- Bayer AG

- Johnson & Johnson

- Nippon Becton Dickinson Company

- QuantuMDx

- Yourgene Health

- Genefirst

- Interlabservis

- GeneMe

- TestLine

- Clinical Diagnostics s.r.o

- Hologic Inc.

- Illumina Inc.

- Novartis AG

- Cepheid Inc.

- Admera Health

- Agilent technologies Inc.

- AutoGenomics

- Bio-Red Laboratories Inc

- Ortho Clinical Diagnostics Inc

- Sysmex Middle East FZ-LLC

- QIAGEN SA (Pty) Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 19.01 Billion |

| Forecasted Market Value ( USD | $ 24.77 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 41 |