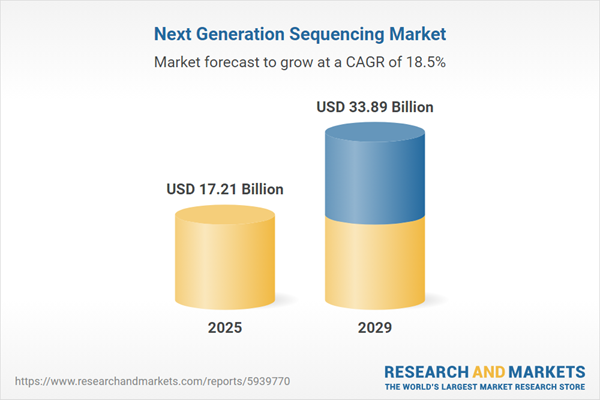

The next generation sequencing market size is expected to see rapid growth in the next few years. It will grow to $33.89 billion in 2029 at a compound annual growth rate (CAGR) of 18.5%. The growth in the forecast period can be attributed to aging population, increase in healthcare access, rising prevalence of chronic diseases and increasing demand for next generation sequencing due to COVID-19. Major trends in the forecast period include focusing on using artificial intelligence to reduce costs and time, studying rare diseases in a cost-effective manner to maintain a competitive edge over other technologies, offering NGS technologies for newborn screening and adopting big data technologies to analyze large genomic data.

The growth of the next-generation sequencing market has been fueled by the increasing incidence of chronic conditions such as cancer, AIDS, and thalassemia. The prevalence of chronic illnesses is on the rise globally due to factors such as an aging population and shifts in social behavior, leading to an escalation in widespread and costly long-term medical issues. Researchers and clinicians employ next-generation sequencing (NGS) as a versatile tool in various cancer studies to identify biomarkers that guide treatment decisions. The World Health Organization anticipates a significant increase in the prevalence of chronic diseases. Consequently, the growing number of cases with chronic conditions is expected to drive the demand for NGS sequencing, contributing to the revenue growth of the next-generation sequencing market.

The next-generation sequencing market is set to experience growth driven by the increasing demand for personalized medicine. Personalized medicine, also known as precision medicine, is an innovative healthcare approach that considers an individual's unique genetic, environmental, and lifestyle factors to tailor medical decisions and treatments. Next-generation sequencing plays a foundational role in personalized medicine by enabling the precise assessment of an individual's genetic makeup and the development of customized healthcare strategies. Reports from October 2022 indicate a significant presence of over 75,000 genetic testing products and 300 personalized medicines, highlighting the rising demand for personalized medicine as a key driver for the growth of the next-generation sequencing market.

Leading companies in the next-generation sequencing (NGS) market are focusing on developing innovative technologies, such as NGS platform technology, to improve speed, accuracy, and cost-effectiveness. Key advancements include enhanced accuracy, increased throughput, and AI-driven data analysis. NGS platforms are sophisticated technologies enabling rapid, cost-effective sequencing of DNA and RNA by simultaneously processing millions of fragments, supporting applications like whole-genome sequencing and targeted resequencing, which are revolutionizing genomic research and personalized medicine. For example, in April 2022, Thermo Fisher Scientific, a US-based biotechnology company, launched the IonTorrent Genexus Dx Integrated Sequencer. This platform allows rapid, automated NGS in clinical laboratories, providing results within 24 hours. Its user-friendly design and flexibility cater to both diagnostic testing and research, significantly advancing precision medicine.

Strategic partnerships are a key strategy employed by major companies in the next-generation sequencing market to boost profitability. In October 2022, Illumina Inc., a US-based biotechnology company, formed a partnership with GenoScreen. The collaboration aims to enhance access to genetic testing for multidrug-resistant TB and accelerate global efforts to eradicate the disease. Utilizing NGS technology, the alliance plans to develop and commercialize a novel tuberculosis test for the identification of drug-resistant TB strains.

Major companies operating in the next generation sequencing market include Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, Agilent Technologies, Inc., Pacific Biosciences of California Inc., Oxford Nanopore Technologies, 10x Genomics, Bio-Rad Laboratories, Inc., MGI Tech Co., Ltd., Oxford Gene Technology, Hoffmann-La Roche Ltd, BGI, PerkinElmer Inc., Macrogen Inc., Genotypic Technology Pvt. Ltd., Beijing Genomics Institute, SciGenom Labs Pvt. Ltd (India), Dante Labs, Roche, First Genetics JCS, Helix, Tempus, Massive Bio, Genetricsinc and King Abdullah International Medical Research Center, Inqaba biotec.

North America was the largest region in the next generation sequencing market in 2024. Asia-Pacific was the second largest region in the global next generation sequencing market share. The regions covered in the next generation sequencing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the next generation sequencing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The next generation sequencing market consist of sales of genetic sequencing equipment with advanced features and technologies such as ion semiconductor sequencing, nano-pore sequencing, single-molecule real-time sequencing, and other technologies that are used for next generation sequencing. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

Next-generation sequencing is a sequencing technology that provides ultra-high throughput, scalability, and speed, and is utilized to determine the genetic variation associated with diseases or other biological phenomena.

The primary products in the next-generation sequencing market include NextSeq systems, MiniSeq systems, NovaSeq systems, iSeq 100 systems, ion PGM Systems, Ion Proton systems, ion GeneStudio S5 systems, PacBio RS II Systems, Sequel systems, and others. The MiniSeq system combines load-and-go operation with an intuitive user interface for a fast and easy NGS workflow. It integrates clonal amplification, sequencing through synthesis, and base calling into a single benchtop instrument, eliminating the need for additional equipment. Various technologies in next-generation sequencing include sequencing by synthesis, ion semiconductor sequencing, single-molecule real-time sequencing, nanopore sequencing, and other sequencing technologies applied in diagnostics, drug discovery, and other applications.

The next generation sequencing market research report is one of a series of new reports that provides next generation sequencing market statistics, including next generation sequencing industry global market size, regional shares, competitors with a next generation sequencing market share, detailed next generation sequencing market segments, market trends and opportunities, and any further data you may need to thrive in the next-generation sequencing industry. This next generation sequencing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Next Generation Sequencing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on next generation sequencing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for next generation sequencing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The next generation sequencing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Instruments, Reagents and Kits, Software2) By Technology: Sequencing by Synthesis, Ion Semiconductor Sequencing, Single-molecule Real-time Sequencing, Nanopore Sequencing, Other Sequencing Technologies

3) By Application: Diagnostics, Drug Discovery, Other Applications

Subsegments:

1) By Instruments: Sequencing Systems; Library Preparation Instruments; Quality Control Instruments2) By Reagents and Kits: Sequencing Reagents; Library Preparation Kits; Amplification Kits

3) By Software: Data Analysis Software; Bioinformatics Software; Workflow Management Software

Key Companies Mentioned: Illumina, Inc.; Thermo Fisher Scientific Inc.; QIAGEN; Agilent Technologies, Inc.; Pacific Biosciences of California Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- Agilent Technologies, Inc.

- Pacific Biosciences of California Inc.

- Oxford Nanopore Technologies

- 10x Genomics

- Bio-Rad Laboratories, Inc.

- MGI Tech Co., Ltd.

- Oxford Gene Technology

- Hoffmann-La Roche Ltd

- BGI

- PerkinElmer Inc.

- Macrogen Inc.

- Genotypic Technology Pvt. Ltd.

- Beijing Genomics Institute

- SciGenom Labs Pvt. Ltd (India)

- Dante Labs

- Roche

- First Genetics JCS

- Helix

- Tempus

- Massive Bio

- Genetricsinc and King Abdullah International Medical Research Center

- Inqaba biotec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 17.21 Billion |

| Forecasted Market Value ( USD | $ 33.89 Billion |

| Compound Annual Growth Rate | 18.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |