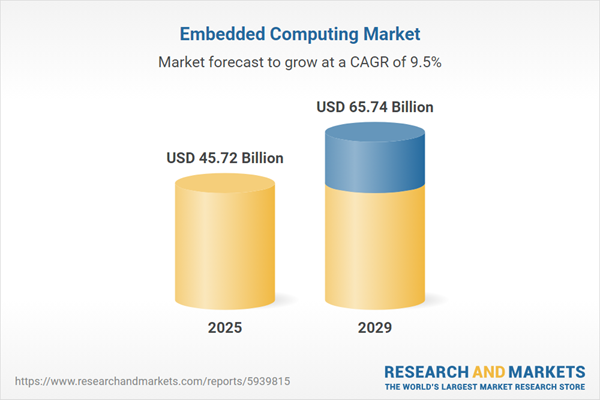

The embedded computing market size is expected to see strong growth in the next few years. It will grow to $65.74 billion in 2029 at a compound annual growth rate (CAGR) of 9.5%. The growth in the forecast period can be attributed to expansion of edge computing applications, increasing adoption of embedded systems in medical devices, rise in cybersecurity concerns driving embedded security solutions, growth in the autonomous vehicles market. Major trends in the forecast period include proliferation of edge computing, development of energy-efficient embedded devices, growth of embedded vision systems, increased focus on open-source embedded software, adoption of ruggedized embedded solutions in harsh environments.

The anticipated growth in the embedded computing market is expected to be propelled by the increasing adoption of consumer electronics. Consumer electronics (CE) denotes electronic devices designed for purchase and daily use by end-users, contributing to the ever-evolving landscape of consumer electronics. The integration of embedded systems enhances electronic products, ensuring they offer innovative features, seamless communication, optimal performance, and heightened efficiency. Notably, the growth rates for units in consumer electronics categories such as computers (+34%) and TV sets (+12%) have outpaced smartphones (+1%) over the past three years, as reported by Deloitte in 2022. Therefore, the escalating adoption of consumer electronics, including smartphones, is a driving force behind the growth of the embedded computing market.

The rise in the automotive industry is poised to drive the growth of the embedded computing market. The automotive industry encompasses a wide array of companies involved in the design, development, manufacturing, marketing, and sales of motor vehicles. Embedded computing technologies play a pivotal role in modern vehicles, powering advanced driver assistance systems (ADAS), infotainment systems, in-car connectivity, and engine control units. In 2022, the U.S. automobile industry saw sales of approximately 13.75 million cars and light truck vehicles, according to AutoLeap, a Canada-based modern and award-winning auto repair shop software. Consequently, the upward trajectory of the automotive industry contributes significantly to the growth of the embedded computing market.

A notable trend gaining traction is product innovation in the embedded computing market. Major companies within the embedded computing sector are actively engaged in the development of cutting-edge products as part of their strategy to maintain a competitive edge. A case in point is Neousys Technology, a Taiwan-based manufacturer specializing in rugged embedded systems and industrial equipment. In January 2022, Neousys Technology introduced the Nuvo-9000 series and Nuvo-9531 series, featuring fanless embedded computers. These solutions target industrial edge computing, vision inspection, and automation systems. The processors in the Nuvo-9000 and Nuvo-9531 series leverage Intel's 12th generation Core i processor with a 16-core/24-thread configuration, resulting in enhanced performance compared to the previous generation.

Major players in the embedded computing market involves forming alliances to bolster their market positions. Strategic collaborations enable companies to join forces with entities possessing complementary expertise, facilitating the realization of envisioned concepts. For instance, in August 2023, SECO, a renowned US-based leader with a 40-year track record in developing embedded microcomputers, integrated systems, and IoT solutions, announced a cooperative agreement with Gopalam Embedded Systems Pte Ltd (GES), an India-based provider of comprehensive hardware and software solutions for the embedded systems market in the Asia-Pacific (APAC) region. This collaboration grants Gopalam Embedded Systems access to SECO's extensive portfolio of embedded systems.

In September 2023, Concurrent Technologies, a UK-based embedded-computing company, completed the acquisition of Phillips Aerospace for an amount totaling $3.38 million. Concurrent Technologies stated that this acquisition enhances the company's capabilities in designing and manufacturing rugged systems that utilize its existing plug-in cards. Phillips Aerospace, a US-based rugged-computing company, is now part of Concurrent Technologies through this strategic acquisition.

Major companies operating in the embedded computing market include Microsoft Corporation, Dell Inc., Intel Corporation, The International Business Machines Corporation, Qualcomm Technologies Inc., Fujitsu Limited, Advanced Micro Devices Inc., Texas Instruments Inc., MediaTek Inc., STMicroelectronics N.V., Infineon Technologies AG, NXP Semiconductors N.V., Renesas Electronics Corporation, Microchip Technology Inc., Super Micro Computer Inc., Arm Holdings plc, Nuvoton Technology Corporation, DataArt, N-iX, Axiomtek Co. Ltd., Yalantis, Congatec AG, Vates, CHI Software, Solw'IT SA, Softeq, ITRex Group, Interelectronix e.K., Smart Embedded Computing Inc.

Asia-Pacific was the largest region in the embedded computing market in 2024. The regions covered in the embedded computing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the embedded computing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Embedded computing involves integrating computing systems into non-computerized devices or objects to enhance their performance and functionality. This technology finds applications across various industries, aiming to improve the capabilities of electronic equipment and systems.

Embedded computing comprises two main types hardware and software. Hardware encompasses the tangible components of an electrical or computer system. Microprocessors, microcontrollers, and system-on-chip (SoC) devices are examples of hardware elements that provide the processing power needed for computations and executing software commands in embedded systems. These embedded systems operate in real-time and can function in standalone, mobile, or networked configurations. End-users span diverse sectors, including automotive, industrial, healthcare, retail, consumer electronics, smart home technology, and others.

The embedded computing research report is one of a series of new reports that provides embedded computing market statistics, including the embedded computing industry's global market size, regional shares, competitors with embedded computing market share, detailed embedded computing market segments, market trends and opportunities, and any further data you may need to thrive in the embedded computing industry. This embedded computing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The embedded computing market consists of revenues earned by entities by providing services such as system development, consulting and design, customization and tailoring, testing and validation, maintenance and support, and system integration. The market value includes the value of related goods sold by the service provider or included within the service offering. The embedded computing market also includes sales of microprocessors, microcontrollers, and digital signal processors, which are used in providing embedded computing services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Embedded Computing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on embedded computing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for embedded computing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The embedded computing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Hardware; Software2) By Function: Real-Time; Standalone; Mobile; Networked

3) By End User: Automotive; Industrial; Healthcare; Retail; Consumer and Smart Home; Other End Users

Subsegments:

1) By Hardware: Microcontrollers; Microprocessors; System-on-Chip (SoC); Development Boards; Memory Devices; Input or Output Devices2) By Software: Operating Systems; Middleware; Application Software; Development Tools; Real-Time Operating Systems (RTOS)

Key Companies Mentioned: Microsoft Corporation; Dell Inc.; Intel Corporation; the International Business Machines Corporation; Qualcomm Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Microsoft Corporation

- Dell Inc.

- Intel Corporation

- The International Business Machines Corporation

- Qualcomm Technologies Inc.

- Fujitsu Limited

- Advanced Micro Devices Inc.

- Texas Instruments Inc.

- MediaTek Inc.

- STMicroelectronics N.V.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Super Micro Computer Inc.

- Arm Holdings plc

- Nuvoton Technology Corporation

- DataArt

- N-iX

- Axiomtek Co. Ltd.

- Yalantis

- Congatec AG

- Vates

- CHI Software

- Solw'IT SA

- Softeq

- ITRex Group

- Interelectronix e.K.

- Smart Embedded Computing Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 45.72 Billion |

| Forecasted Market Value ( USD | $ 65.74 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |