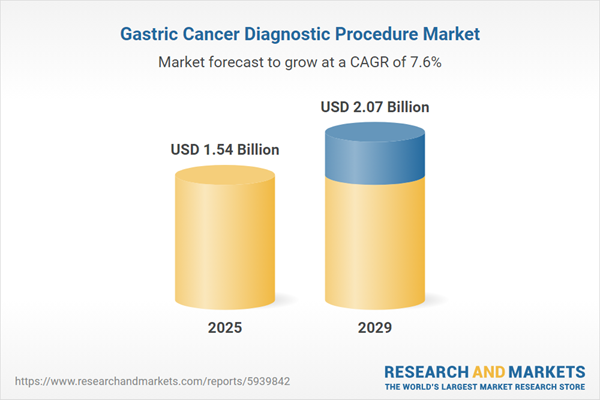

The gastric cancer diagnostic procedure market size is expected to see strong growth in the next few years. It will grow to $2.07 billion in 2029 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to rise in point-of-care testing, introduction of novel biomarkers, shift towards personalized medicine, adoption of next-generation sequencing, enhanced endoscopic imaging modalities. Major trends in the forecast period include integration of nanotechnology, adoption of big data analytics, application of microbiota analysis, increased patient-centric approaches, role of telehealth in diagnostics.

The increasing prevalence of gastrointestinal diseases is a driving force behind the anticipated growth in the gastric cancer diagnostic procedure market. Gastrointestinal disorders encompass a range of illnesses affecting various sections of the digestive system and supporting organs, including the liver and pancreas. The gastric cancer diagnostic procedure is essential for addressing stomach cancer through methods such as endoscopy and biopsy. Therefore, the expanding incidence of gastrointestinal diseases is contributing to the market's growth. For instance, a study conducted by GI Associates & Endoscopy Center, a US-based medical facility specializing in gastroenterology services, involved 73,076 people from 33 nations, revealing that 40% of the subjects suffered from a functional gastrointestinal illness in August 2022. Hence, the increasing prevalence of gastrointestinal diseases is a significant factor propelling the growth of the gastric cancer diagnostic procedure market.

The rising prevalence of smoking is expected to drive the growth of the gastric cancer diagnostic procedure market in the future. Smoking involves the inhalation and exhalation of smoke produced by burning tobacco or other substances. Gastric cancer diagnostic procedures play a crucial role for individuals with a history of smoking or those at risk of smoking-related cancers by enabling early detection, identifying precancerous lesions, developing personalized treatment plans, facilitating communication and coordination, and providing a comprehensive assessment of the gastric mucosa and surrounding tissues. According to a report by The World Health Organization, a Switzerland-based intergovernmental organization, in July 2023, more than 8 million people are killed by tobacco each year, including 1.3 million non-smokers who inhale second-hand smoke. Therefore, the rising prevalence of smoking is a key driver of the growth of the gastric cancer diagnostic procedure market.

Technological advancements represent a prominent trend gaining momentum in the gastric cancer diagnostic market. Leading companies in the gastric cancer diagnostic market are actively incorporating new technologies to maintain their competitive positions. For example, in June 2022, Ibex Medical Analytics, an Israel-based provider of AI-powered diagnostics for health organizations, introduced Galen Gastric, the world's first AI-powered solution designed for gastric cancer detection. Galen Gastric serves as an integrated diagnostic tool assisting pathologists in identifying stomach cancer, H. pylori, and other critical clinical findings, contributing to faster turnaround times and improved diagnostic workflows.

Prominent companies in the gastric cancer diagnostic procedure market are strategically focusing on innovative products such as tissue staining platforms to drive revenue growth. The tissue staining platform aims to deliver rapid and precise test results, enabling medical professionals to make timely decisions regarding patient care. In June 2022, F. Hoffmann-La Roche AG, a Switzerland-based healthcare company, introduced the benchmark ultra plus system. This system, building on the proven technology of the benchmark ultra system, provides a fully automated workflow for immunohistochemistry (IHC) and in-situ hybridization (ISH) slide staining. It enhances the laboratory experience with features such as a retractable work surface, improved sliding drawers, indicator lights, and remote monitoring via a connected device, addressing user feedback. The system emphasizes efficient workflow, testing efficiency, and eco-friendly attributes.

In March 2023, Pfizer, a pharmaceutical corporation based in the United States, acquired Seagen Inc. for $43 billion. This acquisition strengthens Pfizer's position as a leading player in the oncology market by incorporating Seagen's groundbreaking antibody-drug conjugate (ADC) technology and expanding its portfolio of innovative cancer therapies. Seagen Inc. is a US-based biotechnology company focused on the discovery, development, and commercialization of transformative cancer medicines.

Major companies operating in the gastric cancer diagnostic procedure market include Pfizer Inc., Johnson & Johnson Co, F. Hoffmann La Roche Ltd., Merck & Co. Inc., Bayer AG, Novartis AG, Bristol-Myers Squibb Company, Thermo Fisher Scientific Inc., AstraZeneca plc, Abbott Laboratories Inc., Sanofi SA, Eli Lilly and Company, Otsuka Pharmaceutical Co Ltd., AdventHealth, Atrium Health, Astellas Pharma Inc, Bausch Health Companies Inc., Agilent Technologies Inc., Ipsen Pharma, Hartford HealthCare, Myriad Genetics Inc., NovoCure Limited, Foundation Medicine Inc., Biocept Inc.

North America was the largest region in the gastric cancer diagnostics procedure market in 2024. The regions covered in the gastric cancer diagnostic procedure market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the gastric cancer diagnostic procedure market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The diagnostic procedure for gastric cancer involves the identification and treatment of cancerous cells in the stomach. This procedure is crucial for diagnosing stomach cancer.

Key procedures in the diagnostic process for gastric cancer include endoscopic procedures, biopsies, tissue tests, laboratory tests, in-vitro diagnostic tests, imaging tests, molecular diagnostics, multiplexing molecular diagnostics, immunoassays, and others. The endoscopic procedure involves the examination of internal organs, such as the gastrointestinal tract, by inserting a long, thin tube directly into the body. This endoscopy procedure is utilized in gastric cancer diagnosis, addressing both symptomatic and asymptomatic cases, and encompasses instruments, reagents and consumables, and services. Various body fluids, including blood, urine, saliva, stomach juice, and tissue, are required for the procedure. These fluids aid in the detection and treatment of both early and advanced gastric cancer.

The gastric cancer diagnostic procedure market research report is one of a series of new reports that provides gastric cancer diagnostic procedure market statistics, including the gastric cancer diagnostic procedure industry's global market size, regional shares, competitors with a gastric cancer diagnostic procedure market share, detailed gastric cancer diagnostic procedure market segments, market trends, and opportunities, and any further data you may need to thrive in the gastric cancer diagnostic procedure industry. This gastric cancer diagnostic procedure market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The gastric cancer diagnostics procedure market includes revenues earned by entities that provide diagnostic procedures such as surgery, chemotherapy, and radiation therapy. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Gastric Cancer Diagnostic Procedure Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on gastric cancer diagnostic procedure market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for gastric cancer diagnostic procedure? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The gastric cancer diagnostic procedure market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Procedure Type: Endoscopic Procedure; Biopsy; Tissue Tests; Lab Tests; in-Vitro Diagnostic Tests; Imaging Tests; Molecular Diagnostics; Multiplexing Molecular Diagnostics; Immunoassays; Other Procedure Types2) By Symptom Type: Symptomatic; Asymptomatic

3) By Offering Type: Instruments; Reagents and Consumables; Services

4) By Body Fluid Type: Blood; Urine; Saliva; Stomach Juice; Tissue; Other Body Fluid

5) By Disease Indication: Early Gastric Cancer; Advanced Gastric Cancer

Subsegments:

1) By Endoscopic Procedure: Upper Endoscopy (EGD); Endoscopic Ultrasound (EUS)2) By Biopsy: Endoscopic Biopsy; Fine Needle Aspiration (FNA) Biopsy

3) By Tissue Tests: Histopathology; Immunohistochemistry

4) By Lab Tests: Blood Tests; Tumor Markers

5) By in-Vitro Diagnostic Tests: Genetic Testing; Molecular Profiling

6) By Imaging Tests: Computed Tomography (CT) Scan; Magnetic Resonance Imaging (MRI); Positron Emission Tomography (PET) Scan

7) By Molecular Diagnostics: PCR Testing; Next-Generation Sequencing (NGS)

8) By Multiplexing Molecular Diagnostics: Multiplex PCR; Microarray Analysis

9) By Immunoassays: Enzyme-Linked Immunosorbent Assay (ELISA); Radioimmunoassay (RIA)

10) By Other Procedure Types: Breath Tests; Liquid Biopsies

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson Co; F. Hoffmann La Roche Ltd.; Merck & Co. Inc.; Bayer AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- Johnson & Johnson Co

- F. Hoffmann La Roche Ltd.

- Merck & Co. Inc.

- Bayer AG

- Novartis AG

- Bristol-Myers Squibb Company

- Thermo Fisher Scientific Inc.

- AstraZeneca plc

- Abbott Laboratories Inc.

- Sanofi SA

- Eli Lilly and Company

- Otsuka Pharmaceutical Co Ltd.

- AdventHealth

- Atrium Health

- Astellas Pharma Inc

- Bausch Health Companies Inc.

- Agilent Technologies Inc.

- Ipsen Pharma

- Hartford HealthCare

- Myriad Genetics Inc.

- NovoCure Limited

- Foundation Medicine Inc.

- Biocept Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.54 Billion |

| Forecasted Market Value ( USD | $ 2.07 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |