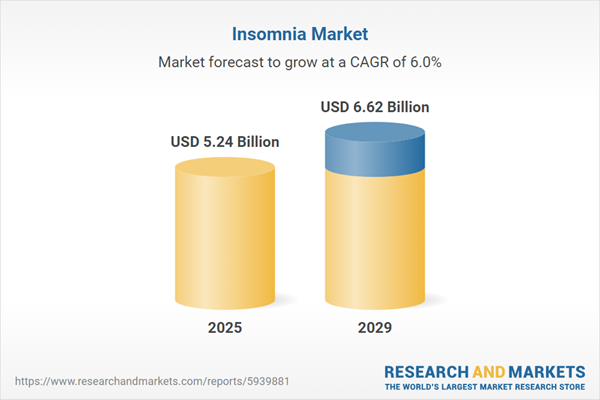

The insomnia market size is expected to see strong growth in the next few years. It will grow to $6.62 billion in 2029 at a compound annual growth rate (CAGR) of 6%. The growth in the forecast period can be attributed to global health crisis impact, increasing awareness of sleep hygiene, emphasis on mental health and wellness, government initiatives for sleep health, influence of social determinants. Major trends in the forecast period include digital health solutions for sleep monitoring, cognitive behavioral therapy for insomnia, telehealth for sleep consultations, integration of sleep health into primary care, research on novel therapeutic targets.

The increase in work-related stress is expected to drive growth in the insomnia market in the future. Work-related stress refers to harmful emotional and physical responses that arise when the demands and pressures of work do not align with a worker's resources, capabilities, or knowledge. This type of job stress can lead to various health issues, including insomnia. Depending on the severity of the insomnia, patients may be treated with medications or cognitive-behavioral therapies, among other approaches. For example, in October 2022, the American Psychological Association, a U.S.-based organization of psychologists, reported that workplace stress remains a significant concern, with 77% of employees indicating they experienced work-related stress in the past month. Additionally, 57% reported negative effects, such as emotional exhaustion (31%), which are often associated with workplace burnout. Therefore, the surge in work-related stress is propelling the growth of the insomnia market.

The growth of the insomnia market is also expected to be propelled by the increasing prevalence of chronic diseases. Chronic diseases, lasting for three months or more and worsening over time, often lead to comorbid conditions such as insomnia. Individuals with chronic conditions such as cardiovascular disorders, diabetes, and chronic pain frequently experience sleep-related issues. The rising prevalence of chronic diseases creates a demand for effective insomnia treatments and management strategies, contributing to the growth of the market. According to the National Center for Biotechnology Information in January 2023, the global number of people with chronic diseases is projected to reach 142.66 million by 2050, up from 71.522 million in 2020. Therefore, the increasing prevalence of chronic diseases is a significant factor driving the growth of the insomnia market.

A key trend in the insomnia market is the adoption of product innovation. Major companies in the insomnia therapeutics market are developing innovative treatments to maintain their market positions. For example, WELT, a Korea-based medical device company, received approval for its digital insomnia treatment device, WELT-I, in April 2023. WELT-I is designed to correct behavioral, psychological, and cognitive factors contributing to insomnia. It delivers treatment based on cognitive behavioral therapy (CBT), a first-line treatment for insomnia. The device, classified as software as a medical device (SaMD), analyzes sleep patterns, intervenes in patient behavior, and delivers personalized relaxation therapy for eight weeks to improve sleep quality and reduce tension and anxiety.

Major companies in the insomnia market are introducing new products, such as zaleplon-based insomnia drugs, to gain a competitive edge. Zaleplon, a non-benzodiazepine sedative-hypnotic medication, is used for the short-term treatment of insomnia. For instance, in April 2023, Bukwang Pharm Co Ltd., a South Korea-based pharmaceutical company, launched Zaledeep Cap., the first insomnia treatment in South Korea utilizing zaleplon as its main ingredient. Zaleplon is known for its rapid onset of action, short half-life, and minimal impact on daily activities. The launch of Zaledeep Cap. aims to provide a new and effective treatment option for individuals suffering from insomnia in response to the increasing cases in modern society.

In August 2022, ResMed, a US-based medical equipment company, acquired Mementor to strengthen its sleep portfolio in Germany. This acquisition included somnio, a digital solution for insomnia, Germany's first and only permanently approved digital health application (DiGA) in sleep medicine. Somnio focuses on improving sleep in insomnia patients, addressing the care gap, and providing alternatives to prevailing drug therapy. Mementor, a Germany-based developer of digital insomnia therapy solutions, contributes to ResMed's overall commitment to enhancing sleep-related healthcare.

Major companies operating in the insomnia market include Pfizer Inc., Merck & Co Inc., Sanofi S.A., GlaxoSmithKline plc., Takeda Pharmaceutical Company Limited, Koninklijke Philips N.V., Viatris Inc., Astellas Pharma Inc., Sun Pharmaceutical Industries Limited, Eisai Co.Ltd., UCLA Health Insomnia Clinic, Jazz Pharmaceuticals PLC, Aurobindo Pharma Limited, Purdue Pharma LP, Cipla Inc., Dr. Reddy's Laboratories Ltd., Zydus Lifesciences Limited, Lupin Limited, Mallinckrodt Pharmaceuticals Plc., Fisher & Paykel Healthcare Corporation Limited, ResMed Inc., Sunovion Pharmaceuticals Inc., Casper Sleep Inc., Biocodex Inc., Vanda Pharmaceuticals Inc., Pernix Therapeutics Holdings Inc., SleepScore Labs, Alpha-Stim, Neurim Pharmaceuticals Ltd., NightWare Inc.

North America was the largest region in the insomnia market in 2024. The regions covered in the insomnia market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the insomnia market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Insomnia is a sleep disorder characterized by difficulties in falling or staying asleep. Depending on the duration of symptoms, insomnia can be categorized as either short-term (acute) or long-term (chronic). Various treatments, including drugs, digital therapeutics, and devices, are employed to address insomnia conditions.

The main therapy types for insomnia encompass non-pharmacological therapy and pharmacological therapy. Non-pharmacological interventions (NPI) or non-pharmacological therapies involve non-chemical interventions performed on and benefiting the patient, such as light therapy and exercise. The various drug classes utilized in pharmacological therapy include anti-depressants, melatonin antagonists, benzodiazepines, non-benzodiazepines, orexin antagonists, and others. These drugs are administered through various routes, such as oral and parenteral, and are distributed through various channels, including hospital pharmacies, retail pharmacies, and online pharmacies.

The insomnia market research report is one of a series of new reports that provides insomnia market statistics, including insomnia industry global market size, regional shares, competitors with an insomnia market share, detailed insomnia market segments, market trends, and opportunities, and any further data you may need to thrive in the insomnia industry. This insomnia market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The insomnia market consists of revenues earned by entities by providing therapies such as light therapy, stimulus control therapy, and relaxation therapy. The market value includes the value of related goods sold by the service provider or included within the service offering. The insomnia market also includes sales of triazolam, estazolam, temazepam, quazepam, and flurazepam. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Insomnia Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on insomnia market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for insomnia? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The insomnia market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Therapy Type: Non-Pharmacological Therapy; Pharmacological Therapy2) By Drug Class: Anti-Depressants; Melatonin Antagonist; Benzodiazepines; Nonbenzodiazepines; Orexin Antagonist; Other Drug Classes

3) By Route of Administration: Oral; Parenteral; Other Route of Administration

4) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Online Pharmacies

Subsegments:

1) By Non-Pharmacological Therapy: Cognitive Behavioral Therapy For Insomnia (CBT-I); Sleep Hygiene Education; Relaxation Techniques; Stimulus Control Therapy; Sleep Restriction Therapy2) By Pharmacological Therapy: Prescription Medications; Over-the-Counter; Herbal Supplements

Key Companies Mentioned: Pfizer Inc.; Merck & Co Inc.; Sanofi S.A.; GlaxoSmithKline plc.; Takeda Pharmaceutical Company Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- Merck & Co Inc.

- Sanofi S.A.

- GlaxoSmithKline plc.

- Takeda Pharmaceutical Company Limited

- Koninklijke Philips N.V.

- Viatris Inc.

- Astellas Pharma Inc.

- Sun Pharmaceutical Industries Limited

- Eisai Co.Ltd.

- UCLA Health Insomnia Clinic

- Jazz Pharmaceuticals PLC

- Aurobindo Pharma Limited

- Purdue Pharma LP

- Cipla Inc.

- Dr. Reddy's Laboratories Ltd.

- Zydus Lifesciences Limited

- Lupin Limited

- Mallinckrodt Pharmaceuticals Plc.

- Fisher & Paykel Healthcare Corporation Limited

- ResMed Inc.

- Sunovion Pharmaceuticals Inc.

- Casper Sleep Inc.

- Biocodex Inc.

- Vanda Pharmaceuticals Inc.

- Pernix Therapeutics Holdings Inc.

- SleepScore Labs

- Alpha-Stim

- Neurim Pharmaceuticals Ltd.

- NightWare Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.24 Billion |

| Forecasted Market Value ( USD | $ 6.62 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |