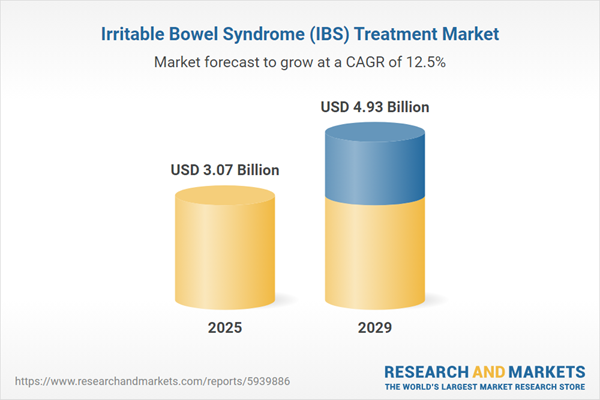

The irritable bowel syndrome (IBS) treatment market size is expected to see rapid growth in the next few years. It will grow to $4.93 billion in 2029 at a compound annual growth rate (CAGR) of 12.5%. The growth in the forecast period can be attributed to patient-centric healthcare models, microbial therapies, blockchain in healthcare, patient-reported outcomes (pros), regulatory fast-track programs, health data interoperability. Major trends in the forecast period include integration of digital health solutions, advancements in diagnostic technologies, increased research and development investments, collaborations and partnerships, emergence of non-pharmacological therapies.

The anticipated growth of the irritable bowel syndrome (IBS) treatment market is driven by the increasing prevalence of irritable bowel syndrome (IBS). IBS is a chronic gastrointestinal disorder affecting the large intestine, and its rising prevalence is attributed to poor lifestyles, unhealthy eating habits, exposure to pollution, and heightened stress levels. Treatment for IBS aims to alleviate symptoms, reduce their severity and frequency, and enhance individuals' ability to manage their conditions effectively. According to the International Foundation for Gastrointestinal Disorders (IFFGD), approximately 5-10% of the global population is expected to have IBS in 2023, with between 25 and 45 million people in the United States affected by the condition. Consequently, the growing prevalence of IBS is a key factor driving the expansion of the IBS treatment market.

The growth of the IBS treatment market is expected to be propelled by the aging population. The aging population refers to a demographic trend characterized by an increasing proportion of elderly individuals within a society. Individuals in this demographic group utilize IBS treatment to manage gastrointestinal symptoms associated with aging, addressing age-related changes in digestive health and promoting a better quality of life by alleviating discomfort and supporting overall well-being. As reported in October 2022 by the World Health Organization (WHO), the global population of individuals aged 60 years and older is rapidly growing and is expected to double by 2050, reaching 2.1 billion. Hence, the aging population is a significant driver for the growth of the IBS treatment market.

A prominent trend in the irritable bowel syndrome (IBS) market is the focus on product innovations by major players. Leading companies in the IBS market are actively engaged in developing new and advanced products to reinforce their market positions. For instance, in April 2022, Ardelyx, a U.S.-based biotechnology company, introduced IBSRELA, a first-in-class treatment for IBS-C in adults. IBSRELA, the first and only NHE3 inhibitor available for treating adult irritable bowel syndrome with constipation (IBS-C), offers a novel mechanism therapy for IBS-C and represents a significant new treatment option for constipation, bloating, and stomach pain associated with this debilitating disorder.

Major companies in the irritable bowel syndrome (IBS) market are adopting a strategic partnership approach to address conditions such as Crohn's disease and ulcerative colitis. Strategic partnerships involve collaboration between companies to leverage each other's strengths and resources for mutual benefits. In October 2023, Sanofi S.A., a France-based pharmaceutical industry company, formed a partnership with Teva Pharmaceutical Industries Ltd., an Israel-based pharmaceutical company, aiming to provide treatment for inflammatory bowel disease.

In October 2023, Roche, a Switzerland-based healthcare company, acquired Telavant Holdings for an undisclosed amount. Through this acquisition, Roche gains the rights to develop, manufacture, and market a novel treatment for Irritable Bowel Syndrome (IBS) in the United States and Japan. Telavant Holdings, a U.S.-based biotechnology company, specializes in developing and commercializing innovative therapies for inflammatory and fibrotic diseases.

Major companies operating in the irritable bowel syndrome (IBS) treatment market include Pfizer Inc., Johnson & Johnson Services Inc., AbbVie Inc., Novartis AG, AstraZeneca plc, Abbott Laboratories, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Amgen Inc., Astellas Pharma Inc., Biogen Inc., Bausch Health Companies Inc., Ironwood Pharmaceuticals Inc., Sebela Pharmaceuticals Inc., Prometheus Laboratories Inc., RedHill Biopharma Ltd., Ardelyx Inc., Cosmo Technologies Ltd., Renexxion Ireland Ltd., 4D Pharma plc, Biora Therapeutics Inc.

North America was the largest region in the irritable bowel syndrome (IBS) treatment market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the irritable bowel syndrome (ibs) treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the irritable bowel syndrome (ibs) treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Treatment for irritable bowel syndrome (IBS) involves a range of approaches and interventions directed at addressing disorders in the gastrointestinal tract, common issues that impact the stomach and intestines. The objective of IBS treatment is to alleviate symptoms such as constipation, diarrhea, and abdominal discomfort, reduce the frequency and severity of flare-ups, and enhance overall well-being.

The primary categories of drugs used in irritable bowel syndrome (IBS) treatment include lubiprostone, linaclotide, eluxadoline, rifaximin, alosetron, and others. Lubiprostone, for instance, is a medication employed in treating IBS. It functions as a selective chloride channel activator, facilitating increased fluid secretion in the intestines. The drug is indicated for IBS with constipation, IBS with diarrhea, and IBS with alternating constipation and diarrhea. These medications are distributed through various channels, including hospital pharmacies, online pharmacies, and retail pharmacies, catering to diverse end-users such as hospitals, clinics, and home care settings.

The irritable bowel syndrome (IBS) treatment market research report is one of a series of new reports that provides irritable bowel syndrome (IBS) treatment market statistics, including irritable bowel syndrome (IBS) treatment industry global market size, regional shares, competitors with an irritable bowel syndrome (IBS) treatment market share, detailed irritable bowel syndrome (IBS) treatment market segments, market trends and opportunities, and any further data you may need to thrive in the irritable bowel syndrome (IBS) treatment industry. This irritable bowel syndrome (IBS) treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The irritable bowel syndrome (IBS) treatment market includes revenues earned by entities by providing services such as consultation, cognitive-behavioral therapy (CBT), hypnotherapy, psychological therapy. The market value includes the value of related goods sold by the service provider or included within the service offering. The irritable bowel syndrome (IBS) market also includes sales of antispasmodics, fiber supplements, laxatives, probiotics, and certain medications targeting gut function. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Irritable Bowel Syndrome (IBS) Treatment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on irritable bowel syndrome (ibs) treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for irritable bowel syndrome (ibs) treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The irritable bowel syndrome (ibs) treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Type: Lubiprostone, Linaclotide, Eluxadoline, Rifaximin, Alosetron, Other Drugs2) By Indication: IBS With Constipation, IBS With Diarrhea, IBS With Alternating Constipation and Diarrhea

3) By Distribution Channel: Hospital Pharmacies, Online Pharmacies, Retail Pharmacies

4) By End-Users: Hospitals, Clinics, Homecare Settings

Subsegments:

1) By Lubiprostone: Chronic Idiopathic Constipation Treatment; Irritable Bowel Syndrome with Constipation (IBS-C) Treatment2) By Linaclotide: IBS-C Treatment; Chronic Idiopathic Constipation Treatment

3) By Eluxadoline: IBS with Diarrhea (IBS-D) Treatment

4) By Rifaximin: IBS-D Treatment; Small Intestinal Bacterial Overgrowth (SIBO) Treatment

5) By Alosetron: Severe IBS-D Treatment for Women

6) By Other Drugs: Prucalopride; Tenapanor; Plecanatide

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson Services Inc.; AbbVie Inc.; Novartis AG; AstraZeneca plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- AbbVie Inc.

- Novartis AG

- AstraZeneca plc

- Abbott Laboratories

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Amgen Inc.

- Astellas Pharma Inc.

- Biogen Inc.

- Bausch Health Companies Inc.

- Ironwood Pharmaceuticals Inc.

- Sebela Pharmaceuticals Inc.

- Prometheus Laboratories Inc.

- RedHill Biopharma Ltd.

- Ardelyx Inc.

- Cosmo Technologies Ltd.

- Renexxion Ireland Ltd.

- 4D Pharma plc

- Biora Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.07 Billion |

| Forecasted Market Value ( USD | $ 4.93 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |