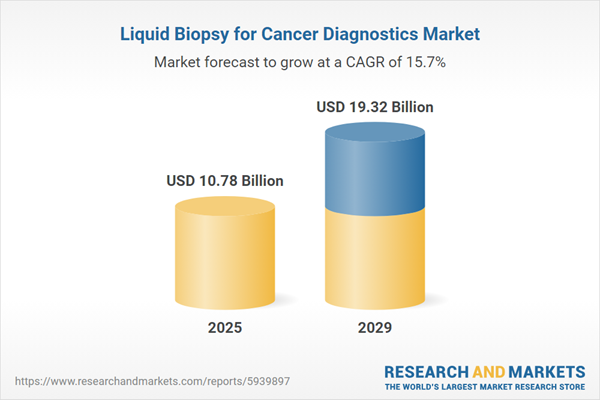

The liquid biopsy for cancer diagnostics market size is expected to see rapid growth in the next few years. It will grow to $19.32 billion in 2029 at a compound annual growth rate (CAGR) of 15.7%. The growth in the forecast period can be attributed to integration of liquid biopsy in routine cancer diagnostics, adoption of liquid biopsy for early cancer detection, expansion of cancer screening programs, growing focus on personalized medicine in oncology, increased funding for liquid biopsy research. Major trends in the forecast period include emergence of multi-omics liquid biopsy approaches, integration of artificial intelligence in liquid biopsy analysis, expansion of liquid biopsy applications beyond oncology, development of blood-based biomarkers for cancer, customization of liquid biopsy assays for specific cancer types.

The increasing incidence of cancer is anticipated to drive the growth of the liquid biopsy market for cancer diagnostics in the future. Cancer encompasses a wide range of diseases that can arise in almost any organ or tissue in the body when abnormal cells grow uncontrollably, breach their typical boundaries, and either spread to other organs or invade adjacent tissues. This surge in cancer cases heightens the demand for diagnostic methods, such as early detection of cancer or tumor recurrence, patient risk assessment, and therapy monitoring. Liquid biopsy plays a crucial role by capturing tumor cells or their products released from primary or metastatic sites, offering comprehensive and real-time insights into tumor evolution, therapeutic targets, and mechanisms of treatment resistance. For example, in May 2024, the National Cancer Institute, a U.S.-based government agency, reported approximately 18.1 million cancer survivors in the United States, with projections suggesting this number will rise to 22.5 million by 2032. Furthermore, by 2040, the annual incidence of new cancer cases is expected to reach 29.9 million, with cancer-related deaths estimated to rise to 15.3 million. Thus, the increasing prevalence of cancer is propelling the growth of the liquid biopsy market for cancer diagnostics.

The rising demand for personalized medicine is expected to drive the growth of the liquid biopsy market for cancer diagnostics in the future. Personalized medicine represents a groundbreaking approach to healthcare that takes into account individual differences in patients' genetics, environments, and lifestyles. Liquid biopsy plays a crucial role in identifying specific genetic mutations and biomarkers linked to cancer, thereby enabling the development of tailored and targeted treatment strategies. For example, the Personalized Medicine Coalition, a U.S.-based professional membership organization, reported that in 2022, the approval of 12 new personalized medicines accounted for approximately 34% of all newly approved therapies, reflecting a significant increase from previous years. Consequently, the growing demand for personalized medicine is fueling the expansion of the liquid biopsy market for cancer diagnostics.

A prominent trend gaining traction is the focus on product innovations by major companies. These companies are strategically investing in the development of cutting-edge products to bolster their market position. An exemplar of this trend is BostonGene, a US-based biomedical software company, which introduced new liquid biopsy solutions in June 2023. These solutions aim to identify clinically relevant gene alterations, expanding the test portfolio and accelerating the development of novel assays, analytical tools, and pipelines. The innovative approach involves leveraging artificial intelligence-driven molecular and immunological profiling methodologies to analyze tumors, microenvironments, and host immunity. Notably, these solutions support immunotherapy treatment, provide insights into a patient's immune-related disorders, and enable the monitoring of disease progression and response to treatment.

Major players in the liquid biopsy for cancer diagnostics market are directing their efforts toward the development of advanced liquid biopsy assays. These assays, characterized by sophistication and refinement, analyze various components within liquid biological samples, such as blood or other bodily fluids. The objective is to detect and characterize specific biomarkers associated with cancer or other diseases. Illumina Inc., a global leader in DNA sequencing, exemplifies this focus on innovation. In November 2023, the company announced the launch of the 'TruSight Oncology 500 ctDNA v2 (TSO 500 ctDNA v2)' research assay. This assay facilitates noninvasive comprehensive genomic profiling (CGP) of circulating tumor DNA (ctDNA) extracted from blood. Designed to streamline integration for users, the TSO 500 ctDNA v2 assay enhances the depth of insights available for cancer research.

In January 2022, when Exact Sciences Corp., a US-based molecular diagnostics company, acquired Thrive Earlier Detection Corp. for $2.15 billion. This strategic acquisition positions Exact Sciences Corp. to access clinical and regulatory teams, scale laboratory and IT capabilities, and advance blood-based, multi-cancer screening, aligning with evolving norms in cancer treatment. Thrive Earlier Detection Corp., known for its expertise in producing liquid biopsy tests, focuses on the early detection of multiple cancers.

Major companies operating in the liquid biopsy for cancer diagnostics market include F. Hoffman La Roche Ltd., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Illumina Inc., The Menarini Group, Bio-Rad Laboratories Inc., QIAGEN Inc., Exact Sciences Corporation, Bio-Techne Corporation, ArcherDX Inc., Neogenomics Laboratories Inc., Guardant Health Inc., Myriad Genetics Inc., Foundation Medicine Inc., Amoy Diagnostics Co. Ltd., Biocartis Group NV, Biodesix Inc., MDx Health Inc., Sysmex Inostics Inc., Biocept Inc., Agena Bioscience Inc., Laboratory for Advanced Medicine (LAM) Inc., MiRXES Pte Ltd., Inivata Limited, Resolution Bioscience Inc., SAGA Diagnostics AB, NuProbe Inc., Personal Gemone Diagnostics Inc., Pathway Genomics Corporation, Angle PLC.

North America was the largest region in the liquid biopsy for cancer diagnostics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the liquid biopsy for cancer diagnostics market report during the forecast period. The regions covered in the liquid biopsy for cancer diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the liquid biopsy for cancer diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Liquid biopsy for cancer diagnostics offers a less invasive alternative to traditional tissue biopsies, involving the assessment of genetic material or biomarkers found in a patient's blood or other bodily fluids to detect and monitor the presence of cancer. This approach is commonly utilized for screening and identifying non-small cell lung cancer (NSCLC) and is also employed as a gastrointestinal and ovarian liquid biopsy for cancer diagnostics.

The main categories within liquid biopsy for cancer diagnostics encompass products and services. Products refer to procedures, methods, or tools designed or utilized for identifying illnesses or diseases in humans or other vertebrate animals. Various types of samples, such as blood, urine, and saliva, are utilized in this diagnostic approach. Liquid biopsy for cancer diagnostics is applicable to various types of cancer, including lung cancer, breast cancer, colon cancer, and others. The end-users for these diagnostics include hospitals, diagnostic centers, and other healthcare institutions.

The liquid biopsy for cancer diagnostics market research report is one of a series of new reports that provides liquid biopsy for cancer diagnostics market statistics, including liquid biopsy for cancer diagnostics industry global market size, regional shares, competitors with a liquid biopsy for cancer diagnostics market share, detailed liquid biopsy for cancer diagnostics market segments, market trends and opportunities, and any further data you may need to thrive in the liquid biopsy for cancer diagnostics industry. This liquid biopsy for cancer diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The liquid biopsy for cancer diagnostics market includes revenues earned by entities by providing tumor detection, test validation, and clinical utility. The market value includes the value of related goods sold by the service provider or included within the service offering. The liquid biopsy for cancer diagnostics markets also include sales of instruments, reagent kits, and liquid biopsy kits, which are used in providing liquid biopsy services. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Liquid Biopsy For Cancer Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on liquid biopsy for cancer diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for liquid biopsy for cancer diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The liquid biopsy for cancer diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Product; Services2) By Sample: Blood; Urine; Saliva

3) By Cancer: Lung Cancer; Breast Cancer; Colon Cancer; Other Cancers

4) By End-User: Hospitals; Diagnostic Centers; Other End-Users

Subsegments:

1) By Product: Circulating Tumor Cells (CTCs) Detection Kits; Circulating Tumor DNA (ctDNA) Detection Kits; Exosome Isolation Kits; Sample Collection Devices2) By Services: Testing Services; Analytical Services; Bioinformatics Services

Key Companies Mentioned: F. Hoffman La Roche Ltd.; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; Illumina Inc.; the Menarini Group

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffman La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Illumina Inc.

- The Menarini Group

- Bio-Rad Laboratories Inc.

- QIAGEN Inc.

- Exact Sciences Corporation

- Bio-Techne Corporation

- ArcherDX Inc.

- Neogenomics Laboratories Inc.

- Guardant Health Inc.

- Myriad Genetics Inc.

- Foundation Medicine Inc.

- Amoy Diagnostics Co. Ltd.

- Biocartis Group NV

- Biodesix Inc.

- MDx Health Inc.

- Sysmex Inostics Inc.

- Biocept Inc.

- Agena Bioscience Inc.

- Laboratory for Advanced Medicine (LAM) Inc.

- MiRXES Pte Ltd.

- Inivata Limited

- Resolution Bioscience Inc.

- SAGA Diagnostics AB

- NuProbe Inc.

- Personal Gemone Diagnostics Inc.

- Pathway Genomics Corporation

- Angle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.78 Billion |

| Forecasted Market Value ( USD | $ 19.32 Billion |

| Compound Annual Growth Rate | 15.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |