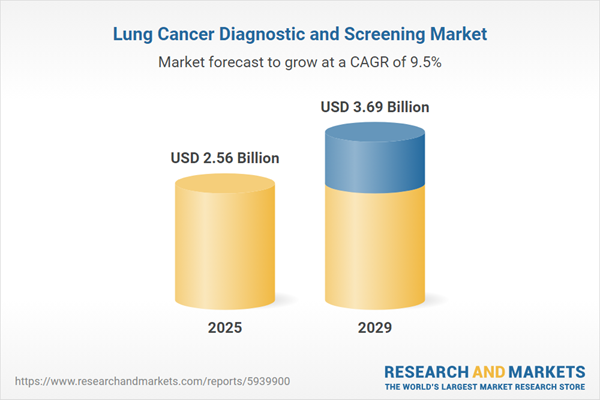

The lung cancer diagnostic and screening market size is expected to see strong growth in the next few years. It will grow to $3.69 billion in 2029 at a compound annual growth rate (CAGR) of 9.5%. The growth in the forecast period can be attributed to increasing incidence of lung cancer, growing emphasis on early detection, expansion of high-risk screening programs, shift towards personalized medicine, government initiatives and funding. Major trends in the forecast period include emergence of novel screening modalities, advancements in biomarker testing, integration of artificial intelligence (AI), rise in liquid biopsy adoption, focus on early stage detection, and expansion of low-dose CT screening programs.

The projected increase in the prevalence of lung cancer is poised to drive the growth of the lung cancer diagnostic and screening market in the foreseeable future. Lung cancer, characterized by symptoms such as coughing, chest pain, and difficulty breathing, is a malignant disease marked by the uncontrolled proliferation of abnormal cells in lung tissues. Diagnostic and screening methods for lung cancer play a crucial role in early detection, utilizing various tests such as incisional biopsy and bronchoscopy. As of January 2023, data from the American Cancer Society indicates approximately 238,340 new cases of lung cancer in the United States, with 127,070 reported deaths. This surge in lung cancer cases underscores the significance of diagnostic and screening measures, thereby fueling the growth of the lung cancer diagnostic and screening market.

The upward trajectory of healthcare expenditures is anticipated to further propel the expansion of the lung cancer diagnostic and screening market. Healthcare expenditures encompass the total costs associated with providing and receiving medical services, treatments, and healthcare-related goods and activities. The implementation of lung cancer diagnostic and screening methods contributes to healthcare expenditures by facilitating early detection, potentially reducing long-term treatment costs, and enhancing patient outcomes. In November 2022, the Canadian Institute for Health Information (CIHI) projected a 0.8% increase in total health spending in Canada, reaching $331 billion in 2022 from $328 billion in 2021. This upward trend in healthcare expenditures is a key driver in the growth of the lung cancer diagnostic and screening market.

Key players in the lung cancer diagnostic and screening market are advancing technologies such as lung cancer tests aimed at enhancing early detection, improving diagnostic accuracy, and enabling personalized treatment strategies for patients at high risk of the disease. These lung cancer tests utilize various methods, including imaging, biomarker analysis, and cytological examinations, to identify the presence of lung cancer. For example, in December 2023, Freenome, a biotechnology company based in the United States, introduced PROACT LUNG. This trial represents a significant advancement in lung cancer screening, potentially leading to earlier detection and improved patient outcomes while addressing current shortcomings in screening practices.

Major players in the lung cancer diagnostics and screening market are strategically focused on the development of blood-based tests that leverage machine learning, specifically whole-genome machine learning. This approach involves applying machine learning algorithms to analyze and interpret comprehensive sets of genetic information, encompassing an organism's entire genome. DELFI Diagnostics Inc., a US-based developer of accessible blood-based tests, exemplified this strategy in October 2023 with the launch of FirstLook Lung. This blood test utilizes whole-genome machine learning to analyze cell-free DNA fragments, enhancing lung cancer screening with an impressive 99.7% negative predictive value (NPV). Designed for routine blood work, the test identifies individuals with potential lung cancer, including those in early stages, aiming to improve population health by addressing low uptake of low-dose computed tomography (LDCT) screening.

In January 2022, RadNet Inc., a US-based radiology company, acquired Aidence BV for an undisclosed amount. This acquisition is anticipated to strengthen RadNet Inc.'s leadership in developing and deploying artificial intelligence (AI) for improved patient care and health. It also accelerates their growth and innovation pipeline, providing automated and integrated AI oncology solutions for clinicians. Aidence BV, based in the Netherlands, is a healthcare technology company with a focus on clinical solutions for lung cancer screening and pulmonary nodule treatment.

Major companies operating in the lung cancer diagnostic and screening market include Pfizer Inc., F. Hoffmann-La Roche AG, Bristol-Myers Squibb Company, Thermo Fisher Scientific Inc., AstraZeneca Plc, Abbott Laboratories Inc., Danaher Corporation, Siemens Healthcare GmbH, FUJIFILM Corporation, Koninklijke Philips N.V., GE Healthcare Bio Sciences AB, Quest Diagnostics Incorporated, Agilent Technologies Inc., Illumina Inc., Qiagen Inc., Myriad Genetic Laboratories Inc., NeoGenomics Laboratories Inc., Canon Medical Systems Corporation, OncimmuneHoldings Plc, Broncus Medical Inc., OncoCyte, Riverain Technologies LLC, VisionGate, Foundation Medicine Inc., Biodesix,

North America was the largest region in the lung cancer diagnostic and screening market in 2024. The regions covered in the lung cancer diagnostic and screening market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the lung cancer diagnostic and screening market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Lung cancer diagnosis and screening involve employing examinations and techniques to detect and identify lung cancer, aiming for early detection and accurate diagnosis to facilitate effective treatment planning. This process is commonly applied in the treatment of squamous cell carcinomas, adenocarcinoma, and large cell carcinoma.

The primary products associated with lung cancer diagnostics and screening include instruments, consumables, and accessories. Instruments are products utilized to analyze the results of diagnostic tests and process samples for diagnostic purposes. Various tests, such as biomarker tests, imaging tests, biopsy, and blood tests, are employed for different cancer types, including non-small cell lung cancer and small cell lung cancer. These diagnostic tools find application across diverse end-users, including hospitals, independent diagnostic laboratories, diagnostic imaging centers, cancer research institutes, and others.

The lung cancer diagnostics and screening market research report are one of a series of new reports that provides lung cancer diagnostics and screening market statistics, including lung cancer diagnostics and screening industry global market size, regional shares, competitors with a lung cancer diagnostics and screening market share, detailed lung cancer diagnostics and screening market segments, market trends and opportunities, and any further data you may need to thrive in the lung cancer diagnostics and screening industry. This lung cancer diagnostics and screening market research report deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The lung cancer diagnosis and screening market consists of revenues earned by entities by providing positron emission tomography (PET) scanners, and bronchoscopy. The market value includes the value of related goods sold by the service provider or included within the service offering. The lung cancer diagnosis and screening market also includes sales of products such as liquid biopsy kits, molecular testing kits, and biopsy tools. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Lung Cancer Diagnostic and Screening Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on lung cancer diagnostic and screening market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for lung cancer diagnostic and screening? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The lung cancer diagnostic and screening market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Instruments; Consumables and Accessories2) By Test: Biomarkers Tests; Imaging Test; Biopsy; Blood Test; Other Tests

3) By Cancer Type: Non-Small Cell Lung Cancer; Small Cell Lung Cancer

4) By End User: Hospital; Independent Diagnostic Laboratories; Diagnostic Imaging Centers; Cancer Research Institutes; Other End-Users

Subsegments:

1) By Instruments: Imaging Devices; Biopsy Devices; Bronchoscopy Systems2) By Consumables and Accessories: Biopsy Needles; Reagents and Assays; Imaging Contrast Agents; Patient Preparation Equipment; Sample Collection Kits; Laboratory Supplies

Key Companies Mentioned: Pfizer Inc.; F. Hoffmann-La Roche AG; Bristol-Myers Squibb Company; Thermo Fisher Scientific Inc.; AstraZeneca Plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- F. Hoffmann-La Roche AG

- Bristol-Myers Squibb Company

- Thermo Fisher Scientific Inc.

- AstraZeneca Plc

- Abbott Laboratories Inc.

- Danaher Corporation

- Siemens Healthcare GmbH

- FUJIFILM Corporation

- Koninklijke Philips N.V.

- GE Healthcare Bio Sciences AB

- Quest Diagnostics Incorporated

- Agilent Technologies Inc.

- Illumina Inc.

- Qiagen Inc.

- Myriad Genetic Laboratories Inc.

- NeoGenomics Laboratories Inc.

- Canon Medical Systems Corporation

- OncimmuneHoldings Plc

- Broncus Medical Inc.

- OncoCyte

- Riverain Technologies LLC

- VisionGate

- Foundation Medicine Inc.

- Biodesix

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.56 Billion |

| Forecasted Market Value ( USD | $ 3.69 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |